yoh4nn

A Quick Take On Manhattan Associates

Manhattan Associates (NASDAQ:MANH) reported its Q2 2022 financial results on July 26, 2022, beating expected revenue and EPS estimates.

The company provides supply chain and inventory management software and related services to businesses worldwide.

Management has performed well across many metrics, the company has no debt and significant free cash flow yield, continues to buy back its stock on a steady basis and appears well positioned in a growing industry.

My outlook is a Buy for MANH at around $134.00 per share.

Manhattan Associates Overview

Atlanta, Georgia-based Manhattan Associates was founded in 1990 to assist companies in optimizing their product supply chains, inventory management capabilities and omnichannel order and fulfillment operations.

The firm is headed by president and Chief Executive Officer Eddie Capel, who previously held senior executive positions at Real Time Solutions.

The company’s primary offerings include:

-

Transportation Management

-

Warehouse Management

-

Point of Sale

-

Order Management

-

Customer Engagement

-

Store Inventory & Fulfillment

The firm acquires customers through its in-house direct sales and marketing efforts, as well as through partner referrals and implementation assistance.

Manhattan Associates’ Market & Competition

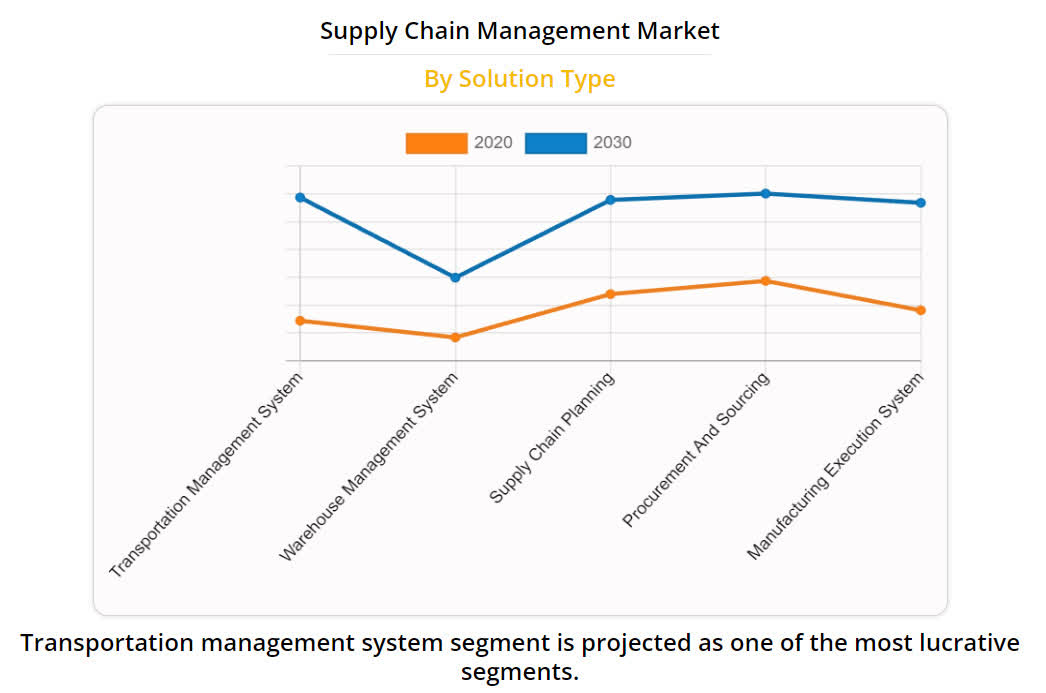

According to a 2021 market research report by Allied Market Research, the market for supply chain management software and services was an estimated $18.7 billion in 2020 and is forecast to reach $52.6 billion by 2030.

This represents a forecast CAGR of 10.7% from 2021 to 2030.

The main drivers for this expected growth are demand for increased supply chain visibility, especially after the disruptions caused by the COVID-19 pandemic.

