cemagraphics

The SPDR S&P Dividend ETF (NYSEARCA:SDY) is an all-cap equity index ETF investing in U.S. stocks with at least 20 consecutive years of dividend growth. Very similar to the Dividend Aristocrats, but including small-caps and mid-caps. SDY’s diversified holdings, strong dividend growth track-record, above-average 2.6% dividend yield, and cheap valuation, make the fund a buy.

As the fund’s yield is low, but fast-growing, the fund is mostly appropriate for long-term dividend growth or total return investors, less so for those in need of present income.

SDY – Basics

- Investment Manager: State Street

- Underlying Index: S&P High Yield Dividend Aristocrats

- Dividend Yield: 2.64%

- Management Fee: 0.35%

- Total Returns CAGR 10Y: 12.52%

SDY – Overview

SDY is an equity index ETF, administered by State Street. The fund tracks the S&P High Yield Dividend Aristocrats, an index of U.S. equities with at least 20 consecutive years of dividend growth, from all relevant industries and market capitalizations. It is a yield-weighted index, with higher yields leading to higher weights, to a 4% cap. As with most indexes, there are several screening criteria centered on liquidity, trading, etc., criteria. The fund’s underlying index seems simple enough, and I did not see any significant issues or negatives with it.

SDY’s investment strategy and holdings provide investors with several key benefits. Let’s have a look at these.

Diversified Holdings

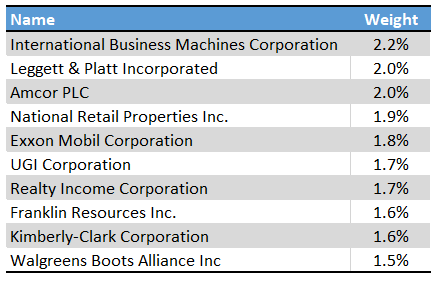

SDY invests in U.S. equities from all relevant industries and sizes, leading to a reasonably well-diversified fund. The fund provides investors with exposure to over 100 companies, all relevant industry segments, and small and medium-sized companies. The latter is quite rare, as most well-known dividend / dividend growth funds focus on large-caps. Concentration is quite low too, with the fund top ten holdings accounting for just 18% of its value. These are as follows.

SDY Corporate Website – Chart by author SDY Corporate Website

SDY’s diversified holdings reduce portfolio risk and volatility, and are a significant benefit for the fund and its shareholders. The fund’s small-cap and mid-cap exposure is particularly relevant, as most funds lack investments in these securities. In my opinion, SDY is diversified enough that it could function as a core portfolio holding.

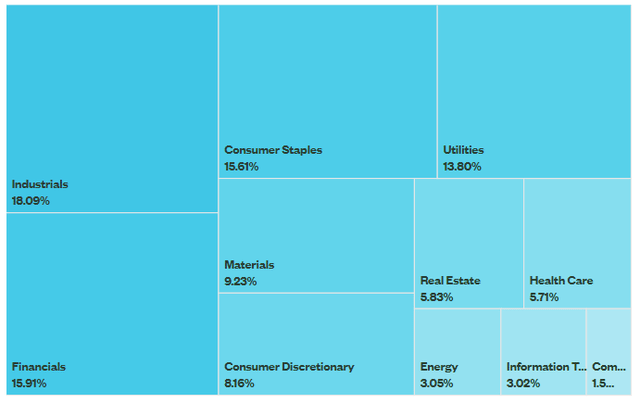

As can be seen above, SDY is overweight old-economy industries, including industrials, consumer stables, and industrials, while being underweight tech. This is the case for most dividend-focused funds too. SDY is somewhat more overweight these industries than average, as the fund’s dividend growth inclusion criteria is quite restrictive, especially in regards to tech companies. There are simply few tech companies with at least 20 consecutive years of dividend growth. Meta Platforms (META) did not even exist 20 years ago, Amazon (AMZN) was a small online bookstore, and Apple (AAPL) had yet to release the iPhone. SDY excludes these and other companies, and focuses on stodgier, more established companies in other industries.

