Abu Hanifah

Introduction

While many companies seek growth from acquisitions, sometimes the opposite is needed to revitalize a company. In the coming years, multiple high profile spin-offs will be occurring in the healthcare industry as growth stalls among the giants. While it is unknown how each spin-off transaction will end up influencing returns of the parents or new companies, there is some data we can look at to maintain realistic expectations moving forward.

The major future transactions are as follows:

-

Johnson & Johnson (JNJ) Consumer segment

-

General Electric (GE) HealthCare

-

3M (MMM) Health Care

-

Novartis (NVS) spin of Sandoz subsidiary

-

Labcorp (LH) clinical development department

-

Danaher (DHR) Environmental and Applied Solutions segment

Analytics of Spin-offs and Splits

Financial advisor Houlihan Lokey (HLI) recently published a report of spin-offs over the past three years, and the data therein succinctly summarizes the data driving recent spin offs, and subsequent performance. While there are distinct patterns and averages that we can rely on to generalize the coming transactions, I believe it is fairly easy to determine the winners and losers based on this data and a qualitative analysis of each company. But first, let’s look at the analytics of recent spin-offs between 2019 and 2021.

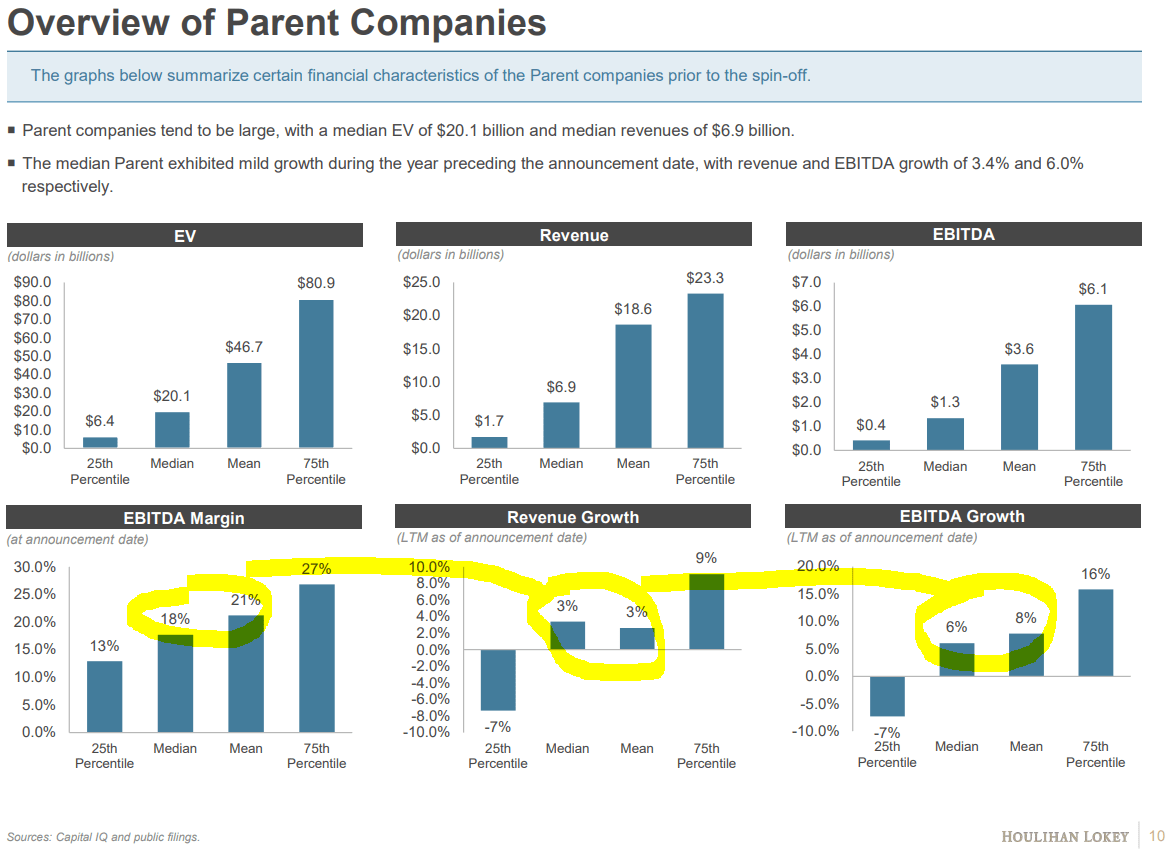

The first important factor to understand is that spin-offs typically are undertaken by large organizations, between $20 and $46.7 billion in enterprise value. Another distinction is that these companies tend to be at a mature stage of their life: slow revenue growth, and a focus on increasing profitability. The problem is that this business style often comes with some issues such as the steady accumulation of debt, financial stagnation, and lackluster financial performance.

Investors certainly aren’t always wary of these issues as the dividends continue to flow, and cap gains are thought of as unnecessary. However, companies realize that in order to drive growth and longevity, changes to the business structure must occur, and one way to do so is through a spin-off.

