ferrantraite

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 8th.

The Vanguard Materials ETF (NYSEARCA:VAW) is a simple, diversified materials equity index ETF. VAW invests in companies focusing on the manufacturing of basic materials, which perform relatively well when inflation is elevated, but underperform during downturns and recessions. VAW’s cheap valuation, good performance track-record, and slight outperformance during inflationary environments, make the fund a buy.

VAW – Basics

- Sponsor: Vanguard

- Underlying Index: MSCI US Investable Market Materials 25/50 Index

- Dividend Yield: 2.15%

- Expense Ratio: 0.10%

- Total Returns CAGR 10Y: 9.75%

VAW – Overview

VAW is a materials equity index ETF. It is administered by Vanguard, the second-largest investment manager in the world, and the largest provider of index funds in the same. Vanguard is almost always my top choice for simple index ETFs, and VAW is no exception.

VAW itself tracks the MSCI US Investable Market Materials 25/50, an index of the U.S. materials industry sector. Said sector includes companies producing basic material products, including metals, steel, paper, glass, and assorted construction material. It also includes more specialized material products, mostly industrial chemicals, gasses, etc. Applicable securities must also meet a basic set of liquidity, trading, and size criteria for index inclusion. It is a market-cap weighted index, with security caps to ensure a modicum of diversification.

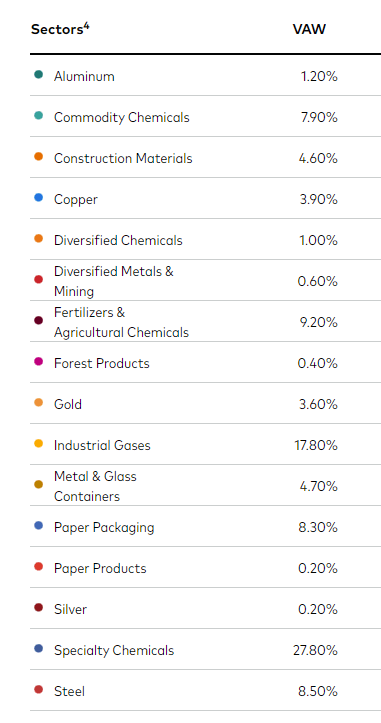

Sector weights are as follows.

VAW

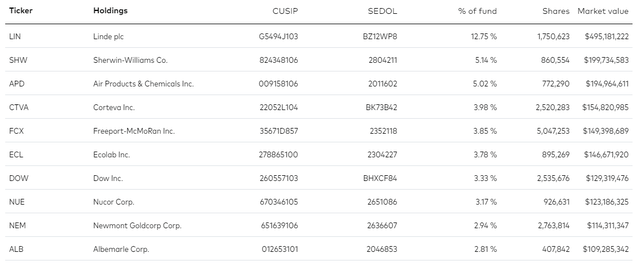

Concentration is relatively high for an equity index fund, with VAW’s top ten holdings accounting for around 45% of its value. Concentrated portfolios are dependent on the performance of a couple of specific securities, and might see significant losses if these underperform. Expect significant losses if Linde (LIN), the fund’s largest holding, underperforms, for instance.

As VAW only invests in a specific industry and has a relatively concentrated portfolio, it should not be a core or large portion of an investor’s portfolio, in my opinion at least.

Besides the above, not much else stands out about the fund or its underlying index. With this in mind, let’s have a look at the fund’s investment thesis.

VAW – Investment Thesis

Cheap Valuation

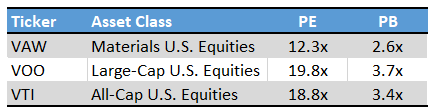

VAW invests in material companies. These tend to be older, stodgier companies which produce real, tangible products for commercial and industrial uses. Growth tends to be reasonable, albeit somewhat below-average. Lower growth means cheaper valuations, for obvious reasons. VAW itself sports a PE ratio of 12.3x and a PB ratio of 2.6x, both significantly lower figures than the equity average.