Also, the chart below shows the supply chain management market changes between 2020 and 2030, by solution type:

Supply Chain Management Market (Allied Market Research)

Major competitive or other industry participants include:

-

Epicor Software

-

HighJump

-

Info

-

IBM

-

JDA Software Group

-

Kinaxis

-

e2open

-

Oracle

-

SAP

-

Descartes Systems Group

-

Others

Manhattan Associates’ Recent Financial Performance

-

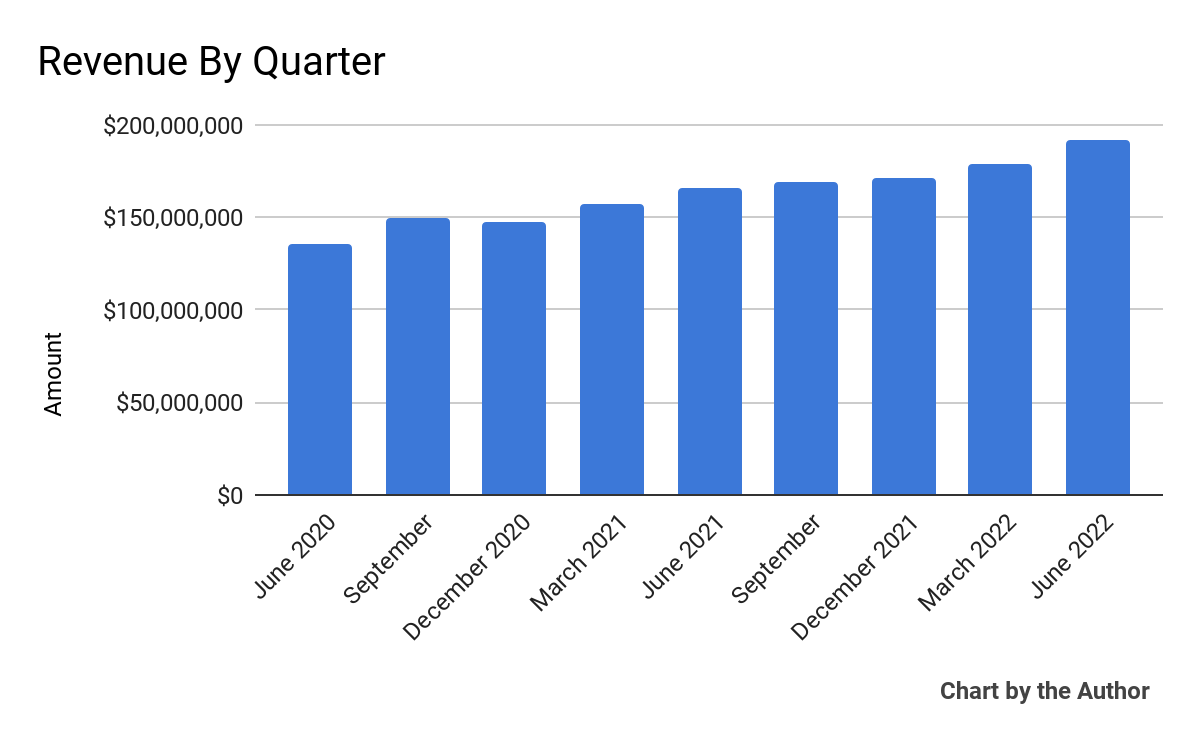

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

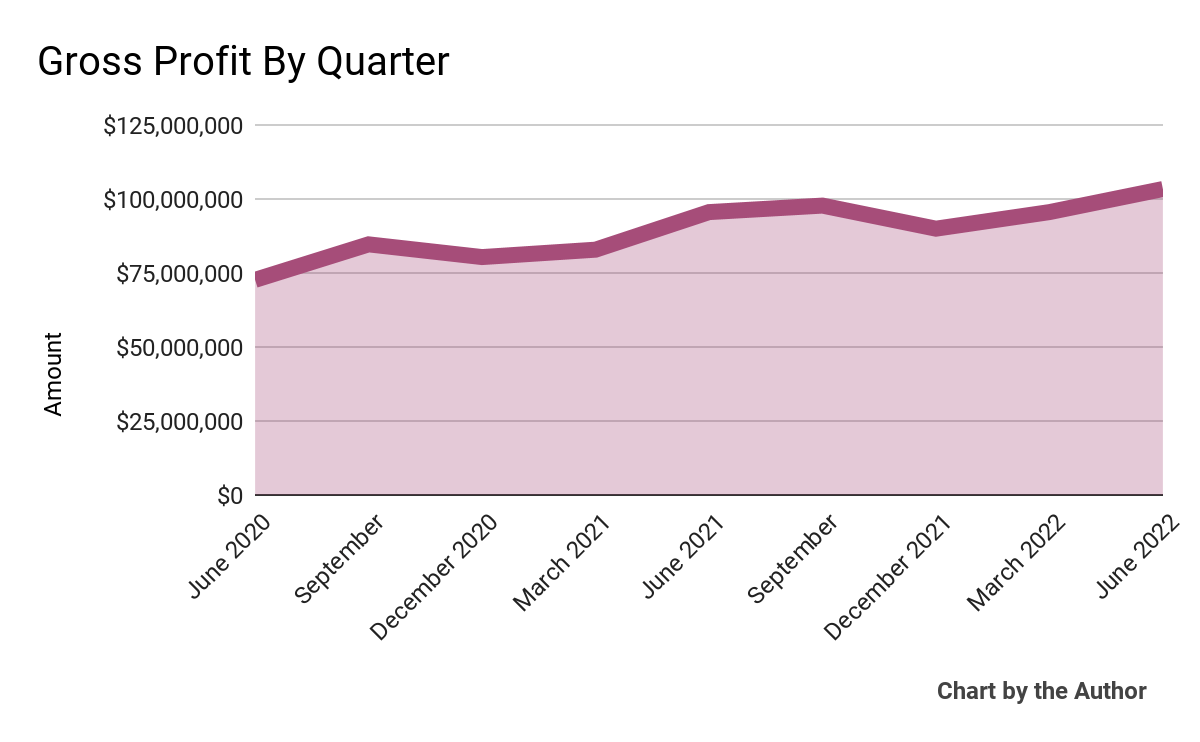

Gross profit by quarter has trended higher in a similar respect:

9 Quarter Gross Profit (Seeking Alpha)

-

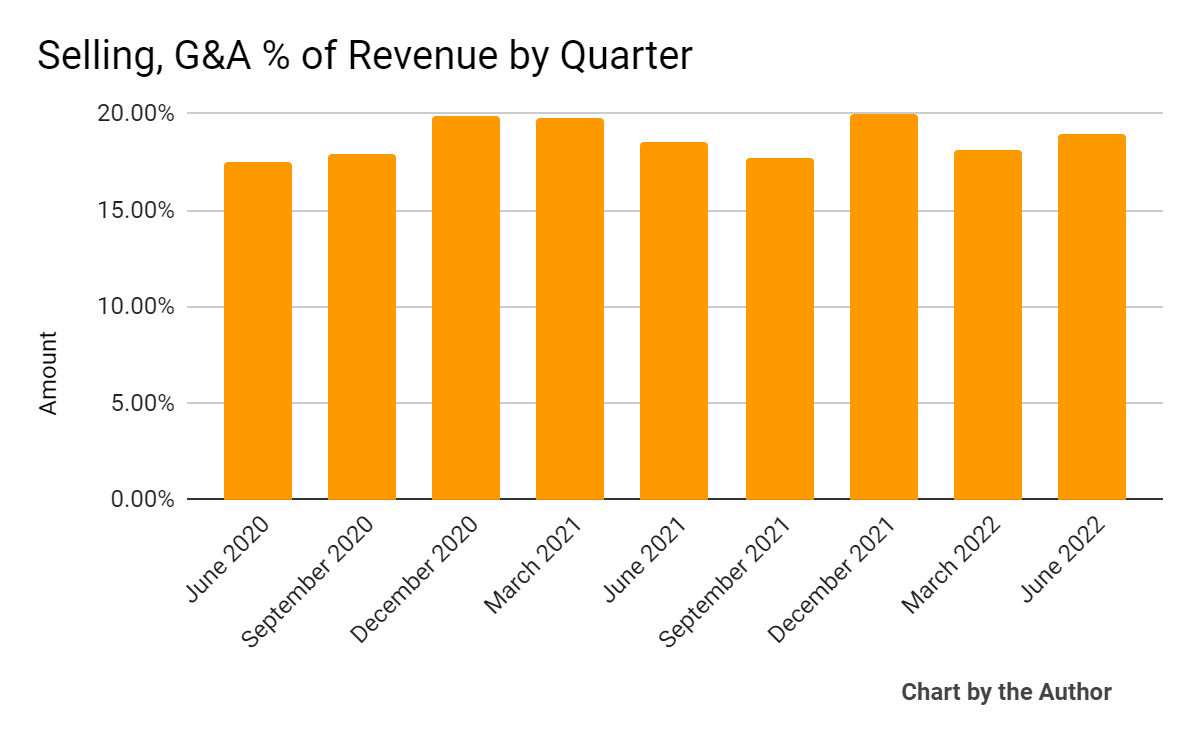

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated within a range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