HLI 2022 Spin-Off Transaction Study

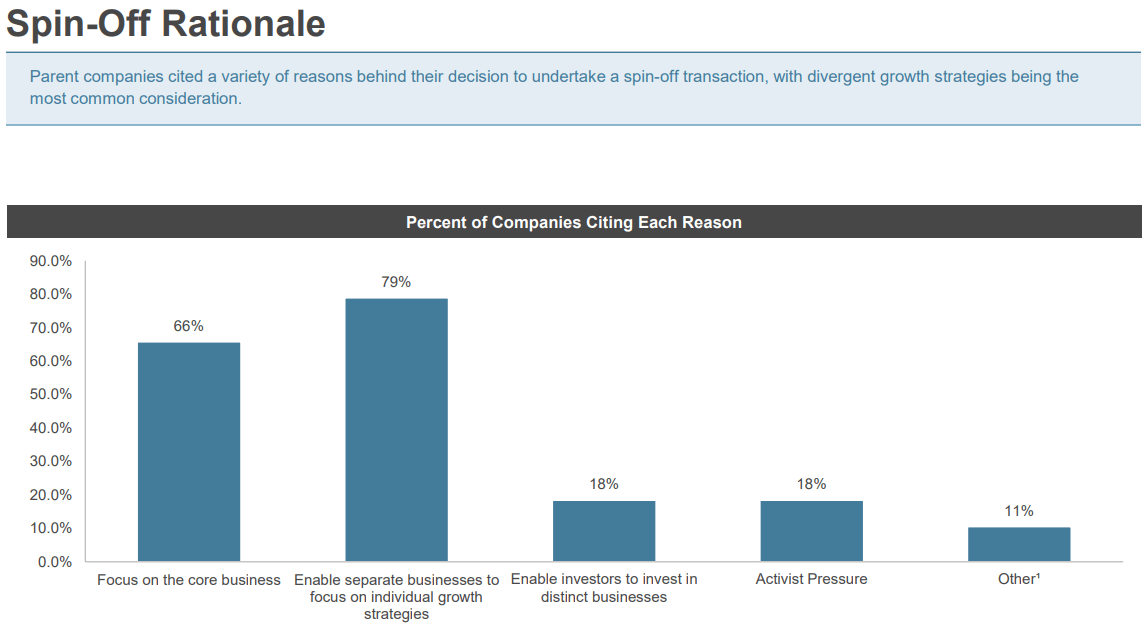

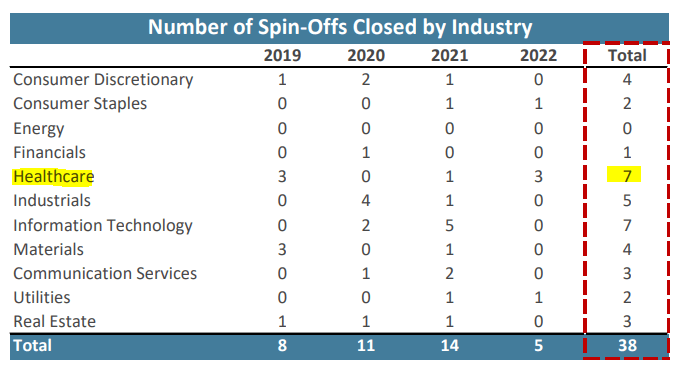

Put in business terms, management typically cites a “focus on the core business” and enablement of “separate businesses to focus on individual growth strategies” as the core reasons for a spin-off. There is usually never one individual reason for a split, and other factors include high leverage, activism, political pressure, and more. Due to the varied reasoning, spin-offs are not limited to individual sectors, but healthcare has been seeing a high quantity of late. During the study’s time period, seven out of the thirty eight spin-offs were from within the healthcare industry. I will discuss the major healthcare transactions below.

HLI 2022 Spin-Off Transaction Study HLI 2022 Spin-Off Transaction Study

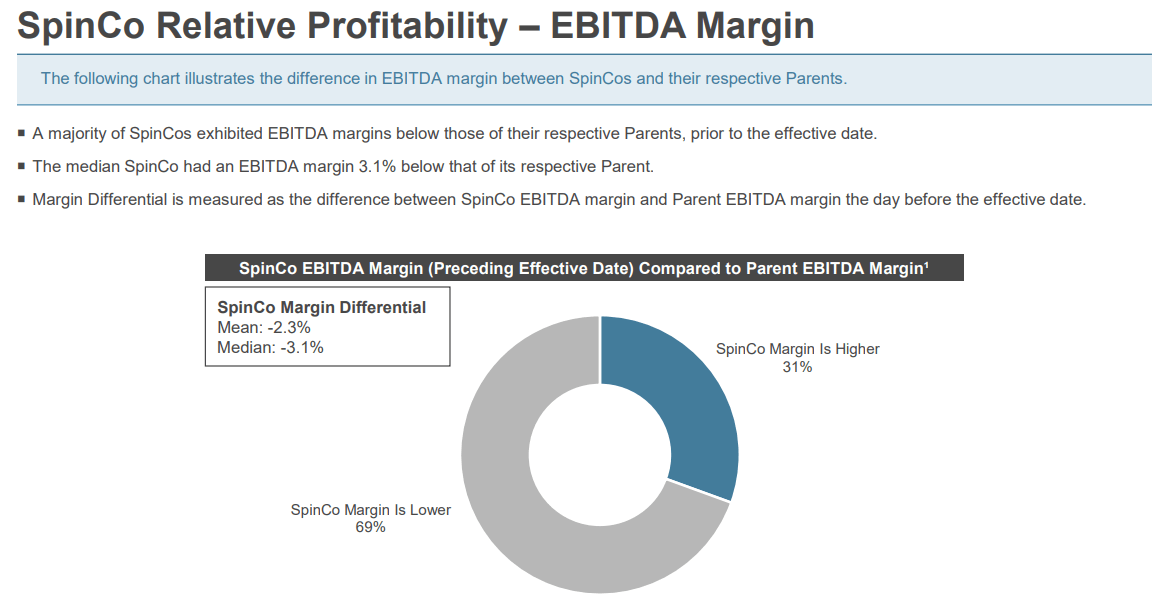

While every spin off is different, a few financial patterns emerge. Over two-thirds of the SpinCos, or spun off assets, see a lower EBITDA margin when operating on their own. This highlights the pattern that most assets that are spunoff are weak and underperforming. However, this is not true for leverage, and HLI’s data does indicate that leverage is in fact lower for the SpinCos. This contradicts the common myth that SpinCos are saddled with the parent company’s debt, but the SpinCos still see poorer financial performance.