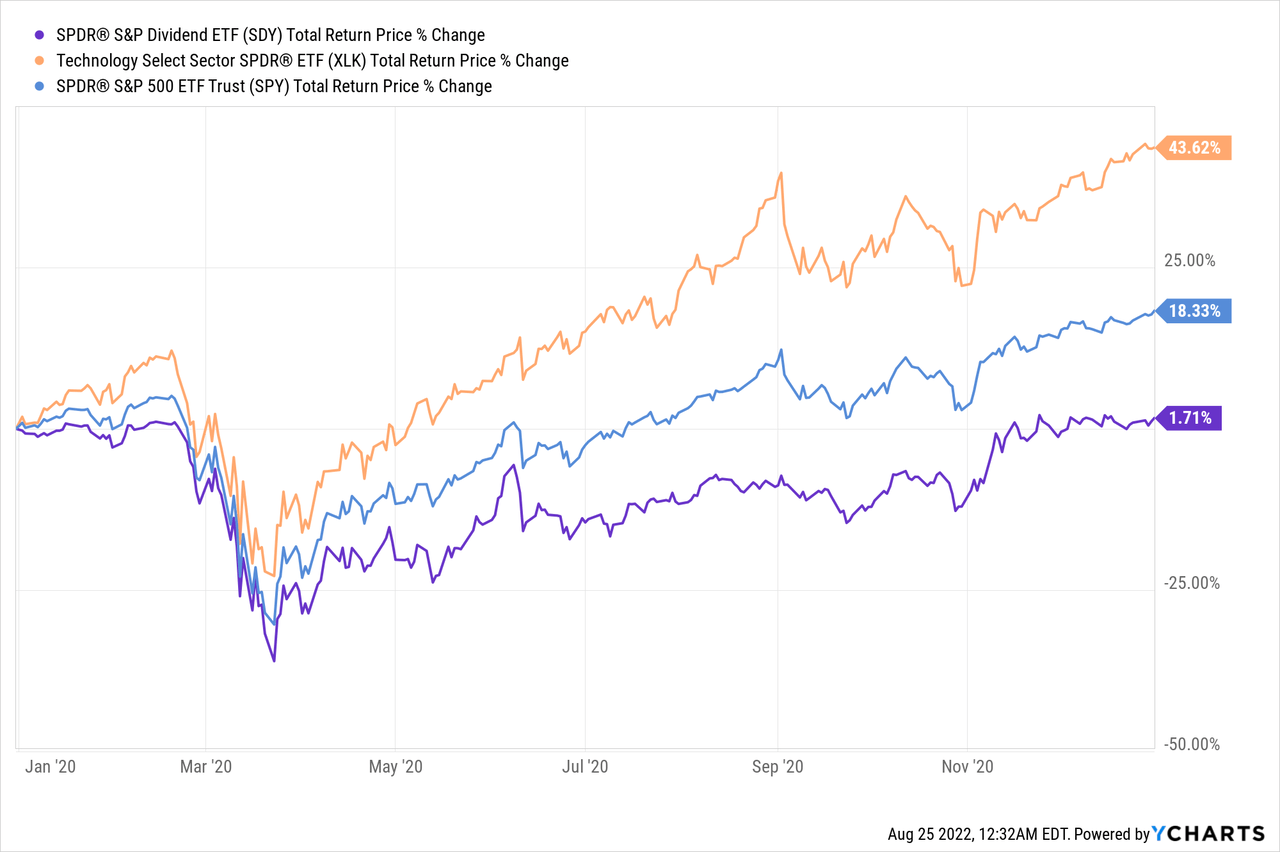

SDY’s industry weights have two important implications for shareholders. First, being underweight tech means the fund should underperform when tech outperforms. This was the case during 2020, during which the coronavirus pandemic was in full swing, benefiting many tech companies.

SDY does provide investors with sufficient diversification and industry exposure, but weights differ from those of most equity indexes, an important fact for investors to consider.

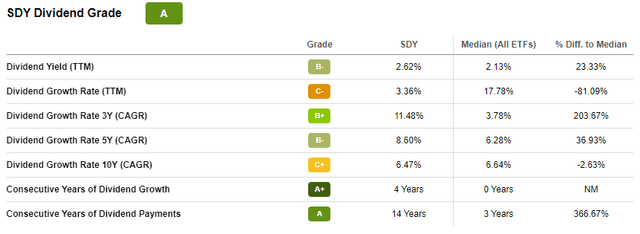

Above-Average Dividend Yield and Growth Track-Record

SDY focuses on companies with at least 20 consecutive years of dividend growth, a strong achievement. SDY’s companies all have stellar dividend growth track-records, almost all of which are set to continue into the future. This is because decades-long dividend growth track-records are a significant indicator of underlying business strength and management policy. Only the best companies can grow their dividends uninterruptedly for decades, and only the best management teams have the foresight and planning capacities to do so across the entire business cycle, recessions and all. SDY’s holdings all grew their dividends during the coronavirus pandemic and the financial crisis / housing bubble, and they are likely to grow their dividends during any future recession or downturn as well. SDY provides investors with safe, growing dividends, a significant benefit for the fund, and its core investment thesis.

SDY’s dividend growth itself has been reasonably good, but not all that different from that of most broad-based equity index funds.

