Vertigo3d

Ladder Capital Corp (NYSE:LADR) is a real estate investment trust that offers investors not only a covered 8.7% dividend yield and a low pay-out ratio based on distributable earnings, but the trust’s stock is also available at a discount to book value.

Ladder Capital has excellent dividend coverage, giving the dividend a high margin of safety. The originations of the trust remained strong in the third quarter, and there is no evidence that the commercial real estate market is currently in a slump.

Ladder Capital is a good investment for investors looking for high quality passive dividend income because the stock is available at a discount and the trust increased its dividend pay-out to $0.23 per share per quarter in 3Q-22.

Robust Origination Volume

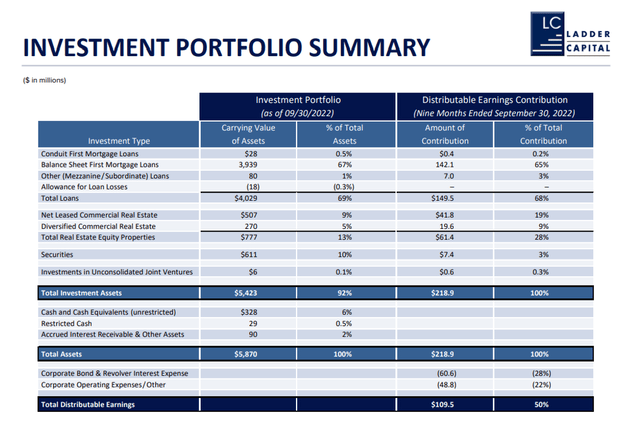

Ladder Capital’s loan portfolio was valued at $4.0 billion at the end of the September quarter, with Balance Sheet First Mortgage Loans accounting for approximately 67% of total investments. These are highly secured loans to commercial real estate investors.

At the end of the last quarter, the commercial mortgage real estate investment trust had $5.9 billion in assets, including Subordinate Loans, Commercial Real Estate, Securities, and cash.

Investment Portfolio Summary (Ladder Capital Corp)

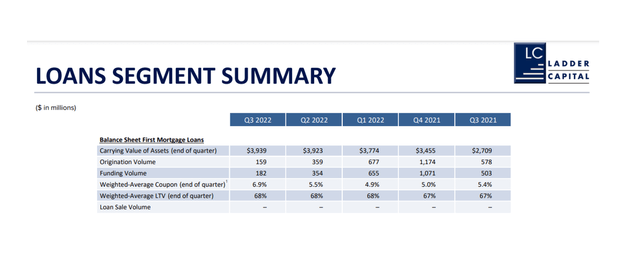

In the third quarter, Ladder Capital originated $159 million in loans, compared to $371 million in the previous quarter. The loan portfolio of the trust is well-managed and heavily weighted toward high-quality Balance Sheet First Mortgage Loans. These are secured loans with a low loss ratio.

In the third quarter, all of Ladder Capital’s new loan fundings were Balance Sheet First Mortgage Loans.

Loans Segment Summary (Ladder Capital Corp)

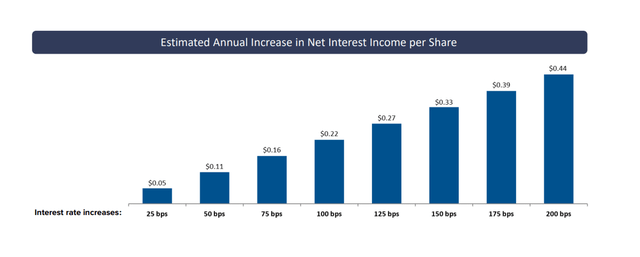

As I mentioned in my article Path To Financial Freedom: Buy Ladder Capital’s Fat 9.5% Yield, one of the best reasons to invest in Ladder Capital is the trust’s positive interest rate leverage.

Higher interest rates are expected to increase the real estate investment trust’s net interest income. The updated interest rate table from Ladder Capital is shown below.

Interest Rate Increases (Ladder Capital Corp)

The Trust Continues To Have Good Dividend Coverage

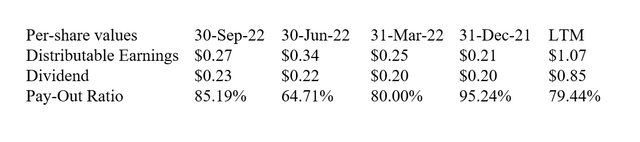

Ladder Capital earned $0.27 per share in distributable earnings in the September quarter, for a dividend payout ratio of 85%. This pay-out ratio is roughly in line with the previous twelve-month pay-out ratio of 79%.

Ladder Capital’s dividend has a high margin of safety because the real estate investment trust has adequate dividend coverage and origination volume has remained strong throughout the third quarter.

Having said that, an increase in the dividend pay-out ratio would be a red flag that Ladder Capital might have to cut its dividend.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

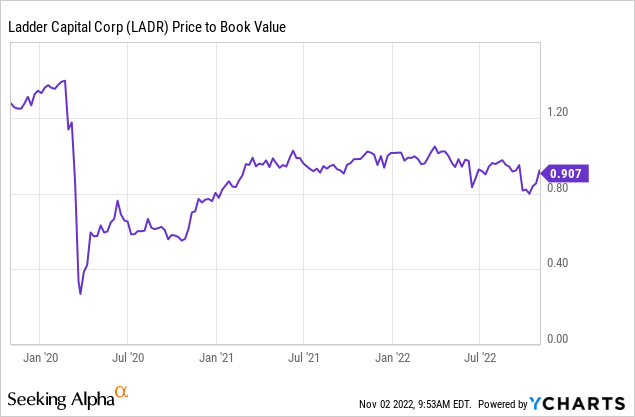

Ladder Capital’s Stock Is Still Trading At A Discount To Book Value

Ladder Capital’s investment portfolio, which primarily consists of very stable and low risk Balance Sheet First Mortgage Loans, is available to passive income investors at a discount.

The stock of the trust is currently trading at a 10% discount to book value.

Even though Ladder Capital’s stock has been trading at a greater discount to book value in recent weeks, I believe the discount is still low enough to make the stock appealing from both a yield and a valuation standpoint.

Why Ladder Capital Might See A Lower/Higher Valuation

A drop in new mortgage loan originations as a result of a slowing commercial real estate market could change Ladder Capital’s investment case.

Higher interest rates and inflation are also a threat to investment firms because they may reduce demand for new commercial real estate investment capital.

Ladder Capital will face some headwinds in this regard as long as inflation rates remain high and the central bank continues to raise interest rates to control inflation.

My Conclusion

Ladder Capital reported strong third-quarter distributable earnings. The commercial real estate investment trust’s dividend was once again covered by distributable earnings, and the pay-out ratio was low enough to suggest that Ladder Capital can continue to grow its dividend.

Furthermore, the trust benefited from strong originations, and the portfolio was still overweight relatively safe Balance Sheet First Mortgage Loans.

Ladder Capital stock is a buy for passive income investors because it trades at a discount to book value, the dividend is covered by distributable earnings, and there are no signs of a major commercial real estate market correction.

Be the first to comment