HLI 2022 Spin-Off Transaction Study

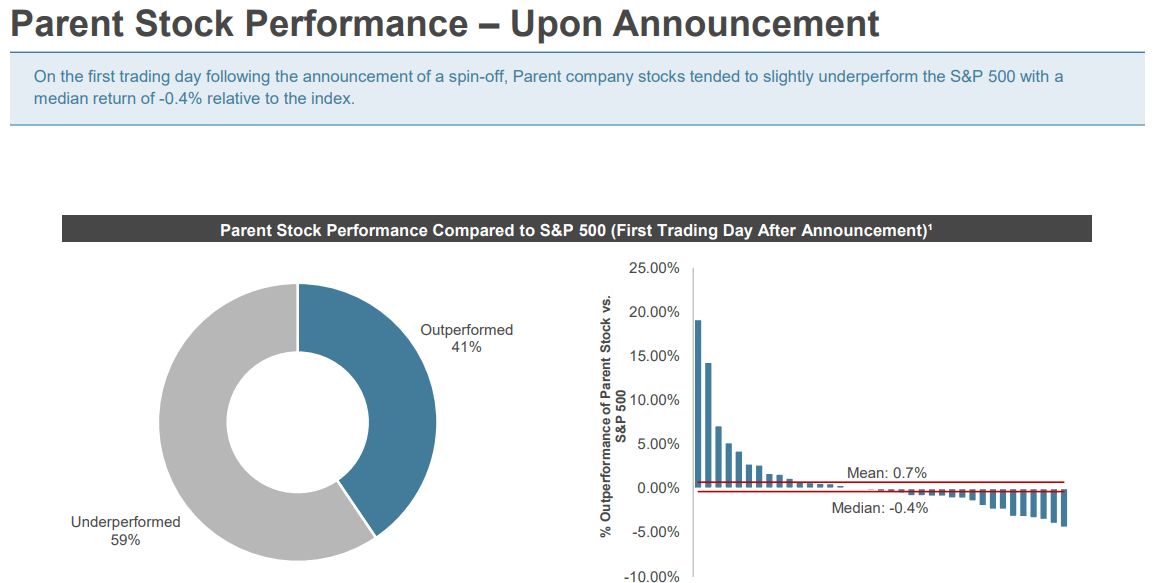

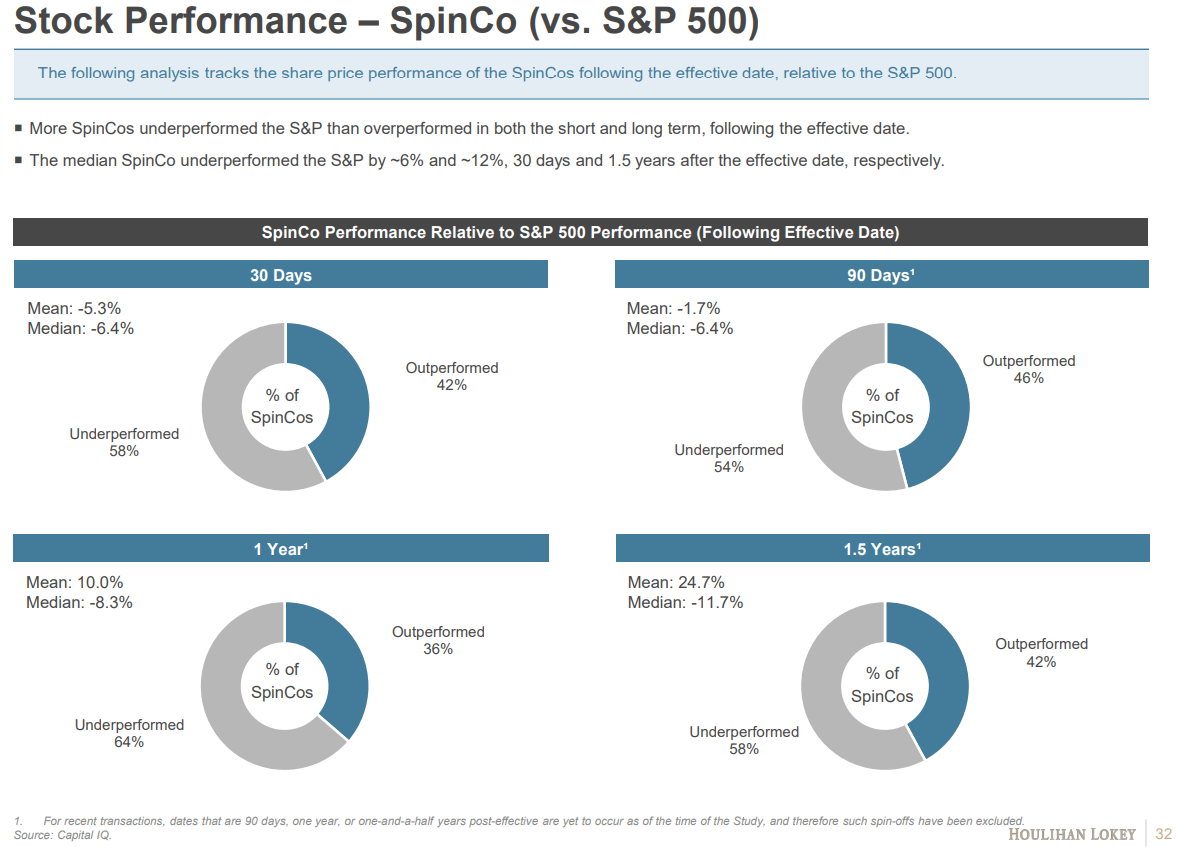

As shown in the two charts below, financial performance before and after a split is mixed. Therefore, we cannot conclude whether the announcement of a split, and resulting changes to financials, are directly related to the announcement or a continuation of historical performance trends (relative to S&P 500). However, what we can see is that the data does suggest that SpinCos do underperform after the split occurs.

With almost two-thirds of SpinCos underperforming the S&P 500 at various time periods after the transaction, we have more evidence that the SpinCos are weaker than the parents on average. The problem is, there is still a wide variance in performance, so an analysis of each individual transaction will likely prove more insightful than using analytical data and averages.

HLI 2022 Spin-Off Transaction Study HLI 2022 Spin-Off Transaction Study

Recent Spin-offs Completed

There have been five major healthcare industry spinoffs over the past three years. Using 20-20 hindsight vision, I will provide quick summaries of the reasons why the items were sold off, and how they have performed since.

Merck (MRK) and Organon (OGN)

Merck has been facing negative growth since the financial crisis of the late 2000s until 2018. However, the approval of blockbuster therapy Keytruda opened up the door to significant cash flows. This was not enough, and the company decided to spin off non-core, older therapies into a new company. As reliance on Keytruda increased, management has used the cash from the spin-off to significantly increase capex, M&A, and R&D. While it will take some time for these effects to become reflected in the financials as revenues, I feel this was an example of a beneficial spin off.

Organon shareholders have access to a company with a fairly stable profile, primarily focused on women’s health products and biosimilars (the opposite transaction from AbbVie (ABBV) /Allergan). While profitable, the biggest issue will be finding growth while saddled with a market cap’s worth of debt (~$9 billion). Was the debt part of the subsidiary before, or part of Merck? Who knows, but it certainly limits OGN’s prospects in the intermediate term (Merck’s debt has gone up since the spin-off so perhaps it has not been forcefully placed upon OGN’s shoulders).

Danaher and Envista (NVST)

Danaher, a diversified medical device and consumables manufacturer spun-off their dental equipment segment in 2019. Since then, NVST has returned 24% while DHR saw a total return of ~110%. DHR seems to have been the winner in this deal as financials are at a high point: earnings growth above 10% on average, debt reduction, rising profit margins, and more. The same can’t be said with Envista as growth is slow and debt is flat. However, NVST is doing better than Organon, and I expect this will continue as the company figures their operations out.

