imaginima

A few months ago, I gave my initial thoughts on Freehold Royalties Ltd. (OTCPK:FRHLF). I liked the company’s low-risk dividend paying business model and high-quality asset base and own the name in my personal portfolio.

As we head into 2023, I believe it is timely to revisit the company to see if there are any new developments that investors should be aware of and to refresh the thesis.

Freehold Royalties remain one of my preferred ways to gain energy exposure with downside protection in case the economy turns south, as many analysts are predicting. It is currently trading at 9.8x P/FFO using US$75 WTI, which I believe is a fair valuation. Its C$0.09 monthly dividend is sustainable down to US$40 WTI.

Brief Company Overview

Freehold Royalties is a Canadian energy royalty company with assets in Canada and the US. Although I am highlighting the US OTC ticker in this article, the stock mainly trades on the TSX under the symbol (“FRU”).

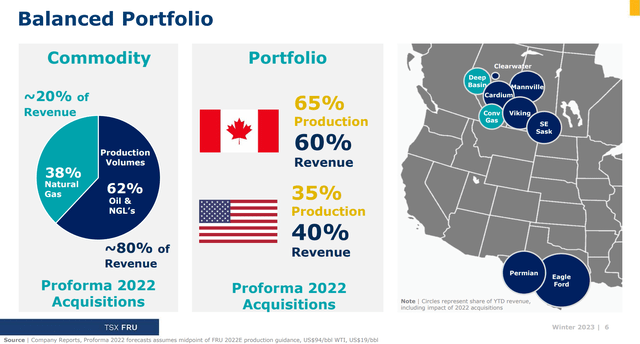

Freehold derives 65% of production and 60% of revenues in Canada and 35% of production and 40% of revenues from the U.S. (Figure 1).

Figure 1 – Freehold asset portfolio (Freehold investor presentation)

