FreezeFrames

On Monday, October 24, 2022, natural gas-focused exploration and production firm Range Resources Corporation (NYSE:RRC) announced its third-quarter 2022 earnings results. These results were generally mixed in the eyes of analysts as the company beat their expectations in terms of top-line revenues but missed earnings estimates. The stock was largely flat during the after-market session that accompanied the earnings report, which serves to reinforce the conclusion that these results were mixed in the eyes of many analysts and investors. However, a deeper look at the company’s actual results reveals that there is a great deal to like here as the company showed substantial revenue and cash flow growth. There are some reasons to believe that the company can continue on this growth trajectory too as the demand for natural gas continues to grow and the laws of economics dictate that the price of the substance will likely remain high. The company may also generate some growth from a few areas that might not be expected. Despite all of this potential though, the stock remains remarkably cheap and thus may be worth considering given the strengths that we see in the company’s newest earnings report.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the remainder of the article. Therefore, here are the highlights from Range Resources’ third-quarter 2022 earnings results:

- Range Resources reported total revenues of $1.110545 billion in the third quarter of 2022. This represents a 266.95% increase over the $302.639 million that the company reported in the prior-year quarter.

- The company reported an operating cash flow of $520.969 million during the reporting period. This represents the highest level that the company has ever had and a 171.54% increase over the $191.854 million that the company reported in the year-ago quarter.

- Range Resources produced an average of 2.132550 billion cubic feet of natural gas equivalent per day during the most recent quarter. Approximately 70% of this amount was natural gas with most of the remainder being natural gas liquids.

- The company declared a dividend and will pay its shareholders $0.08 per share for this quarter.

- Range Resources reported a net income of $373.087 million in the third quarter of 2022. This represents a substantial improvement over the $350.267 million net loss that the company reported in the third quarter of 2021.

It seems essentially certain that the first thing that anyone reading these highlights will notice is that essentially every measure of financial performance showed significant improvement compared to the prior-year quarter. This is hardly surprising considering that natural gas prices were substantially higher in the quarter than they were a year ago. We can see this in the fact that Range Resources realized an average price of $7.40 per thousand feet of natural gas equivalent during the quarter, which represents a substantial improvement over the $4.37 per thousand feet of natural gas equivalent that the company realized in the year-ago quarter. It should be fairly obvious how this would result in an increase in revenues. After all, the more money that the company brings in, the more money that is available to cover its expenses and make its way down to the bottom line. All else being equal, higher revenue usually results in a higher profit, which is exactly what we see here.

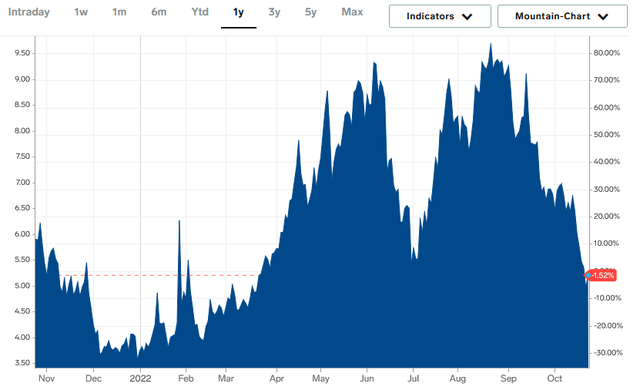

Unfortunately, the price of natural gas has begun to reverse over the past week or two. As we can see here, the price is currently down 1.52% year-over-year:

We can see though that the same basic trend happened during the fourth quarter of 2021, in which the price of natural gas fell through the end of the year before finally beginning to rebound in January 2022. Thus, we may still see the fourth quarter of 2022 come in stronger than the fourth quarter of 2021 despite the recent declines in natural gas prices. It will ultimately depend on how far prices fall, which is hard to determine. However, it does seem possible that we will see further declines in energy prices due to the weakness in the American economy. The nation has now seen two consecutive quarters of gross domestic product declines and it seems highly likely that we will see the same thing when the third quarter report is released. This is the classic definition of a recession and recessions tend to result in declining energy prices. That may not happen in natural gas as it does in gasoline though because natural gas is most often used to heat homes and businesses so people may not cut back on the consumption of it like they do with gasoline and diesel fuel.

