chaiyapruek2520/iStock via Getty Images

China’s increasing technological capability has fueled a sense of urgency within the Pentagon about adopting Artificial Intelligence (“AI”). The U.S. and other militaries see similar advantages, and are rushing to use AI for cybersecurity, weapons technology, mission planning, intelligence gathering, or to improve logistics.

Except for the probability of cyberattacks using AI and the large number of cyber security companies using AI to thwart cyberattacks, there are no know attacks to date on the U.S. by China employing AI capabilities.

In a move to eliminate an existential AI danger, President Biden just declared war against China on the AI front, as the U.S. has imposed a new license requirement for any future export to China (including Hong Kong) and Russia of Nvidia’s (NASDAQ:NVDA) A100 and forthcoming H100 integrated circuits without an export license.

Then on Thursday, NVDA filed an amended disclosure saying that the government had walked back the sanctions by agreeing to allow the exports necessary to continue the development of the H100 through March 1 of next year, and authorized Nvidia to continue any exports needed to provide support for U.S. customers of the A100 until the same date.

Nvidia said that its outlook for its fiscal third quarter, which included $400 million in potential sales to China, may be subject to the new license requirement if customers don’t want to purchase the company’s alternative product offerings or if the U.S. doesn’t grant licenses in a timely manner or denies licenses to significant customer.

According to the company, the fourth-generation Nvidia DGX H100 is the world’s most advanced enterprise AI infrastructure, and the world’s first AI platform to be built with new NVIDIA H100 Tensor Core GPUs.

- Each DGX H100 contains eight H100 GPUs with an aggregated 640 billion transistors

- These systems will also power the NVIDIA “Eos” supercomputer, expected to be the world’s fastest AI system when it begins operations later in 2022

But the move by Biden is not about compute power, it’s about suppressing the ability of China to use these chips to extend its Artificial Intelligence threat.

Why would the U.S. government be concerned?

Recognizing China’s efforts to use GPUs in AI applications, the U.S. government put Jingjia Micro Co., a military-civilian integration company, on the entity list. Its products involve GPU chips, military radars, etc. Among them, Jingmei series GPU chips are currently their core business, accounting for more than 70% of revenue and profit. In 2014, the company developed The JM5400 GPU chip is successful, which is known as the first high-performance GPU chip with independent intellectual property rights in China.

Prior to Jingjia Micro’s development of the JM5400 GPU, Chinese military drones and aircraft relied in part on M9 GPUs produced by ATI Technologies, a Canadian company owned by U.S.-based Advanced Micro Devices (AMD). The M9 chip was originally developed in 2002, and Jingjia was only able to match its performance in 2018. ATI folded in 2010, unable to compete with Nvidia.

With the combination of SMIC and Jingjia, China’s ability to domestically design and produce GPUs for military use in order to “fully replace foreign chips such as the M9” is still a major milestone for the PLA.

Reacting To China AI Efforts

According to a new report by the Center for Strategic and Emerging Technology (CSET), over the last five years, the People’s Liberation Army has made “significant progress” in adopting AI for combat and support functions.

The CSET report noted that “despite more aggressive efforts by the Trump and Biden administrations to limit technology exports to the Chinese military, the PLA is placing orders for AI chips designed by U.S. companies and manufactured in Taiwan and South Korea.”

U.S. semiconductor companies may not be aware that their products are in some cases destined for the Chinese military, the study noted.

Of the 97 individual AI chips that CSET researchers identified while examining public PLA purchase records, nearly all were designed by Nvidia, Xilinx (now Advanced Micro Devices), Intel (INTC), or Microsemi (now Microchip (MCHP)).

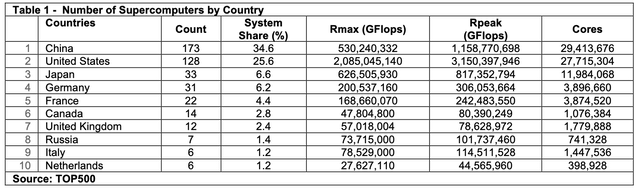

In terms of individual AI-related technology indicators, Russia has only seven supercomputers ranked among the 500 most powerful computers in the world, for example, while China has 173, the United States has 128, and Japan has 33, as shown in Table 1.

TOP500

Also, the number of AI start-ups in a given country is also a key indicator of its progress in this field. Russia currently has 346 AI start-ups, compared with 12,378 in the United States and 1,820 in China.

AI at the Cloud and Data Center

In 1999, Nvidia invented the GPU (graphical processing unit) and launched the GeForce256. By 2011, AI researchers around the world had discovered Nvidia GPUs. With AI, Nvidia has emerged as the leader in AI-based training and inference for data centers and autonomous transportation solutions.

