Grigorev_Vladimir/iStock via Getty Images

La-Z-Boy Inc (NYSE:LZB) is recognized for its namesake reclining chairs although the business is significantly broader with a major market position globally in several product categories of residential furniture. This is a segment that got a big boost during the pandemic amid the record housing boom although the story this year has been consumer spending uncertainties against macro headwinds. Indeed, shares of LZB have been under pressure through poor sentiment towards the sector while the company deals with some supply chain challenges.

That being said, the latest quarterly report was highlighted by impressive operating and financial trends that beat expectations. The company issued positive guidance benefiting from several strong points including momentum from its contemporary “Joybird” brand. We like the stock supported by overall solid fundamentals including its dividend growth profile. We’re bullish and view the recent selloff as a buying opportunity.

LZB Earnings Recap

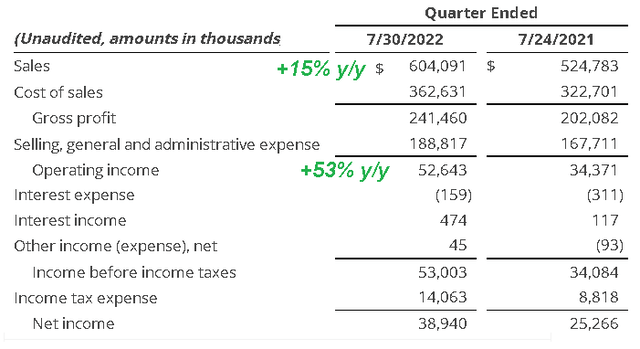

This was LZB’s fiscal 2023 Q1 earnings with non-GAAP EPS of $0.91, up from $0.55 in the period last year, and $0.24 ahead of the consensus. Revenue of $604 million climbed by 15% year-over-year and was also above the estimate. Management noted that the operating income of $52.6 million, and operating margin of 8.7% compared to 6.5% in the period last year, was a Q1 company record. The effort here included a higher gross margin based on savings achieved as a new manufacturing facility in Mexico ramped up along with pricing initiatives and a shifting sales mix.

source: company IR

The strength here was driven by the retail segment, which considers direct-to-consumer channels and brick-and-mortar stores, where sales climbed by 30% y/y to $236 million. The larger wholesale business also posted a 12% increase. The Joybird group, with sales up 10% y/y, benefited from improved e-commerce conversion and a higher average sales price. Easing supply chain disruptions compared to the start of the year has also helped with the results.

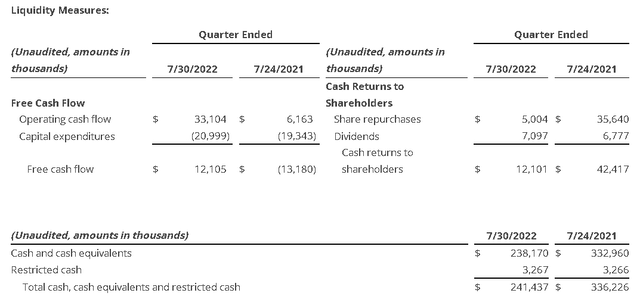

La-Z-Boy ended the quarter with $241 million in total cash against $78 million in long-term financial debt. The balance sheet position and positive cash flows support the company’s capital allocation program. The quarterly dividend currently at $0.165 per share represents an annualized distribution of $28 million or a modest payout ratio of just 21% compared to earnings over the past year. The company has also been active with buybacks, repurchasing $5 million in stock during the last quarter, while there is still $7.3 million remaining under the existing authorization.

In terms of guidance, the company is projecting some optimism for the trends to continue. The target is for Q2 revenue growth between 2% and 5% y/y recognizing what was a tough comparison period last year.

source: company IR

LZB Stock Price Forecast

La-Z-Boy’s Q1 results speak for themselves as a testament to the success of the company’s “Century Vision” strategy that was launched last year. The idea is to “reinvigorate” the La-Z-Boy brand including through store remodelings and a back-to-basics focus on new brick-and-mortar retail locations.