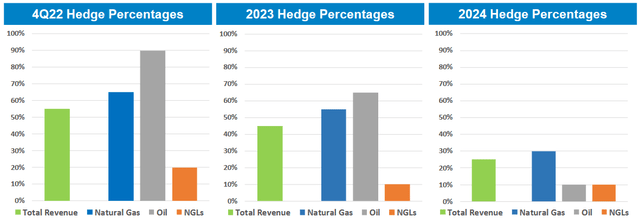

Range Resources is fairly well-equipped to handle any potential short-term decline in natural gas prices, however. This is because the company runs a hedging program, just like most other independent exploration and production companies. In short, the company uses a variety of derivates such as futures and forward contracts in order to lock in a selling price for its natural gas. As we can see here, more than 60% of the company’s expected fourth-quarter 2022 and more than 50% of the company’s full-year 2023 production is covered by hedges:

This effectively ensures that the company’s revenue and cash flow will not fall too far if natural gas prices do indeed continue to decline in the short term. Unfortunately, it also prevents the company from benefiting as much as it otherwise could if natural gas reverses course and once again begins to climb. Overall though, the fact that the company has some protection against an energy price decline is fairly nice to see given the current macroeconomic conditions.

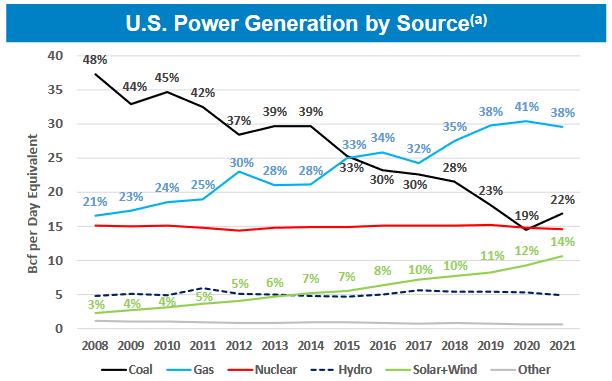

Over the past several years, we have been hearing that electric cars will eventually replace gasoline-powered cars. While the most optimistic scenarios that some people have presented seem rather far-fetched, we are seeing a growing number of automakers focusing their efforts on manufacturing these vehicles so it does seem likely that their presence will grow over the coming years. Perhaps surprisingly, this would actually benefit Range Resources. This is because one of the major uses of natural gas is in the generation of electricity. Back in 2008, natural gas only generated approximately 21% of the electricity consumed in the United States but that figure has increased to 38% today:

Range Resources/Data from EIA

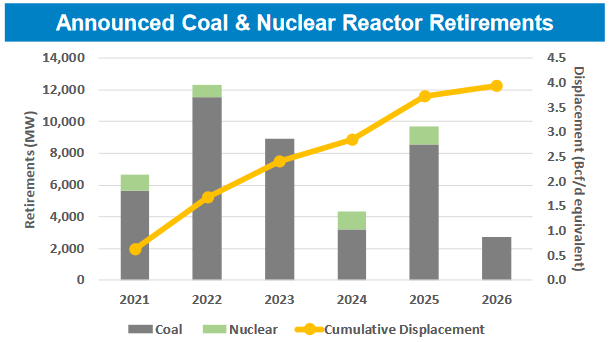

This is mostly because of the retirement of the numerous aging coal-fired power plants around the United States. These power plants are being replaced with renewables and natural gas power plants. Although renewables are generally the generation source of choice for those that are really pushing for the “green transition,” the fact remains that renewables lack the reliability to be the sole source of energy for the electric grid. Thus, natural gas is being used to ensure that the grid remains the “always on” reliability that modern society requires. This is likely to be the case for many years until renewable technology improves substantially. We are already seeing that as the nation’s utilities have announced the retirement of 35 gigawatts of coal generation capacity between now and 2026. If this capacity is entirely replaced with natural gas turbines, that will increase the nation’s demand for natural gas by about twelve billion cubic feet of natural gas per day:

Range Resources/Data from EIA

As electric cars will increase the consumption of electricity fairly dramatically, it should be fairly obvious how the growing popularity of these vehicles will be good for Range Resources. After all, this will ultimately increase the demand for natural gas and thus likely help to prop up natural gas prices over the long term. We can clearly see how high natural gas prices benefit the company by looking at the earnings report.