Eli Lilly and Elanco (ELAN)

Another case of an underperforming SpinCo is with Elanco, the former LLY veterinary science subsidiary. While a pop in growth during the pandemic as pet owners increased exponentially, it seems that the fad is discontinuing and growth is now an issue. Following multiple downgrades, the company is now trading 54% below the spin-off price way back in mid 2018. However, times may be changing again as activist investor group Sachem Head took a stake. Meanwhile, LLY continues to be one of the best performers in pharma thanks to their still diversified platform (and some COVID therapy benefits). Watch that valuation though!

Pfizer (PFE) and Upjohn/Viatris (VTRS)

One of the more recent and major spin-offs, Pfizer’s removal of Upjohn continues to reflect the pattern that the SpinCo has a high chance of underperforming. Mylan, the company Upjohn merged with, was already in a downward trend, and the recent sale of their joint biosimilars segment has caused shares to drop over 50% since the 2020 merger. Controversy, especially when looked through the lens of a spin-off company, always will lead to negative sentiment.

In this case, sticking with Pfizer would have certainly been the better option. However, Pfizer has had its own issues with growth, and the spin-off did little to improve the financials (outside of COVID benefits). Investors will have to look beneath vaccination and COVID treatments to find future revenues, and according to the share price (down 18% ytd while most pharma is up), are having trouble doing so.

McKesson (MCK) and Change Healthcare (CHNG)

Want to finally see an example where a SpinCo performs just as well as the parent company? Look no further than healthcare tech provider Change Healthcare who was spun off from McKesson in mid 2019. Both companies are up big since then, with MCK shooting up 160% and CHNG up 70%. Interestingly, CHNG’s upside has been limited by the fact that they are currently in the process of being acquired by UnitedHealth (UNH), and if not so, I expect Change would have performed far better.

I personally disagree with McKesson’s recent bull run as performance is relatively poor, but investors certainly are expecting a turnaround. Change has its own issues, as growth has not quite reached targets and seem to be plateauing already. Perhaps the acquisition by UNH really was the best outcome for investors? Regardless, both companies have done well the past three years when compared with the SpinCos already covered. As such, we can see that there is no exact predictive power when anticipating a spin-off, but I will try my best to assess the coming transactions.

