loops7

Snowflake (NYSE:SNOW) provides a data platform, primarily targeted at analytic workloads. The company is also positioning itself to capture more transactional workloads, thereby significantly expanding its addressable market. Data gravity, along with Snowflake’s ability to enable data sharing, could potentially provide the company with a strong competitive position in the long-run. Snowflake’s financial metrics are also progressing as expected, indicating the business will be highly profitable at scale. Snowflake’s valuation is still relatively high though, which is a reflection of the large market opportunity, Snowflake’s strong competitive position and the potential for high and durable profits.

Snowflake

In the past data was copied, transferred and replicated to wherever it was processed, leading to operational complexity, cost and governance risks. The Snowflake Data Cloud enables work to come to the data rather than data having to move to the work, which creates network effects. The company is attempting to leverage this to turn Snowflake into an application platform.

Companies have expressed a desire to build on Snowflake, but to do this they need to be able to create, delete and insert records. Snowflake has introduced Unistore to add transactional capabilities to its platform and support the development of an application platform. Unistore allows developers to bridge transactional and analytical workloads in a single dataset to save users’ time and effort associated with moving and transforming data across systems. Unistore is not likely to be released until the first half of next year.

Streamlit

Snowflake has also acquired Streamlit so that developers can build apps using their preferred tools, with simplified data access and governance. The integration of Streamlit is progressing as expected and Snowflake expects that Streamlit will be fully native early next year.

Cloud Applications

In support of the cloud application platform, Snowflake has launched the Powered by Snowflake program, which aims to help customers build applications powered by Snowflake. The Powered by Snowflake program does this by providing access to technical experts, go-to-market benefits, and support.

Snowflake is also focusing the Powered By program on audience-specific workloads, with a solution for cybersecurity teams launched first and more verticals planned for next year. There are currently over 590 Powered by Snowflake registrants, representing 35% quarter-over-quarter growth.

In addition to enabling applications, Snowflake is expanding the capabilities of the platform in areas like analytics so that they can capture more workloads. Snowpark for Python is now in public preview, which provides optionality to a more technical audience of application developers, data engineers and data scientists. It is expected to be in GA by the end of the year.

Snowflake also expects to introduce Iceberg Tables by the end of this year. Iceberg Tables enable customers to shift data in and out of Snowflake using the open Apache Iceberg format, which is popular for analytics. Iceberg brings the performance, reliability and simplicity of SQL tables to big data.

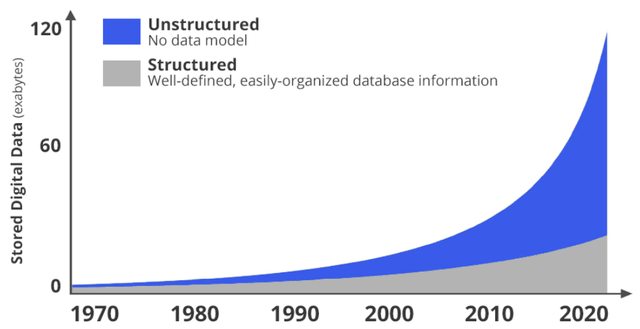

Snowflake has also introduced support for unstructured data, meaningfully increasing the use cases they can support.

Figure 1: Growth in Data (source: m-files)

Applica

Snowflake recently announced that they intended to acquire Applica. Applica mobilizes unstructured data for advanced analytics and machine learning. Applica’s technology uses AI to take unstructured documents and convert them into a semi-structured format. Applica has about 95 engineers, mainly based in Poland.

Data Marketplace

Snowflake’s Data Marketplace enhances the utility of the platform for customers and potentially makes the service stickier. The Data Marketplace is also fueling Snowflake’s application development ecosystem and Powered by Snowflake program.

In the past, compliance and privacy issues have made data sharing impossible. Snowflake has addressed these issues with cleanroom technologies, helping to make a data marketplace viable. Data cleanrooms allow two parties to combine data and run analytics on it without showing each other the data.

Data Marketplace listings grew 22% quarter-over-quarter, and Snowflake now has more than 1,350 data listings from over 260 providers. In Q2, the number of Snowflake data sharing relationships measured by stable edges grew 112% year-on-year. 21% of Snowflake’s customer base has at least one stable edge, up from 15% a year ago. Among customers over $1 million in product revenue, 65% have at least one stable edge.