The plan is to add 40 to 60 more stores on top of its existing 348 La-Z-Boy Furniture Galleries stores and 531 La-Z-Boy Comfort Studio locations globally. The expansion effort coincides with the company’s 100th anniversary in 2027 to reach 400 doors in North America including company-owned and franchised locations. The company is also betting big on its Joybird brand acquired in 2018, as appealing to younger demographics and online presence. The final point of the strategy is to strengthen the fundamentals with a push toward higher margins and an upside in profitability. All-in-all, we’re encouraged by what we’ve seen thus far.

The question is how much of the recent economic volatility will play into a growth slowdown going forward. It appears the market is skeptical that the recent trends will be able to be maintained. We’re a bit more optimistic on the broader economy and would cite ongoing strength in the labor market along with signs inflation is slowing as supporting a more positive outlook. Even looking at the housing market and its connection to home goods and furniture demand, even with headlines of existing home sales down 20% y/y, the other side of the discussion is that the level has simply returned to pre-pandemic levels.

In our view, the economy is well-positioned to emerge out of what has been a rough patch, while beaten-down shares of LZB can head higher. The bullish case for LZB is that operating conditions remain resilient, opening the door for the company to exceed earnings expectations. The attraction here comes down to the steady growth outlook and underlying fundamentals. According to consensus estimates, the forecast is for revenue growth of 1% this year while EPS can climb 6% based on higher margins, we believe these targets may prove to be too low.

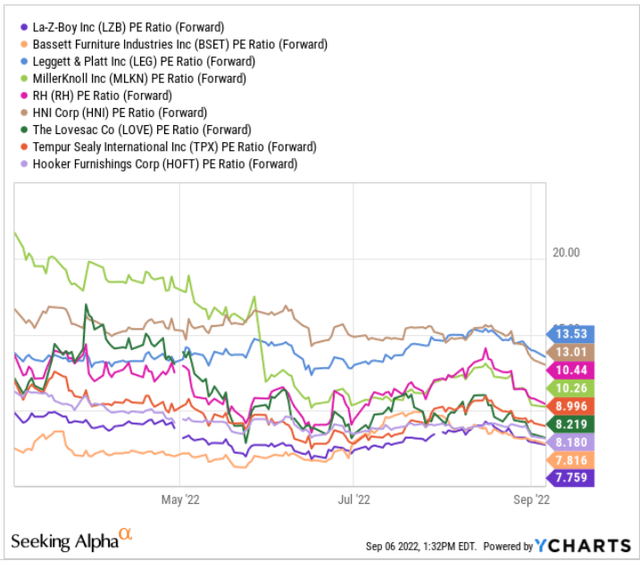

As it relates to valuation, LZB trading at a forward P/E of 7.8x stands out among a peer group of other home furnishings and furniture stocks. While companies like Basset Furniture Industries Inc (BSET), Leggett & Platt Inc (LEG), Hooker Furnishings Corp (HOFT), and HNI Corp (HNI) all have key differences and are not directly comparable, it’s fair to say that LZB is a value-pick in the segment. We could also argue that LZB benefits from greater name recognition and we also like its omnichannel diversification including international exposure.

source: YCharts

Final Thoughts

We rate LZB as a buy with a price target for the year ahead at $33.00 representing a forward P/E multiple of 10x on the current fiscal 2023 consensus EPS of $3.30. It will likely take some improving sentiment across equities as an asset class for momentum in the stock to get going, but we also see the downside as relatively limited from here.

Investors can look forward to the next quarterly dividend where LZB may announce a hike, following its historical trend of increases for the fiscal Q3 payout. Our forecast is for a new dividend rate of $0.175 per share, representing a 6% increase over the current amount. Monitoring points over the next few quarters include the operating margin and same-store sales trends.

Be the first to comment