Coming Spinoffs and Splits

Johnson & Johnson Consumer

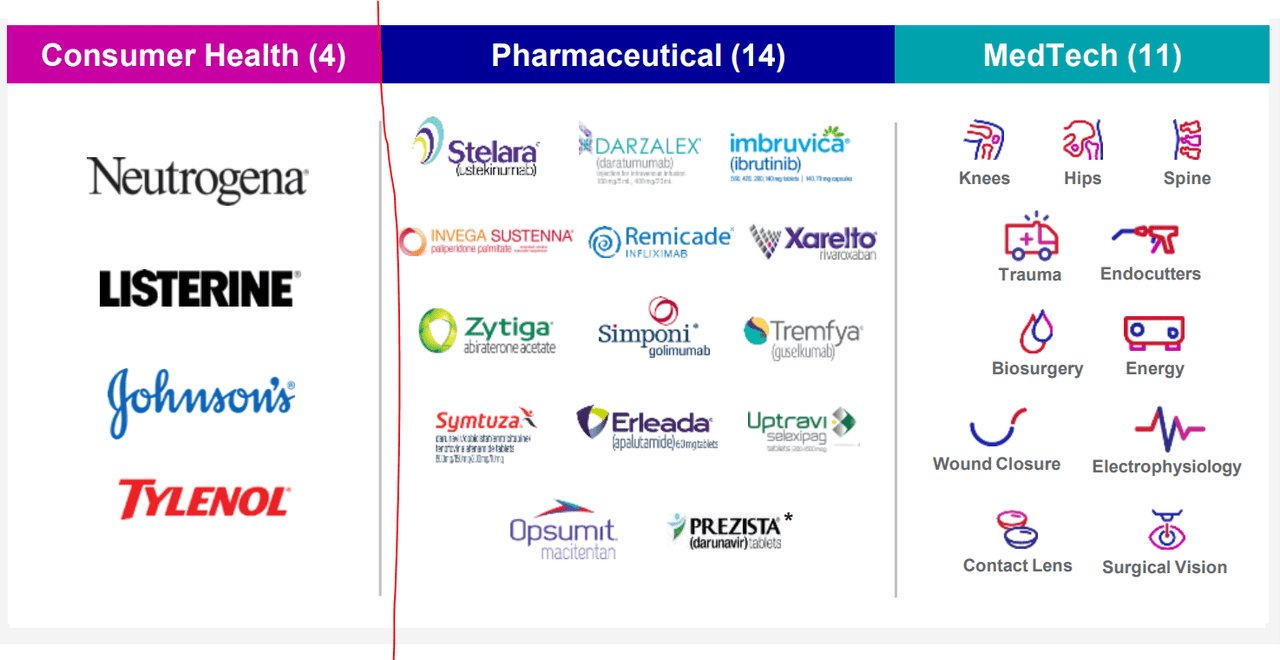

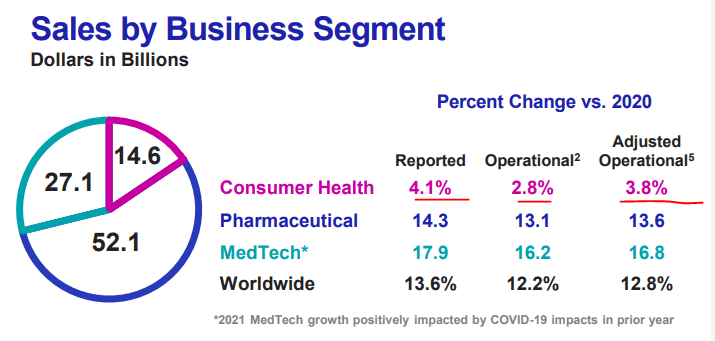

Johnson & Johnson is finally parting ways with their consumer segment. Current growth is fueled by innovation in drug discovery, while legacy assets are only seeing lawsuits, competition, and deteriorating margins. I see this split as favorable, but it will be important to assess the terms carefully.

On one hand, earnings will grow significantly as the core JNJ company focuses on novel medicines and medical devices. With an average growth rate up to 4x that of the consumer health segment, growth will also be improved. If you are happy with JNJ’s current performance, then rest assured that it has nearly all been the result of the pharmaceuticals and MedTech, as consumer revenues are only ~15% of the total.

On the other hand, the traditional products that provided a margin of safety, many of which investors have grown comfortable with, and this may impact the company valuation. Both new companies will certainly be far different than what it was prior to the split. However, I feel assured that the core JNJ will be the superior asset and the removal of lagging consumer health products will lead to significant financial improvement. As this occurs, the valuation will once again reflect the incredible position the core JNJ holds.

Therefore: Avoid SpinCo, and watch for falling valuation of JNJ in the short-term.