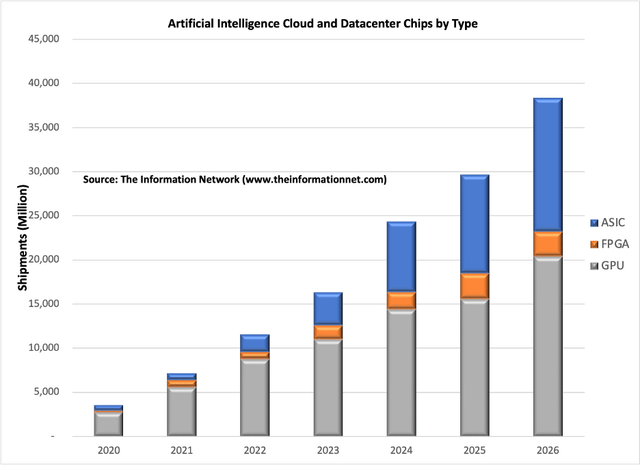

Nvidia held a 100% share of chips for artificial intelligence in 2013, but since that time, other chip types such as ASICs and FPGAs are gaining share on GPUs), according to our report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

I estimate the global AI chip market for cloud and data center at $3.6 billion in 2020, and forecast to grow at a 48% CAGR to $39 billion in 2026, as shown in Chart 1. I estimate GPU dropping from 78% in 2020 to 53% in 2026. I also see the more ASIC market growing at a CAGR of 70% and reaching 40% of the AI chip market in 2026.

The Information Network

Chart 1

The cloud and data center segment remains a dynamic and fast-growing market for AI processors. The cloud is in the early stages of AI processor adoption, while data center demand is set to rise.

Nvidia’s GPU (graphic processor units) have dominated the datacenter ever since architecture (originally designed as a graphics accelerator for 3D games) into a more general-purpose parallel processing engine in 2010.

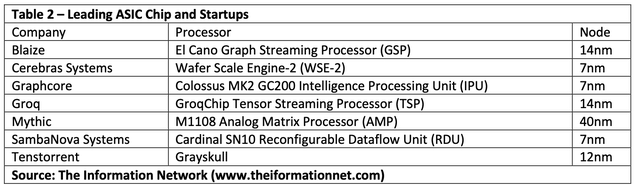

As noted in Chart 1 above, ASICs are the fastest growing segment of the cloud/datacenter AI. Shown in Table 2 are leading ASIC chips and startups in competition with Nvidia.

The Information Network

China Fabs Today

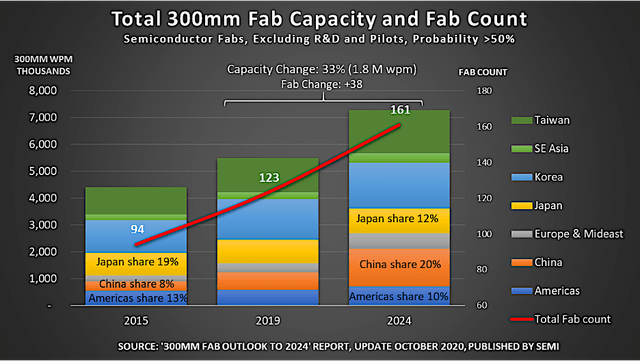

Chart 2 from SEMI shows that China will rapidly increase its global share of 300mm capacity, from 8% in 2015 to 20% in 2024, reaching 1.5 million 300mm wpm in the final year of the reporting period. While non-Chinese companies will account for a substantial portion of that growth, Chinese-owned organizations are accelerating their capacity investments. These companies will represent about 43% of China’s fab capacity in 2020, a proportion expected to reach 50% by 2022 and 60% by 2024.

SEMI

Chart 2

China’s GPU

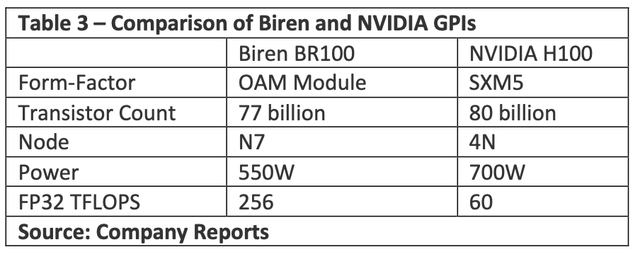

The U.S. restrictions have placed attention China’s GPU industry. Biren Technology and Moore Threads were both started from former Nvidia employees. Biren Technology was founded by a senior Nvidia GPU architect, Lingjie Xu, in 2019. The company has raised US$285 million over three rounds. Built on TSMC’s 7nm process, Biren’s initial family of compute GPUs includes two chips. The BR100 promises up to 256 FP32 TFLOPS vs 60 for the H100, as shown in Table 3.