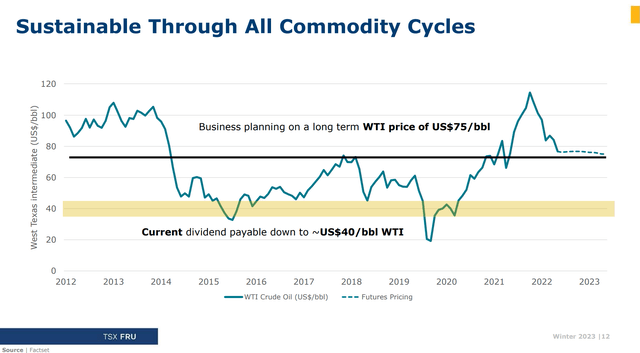

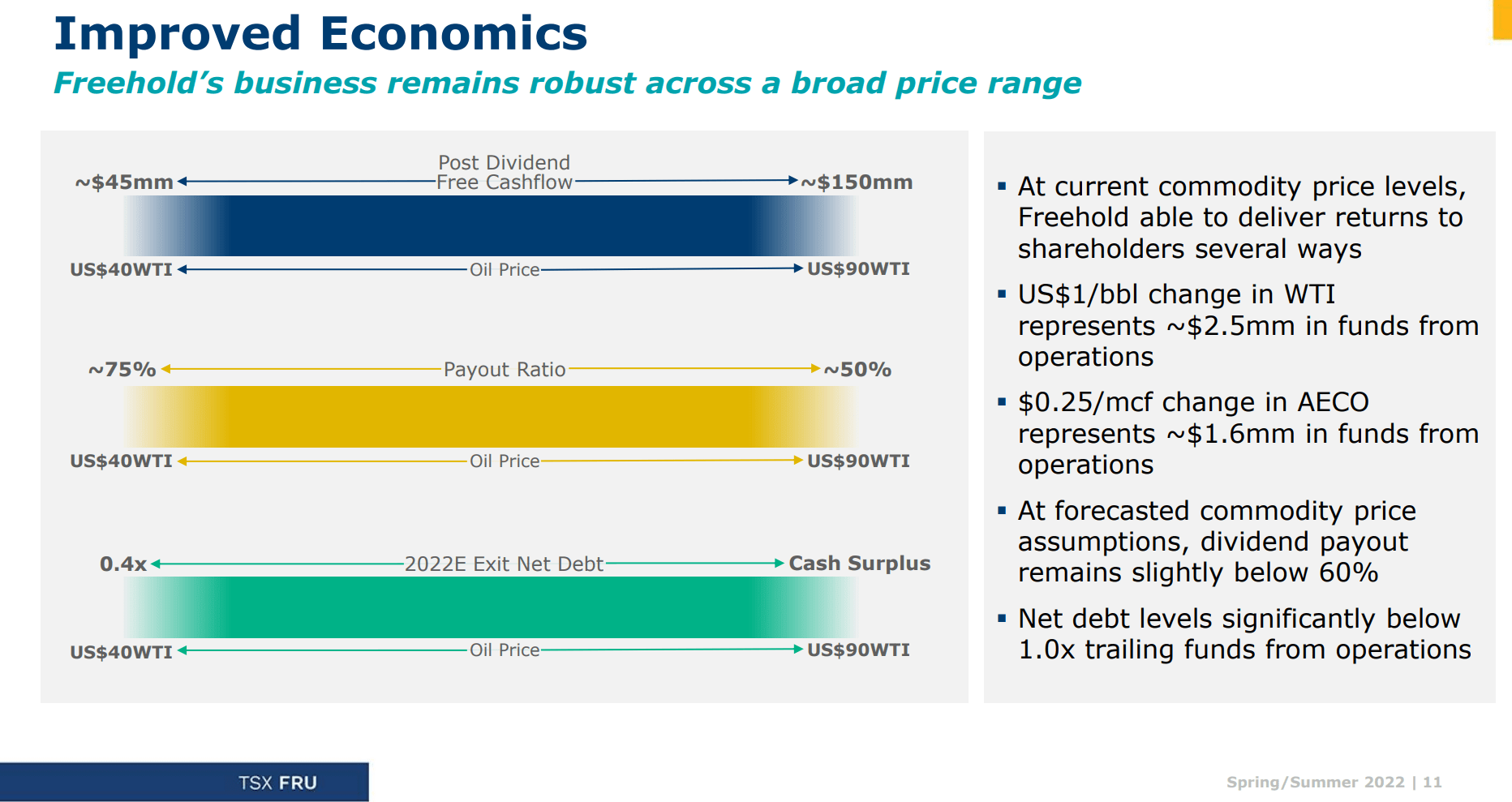

As a royalty company, Freehold enjoys very low ‘cash costs’ of production of ~C$4 / boe. This allows the company to fund a very generous dividend, which is currently set at C$0.09 / month for a 6.8% forward yield that is sustainable down to US$40 / bbl WTI (Figure 2).

Figure 2 – Freehold’s dividend is sustainable down to US$40 WTI (Freehold investor presentation)

Reviewing 2022 Acquisitions

When I last wrote about Freehold, it was literally hours before the company announced an acquisition of Permian and Eagle Ford assets.

At the time of the acquisition, I commented:

They paid C$155 million for 1100 boed, so about C$140k a flowing barrel. This is slightly higher than their corporate average, and higher than what they paid in 2021 ($86k) for sure.

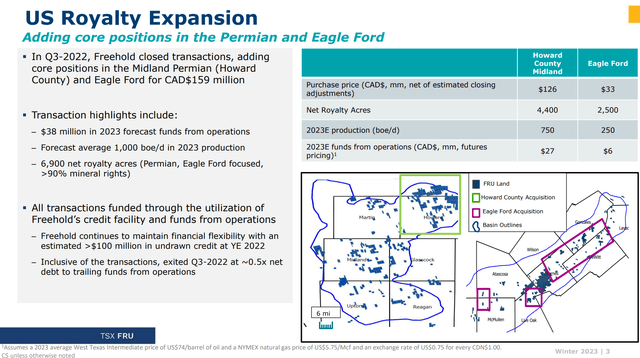

With a few months of Freehold operating the assets, let’s review the acquisition to see how it has performed. Net of closing adjustments, the final cost of the acquisition came to C$159 million for 6,900 net royalty acres and 1,000 boe/d of 2023E production (Figure 3).