Fund Filings – Chart by Author

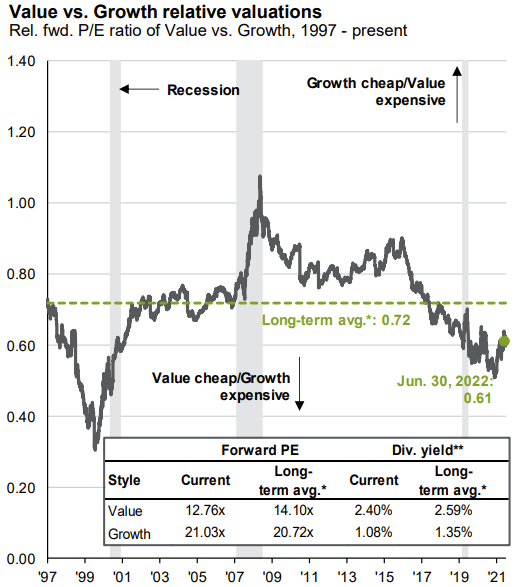

Old economy industries, including materials, with slower growth prospects consistently trade with discounted valuations, but the size of the discount is at relatively elevated levels. Value stocks are currently around 40% cheaper than growth stocks, versus a long-term average of 30%. Discounts were higher last year, and during the dot-com crash.

J.P. Morgan Guide to the Markets

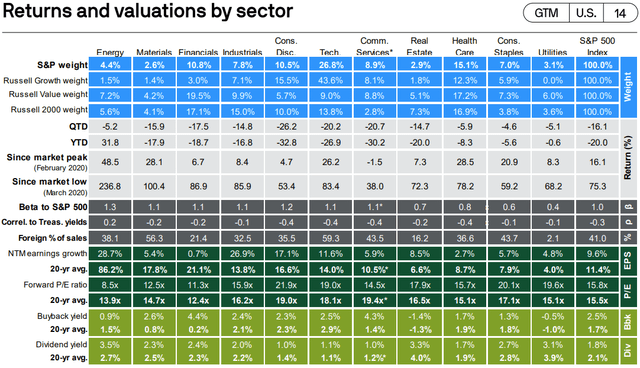

Looking at materials themselves shows a similar pattern. Currently, materials valuations are slightly below their long-term historical average, while the opposite is true for the broader stock market. Source below, although you might have to squint to see this data.

J.P. Morgan Guide to the Markets

Valuation gaps have widened due to improved tech growth prospects following the pandemic, and due to waning investor demand for old-economy industry and companies. Investors much prefer to focus on high-growth tech companies with zero marginal cost and low capex needs, as these offer (potential) outsized returns. Everyone wants to invest in the next Google (GOOG) or Facebook (META), and Linde, Nucor (NUE), and most of VAW’s holdings, are most definitely not the next Google or Facebook.

Due to the above, VAW trades with a cheap, historically below-average valuation. Cheap valuations can lead to strong capital gains and market-beating returns, if these were to normalize, contingent on improved investor sentiment. Sentiment has improved for close to a year, during which VAW has outperformed, although by very little.

As valuations remain cheap, and considering prevailing investor sentiment, I think further gains are likely. VAW remains around 10% undervalued, so gains and outperformance in that range seem possible.

On a more negative note, I see no catalyst for improved sentiment or valuations. The economy remains somewhat weak, interest rates are rising, and VAW’s underlying holdings are seeing good, but not outstanding, growth. Dividends would help, but VAW only yields 2.0%. Share buybacks would also help, but materials are not generating sufficient cash-flow for massive buyback programs unlike, say, energy. With no catalyst in sight, I don’t foresee significant gains any time soon, but valuation gaps as significant as current ones have not lasted long in the past, and I do not believe that they will last long in the present.