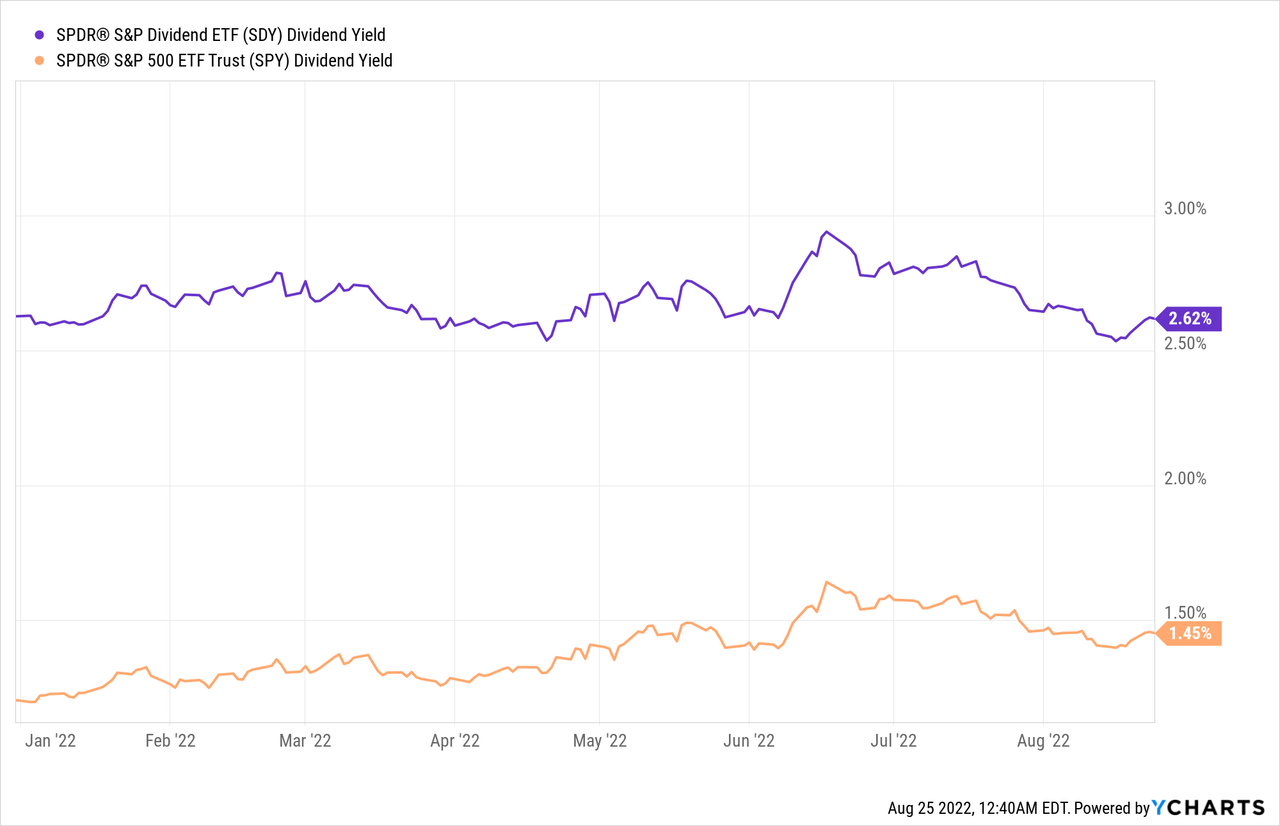

SDY currently sports a dividend yield of 2.6%. It is a low yield on an absolute basis, but moderately higher than that of most broad-based equity indexes. As an example, the S&P 500 currently yields 1.5%, almost half SDY’s yield.

SDY’s above-average dividend yield directly increases shareholder returns, and is a benefit for the fund and its shareholders. As the fund’s yield remains low on an absolute basis, the fund’s yield is only a small benefit for shareholders, but a benefit nonetheless.

Cheap Valuation

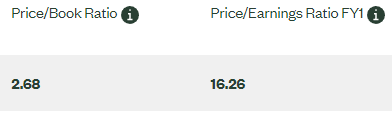

SDY focuses on old-economy industries, and overweight companies with above-average dividend yields. These two factors indirectly target companies with low prices and cheap valuations, resulting in a fund with a competitive, below-average valuation. SDY currently sports a PE ratio of 16.2x and a PB ratio of 2.7x, both moderately lower figures than average.

SDY Corporate Website

As a comparison, the S&P 500 currently sports a PE ratio of 18.2x and a PB ratio of 3.9x.