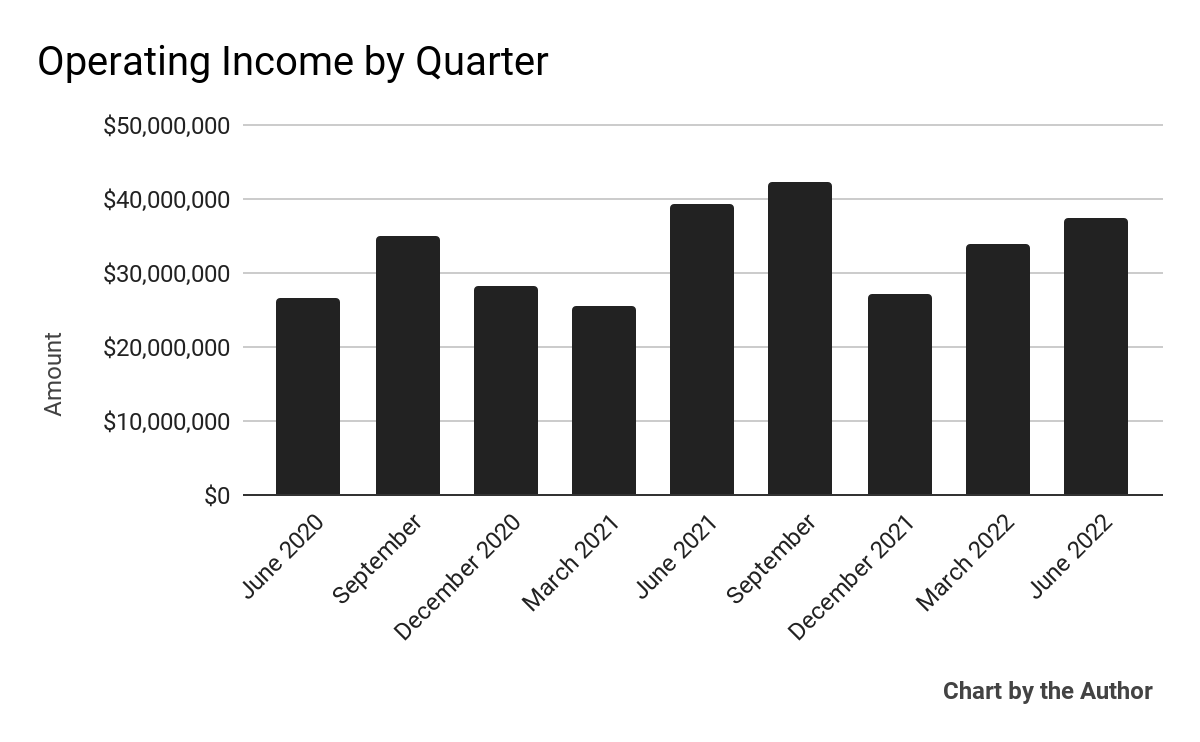

Operating income by quarter has produced the following results:

