wildpixel

The biotechnology sector has done relatively well during the last four months. It is expected to continue trading sideways. As such, the 3x inverse leveraged fund, LABD, is almost guaranteed to lose value.

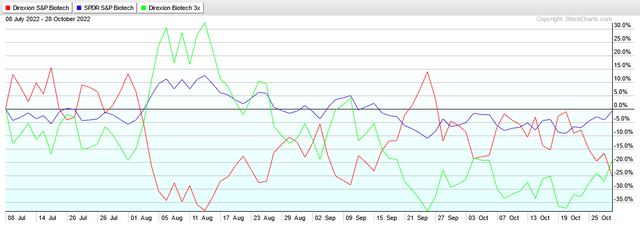

Since July 8 when I rated LABD a SELL, the underlying biotechnology index has moved very little up or down, as shown in the chart below. On Friday, October 28, XBI (blue) closed at -0.79%, LABU (green) at -19.36%, and NYSEARCA:LABD (red) at -25.22%. Unless XBI exhibits a prolonged trend, either up or down, both the direct and the inverse leveraged funds are losing money. This is one of the reasons why the leveraged funds are not suitable for long term investments.

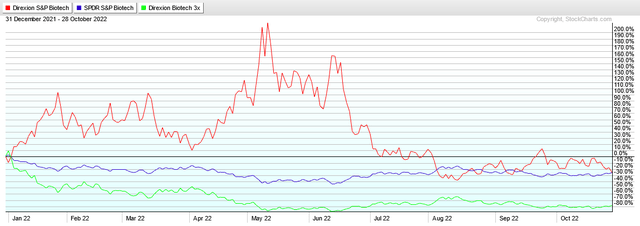

A similar conclusion can be drawn by looking at the YTD chart. Since the beginning of 2022 until Friday, October 28, XBI returned -25.19%, LABD -25.80%, and LABU -78.18%. Obviously, the inverse leveraged fund would not have been a good investment, even though the underlying index was in a bear market.

Looking in more detail at the YTD chart, we see that there have been two short periods when XBI was in uninterrupted declines. During those periods, the inverse fund, LABD, made outsized returns. January 3 to January 27, LABD gained 113.06% and April 4 to May 11 gained 205.91%. Of course, these gains are unrealistic since they assume perfect timing.

Everyday Finance published an article discussing shorting leveraged ETFs in April 2011. Here is a link to that article.

Here is an extract from that article: “by shorting leveraged ETFs in pairs, you can often benefit from the value decay on both sides while remaining virtually market-neutral. This has been my primary strategy to date. The ideal situation here is that a market is roughly flat and you’ve made money on both sides of the trade”.

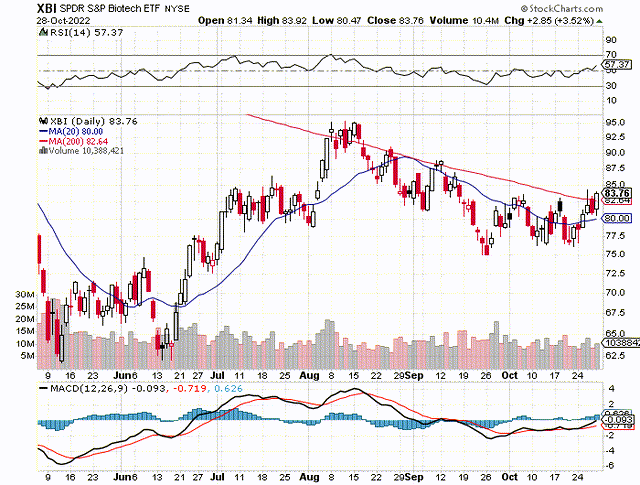

XBI Technical Analysis

Below is a 6-month daily chart of XBI with 20-day and 200-day simple moving averages and its MACD. As we see, the biotech made a double-bottom in May-June and those lows have hold well so far. That means that biotech stocks are in an intermediate term uptrend. That uptrend has been confirmed by the price crossing above the 200-day SMA. Right now, the biotech is also in a short-term rally with the price above an upward increasing 20-day SMA. Additionally, we see an MACD- price bullish divergence.

The technical analysis indicates a high probability of a continuation of the biotech price short-term uptrend. Therefore, shorting LABD is expected to be a profitable trade.

Conclusion

The Biotech ETF (XBI) is in a sustained short-term uptrend, supporting my rating of LABD as a SELL.

Be the first to comment