Good Performance Track-Record

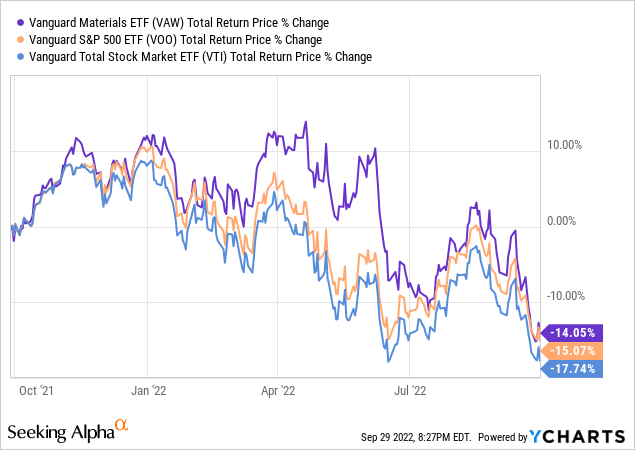

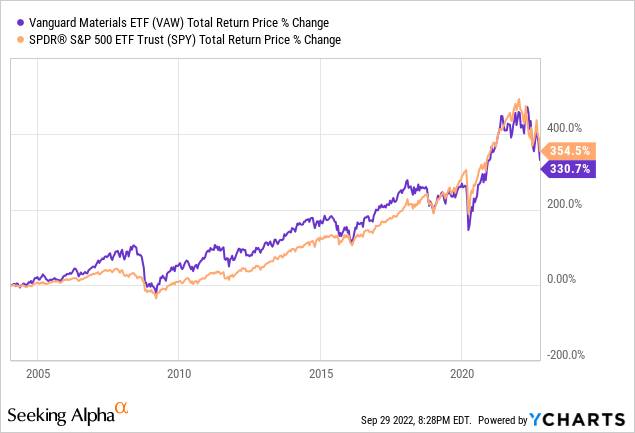

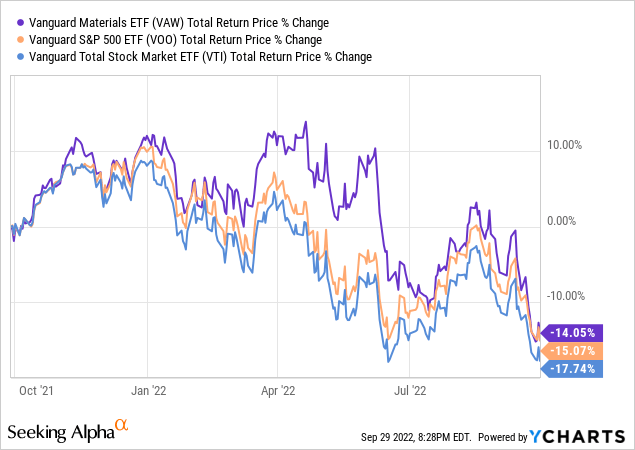

VAW’s performance track-record is reasonably good, with the fund very slightly underperforming relative to most broad-based equity indexes since inception.

Underperformance is more than entirely due to widening value-growth valuation gaps between 2018 and 2020. VAW’s performance was materially stronger since inception in the early 2000s to 2018, and from mid-2020 to now. As the fund has only materially underperformed during the years in which tech valuations soared to (unsustainable) highs, I would characterize the fund’s performance as good. VAW will obviously underperform if other industries see skyrocketing valuations, but that is the case for all industries and equity funds, and so not all that important. At the same time, outperforming due to rising valuations is not sustainable, so VAW should see comparatively strong returns moving forward. As mentioned previously, that has been the case these past twelve months, although only very slightly so.

Slight Outperformance During Inflationary Environments

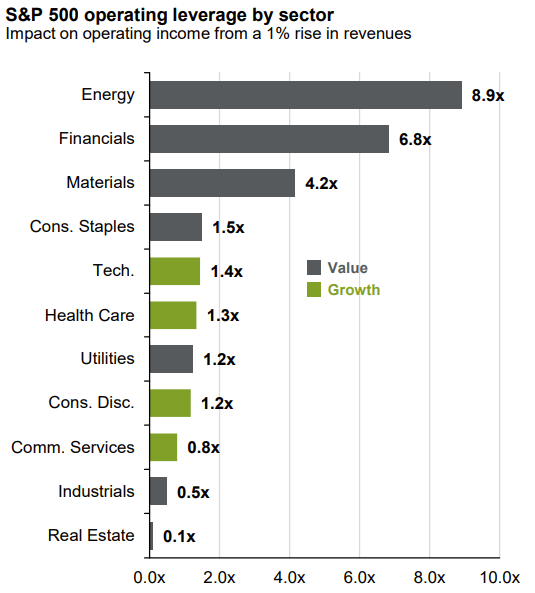

VAW’s underlying holdings generally have more exposure to commodity prices and inflation than average, for two reasons.