9 Quarter Operating Income (Seeking Alpha)

-

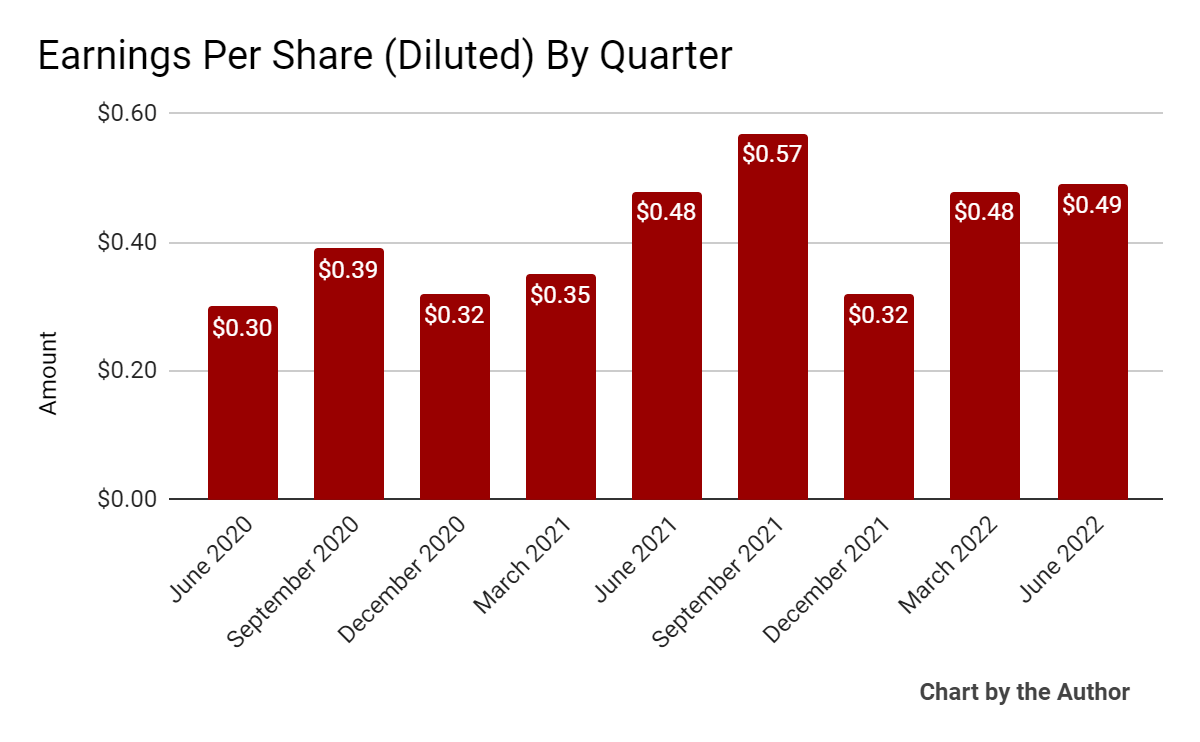

Earnings per share (Diluted) have trended higher in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

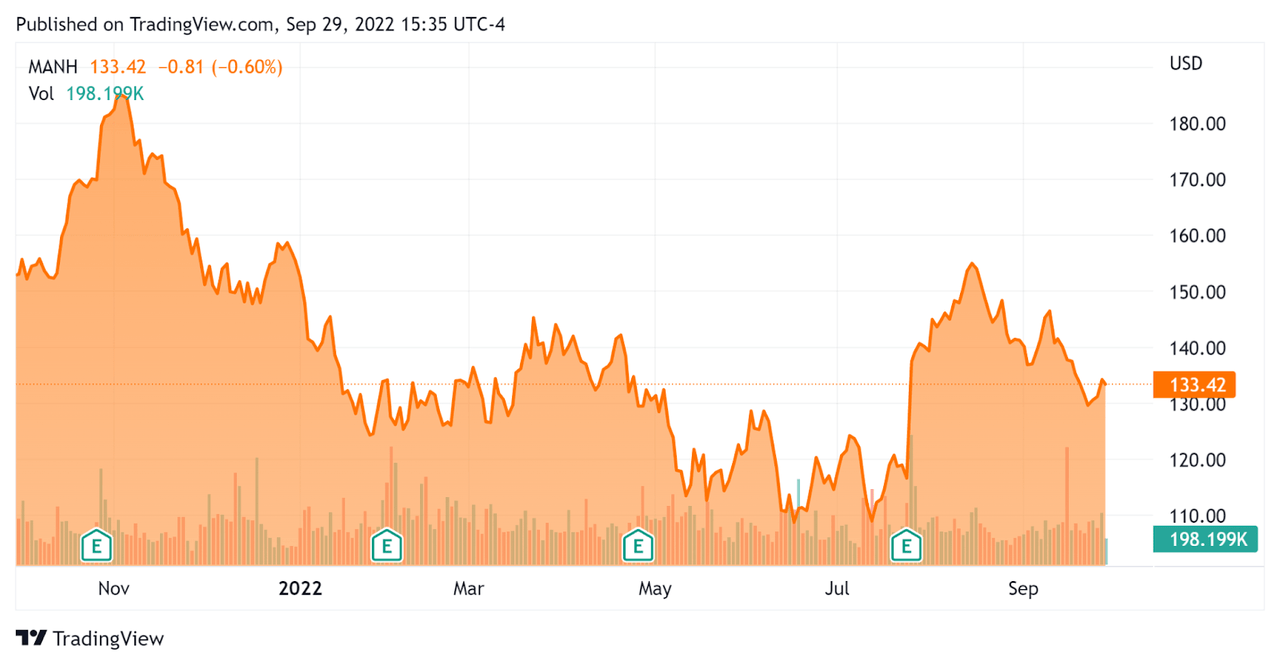

In the past 12 months, MANH’s stock price has fallen 12.7% vs. the U.S. S&P 500 index’s drop of around 16.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Manhattan Associates