JNJ Investor Presentation JNJ Investor Presentation

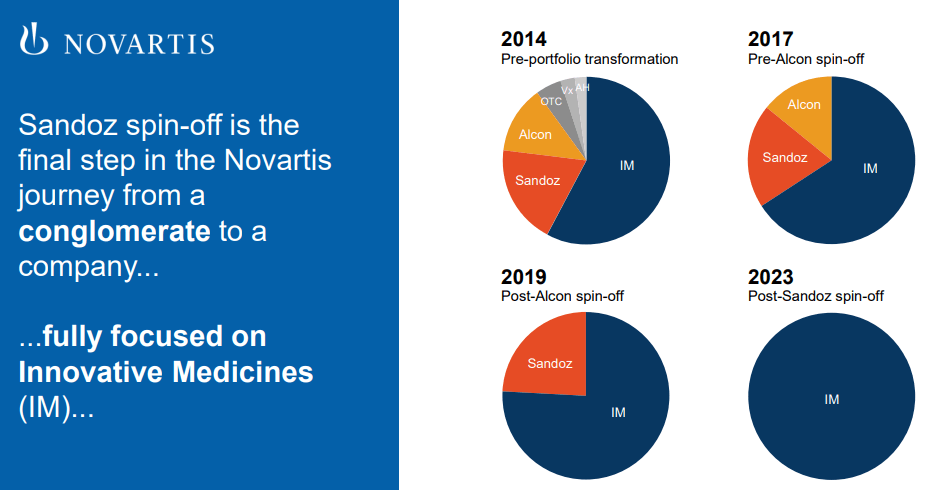

Novartis and Sandoz

Sandoz is Novartis’ large generics and biosimilar medicine manufacturer, and it is quite clear that is a good choice for the two entities to part ways. There is little synergy between generics and novel drug development, and so management believes that operational efficiency will increase across both companies. For Novartis, this means higher margins from innovative medicine sales and continued reliance on R&D, while Sandoz will have a more stable growth profile of lower margin products.

The spin-off is likely to occur smoothly as Novartis has also recently separated their Alcon (ALC) eye health unit successfully (a fairly well-performing SpinCo). Over the past three years, Novartis has seen significant earnings growth, and this is set to continue after the next spin-off they have planned. Sandoz is interesting, as they will be one of Europe’s largest generics producers and have fairly diverse growth opportunities thanks to biosimilars. Just watch both companies’ valuations and growth as Europe faces multiple headwinds (and NVS has had multiple lawsuits this summer as well).

Therefore: Novartis should see meaningful financial improvement and Sandoz may be a profitable endeavor, however, I would watch for short-term weakness to create an opportunity.

Spin-off Investor Presentation

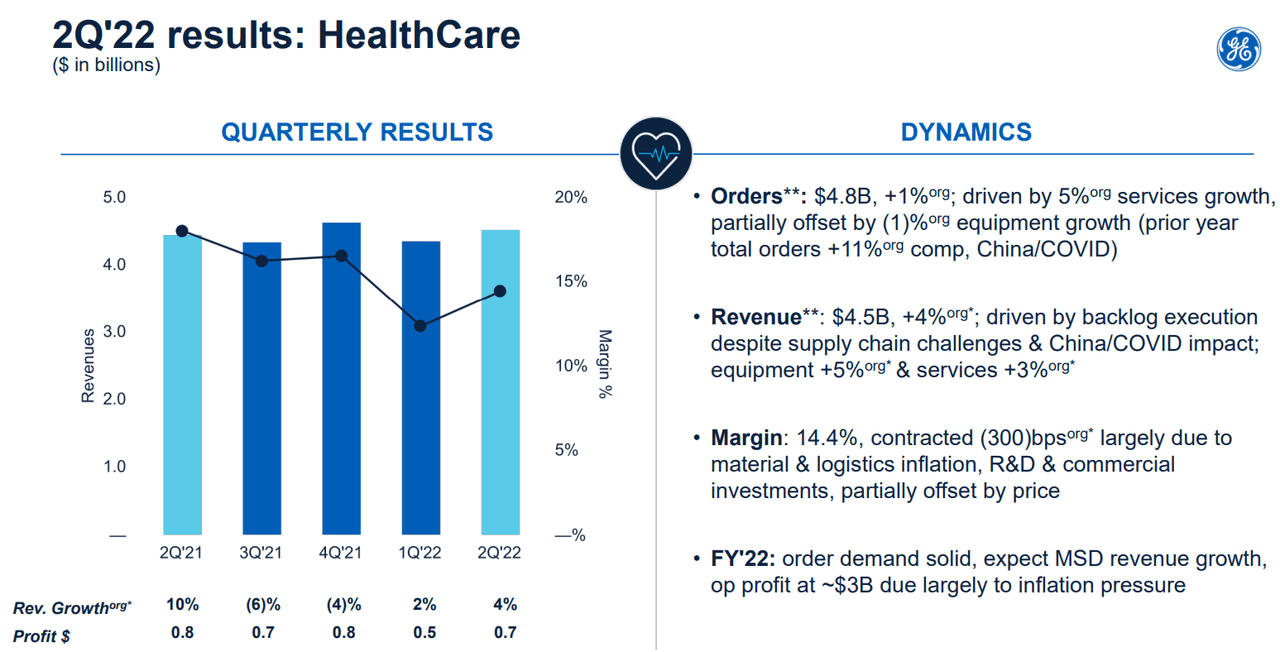

GE Health Care Segment

GE has a storied history of R&D across many industries, including Healthcare equipment and consumables. As the company suffers growth issues, management decided it was best to split into three whole companies. The healthcare segment will have over $16 billion in revenues per year, but growth is plateauing due to supply chain and other pandemic issues. Also, like GE as a whole, margins are slowly falling with time, even though the healthcare segment offers the highest margins of the group. I believe improvements are possible upon the conclusion of the transaction.

Therefore: GE Healthcare can be considered on its own as a stable play on healthcare equipment and technology, but only once trading alone.