First, most of VAW’s underlying products sell products and are structured in such a way that inflation directly leads to higher product prices and company revenues. Linde, for instance, has contracts in place which adjust product prices for local cost inflation. As costs rise, so do company prices and earnings, benefitting the company and its investors. Although the net effect might not necessarily be positive, it does help insulate the company from the negative impact of rising prices and high inflation.

Second, most of VAW’s underlying holdings have high operating leverage ratios, meaning small increases in revenues, from rising prices for instance, lead to outsized increases in earnings. This is due to structural and operational factors, centered on fixed-costs, CAPEX, interest rate payments, and the like. Nucor, for instance, recently spent $2.7B building a new steel plant in West Virginia. Lower prices would have an outsized negative impact on the company, because wasting billions building unprofitable industrial plants is disastrous for any company. Higher prices would have an outsized positive impact on the company, as these would lead to higher revenues without increasing the $2.7B spent building the plant. Similar principle applies for other materials companies.

J.P. Morgan Guide to the Market

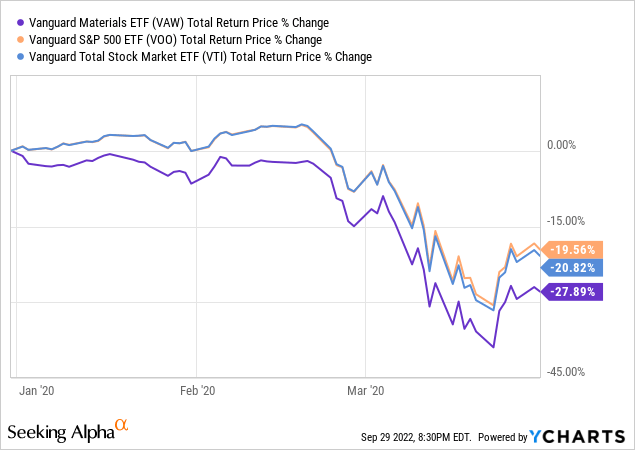

On a more negative note, the above does mean that the fund’s underlying holdings suffer above-average earning losses when revenues decrease, as is the case during most downturns and recessions. Expect the fund to underperform during these, as was the case during 1Q2020, the onset of the coronavirus pandemic.

VAW – Looking Back

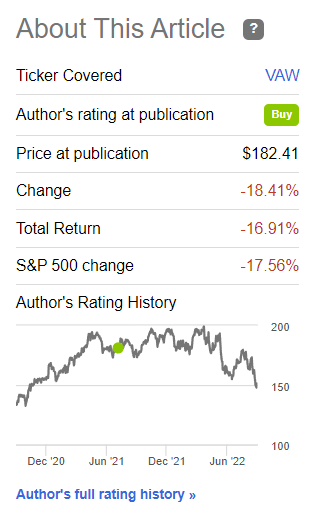

Finally, I wanted to have a quick look at my previous article on VAW, written close to a year ago. In that article, I was bullish on the fund, due to its strong performance track-record and effectiveness as an inflation hedge. The inflation hedge aspect seemed particularly enticing, as price pressures were starting to build up at the time.

Since then, VAW has broadly matched, very slightly outperformed, relative to the S&P 500. The fund performed particularly well in prior months, during which valuation gaps started to normalize, but has underperformed as of late, due to worsening economic fundamentals. Inflation played less of a positive role than I expected, as rising prices led to weakened economic conditions, lower demand, and higher interest rates.

VAW Previous Article

Conclusion

VAW’s cheap valuation, good performance track-record, and slight outperformance during inflationary environments, make the fund a buy.

Be the first to comment