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

11.30 |

|

Revenue Growth Rate |

14.8% |

|

Net Income Margin |

16.7% |

|

GAAP EBITDA % |

20.8% |

|

Market Capitalization |

$8,230,000,000 |

|

Enterprise Value |

$8,040,000,000 |

|

Operating Cash Flow |

$184,270,000 |

|

Earnings Per Share (Fully Diluted) |

$1.86 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be e2open (ETWO); shown below is a comparison of their primary valuation metrics:

|

Metric |

e2open |

Manhattan Associates |

Variance |

|

Enterprise Value / Sales |

6.05 |

11.30 |

86.8% |

|

Revenue Growth Rate |

66.0% |

14.8% |

-77.6% |

|

Net Income Margin |

-6.7% |

16.7% |

–% |

|

Operating Cash Flow |

$36,770,000 |

$184,270,000 |

401.1% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MANH’s most recent GAAP Rule of 40 calculation was 35.6% as of Q2 2022, so the firm has performed reasonably well per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

14.8% |

|

GAAP EBITDA % |

20.8% |

|

Total |

35.6% |

(Source – Seeking Alpha)

Commentary On Manhattan Associates

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its record revenue and earnings results which exceeded expectations.

The firm is seeing ‘solid demand across our product suite’, with new customers representing 35% of new demand in its pipeline.

Management believes the firm is well positioned to continue its growth as customer demand for supply chain technologies increases due to global supply disruptions.

As to its financial results, total revenue rose 16% on an as-reported basis, with cloud revenue rising 48% and accounting for nearly 22% of total revenue.

Management did not disclose the company’s net dollar retention rate, which is an important metric indicating product/market fit and sales & marketing efficiency.

The company’s Rule of 40 results have been impressive given its size.

However, foreign exchange headwinds as a result of the strong US dollar amounted to $30 million in the first half of 2022.

For the balance sheet, the firm ended the quarter with cash and equivalents of $213.8 million and no debt. So, the company continues to buy back its shares, with the Board recently approving ‘the replenishment of our $75 million share repurchase authority.’

Over the trailing twelve months, free cash totaled an impressive $179.2 million.

Looking ahead, management raised its full year 2022 revenue expectation to $737 million at the midpoint of the range, or a 21% growth rate. GAAP EPS expectation is now $1.65 at the midpoint.

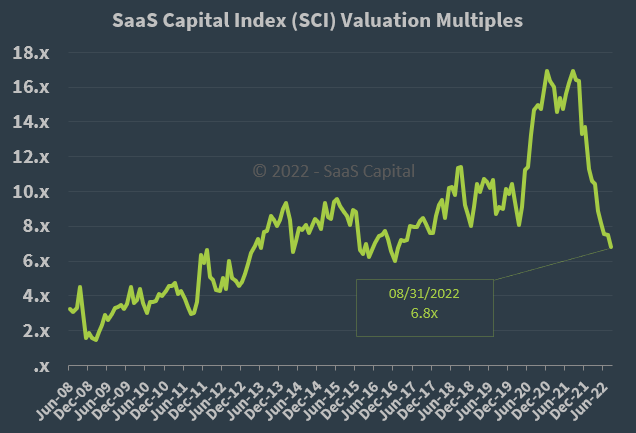

Regarding valuation, the market is valuing MANH at an EV/Sales multiple of around 11.3x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although MANH is not a pure subscription software company, it’s interesting that it is currently valued by the market at a significant premium to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

While MANH may not be cheap compared to other software stocks that have been beaten down over the past 12 – 18 months, the need for supply chain optimization is not going to go away soon.

Management has performed well across many metrics, the company has no debt and significant free cash flow yield, continues to buy back its stock on a steady basis and appears well positioned in a growing industry.

My outlook is a Buy for MANH stock at around $134.00 per share.

Be the first to comment