Snowflake is pursuing a vertical strategy with industry specific solutions. They recently announced the introduction of a healthcare and life sciences data cloud and a retail data cloud. The healthcare and life sciences data cloud helps customers deliver improved patient outcomes and accelerate clinical research and time to market. One pharmaceutical customer estimates that using Snowflake will improve their time to market for a new drug by three years, which would provide an enormous financial benefit. The retail data cloud enables retailers, manufacturers and consumer packaged goods vendors to access new data and seamlessly collaborate across the retail industry. Financial services is currently Snowflake’s number one vertical, and from a revenue perspective contributes about 20%. Media and entertainment, and technology are also large verticals for Snowflake.

Global systems integrators are a small but growing component of Snowflake’s sales. GSIs help to perform the services work necessary to get customers to consume on Snowflake. In the first half of 2022, GSIs performed over $550 million in services around Snowflake, with the top five GSIs representing more than $320 million of that work. The development of this type of ecosystem around Snowflake’s platform helps to support growth as the business scale and increases barriers to entry for competitors.

Over 80% of Snowflake’s customers run their workloads on AWS, with approximately 18% using Azure and the remainder GCP. Snowflake appear to have a fairly antagonistic relationship with Google (GOOG), with management specifically citing challenges on the commercial side. While Snowflake faces competition from the hyperscalers, they appear relatively comfortable with their competitive position.

Snowflake believes that being cloud native and multi-cloud are competitive advantages over the hyperscalers. BigQuery, Redshift and Synapse were not initially built for the cloud, which may be a limiting factor on their performance. Snowflake has stated that Google’s BigQuery is probably the closest competitor, although they continue to win against them. Google has lost engineering talent to Firebolt and GCP continues to disappoint given their technical capabilities.

Databricks is another potential Snowflake competitor, although the two companies have historically focused on different areas of the analytics database market. Databricks has traditionally been targeted at a more technical audience, but with Snowpark and Python support for Snowpark, Snowflake is beginning to address the needs of data scientists and data engineers more.

Snowflake is its own platform, whereas Databricks has been one of many tools that could be used. This makes Snowflake more of a strategic choice for customers as they are making a bigger commitment to the Snowflake ecosystem. The two companies are converging over time though, with Snowflake adding the Iceberg open table format, which allows Snowflake files to be used by non-Snowflake tools.

Financial Analysis

While deteriorating macro conditions are a concern, Snowflake is yet to see any softness in their key business metrics. For example, Snowflake’s corporate sales team that addresses SMBs outperformed their net new bookings goal in the second quarter. Snowflake has described the environment as good not euphoric, which is likely a step back from the past few years.

Snowflake sits at the intersection of the cloud computing and machine learning mega trends. The fact that Snowflake’s platform is utilized in business-critical processes means that it generally gets prioritized fairly highly within customers. This should mean that workloads are not discretionary and hence are not cut during a downturn. It also means that consumption is likely to be tied to the business activity of customers and hence may slow.

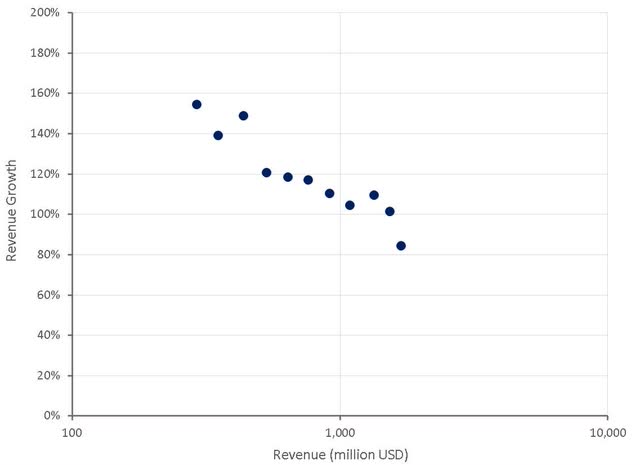

For the full fiscal year 2023 Snowflake expects product revenues of $1.905-$1.915 billion, representing 67-68% YoY growth. A substantial proportion of this growth deceleration from previous years can likely be attributed to performance gains which have led to lower costs for customers. Snowflake is also facing difficult comparable periods from 2021, where certain customers experienced much higher than expected consumption due to the growth of their businesses. Snowflake continues to expect product revenue of $10 billion in fiscal year 2029, growing 30% YoY.