2Q22 Investor Presentation

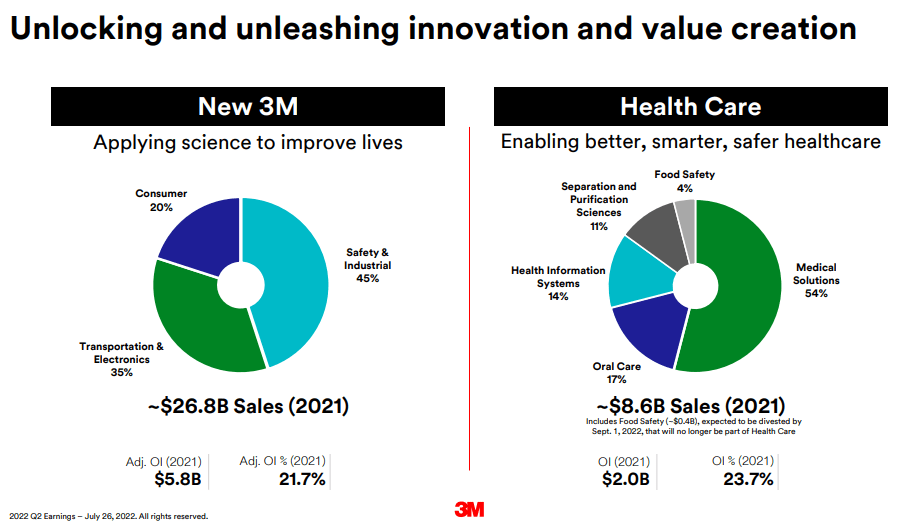

3M and their Health Care Segment

3M, a name to avoid in my eyes, is attempting to restart their growth by spinning off their healthcare unit. At approximately one fourth of total revenues, the inflow of cash to 3M will need to be reallocated significantly if the company wants to maintain their dividend. Also, I fail to see the benefits of the spin-off, other than the fact that the HC unit may earn a high valuation at time of sale. The segment is performing well through time, and even is in an upward trend as COVID subsides and elective procedures return.

Regardless, MMM is moving forward with this transaction, and I find the Health Care unit is worthy of further consideration. 3M does not have significant amounts of debt, and I do not worry about the SpinCo being held down by needless leverage. However, it is unknown whether litigation will follow the SpinCo, as some lawsuits have demanded that the spin-off does not occur. If things go south, watch 3M’s price to fall as growth is cut 25%, profits hurt as a high margin segment is removed, and the dividend heads to the chopping block.

Therefore: I would avoid both 3M and the SpinCo for the time being.

3M Investor Presentation

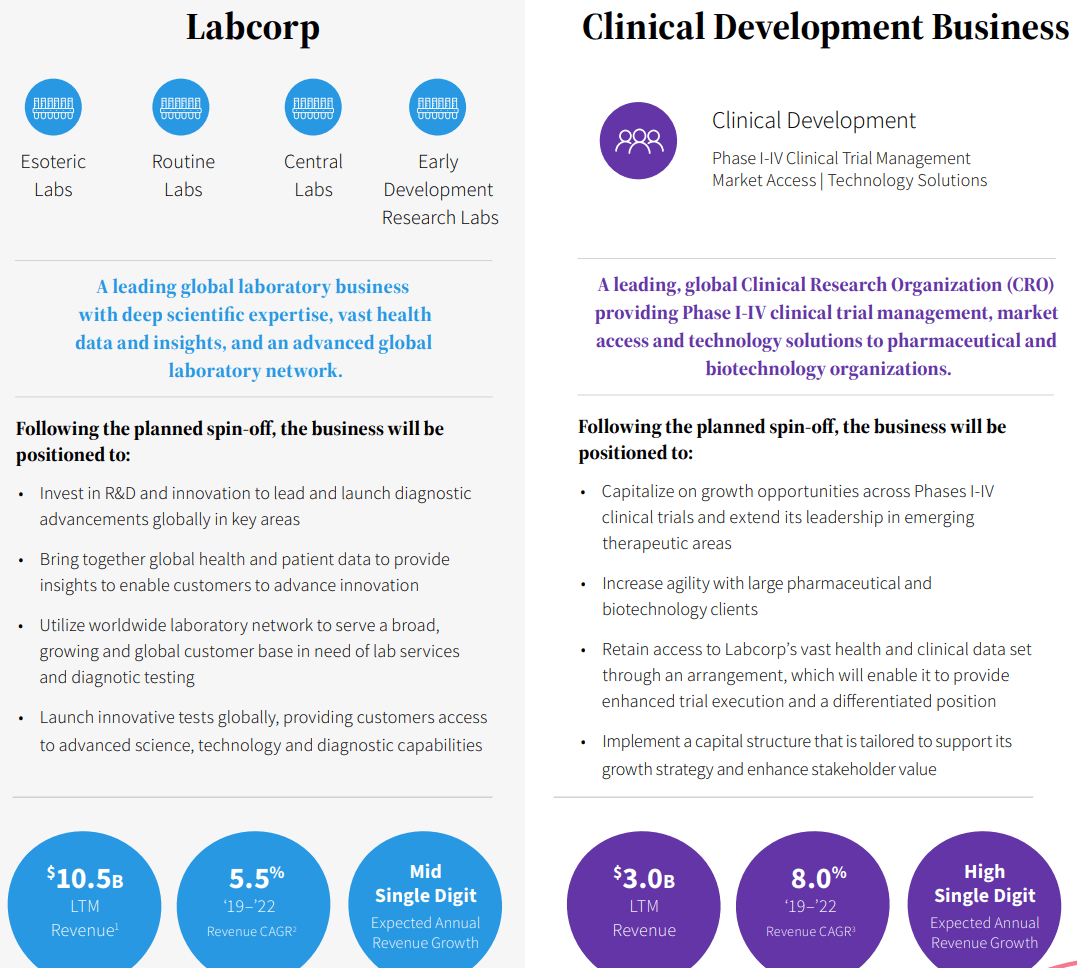

Labcorp’s Clinical Development Business

Labcorp is finally exiting clinical research (aiding drug developers with their clinical trials) and focusing entirely on lab work. This comes less than a decade after Labcorp acquired clinical research organization Covance for over $5 billion in 2014. This is another interesting spin-off that seems to be removing the stronger segment, rather than removing a lagging asset. While laboratory analysis and operation are not similar to a CRO, I struggle to see how a joint company cannot succeed.