Figure 3 – Freehold U.S. royalty expansion (Freehold investor presentation)

Judging by the 2023E production of 1,000 boe/d, the assets have underperformed the initial estimate of 1,100 boe/d set by the company in the initial press release. This translates to a purchase price of C$159k per flowing barrel.

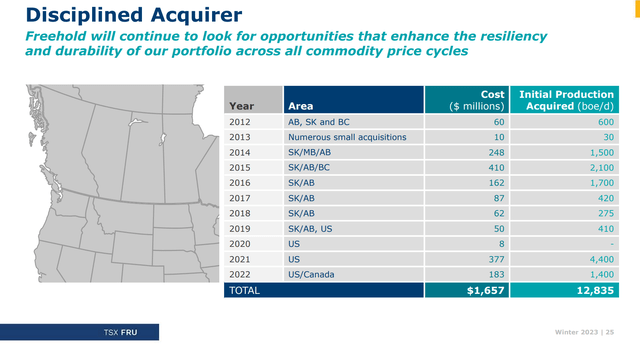

Compared to the company’s historical average of C$129k per flowing barrel, the 2022 acquisition of Permian and Eagle Ford assets was definitely on the expensive side (Figure 4). However, we should note that based on 2023 forecasted FFO of C$38 million, the company paid only 4.2x cash flow, which is reasonable.

Figure 4 – Freehold historical M&A transactions (Freehold investor presentation)

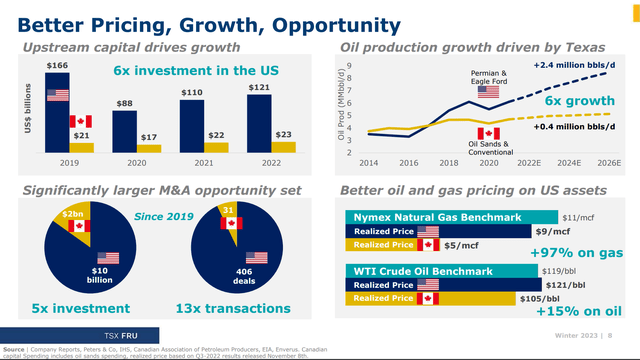

Furthermore, we need to bear in mind that U.S. assets may trade at a structural premium to Canadian assets, since the U.S. has better realized pricing (Canadian oil producers often receive discounted pricing as there is a lack of transport capacity to the gulf coast refining hubs) and more production growth (Figure 5). The large transaction in 2022 also gives Freehold a platform to make further tuck-in acquisitions in the Permian and Eagle Ford areas over time.

Figure 5 – Freehold rationale for U.S. expansion (Freehold investor presentation)

Overall, although the Permian and Eagle Ford acquisition was more expensive than I would have liked, I am not too concerned. However, if this becomes a new trend of overpaying for acquisitions, then I will have to reassess my view of the company.

Recent Results Continue To Show Business Model Strength

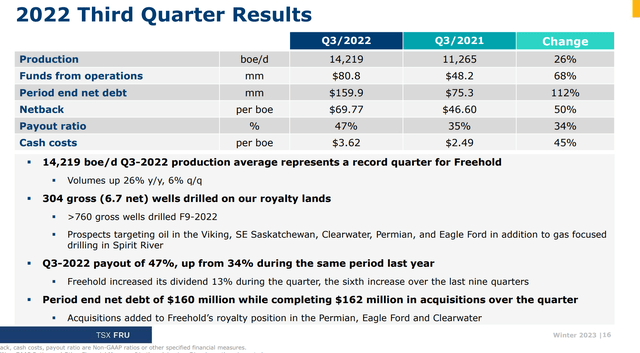

Freehold’s Q3/2022 results continued to show the strength of the business model, with production growing 26% YoY and funds from operation growing 68% YoY. Freehold enjoyed netbacks of almost C$70 / bbl, since its cash costs are so low (Figure 6).