The strength of the USD will only be a minor headwind for Snowflake, as less than 5% of their revenue is invoiced in currencies other than the USD.

Figure 2: Snowflake Revenue Growth (source: Created by author using data from Snowflake)

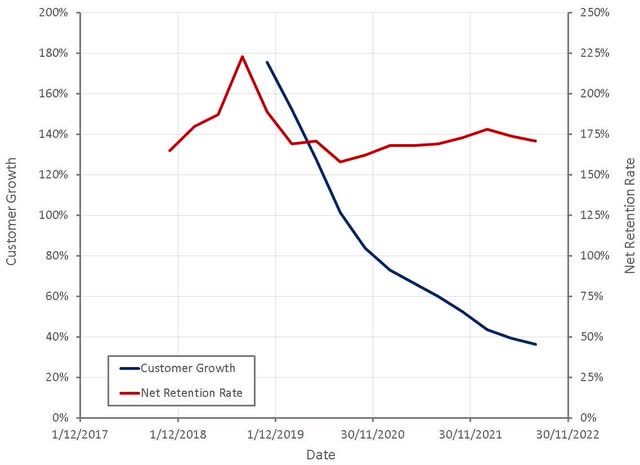

Snowflake’s growth is partially driven by their extremely high net retention rate, which is a result of their consumption-based business model and ability to expand use cases within an organization over time. This number is expected to decline over time, but Snowflake’s management believes it will remain above 130% for a long time.

Snowflake has a 97% gross retention rate and an industry leading net promoter score of 72, both of which are supportive of continued growth and improving margins with scale.

The fact that Snowflake workloads are generally grafted into operational processes makes moving workloads to Snowflake a difficult process. It also means that there is generally a lag between when a customer is signed up and when they begin to generate meaningful revenue. Hence current revenue growth is potentially being driven by customer acquisitions from 2021. Approximately 60% of new customers are migrating from legacy on-prem systems. More than 40% of Snowflake’s migrations are coming from other cloud solutions.

Figure 3: Snowflake Customer Growth and Net Retention Rate (source: Created by author using data from Snowflake)

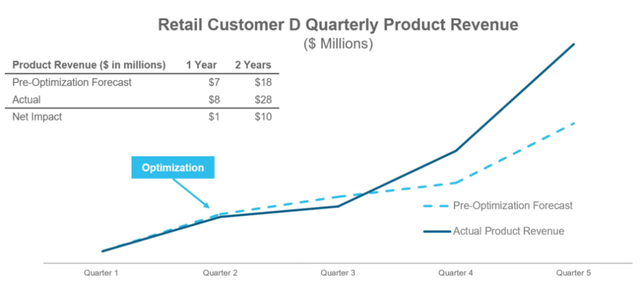

Snowflake’s cloud native architecture removed the scale, performance and economic bottlenecks that previously held back data analytics. Driving lower costs for customers through performance improvements is a revenue headwind for Snowflake, but is generally expected to lead to new workloads in time. CPU enhancements on Graviton 2 that make warehouse scheduling more efficient are one example. Snowflake is now two quarters past platform optimizations and may be starting to benefit from additional workload migrations by large customers.

Figure 4: Impact of Optimization on Customer Revenue (source: Snowflake)

