David Becker

Panasonic is transitioning and no one is paying attention

An undercovered gem, Panasonic (OTCPK:PCRFY) (OTCPK:PCRFF) is trading at below book value for a company transitioning the lion-share of its business into batteries and green energy. There are not many deals, if any, left in this space. Panasonic at these prices is a buy-and-hold through the execution period of their transition.

Panasonic is a company dear to my heart and one that I have been invested in for years. The stock price has traded in a somewhat narrowband since the ADR listed, the past 5 years have seen Panasonic’s share price depressed to some of its lowest prices in the company’s history at $8 a share. Being a resident of Reno, Nevada, I have seen the company employ thousands of workers in the community, offering amazing blue and white-collar jobs that have helped to transform the town. Panasonic busses are buzzing all over the place, shuttling workers from central locations of the city to the more rural area where the factory is located about 45 minutes outside of Reno.

Having known several employees at Giga 1, I can say that this is a very busy operation and Panasonic seems just as important as Tesla (TSLA) in rolling cars off the line and into consumers’ hands. The factory set up in Nevada is split almost evenly down the middle, with Panasonic workers on one side and Tesla employees on the other. The Panasonic employees produce the battery cells and deliver them to the Tesla employees to insert into the bodies of the vehicles. The vehicle bodies were all produced in Fremont, California, which is about 3.5 hours to the west of Giga 1. After the full car is assembled, they are shipped all over the United States to the end consumer.

With this intertwined relationship in mind, why is Panasonic not getting the love that Tesla does? Is it a lack of an outspoken CEO to help promote the share price? That can’t be it because LG Chem (OTCPK:LGCLF), Samsung (OTCPK:SSNLF), and CATL have performed well as lithium-ion battery-producing names. Possibly the prior associations with Household durables versus energy? It’s really hard for to say, but it does lack the coverage it should be getting. Zero analysts are covering this stock from Morning Star to CFRA. Goldman Sachs initiated coverage for its clients, but that’s not typically available to investors from outside the investment house.

I have a buy rating on Panasonic. My thesis is centered around their transition to a holdings company in order to pivot into a green energy-centric company.

Benefits of a holdings company

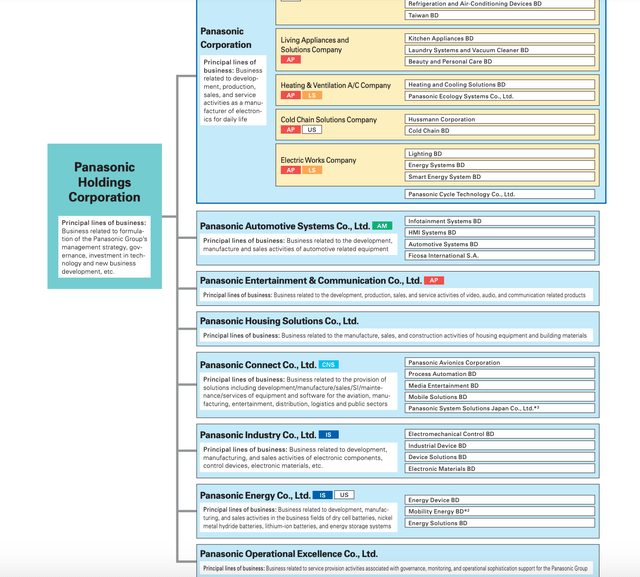

In transitioning to a holdings company, the goal is clear: separate the parts from the whole to divest from inefficient businesses and focus attention on businesses that have enormous future profit potential.

Panasonic’s new CEO, Yuki Kusumi, who has led the automotive segment of Panasonic’s operations for the past ten years, had this to say about their mid-term strategy:

We are undertaking initiatives with an awareness of financial discipline under our capital allocation policy of generating cash needed for investments, structural reforms, and dividend payments from cash flow generated by businesses, divestitures, and the sale of assets.

We can see throughout the report evidence of inefficient segment divestitures and allocation of capital to more efficient ones:

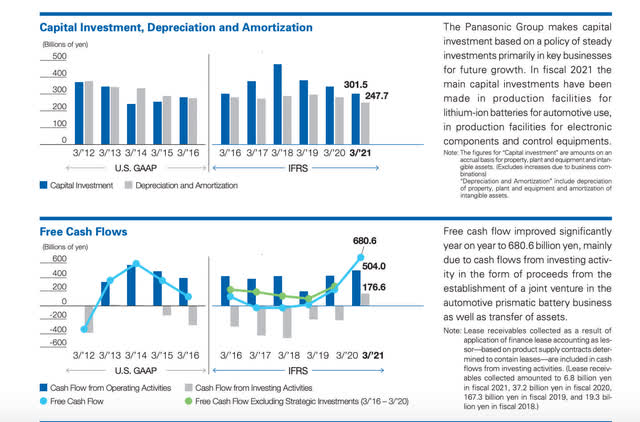

Panasonic annual report

Viewing the above chart are examples of capital investment focused by Panasonic, with the main capital being directed to lithium-ion battery plants for automotive use. While Tesla has complained about Panasonic not being fast enough to produce the volume of batteries they need, they are not the player in Panasonic’s wheelhouse.

Coming soon

Toyota Motor (TM) has several joint initiatives with Panasonic to produce batteries for their EV lines and arguably would be a much better partner for Panasonic versus Tesla. Many of the same Japanese business practices would be joined by the two large caps, with Toyota Motor selling over 10 million vehicles in 2021 versus Tesla with slightly less than 1 million.

The JV with Toyota when first established was described as follows in the 2021 annual report:

Automotive prismatic batteries Combine the electric vehicle know-how and manufacturing capability of Toyota with our high-quality, high-safety battery technologies, mass production capabilities, and customer base to develop the No.1 automotive prismatic battery in the industry January 2019 Announced decision on joint venture with Toyota Motor Corporation to engage in automotive prismatic battery business April 2020 Established Prime Planet Energy & Solutions, Inc.

The first of many battery expansions and partnerships that Panasonic is rumored to be involved in is a joint multi-billion dollar plant in North Carolina with Toyota. A second is a plant in Kansas that was just announced, a $4 billion battery plant. Both of these investments will significantly expand Panasonic’s North American operations and put them at the forefront of the EV industry for years to come.

How could I have missed a stock so cheap?

In the not-too-distant future, if Panasonic executes all its initiatives, today’s prices are one of the greatest bargains out there for value and growth. Panasonic currently trades at a price-to-book ratio of .82 and a price-to-earnings ratio of 10 x with a forward p/e of 10 as well.

The company has secured free cash flow equivalent to net profit according to its most recent earnings presentation, which is an amazing feat for any company involved in automotive manufacturing. If you analyze the free cash flow of many of the top auto manufacturers, you will see that although they are earnings positive, most are free cash flow negative due to the capital-intensive nature of the automotive industry that forces companies to reinvest more than their cash from operations to remain competitive.

Debt levels are looking conservative to boot, with a debt-to-equity ratio of only 43.9% and a current ratio of 1.38. This is a company that has produced 9 Trillion Yen in revenue over the past 12 months, the equivalent of USD 64 billion, and currently has a market cap of only USD 18.8 Billion, that’s a price-to-sales ratio of a tad less than .3 folks. While I’ve seen screeners analyze the forward compound annual growth rate of their earnings to be a higher number than the current p/e ratio, resulting in very low forward PEG ratios in trailing quarters, guidance is spotty at best from Japanese companies with several projects in the pipeline yet to be executed.

In this case, I would defer to the Graham number calculation to find a value rather than the PEG ratio, which I would commonly apply to a growth story. The Graham number is the square root of (22.5) x (TTM EPS) x (MRQ Book Value per Share), in this case, we input sqrt (22.5 x .8 X 10.79), this spits out a value of $13.93 a share, a 73% potential upside in value based on this metric.

What could move this stock?

Execution on their battery expansions should continue to increase revenue but decrease cash flow in the near term. Although the recent earnings report stated that free cash flow has stabilized to equal earnings, this has not taken into account the huge investments in battery factories that have yet to be made.

While this stock has been stagnant forever, it’s easy to see how cheap Panasonic is and how cheap the overall Japanese market is in general. The Nikkei is currently trading around 15x earnings while the S&P is hovering around 20x. Additionally, most Japanese companies maintain a very conservative balance sheet and low debt. It’s a popular macro trend to pit the value of the European and Japanese markets on an average price-to-earnings ratio against our own. If you believe in the value Japan presents, Panasonic is one of my favorite names to be in. Buy and hold for at least 5 years.

Be the first to comment