SPY Corporate Website

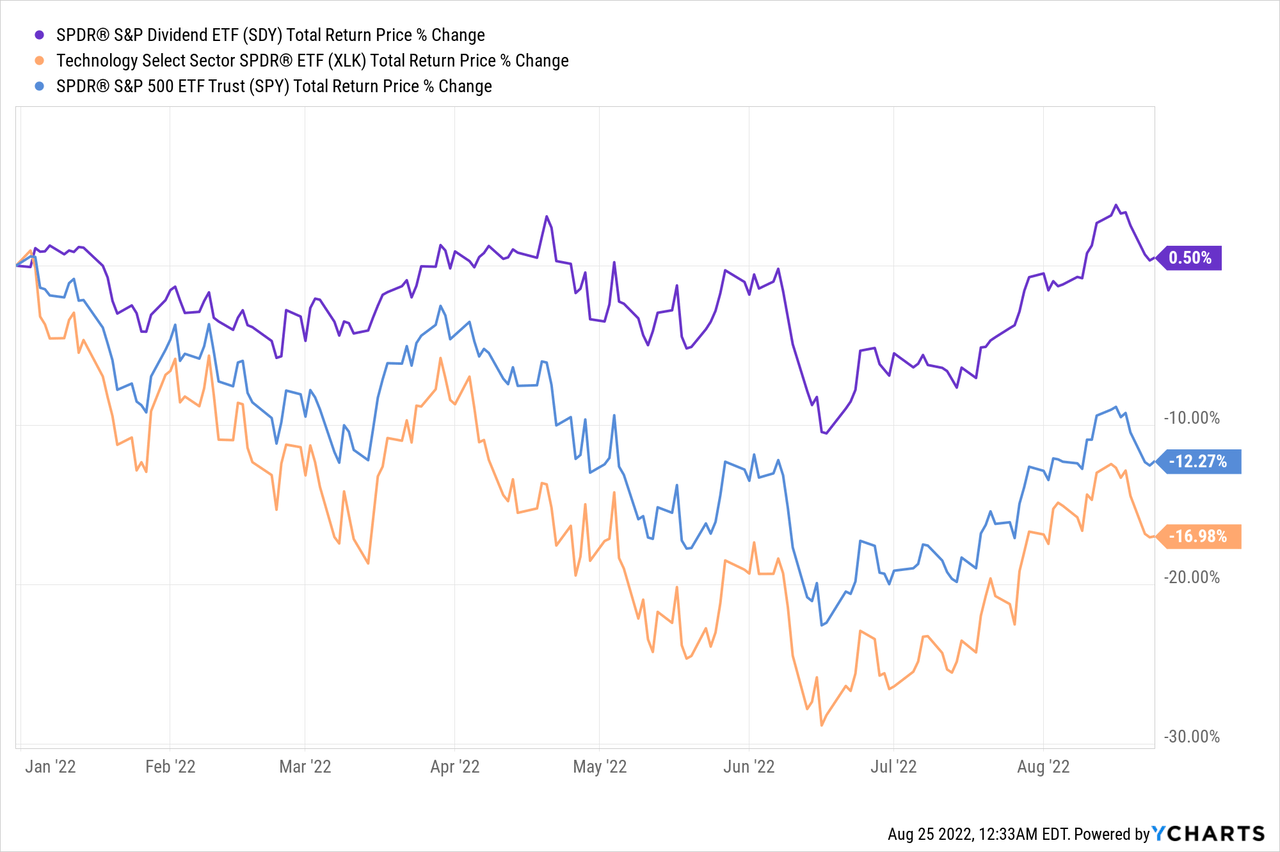

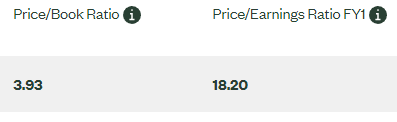

SDY’s cheap valuation is a benefit for the fund and its shareholders, and could lead to moderate, market-beating returns if valuations normalize. Valuations have normalized for the past two years or so, although not consistently so. SDY has outperformed for the same time period, but very inconsistently so, as expected.

SDY – Performance Analysis

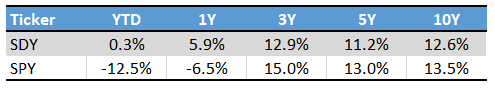

SDY’s performance track-record is about average. The fund has slightly underperformed relative to the S&P 500 since inception, as tech has outperformed during the same. At the same time, the fund has significantly outperformed during the past year or so, as tech valuations normalize, and tech underperforms.

ETF.com – Chart by author

In my opinion, and considering the above, SDY’s overall performance track-record is about the same as that of the S&P 500, contingent on tech performance. Under these conditions, I think investors should focus on forward-based measures of expected returns, including valuations and dividend yields, instead of backwards-looking measures. The fund does look superior to equity indexes with the former, notwithstanding its performance.

Conclusion – Buy

SDY’s diversified holdings, strong dividend growth track-record, above-average 2.6% dividend yield, and cheap valuation, make the fund a buy.

Be the first to comment