In terms of the SpinCo, financial performance will be expected to be better as growth is closer to 10% than 5% with the legacy business. While management may be attributing poor earnings performance from 2014 to 2020 on the clinical development business, I will continue to believe that low-margin lab work is not an enticing business. Also, the CRO will be facing stiff competition from Thermo Fisher (TMO), IQVIA (IQV), ICON (ICLR), and Syneos Health (SYNH). Being tossed back in with the sharks may continue to inhibit performance of the SpinCo.

Therefore: I expected joint synergies to lead to strong performance, and splitting does not allow for that to occur. On their own, both are weak.

Labcorp Website

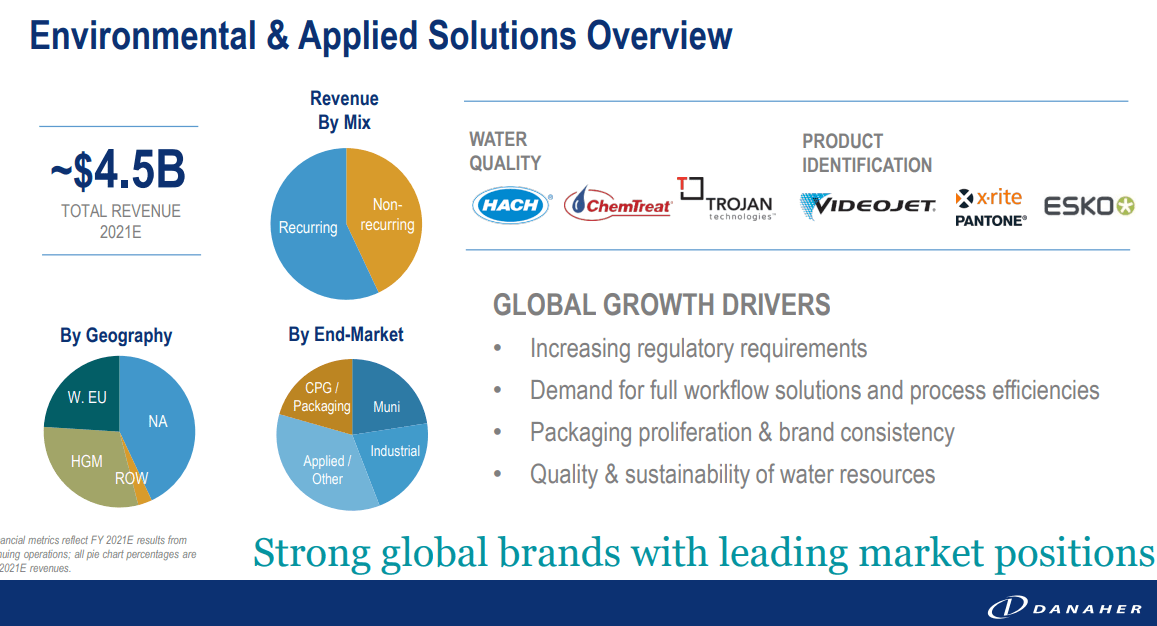

Danaher’s Environmental & Applied Solutions Segment

Danaher is finally taking their focus entirely on human health. With the spin-off of their water quality and product identification businesses (for now referred to as EAS), DHR will lose approximately $4.7 billion in revenues, or slightly more than 15% of total revenues (FY21). Similar to a pharmaceutical parting ways with their generic or consumer segments, I feel this spin-off will have a net positive effect on Danaher as their focus on core segments. Margins will also improve as the EAS segment 20-25% operating margins opposed to 25-35% for diagnostics and life sciences segments.

However, the EAS SpinCo will be a force in their own right with multi-billion in revenues and earnings per year, a diverse range of subsidiaries, and multiple growth catalysts. As a fan of Danaher on a normal day, I am viewing this transaction as positive, but I will be scrutinizing the coming financial data. I will always be a proponent of diverse businesses rather than focused ones, but DHR knows how to perform well, and I should have some faith.

Therefore: DHR is a buy as SpinCo is likely to be the best performing asset of all upcoming SpinCos, and DHR should be able to continue their upward trend in both revenue and earnings growth.

DHR 2021 Annual Presentation

Conclusion

While the past five years saw multiple spinoffs of lagging and underperforming assets, the coming wave is quite different. Instead, we see that a few underperforming giants are looking to find growth catalysts by spinning off their stronger assets and using the high value cash inflows to fund their last dying breath. As such, I look bearishly on most of the parent companies, but each SpinCo may be considered on their own.

This goes against the data found by Houlihan Lokey who noticed the general pattern is that the SpinCos tend to underperform the parent companies, and this data is useful in maintaining realistic expectations. Variance is high, but I believe it is best to not be too excited about any SpinOff. As the market remains in a downtrend I would recommend waiting for data to fill in and reassess each transaction carefully. In fact, if you do not hold any of the above companies, as I don’t, I would recommend staying on the sidelines for now. If interesting data points arise, I will be sure to follow up, but for now, take your time to do your homework.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment