Panama7

Since our Q2 results comment, Sanofi (NASDAQ:SNY, OTCPK:SNYNF) has lost almost 14% of its entire market capitalization equivalent to approximately €13 billion. The reason behind this was related to liability litigation for a product called Zantac. When we initiated to cover the French pharmaceutical giant, our buy case recap was based on: 1) a compelling valuation based on the net present value of new drug development, 2) the European dividend aristocrats status, 3) a superb drug pipeline not fairly priced in by the market and 4) a continuous COGS improvement (this was also supported by Eurapi spin-off). Today, we are asking if the four above points still hold and what are Sanofi’s implications in the Zantac litigation, looking also at the French company’s Q3 results.

Zantac litigation

Having checked Zantac product development, there are four enterprises that have been involved in ownership rights over time. In 2017, the drug was transferred to Sanofi; however, already in October 2019, the French company voluntarily withdrew its over-the-counter drug from the US. According to med research, Zantac can cause cancer, especially in the presence of specific foods.

Speaking of numbers, today there are less than 2,000 claims, but this might increase as the litigation moves forward. If we are looking at past drug settlements, we are ranging from $30k to $270k per person. If liabilities were cumulatively split over time, GSK would have been the major company impacted with almost 80% of the claims, while the other OTC manufacturers with the remaining 20% to be paid. Given the limited number of claims, Sanofi’s latest stage in the OTC drug, and its voluntary withdrawal, we are not assuming any liabilities in our Sanofi estimates. In addition, management seems very confident in dealing with these complicated matters and no major comments were disclosed in the Q3 Q&A call.

Q3 results

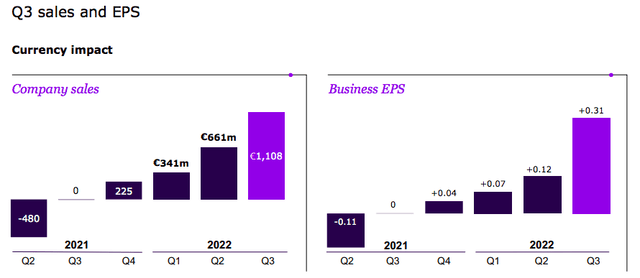

Going to the company’s numbers and cross-checking Wall Street expectations, we confirm our thesis on Sanofi is our next value pick. Top-line sales and EPS both exceed and beat analyst numbers by 5% and 9% respectively. Here at the Lab, we were already above the average consensus; however, a positive contribution was related to the favorable currency development.

Sanofi favorable currency development

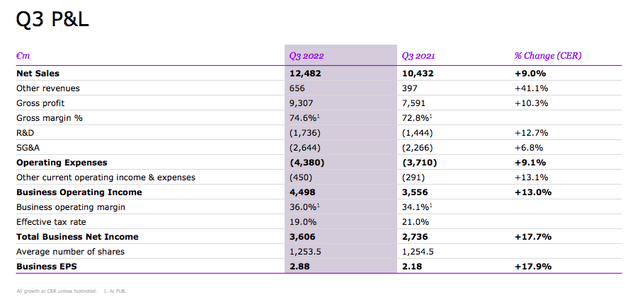

Looking at Sanofi’s division, key drivers of the company’s overperformance were Dupixent sales, which benefitted from US new launches, and the Vaccines segment, which also delivered good sales momentum thanks to the flu development as well as the traveler vaccines (there is a recovery story from post-COVID-19 outbreaks). Whereas, Consumer, GenMed and Rare disease outcomes were broadly in line with estimates. The company is also delivering on its promises to reduce expenses, from the snap below, we can clearly see that the company’s operating leverage is working. Looking at the details and despite some macroeconomic headwinds such as higher logistic costs, the gross margin improved to 74.6%. Going down in the P&L, SG&A to sales decreased by 50 basis points and reached 21.2%.

Conclusion and valuation

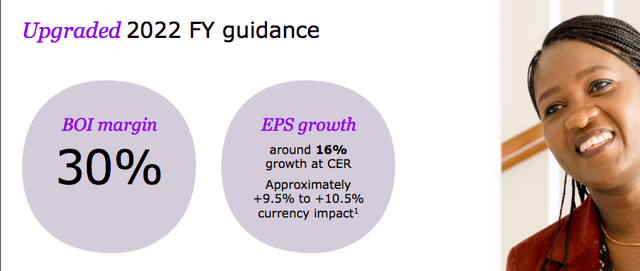

Quoting the CEO: “Sanofi’s strong results for the third quarter demonstrate that the company is on the right path, with a remarkable performance of 20% growth in both Specialty Care and Vaccines, leading us to again raise our business EPS guidance for the full-year“, so management increases its 2022 outlook and now targets 16% EPS growth compared to the previous 15%. Moreover, Sanofi notes positive development on Dupixent sales, lower operating cost, and additional disposal expected in Q4 for a total gain consideration of almost €600 million. Currently, the company is trading at a 10x P/E and more than a 30% discount compared to peers (including a notional provision of $5 billion for Zantac). We believe this is totally unjustified and we decided to leave our target price at €110 per share unchanged.

Be the first to comment