Thank you for your assistant/iStock via Getty Images

What Happened This Week

KLX Energy Services (NASDAQ:KLXE) rose 30% on Sept 28, 2022, because it raised its revenue guidance from 9%-13% Q/Q growth to 16%-18%, raised its EBITDA margin guidance from 10%-12% to 14%-16%, and amended its ABL in which maturity date was extended to 2024. The CEO also reaffirmed that KLXE is returning to positive FCF in 2H22 and that KLXE is “on pace to deliver our best pro forma quarterly performance since 2019”. I believe KLXE still has a large upside despite the recent price surge.

Thesis

Before the ABL amendment, KLXE was an oil E&P company being left for dead by the market. The pessimism was due to several reasons; 1) KLXE had a $50 million ABL due in September 2023, and $250 million 11.5% notes due Nov 2025 (liquidity issue), 2) It produced negative EBITDA last year due to pandemic interruption, and 3) an ill-timed acquisition leveraged the company right before a black swan event (Covid), and caused #1 and large goodwill impairments. The market values KLXE as if it is going bankrupt, but I believe the recent oil upcycle provides huge tailwinds to KLXE especially given that KLXE was turning around before the pandemic. I think KLXE is very likely to generate at least $100 million EBITDA in 2023, which 1) deleverages the company, and 2) at 5x TEV/$100 million EBITDA it should be valued at $17/sh, suggesting a ~100% potential upside in the next 12 – 18 months. The amendment of the ABL definitely eliminated substantial execution risks.

Business Overview

According to its 2021 10-K,

KLXE is a diversified provider of onshore oilfield services including drilling, completion, production, and intervention activities for the most technically demanding wells from over 60 service facilities located in the United States. Its primary services include directional drilling, coiled tubing, thru tubing, hydraulic frac rentals, fishing, pressure control, wireline, rig-assisted snubbing, fluid pumping, flowback, testing, pressure pumping, and well control services. Its primary rentals and products include hydraulic fracturing stacks, blowout preventers, tubulars, downhole tools, dissolvable plugs, composite plugs and accommodation units.

It has three segments: Rocky Mountains Region, the Southwest Region, and the Northeast/Mid-Con Region. Each segment accounted for 28.7%, 35.6%, and 35.7% of the revenue, respectively. As of December 31, 2021, KLXE’s market share of the U.S. onshore drilling market was 8.4%, according to 2021 10-K.

A Disrupted Turnaround Story

KLXE was initially formed from the combination of seven oilfield service companies during 2013-2014, whose P&L took a hit due to the oil crash in 2015. To address this, the management restructured the business through rationalization, efficiency improvement, and headcount reductions. Although KLXE was still losing money, its operation had become healthier: its pre-tax income grew from ($89.5 million) in 2016 to ($24 million) in 2017 before finally going positive to $15 million in 2018 (helped by rising oil prices). During the meantime, KLXE recruited many new customers and grew from 400 Master Service Agreements to more than 1,000. Its revenue grew from $152 million in 2016 to $495 million in 2018, a CAGR of 80%, with few acquisitions.

In 2018, KLXE was spun off from KXI and the stock was trading at $142/sh.

Mis-timed Acquisition

In 2018, KLXE took on $250 million debt to acquire Motley, another oilfield services provider that offers coiled tubing, thru-tubing, and pumping services, as well as perforators and pressure control equipment for $170 million in cash and $9 million in stock. This acquisition could’ve successfully reduced SG&A expenses through synergies, and helped KLXE to expand into new markets. Unfortunately, right before KLXE went back on track, a small downcycle and the pandemic hit. KLXE recorded a $42 million non-cash impairment charge in 2019 due to “abrupt deterioration in industry conditions, which began in the third quarter and accelerated through the end of our fourth quarter of Fiscal 2019, was driven by a sharp decline in U.S. land rig count and an unprecedented decline in operating frac spreads from the second quarter through the end of 2019”, which sent KLXE’s bottom line back to ($96 million). However, KLXE was still operating cash flow positive at the moment ($58 million operating CF vs. $70 million capex). The hardest time had yet to come. Later in 2020 and 2021, KLXE’s operating cash flow dropped to ($55.6 million) and ($64.9 million), respectively. However, capex was also decreased sharply to $11 million in 2021 and $12 million in 2020. KLXE achieved net cash inflow from investing activities in 2021 due to $15 million equipment sales. From this, we can see the liquidity management ability of the new mgmt, which will be elaborated below.

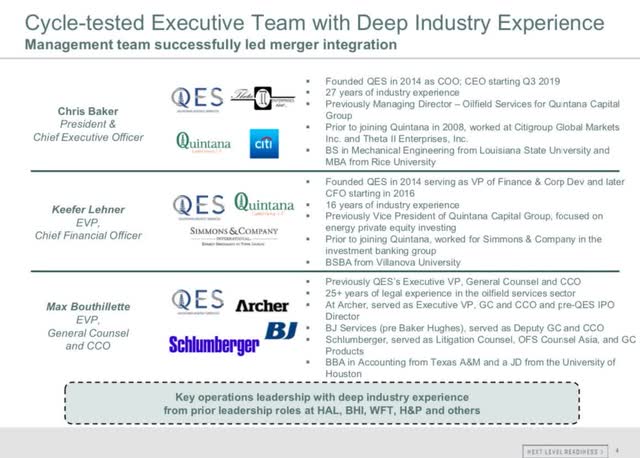

Brand new management (IR presentation)

Merger

In 2020, KLXE merged with Quintana, with Quintana’s previous management becoming the CEO and CFO of the merged company. This merger enhanced the turnaround opportunity because 1) it realized a $40 million SGA reduction, calculated by subtracting the current SGA expense from pre-merger combined SGA expense, and 2) the new management is good at maintaining decent liquidity (based on Quintana’s pre-merger performance and KLXE’s post-merger capex performance), compared to the previous management which created massive debts and equity dilutions through unnecessary acquisitions, such as Tecton and Red Bone (for $47 million equity issuance and $28 million in cash) in 2019. The fact that the pandemic hit right after only made things worse.

Significant SG&A synergy (IR presentation)

Oil Cycle

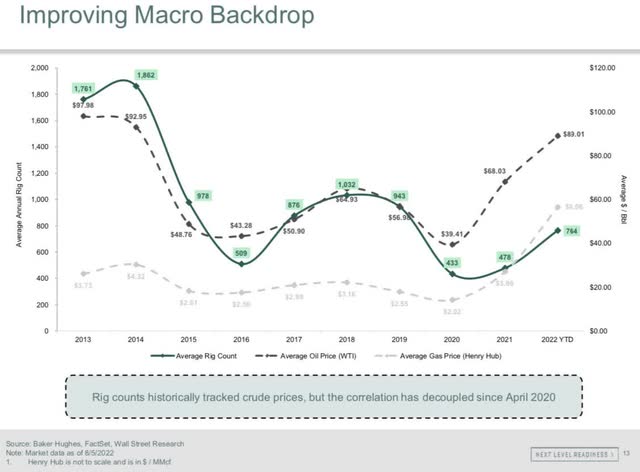

Since 2014, the capex spent in the oil field has been drastically reduced. According to BofA Global Research, the capex in the global oil and gas industry was around $600-700 billion from 2011 to 2014, before it plunged to $400 billion during 2015-2018. According to Raymond James Research, capital spending of Mid/Large Oil & Gas companies has declined from ~$500 bn from 2011 to 2014 to around $300bn, before it dropped further to $220bn in 2020. In the meantime, the global demand for crude oil grew steadily from 92.7 mmbpd in 2014 to 99.7 mmbpd today (still 2-4 mmbpd lower than 2019). US oil rig count and frac spread are at 596 and ~280 today, respectively, compared to ~800 and ~400 in 2018&2019. According to KLXE 2020 10-K: “In response to the COVID-19 pandemic and the concurrent Saudi-Russia market share dispute, activity levels in the US plunged to record lows. US operators responded by shutting-in production and drastically reducing drilling and completions activity and associated spending. For example, US operators laid down nearly 70% of active rigs between the first and third quarters of 2020 and a majority of US operators reduced 2020 capital spending by 50% when compared to 2019 and renewed their focus on living within free cash flow.”

Rig count and oil price mismatch (IR presentation)

KLXE Tailwinds

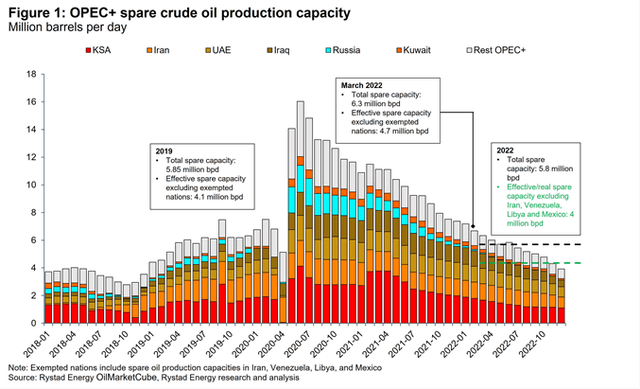

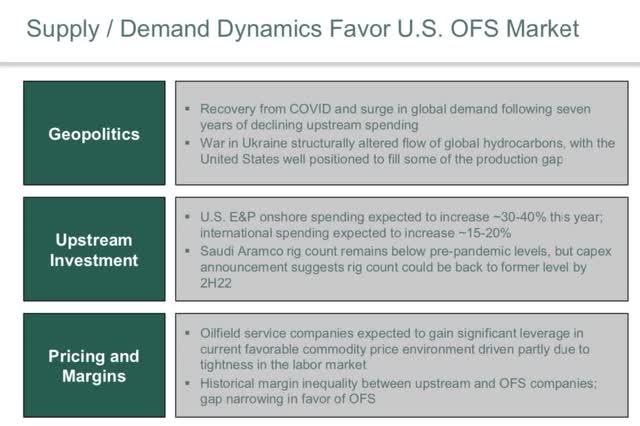

Keep in mind that we are already at $90 oil today. The current oil price surge is caused by under-investment in the oil field during the past decade and the “shock” of a fast pandemic recovery, right after substantial capex cuts. The global spare oil production capacity is at an all-time low (see the chart below), and OPEC’s fiscal breakeven oil price is at $80, which is way higher than the US & EU integrated producers (around $50). Macro events such as the Russia-Ukraine war, European energy shortage, and China potentially coming out of lockdown can only make things worse. Furthermore, OPEC+ just cut production by 100,000 BPD right after they agree to increase output in August. In my opinion, OPEC+’s stance is very clear: they won’t let free money go. Therefore, I anticipate that high oil prices will stay for a long time (the typical lead time for an oil E&P project is 5.5 years). Geo-political events mentioned above plus lower cost as well as shorter lead time make US onshore the best place to address this supply shortage. It’s not unreasonable to expect a surge in onshore E&P activities.

Global Oil Spare Production Capacity (Reuters)

Here is the management’s summary of the favorable upcycle:

Management on tailwinds (IR presentation)