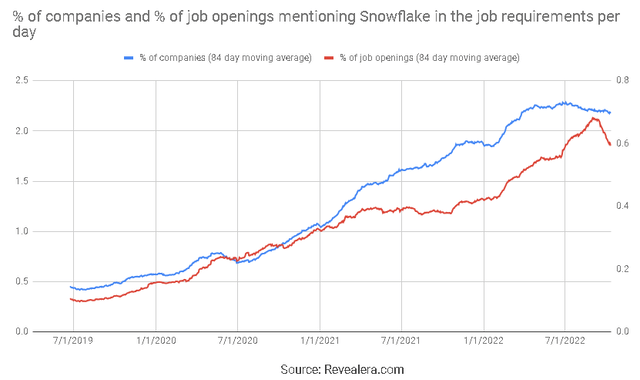

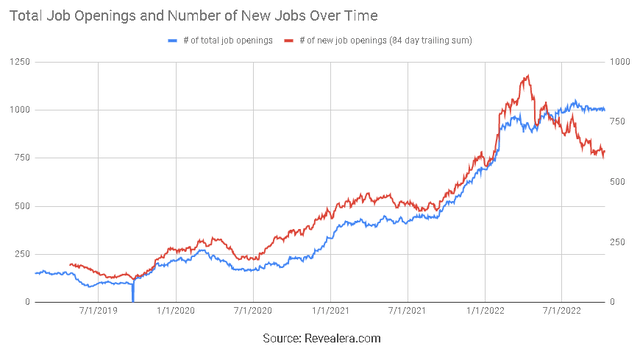

The number of job openings mentioning Snowflake in the requirements has been increasing over time, indicating growing adoption of Snowflake’s platform. Openings have begun to dip in recent months though, which is likely the result of softening economic conditions. This could be an early indicator that Snowflake will face growth headwinds in the next 12 months.

Figure 5: Job Openings Mentioning Snowflake in the Job Requirements (source: Revealera.com)

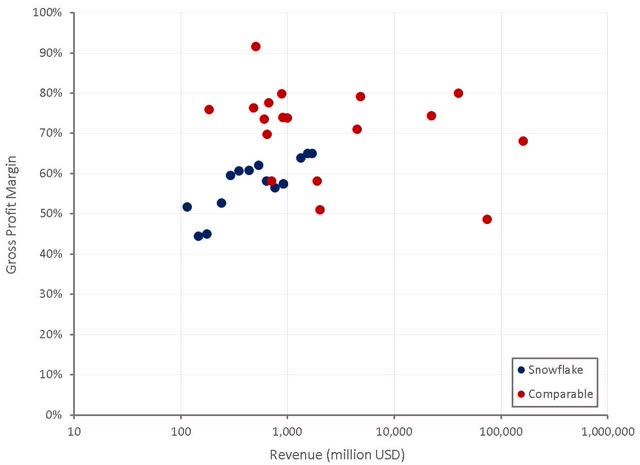

Snowflake’s gross margins have been trending upward over time and have the potential to move higher as services like marketplace and the application platform grow in importance. Snowflake’s relatively low gross margins have been one of the uncertainties regarding the company’s prospects in the past. Gross margins could indicate the extent to which Snowflake is facing price-based competition.

Figure 6: Snowflake Gross Profit Margins (source: Created by author using data from company reports)

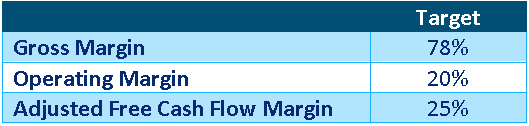

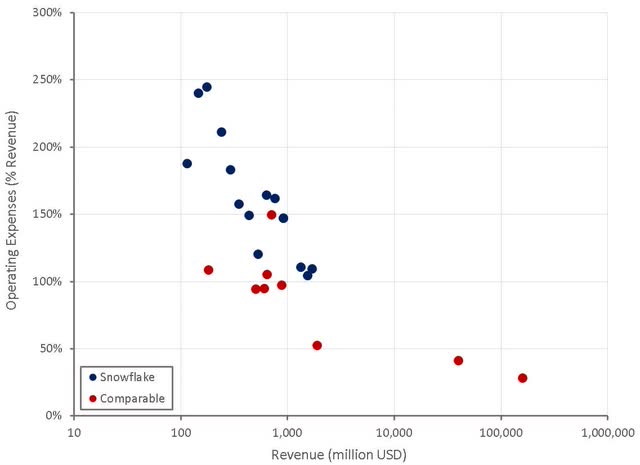

Snowflake has raised their non-GAAP margin targets, although it is unclear whether this is just the result of past conservatism or an improvement in business fundamentals. Snowflake continues to exhibit a large amount of operating leverage, but their operating expenses are still relatively high given the company’s size.

Table 1: Snowflake Non-GAAP Margin Targets (source: Created by author using data from Snowflake)

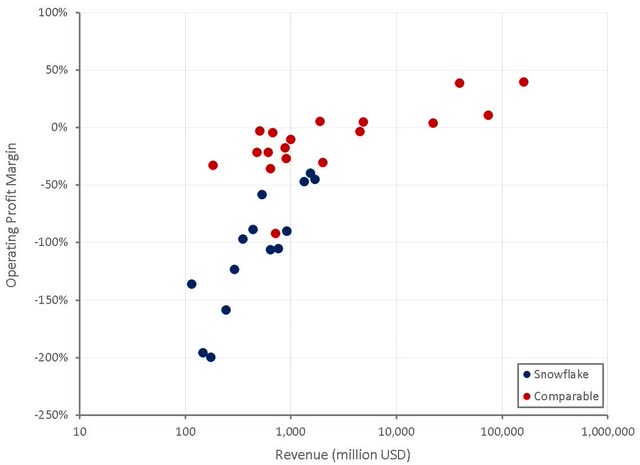

Snowflake’s operating expenses continue to be driven by large investments in R&D and sales and marketing. Given the size of the market opportunity and the platform’s expanding capabilities, the R&D investments do not appear unreasonable. Similarly, Snowflake’s high NPS and low churn are both supportive of investing aggressively in customer acquisition.

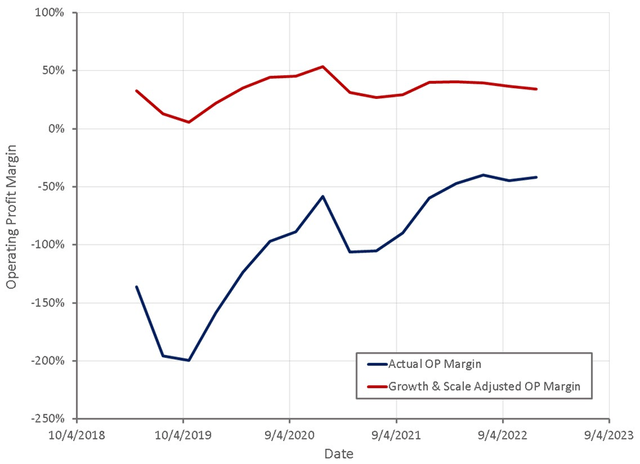

Figure 7: Snowflake Operating Profit Margins (source: Created by author using data from company reports)

Figure 8: Snowflake Operating Leverage (source: Created by author using data from company reports)

By capitalizing and amortizing a portion of Snowflake’s operating expenses, and adjusting margins to account for operating leverage, a better picture of Snowflake’s underlying profitability at scale and with low growth can be seen. This exercise indicates that Snowflake’s target margins are feasible, and if anything, remain overly conservative.

Figure 9: Snowflake Growth and Scale Adjusted Operating Profit Margins (source: Created by author using data from Snowflake)

Despite the prospect of a weaker operating environment, Snowflake continues to hire aggressively due to faith in the long-term opportunity. In the first quarter of 2022, Snowflake stated that they planned on increasing their headcount by more than 1,500 in 2022. In the first quarter, sales and marketing headcount grew 55% YoY.

Figure 10: Snowflake Hiring Trend (source: Revealera.com)

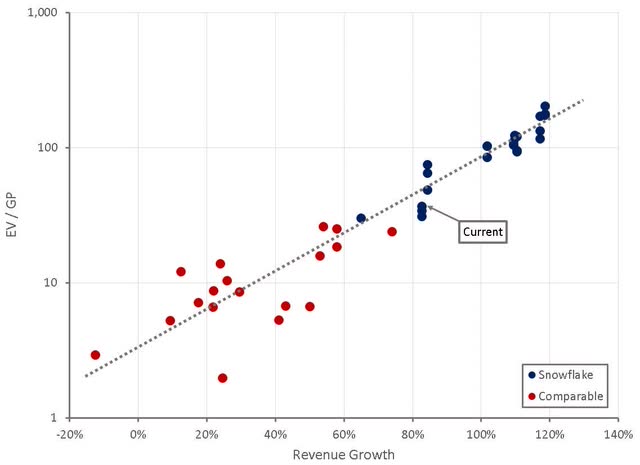

Valuation

Snowflake still trades on a high revenue multiple, but this must be weighed against the company’s strong competitive position, high growth rate and potential for relatively high margins. The stock currently appears to be broadly priced inline with peers and at a modest discount to its own history. Based on a discounted cash flow analysis, I estimate Snowflake’s stock is worth approximately $280 per share.

Figure 11: Snowflake Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Snowflake’s financial performance continues to impress, despite the stock’s dramatic fall from its highs. The stock has faced significant multiple compression due to lower growth and higher interest rates, and now appears more reasonably priced. A further deterioration in macro conditions could still present significant downside, but the stock is now beginning to look more attractive for long-term investors.

Be the first to comment