Company Reports

Moore Thread was founded by Nvidia’s former global VP and general manager in China, Zhang Jianzhong in 2020, and independently developed its own GPU architecture MUSA (Moore Threads Unified System Architecture) used on its desktop-oriented MYS60 and server-oriented MTT S2000 GPUs that were announced this year. The startup has raised a total of $313 million over two rounds, with ByteDance and Tencent among its investors.

Interestingly, Changsha Jingjia Microelectronics Co. was the first company in China to successfully develop domestic GPU chips and realize large-scale engineering applications. Founded in 2006 as a military-focused GPU design company, Jingjia Micro used its early support from the government to develop several generations of GPUs for deployment in radars and satellites. In 2018, Jingjia Micro leveraged its acquired know-how to enter the civilian market for GPUs, launching its JM7200 GPU for niche commercial applications. A later version, JM7201, was launched for desktop applications. In 2021, Jingjia Micro was included in the U.S. Entity List, and in 2022 it launched two versions of its JM9 family of GPUs, despite the sanctions.

Investor Takeaway

China’s stated goal is to become self-sufficient in the production of semiconductors for its domestic market and to develop technology that is competitive on the world market. The U.S. had a chance to stop China from being a technology powerhouse and ultimately an existential threat 20 years ago but buckled under lobbying from industry consortium SEMI to benefit its semiconductor equipment members.

Twenty years later, the U.S. has attempted to take corrective action by imposing sanctions on Chinese (and Russian) companies, starting with China’s Huawei, which was placed on a trade blacklist that restricted American companies from doing business with the major provider of network equipment and smartphones. The U.S. also imposed sanctions on Chinese chip companies and on equipment companies from selling advanced equipment to Chinese chip companies.

Over the past several years, Nvidia has been instrumental in developing and extending its business in China. Nvidia has had a close relationship with the Chinese market in recent years. The company provided the cutting-edge chips that helped some of China’s surveillance companies train their image recognition algorithms.

More recently, Nvidia executives said the company’s technology has also become critical to vehicle makers such as BYD Co. (OTCPK:BYDDF) to fuel their electric car and self-driving vehicle ambitions. Other Chinese customers include information technology juggernaut Lenovo Group Ltd. (OTCPK:LNVGY) and cloud provider and server company Inspur Group.

More than a quarter of Nvidia’s $26.9 billion in fiscal 2022 revenue was derived from China and Hong Kong. Jensen Huang, the president and co-founder of Nvidia, said in a call with analysts last month that China is a “very important market for us, a very large market for us.”

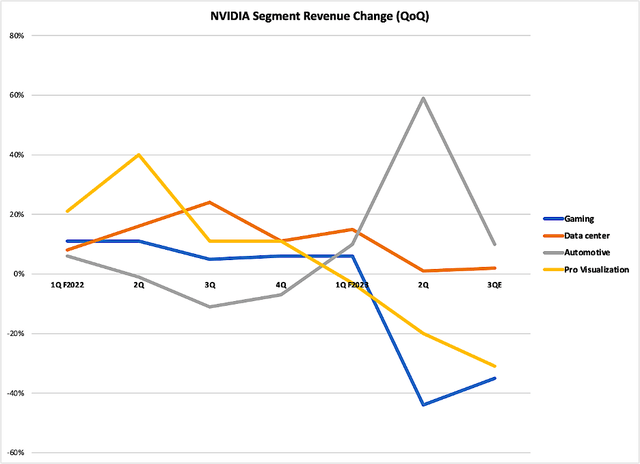

This licensing restriction action is another headwind for the company beset with headwinds in F2Q ending July 2022. Chart 3 shows QoQ revenue changes for Nvidia between F1Q 2021 and F2Q 2022.

NVIDIA

Chart 3

According to Colette Kress, NVDA CFO:

Data Center: The Hopper architecture flagship H100 data center GPU is in production. Grace is our first CPU. Top computer makers, including Dell, HPE, Inspur, Lenovo and Supermicro are adopting the new Nvidia Grace CPU Superchip and Grace Hopper Superchip to build the next generation of supers. 72% of the systems on the latest top 500 list of the world’s fastest supercomputers are powered by Nvidia, including 31 of 39 new systems.

Gaming: The decline in Gaming GPU revenue was sharper than anticipated, driven by both lower units and lower ASPs. Macroeconomic headwinds across the world drove a sudden slowdown in consumer demand.

Professional Visualization: A sequential increase in mobile revenue was more than offset by lower desktop revenue, particularly at the high end. As macroeconomic headwinds intensified, enterprise demand slowed and OEMs worked to reduce inventory. We expect these trends to persist in Q3.