Figure 6 – Freehold Q3/2022 summary (Freehold investor presentation)

Importantly, Freehold’s dividend payout ratio remained low at 47%, despite the monthly dividend rising from C$0.05 in Q3/21 to $0.09 in Q3/22. Given the company’s stated target of a 60% payout ratio, I believe there is scope for a dividend increase once Freehold finalizes its 2022 financial reporting and budgeting for 2023.

As a frame of reference, Freehold increased its dividend last year in March, concurrent with the reporting of its Q4/2021 results.

Valuation Is Fair

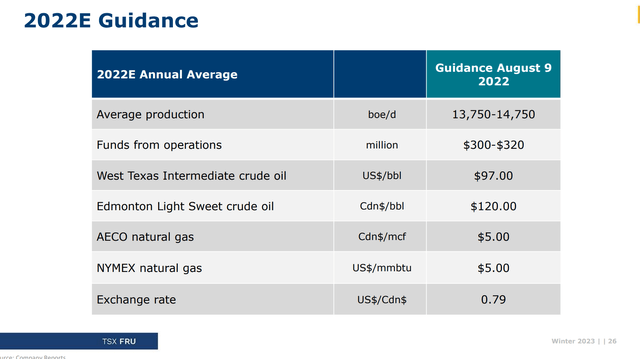

With the shares rallying ~30% since my initial article, Freehold is now trading at a market cap of C$2.4 billion. Compared to the company’s estimates for 2022 funds from operations of C$310 million, this is equivalent to 7.7x P/FFO. Note that the FFO figure was increased from the May 10th guidance of C$240 in FFO using US$75 WTI.

Figure 7 – Freehold 2022E guidance (Freehold investor presentation)

From an old investor presentation, we can see that the company’s FFO sensitivity is approximately C$2.5 million per US$1/bbl in WTI (Figure 8). So normalizing the FFO figure above back to US$75 WTI, we see the company is guiding to ~C$255 million in FFO at US$75 WTI, a slight increase due to the U.S. acquisitions made in August.

Figure 8 – Freehold business sensitivity (Freehold investor presentation)

Using the more conservative US$75 WTI estimate, Freehold is currently trading at 9.8x P/FFO. I believe this is a fair valuation providing plenty of margin of safety.

Risks To Freehold

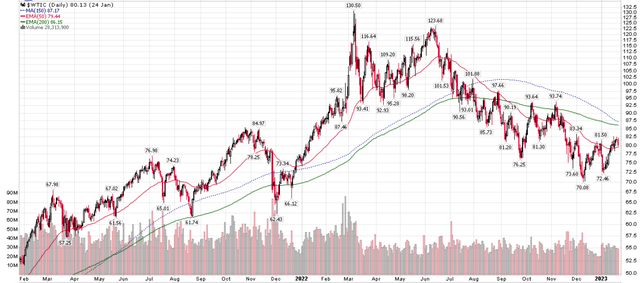

The biggest risk to Freehold remains the commodity price. Although crude oil prices ran up in the aftermath of Russia’s invasion of Ukraine, they have been drifting lower in the past few months, exiting 2022 at roughly the same level as in 2021, as oil demand weakened on the back of a slowing global economy (Figure 9).

Figure 9 – Crude oil prices have been drifting lower (stockcharts.com)

However, in recent weeks, crude oil prices appear to have stabilized, as news of China’s re-opening have spurred bets on higher Chinese oil demand. The International Energy Agency (“IEA”) is forecasting that China’s re-opening could lift global oil demand by 1.9 million barrels per day to a record 101.7 mmbpd, with more than half of the growth coming from China. Similarly, OPEC is expecting Chinese demand to grow by more than 500,000 bpd in 2023.

Conclusion

Freehold Royalties remain one of my preferred ways to gain energy exposure with downside protection in case the economy turns south, as many analysts are predicting. It is currently trading at 9.8x P/FFO using US$75 WTI, which I believe is a fair valuation. Its C$0.09 monthly dividend is sustainable down to US$40 WTI.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment