Sundry Photography

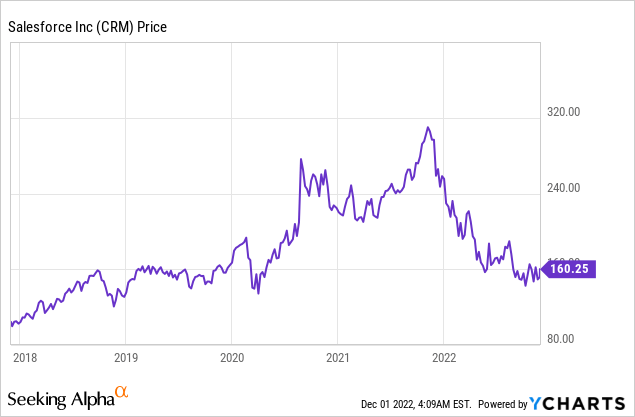

Salesforce (NYSE:CRM) is a global software company that provides market-leading Customer Relationship Management [CRM] software. The company serves an elite list of clients which includes Ford (F), L’Oréal (OTCPK:LRLCY), and nearly all of the Fortune 1000. The company has grown via acquisition and continued to produce strong financial results in the third quarter of FY23, beating both top and bottom-line growth estimates. Despite this, the stock price is down 47% from its highs in November 2021. In this post, I’m going to break down the company’s financials and valuation, let’s dive in.

Strong Third Quarter Financials

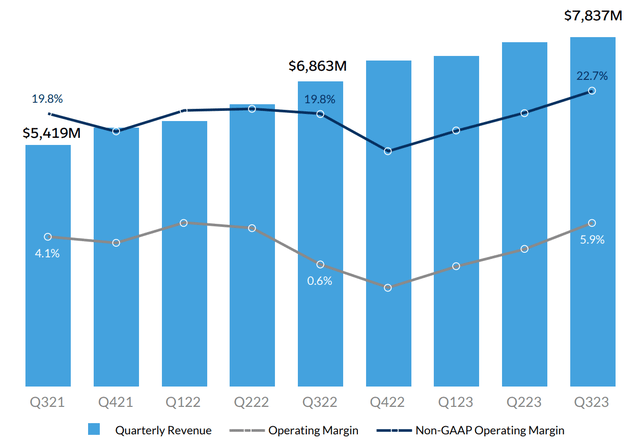

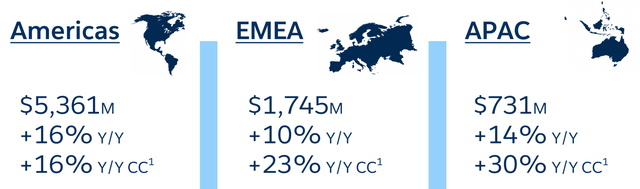

Salesforce reported strong financial results for the third quarter of the fiscal year 2023. Revenue was $7.84 billion which increased by 14% year over year and beat analyst estimates by $3.41 million. The main headwind for the company was a strong dollar which impacted international revenue by ~$300 million. On a constant currency basis revenue increased by 19% year over year.

Salesforce Revenue (Q3,FY23 report)

Breaking Salesforce revenue down by region, the Americas is the largest contributor making up 68% of total revenue and increasing by 16% year over year to $5.4 billion. This is a positive sign as it means the strong dollar is only impacting foreign exchange headwinds for the remaining 32% of the company. EMEA revenue increased by 10% year over year to $1.745 billion, on a constant currency basis this increased by a rapid 23% year over year. The Russia-Ukraine war has acted as a catalyst for devaluation in the Euro which has caused currency holders to retreat to the safety of the U.S dollar. The APAC region was the smallest revenue contributor making up 9.3% of total revenue but still increasing by a rapid 30% to $731 million on a constant currency basis.

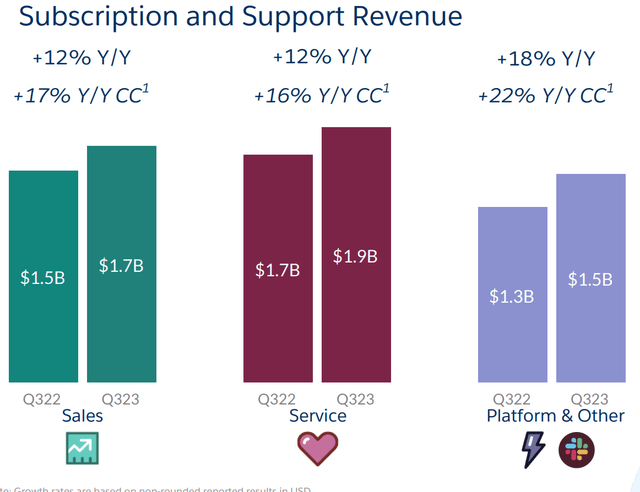

By business unit/product, Salesforce’s flagship Sales Cloud continued to grow its revenue by 12% year over year. Salesforce was a pioneer in Sales Automation and its product is widely known as the best-in-class solution for enterprises. Gartner gives the Sales Cloud the highest rating on its website by customer review number and star rating. The IDC has ranked Salesforce as number one in CRM for nine years in a row, as it continues to maintain market dominance. The company does face competition from cheaper alternatives such as HubSpot (HUBS) but that platform is more popular with the SMB market. The strategy of Salesforce has been to “enable customer-focused” companies. This means the business operates a range of software platforms from the initial Sales to Marketing Automation (Pardot) and Customer Service. The Service part of the business continued to produce solid growth increasing its revenue by 12% year over year to $1.9 billion.

Revenue by product (Q3,FY22 report)

The beautiful thing about Salesforce is the company hasn’t just created a multitude of products but a “platform” where Apps can be built on top and integrations can be made. I was recently speaking to a “Salesforce developer” who informed me that Salesforce uses its own special programming language called “Apex” which is similar to Java. However, the company also offers a series of “low code” app-building technologies, which employees can use to build automation tools and digital experiences for customers. The beautiful thing about this setup is the more custom apps and integrations are made, the less likely a customer will leave as “switching costs” have been layered on. Therefore it’s no surprise that the Salesforce Platform and Chat application Slack reported $1.5 billion which increased by 18% year over year. The internal messaging application Slack was acquired in July 2021 for an eye-watering $27.7 billion. The acquisition was criticized heavily at the time, but I believe Salesforce aims to make the application an easy upsell to its vast range of enterprise clients. I can’t argue with the logic, but the price tag is fairly hefty given the number of productivity tools on the market.

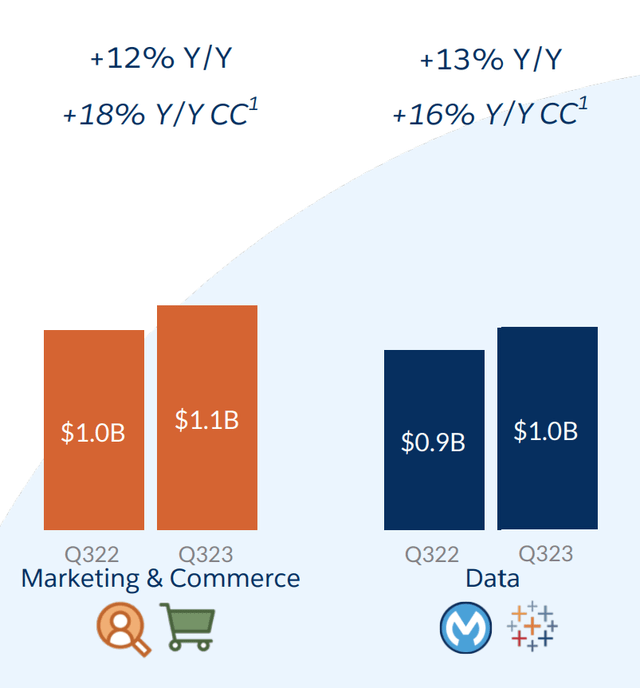

The Salesforce Marketing & Commerce platform increased its revenue by 12% year over year, as this segment was impacted heavily by FX headwinds.

In 2019, Salesforce acquired data visualization company Tableau for $15.7 billion. Similar to the Slack acquisition this was a fairly hefty price but the fact it was an all-stock deal was a silver lining. Tableau is also the leading data visualization provider and is poised to continue its growth in the big data industry. Therefore it is no surprise to see that revenue for Tableau and its integration platform MuleSoft increased by 13% year over year to $1 billion.

Salesforce Marketing and data (Q3,FY23 report)

Salesforce has a vast array of customers across multiple industries which includes “nearly every” Fortune 1000 company. Salesforce believes every company is becoming a “customer-focused” company and thus the adoption of Salesforce makes sense. Salesforce recently signed a deal with T-Mobile (TMUS) as they work to help them create the “next generation” of user experience with the Salesforce Professional services team. This deal builds upon Salesforce’s telecom industry experience as it works with “almost every” major player.

Financial Services is another area Salesforce dominates as it works with “all the major financial service companies”. An example includes Bank of America (BAC) which has been a customer for 20 years and Salesforce is still helping the business to innovate.

Salesforce is continually innovating itself and has recently launched its customer data platform [CDP] called Salesforce Genie. The platform already has 500 customers and aims to help businesses create a 360′ view of the customer in real-time. This can also be integrated with AI models from Amazon Web Services (SageMaker) and Snowflake (SNOW).

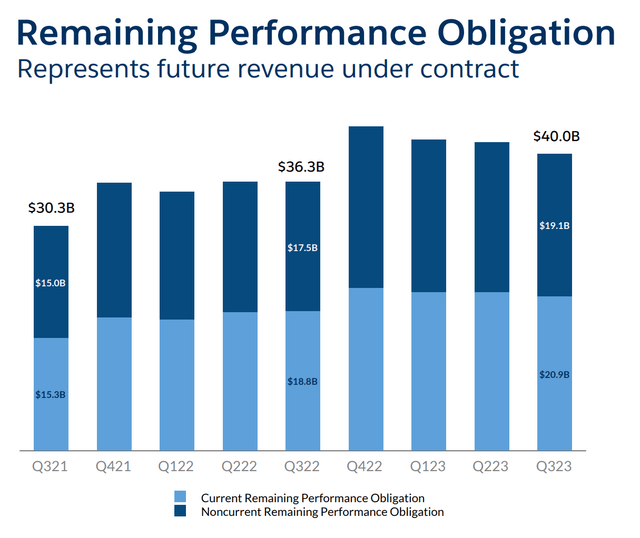

Salesforce has a huge pipeline of future revenue under contract which equates to a staggering $40 billion in RPO. This gives immense consistency to the revenue and makes Salesforce a highly prized company.

Earnings and Cash Flow

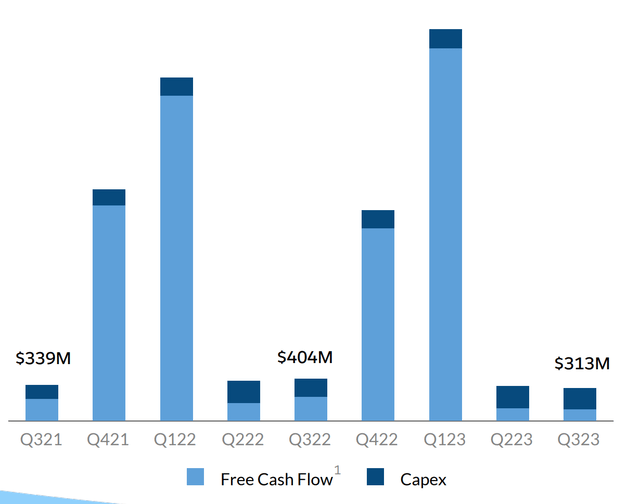

Salesforce reported solid earnings in the third quarter of FY 2023. EPS was $0.21 which beat analyst expectations by $0.11. Salesforce reported $313 million in operating cash flow which is down slightly from the prior year but cash flow does tend to fluctuate. For example, the company has historically had a spike in cash flow during the fourth quarter as its customers renew contracts, this is a trend that is expected next quarter.

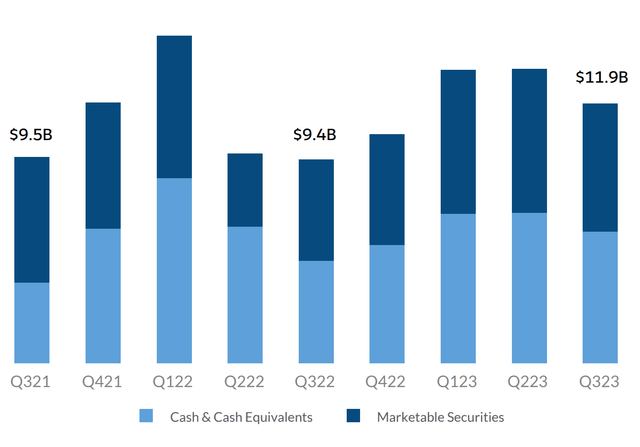

Salesforce has a solid balance sheet with $11.9 billion in cash, cash equivalents and marketable securities. The company does have fairly high long-term debt of $9.4 billion but just $1.18 billion in current debt.

Salesforce Balance Sheet (Q3,FY23 report)

Advanced Valuation

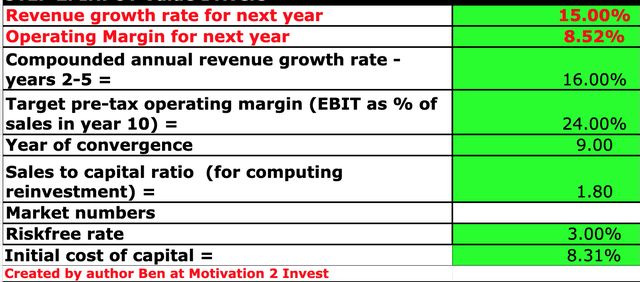

In order to value Salesforce I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 15% revenue growth for next year which is assuming continuing FX headwinds. In addition, I have forecasted 16% revenue growth per year for the next 2 to 5 years, as economic conditions are likely to improve.

Salesforce stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted a 24% operating margin over the next 9 years.

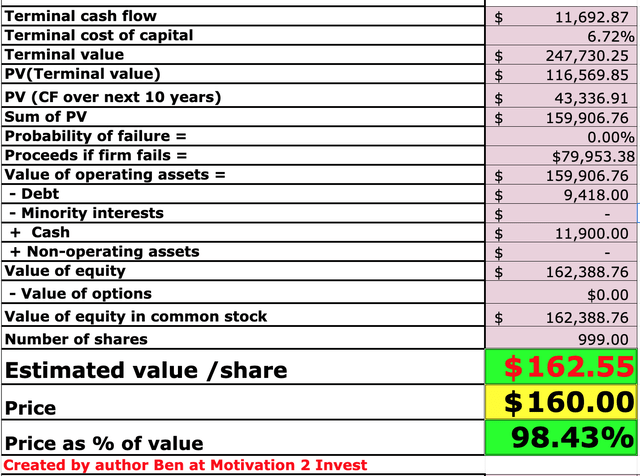

Salesforce stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $162 per share, the stock is trading at $160 per share at the time of writing and thus is “fairly valued”. This makes sense for a company of such high quality, in a strong leadership position with a huge pipeline of revenue and a strong customer base of enterprises.

As an extra datapoint, Salesforce trades at a Price to Sales ratio = 5, which is 41% cheaper than its 5-year average.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Business decision-makers are cutting costs and in a state of fear, like a rabbit caught in the headlights. The likelihood of this is longer sales cycles and a reluctance to embrace new upsell opportunities. The FX headwinds are also impacted international revenue, which I imagine will be a cyclical issue.

Final Thoughts

Salesforce is a tremendous technology company which is a true leader in the CRM arena. The business has continued to produce strong financial results and the only headwind looks to be from unfavorable FX rates. The stock is fairly valued at the time of writing and thus could be a great long-term investment.

Be the first to comment