One thing that we see in these results is that Range Resources generated a strong free cash flow. This has largely been the case over the course of 2022:

|

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

Leveraged Free Cash Flow |

$261.9 |

$38.1 |

$491.7 |

|

Unleveraged Free Cash Flow |

$284.7 |

$61.2 |

$519.2 |

(all figures in millions of U.S. dollars)

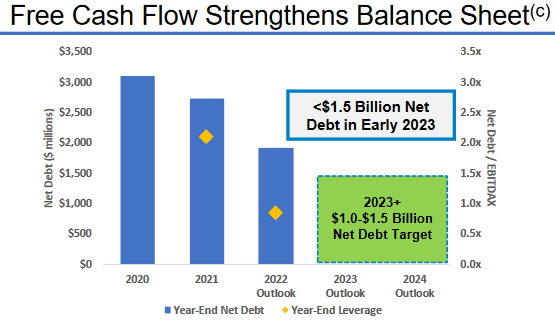

This is a nice change from the company’s track record prior to the pandemic. A positive free cash flow allows the company to do things that benefit the shareholders, such as buying back stock, paying a dividend, or reducing its debt. Range Resources has mostly been doing the latter as it reduced its net debt by $144.1 million during the third quarter of 2022. This is a continuation of the company’s efforts since the pandemic:

Range Resources

This is nice to see because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. This is typically accomplished by issuing new debt to repay the existing debt, which can cause a company’s interest expenses to increase if it has too much debt. In addition to this, the company must make regular payments on its debt if it wishes to remain solvent so an event that causes its cash flow to decline could push the company into financial distress if it has too much debt. When we consider the volatility of commodity prices, this could pose an especially big risk for a company like Range Resources. As such, it is very nice to see that the company is making efforts to reduce its risk with regard to its debt. The company currently has a leverage ratio (defined as net debt-to-EBITDAX) of 1.0x, which is fairly in line with many of the strongest companies in the industry. It is planning to improve on this over the next few quarters, which should allay most concerns about the leverage that Range Resources still has on its balance sheet.

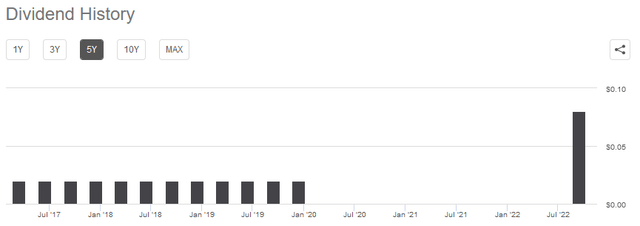

As stated in the highlights, the company reinstated its dividend following the second quarter and maintained it during the most recent one. The dividend was originally suspended back in 2020 in response to the crash in energy prices that created a great deal of uncertainty all across the industry. The new quarterly dividend is substantially higher than the one that the company paid before the suspension though:

Range Resources declared a quarterly dividend of $0.08 per share, in line with the second quarter. This dividend represents a 400% increase over the $0.02 per quarter that the company paid prior to the suspension. It also gives the company a 1.21% yield at the current stock price. This is admittedly a lower yield than many other companies in the energy sector are currently paying but it is nice to see that Range Resources has finally once again begun to reward its stockholders for their patience over the past few years.

In the introduction to this article, I stated that Range Resources is incredibly undervalued at the current price. This is in spite of the significant increases that we saw in both revenue and operating cash flow. We can see this by looking at the company’s price-to-earnings growth ratio, which is a modified version of the traditional price-to-earnings ratio that takes a company’s earnings per share growth into account. According to Zacks Investment Research, Range Resources will grow its earnings per share at a 28.40% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.18 at the current price. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued so we can clearly see that Range Resources appears to be substantially undervalued at the current stock price. As I have pointed out in numerous previous articles though, pretty much everything in the traditional energy sector is dramatically undervalued today. Thus, let us compare it to a few of the company’s peers in order to see which offers the most attractive valuation today:

|

Company |

PEG Ratio |

|

Range Resources |

0.18 |

|

EQT Corporation (EQT) |

0.15 |

|

Chesapeake Energy (CHK) |

0.93 |

|

CNX Resources (CNX) |

0.24 |

|

Pioneer Natural Resources (PXD) |

0.97 |

As we can see, Range Resources does not have the absolute lowest valuation according to this metric but it still compares very well to most of its peers. This is despite the very strong results that the company posted in the third quarter of 2022. In fact, the stock is almost flat from a year ago despite its revenue and cash flow being up significantly. Thus, overall Range Resources appears to be offering a very attractive opportunity to investors today.

In conclusion, the market appeared to be rather lukewarm to the company’s earnings announcement but overall there is a great deal to like here. The company posted substantial year-over-year increases in both revenue and cash flow yet the stock was basically flat. This has presented investors with a very attractive valuation today. There are some reasons to expect that the company’s good fortune will continue over the long term as well, particularly if one expects that electric cars will become more common in the coming years. Overall, this company is worth a purchase today.

Be the first to comment