andresr

With a market capitalization of just $761.5 million, Universal Health Realty Income Trust (NYSE:UHT) is one of the smaller medical property REITs on the market today. That does not mean, however, that the company is a poor operator. Over the past few years, management has done well to steadily grow the firm’s top and bottom lines. In addition to proving itself a stable player in the market, the enterprise is trading at levels that are not necessarily unrealistic. On the whole, the company does seem to me to be more or less fairly valued, leading me to rate it a solid ‘hold’ at this time.

Universal Health Realty – A small play on medicine

As I mentioned already, Universal Health Realty Income Trust focuses on owning and leasing out medical properties. As of the end of its 2021 fiscal year, the firm owned 75 investments or commitments located across 21 US states. The list of properties included six hospital facilities that had three acute care and three behavioral health care units associated with them, 58 medical/office buildings, four freestanding emergency departments, four preschool and childcare centers, and three specialty facilities. Orbit three of these properties are wholly owned by the company and leased out to other players in the medical space.

When you really dig into the operating history of the business, you find that it has taken an intriguing path. For instance, the company dates itself back to 1986 when it purchased properties from subsidiaries of Universal Health Services (UHS) and ended up leasing those properties back to said subsidiaries under long-term agreements. These are referred to as sale-leaseback transactions and they had the benefit of providing the selling enterprise upfront cash that it can use for whatever purpose it deems best, while granting the acquirer long-term assets of significant value that should increase in value over time while bringing in consistent and stable cash flows to said acquirer. This is a fairly simple and common strategy for operators in this space. But what is particularly noteworthy is the fact that Universal Health Realty Income Trust still has a significant amount of exposure to Universal Health Services today.

According to the most recent financial filings provided by Universal Health Realty Income Trust, Universal Health Services through the leases it has, is responsible for 41% of Universal Health Realty Income Trust’s consolidated revenue. But there exists even more in the way of ties between the firms. As at the end of the latest quarter, Universal Health Services owns 5.7% of the common stock in Universal Health Realty Income Trust and it serves as our prospect’s advisory firm in exchange for a fee amounting to 0.70% of Universal Health Realty Income Trust‘s total real estate value. As of the end of the latest quarter, this translated to $1.3 million quarterly or $5.2 million per year. Obviously, this relationship means that a lot of the potential of Universal Health Realty Income Trust when it comes to maintaining its operations relies on Universal Health Services. In prior articles, such as this one here, I have discussed the overall health of Universal Health Services for those who are interested.

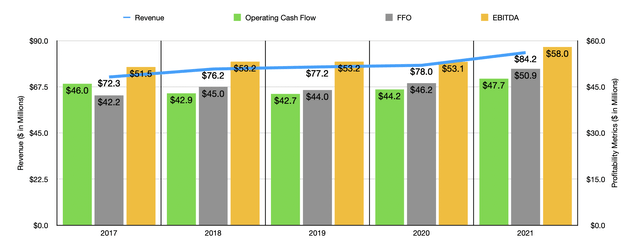

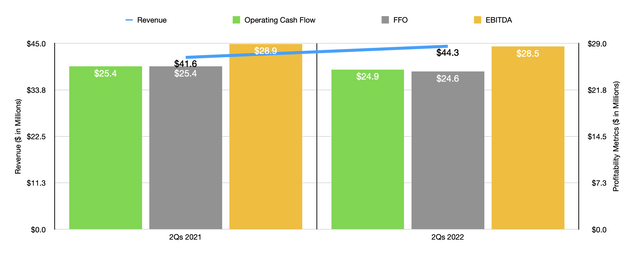

Over the past few years, the management team at Universal Health Realty Income Trust has done a solid job growing the company’s top and bottom lines. Between 2017 and 2021, for instance, revenue increased year after year, climbing from $72.3 million to $84.2 million. That growth has continued into the current fiscal year, with revenue in the first half of the year rising from $41.6 million last year to $44.3 million this year. Truth be told, there is not much that could be considered exciting about the increase from year to year given how small it is. The company is not making any major moves. For the first half of this year, for instance, the $2.8 million rise in revenue was driven in large part by a $1.8 million increase caused by the recording of Grayson Properties, LP on a consolidated basis and because of a $670,000 increase resulting from the fair market value lease renewal on its Wellington Regional Medical Centers. There were other factors as well, but these were the two largest. They were offset, to some degree, by other factors, such as a $780,000 decrease resulting from a December 2021 lease expiration on the specialty hospital that the company has in Chicago, Illinois.