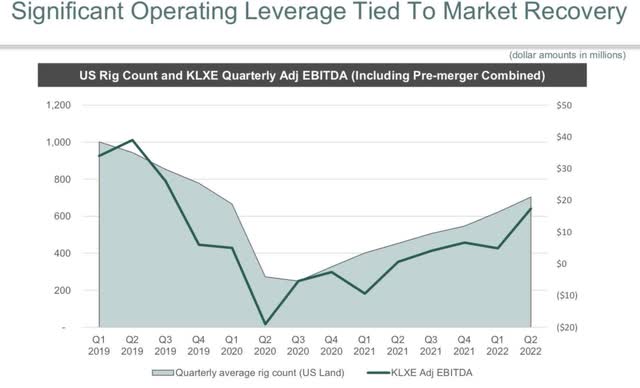

KLXE’s revenue is highly correlated to the onshore E&P activities which makes it basically a call option on rig count and frac spread. US Baker Hughes rig count has grown 52% YoY, and solid recovery signals have appeared on KLXE’s P&L statements: According to the Q2 results published a couple of weeks ago, KLXE generated $17.4 million EBITDA, compared to $3.8 million in Q1. The mgmt also guided the third quarter adjusted EBITDA margin of 10%-12% and increased the full year 2022 revenue guidance to a range of $730.0 million to $750.0 million from the previous $690 million-$710 million. This is the third guidance increase in LTM.

Correlation between KLXE performance & oil activities (IR presentation)

This is what KLXE’s P&L would look like if the oil price stays at the 2018 level: In 2018 when oil was in the $70s (which dropped later), the three companies combined (KLXE, Motley, and Quintana) produced $1.2 billion of revenue and $195 million of adjusted EBITDA, per past 10-Ks. According to 2021 10-K, mgmt “expect to incur between $25.0 and $30.0 in capital expenditures for the year ending December 31, 2022”. If we use the high-end number $30 million, plus $30 million interest payment (run-rate), we ESTIMATE 2023 adjusted FCF of ~$135 million. This reduces KLXE’s debt/FCF ratio to ~2.3x. Even if we use a conservative EBITDA of $100 million due to the current 40% lower headcount (partially due to synergies) and 50% lower frac fleet count compared to 2018, our calculations still reach $40 million FCF. The ABL due Sep 2023 is of no problem in this scenario and by 2025 KLXE can produce ~140 million FCF with $30 million cash on hand. Don’t forget that oil prices are ~$90 today, and there’s a lot of geopolitical turmoil. The realized EBITDA might be well above $100 million. I don’t worry about market share loss because it went from 8.2% in 2020 to 8.4% in 2021 (per 2021 10-K) and the correlation between KLXE’s revenue and onshore activities has never dropped, per the past 10-Ks.

Valuation

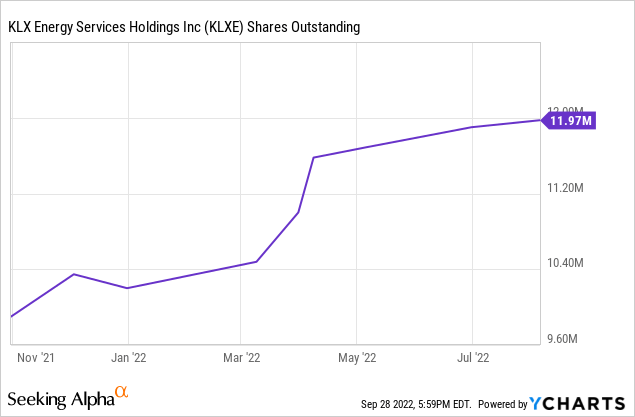

Bull Case: At 4.5x $150 million 2023 EBITDA, Market cap= 4.5*$150mm – $300mm= $375 million, share price= $375mm/11.97mm= $31/sh, 344% upside;

Base case #2: 4x $100 million 2023 EBITDA, Market cap= 4* $100mm – $300mm= 100mm, share price=$100mm/11.97mm=$8.35/sh, 20% upside;

Bear Case: Oil price somehow drops below $70 (very unlikely) for a long time, and the company defaults and goes bankrupt. ~100% loss. I think it is very unlikely.

Risk

- Oil price drops (unlikely).

- Possible recession risk, which will cause oil demand to drop, also driving oil prices lower.

- The stock recently has an $83.46 million market cap, which makes it a “microcap”. Please note that microcaps tend to be illiquid and volatile. In KLXE’s case, I believe KLXE would be less of a micro-cap if it weren’t so undervalued. The company is not that small: they have 8.4% of the US onshore oil E&P market! The averaging trading volume of the stock is ~188,000, which in my opinion is decent.

Be the first to comment