Automotive: Strong growth was driven by auto AI solutions, which include AI cockpit and self-driving revenue, with particular strength in self-driving as new energy vehicle design wins ramp into volume.

Chart 3 above shows guidance for F3Q 2023. Guidance provided by Nvidia is “30-plus percent sequential decline in gaming and Professional Visualization and maybe kind of low to mid-single-digit growth in Data Center and Auto.”

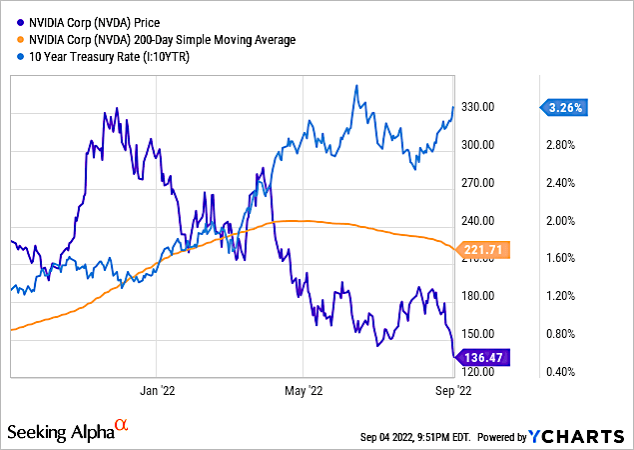

Chart 4 shows share performance for NVDA for a one-year period. It also shows that share performance is below the 200-day moving average since February 2022. In addition, shares have been negatively impacted by an increase in the 10-year Treasury Rate. I have discussed in numerous Seeking Alpha articles how inflation and the 10-year growth rate has been inversely proportional to technology stocks.

YCharts

Chart 4

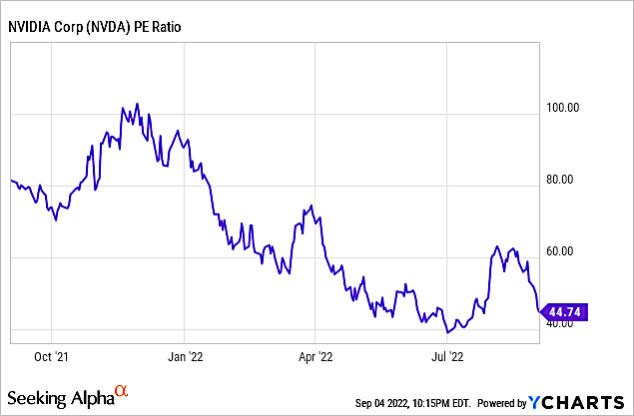

Nvidia’s headwinds of weak F2Q earnings and F3Q guidance, lower growth potential, and licensing restrictions on selling GPUs in China, are coupled with a high valuation. NVDA is expensive based on its PE ratio (44.7x) compared to the US Semiconductor industry average (17x) is shown in Chart 5.

YCharts

Chart 5

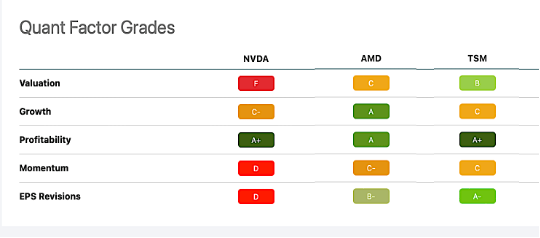

My major focus with this article is to discuss Biden’s targeting of China on the AI front. While Nvidia and its GPU prowess is most impacted, the company has been facing other headwinds as detailed above. This represents a chance for me to compare Quant Factor Grades of Nvidia with those of AMD, which also was implicated in the licensing restrictions, and TSMC (TSM) my top stock pick and the foundry that makes NVDA and AMD chips.

Chart 6 shows that NVDA fares worse in nearly every category except profitability to AMD and TSM. As presented in Chart 3 above, gaming QoQ growth plummeted in the recent quarter, although NVIDIA expects it to increase in the current quarter. In contrast, the smaller Automotive segment grew strongly but is expected to slow.

Seeking Alpha

Chart 6

While macroeconomic headwinds pressuring consumer demand for Nvidia’s gaming GPUs, competitor AMD posted 70% year-over-year revenue expansion in its second quarter, underscored by a 32% rise in gaming revenue. Thus, the question remains about Nvidia’s Gaming sector (representing 30% of revenues in F2Q vs 44% in F1Q) as to whether it is losing share to AMD.

Also, while Nvidia’s Data Center segment increased just 1% QoQ, it represented 57% of total revenues. But guidance growth of just 2% in the sector coupled with 30%+ decrease in guidance for Gaming and Professional Visualization, may be headwinds that last through FY2023. I rate NVDA a hold.

Be the first to comment