The trajectory of profitability for the company has also been positive. Even though operating cash flow declined from $46 million in 2017 to $42.7 million in 2019, it rose in both 2020 and 2021, eventually hitting $47.7 million last year. There are, of course, other profitability metrics that we should pay attention to. The first of these is FFO, or funds from operations. This has risen in four of the past five years, climbing from $42.2 million to $50.9 million. And over that same window of time, EBITDA for the company has expanded from $51.5 million to $58 million. This is not to say that profitability will always increase year after year. So far this year, the company has seen a slight pullback. Operating cash flow fell from $25.4 million to $24.9 million. FFO declined from $25.4 million to $24.6 million. And EBITDA inched down from $28.9 million to $28.5 million.

These changes are fairly small in the grand scheme of things. However, for those who might be worried about inflation, it is important to note that the company has a lot in its favor. For instance, most of the leases that it has contain provisions better geared toward mitigating inflation. Its hospital leases require all building operating expenses, including maintenance, real estate taxes, and other costs, to be paid by the lessee. And for the majority of its medical office buildings, the leases require that the tenant pay any applicable share of operating expenses, including those associated with common area maintenance, insurance, and real estate taxes. So at the end of the day, the company does seem to be very much insulated from what is currently going on with the broader economy. And with an average fixed term on its hospitals of 10.6 years, the company has the ability to wait out the pain.

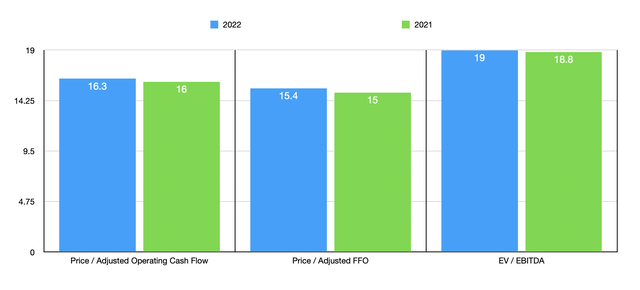

When it comes to the 2022 fiscal year as a whole, management has not really provided any guidance. But if we assume that the rest of the year will look like the first half did, we should anticipate operating cash flow of $46.8 million, FFO of $49.3 million, and EBITDA of $57.2 million. If these numbers come to fruition, it would imply a forward price to operating cash flow multiple on the company of 16.3. The price to FFO multiple would be 15.4, while the EV to EBITDA multiple would come out to 19. By comparison, using the 2021 figures, these numbers would be 16, 15, and 18.8, respectively. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, the four firms with positive results had multiples ranging between 10.2 and 20. And using the price to FFO approach, the range for the four firms was between 12.7 and 19.8. In both scenarios, two of the four firms were cheaper than our prospect. When it comes to the EV to EBITDA approach, the range was between 15.6 and 22.2, resulting in four of the five companies being cheaper than our target.

| Company | Price / Operating Cash Flow | Price / FFO | EV / EBITDA |

| Universal Health Realty Income Trust | 16.0 | 15.0 | 18.8 |

| Global Medical REIT (GMRE) | 10.2 | 12.7 | 17.5 |

| Community Healthcare Trust (CHCT) | 16.4 | 17.8 | 18.7 |

| Diversified Healthcare Trust (DHC) | N/A | N/A | 15.6 |

| LTC Properties (LTC) | 20.0 | 19.8 | 22.2 |

| CareTrust REIT (CTRE) | 13.8 | 14.6 | 18.5 |

Takeaway

The data provided right now suggests to me that Universal Health Realty Income Trust is a solid operator that will likely continue to fare well so long as its exposure to its largest partner does not become a problem. The company seems to be fairly healthy and the long-term outlook is almost certainly positive. Having said that, shares are not exactly cheap at this time. This is true on both an absolute basis and relative to similar firms. To me, the company looks more or less fairly valued, leading me to rate it a ‘hold’ at this time.

Be the first to comment