Diego Antonio Maravilla Ruano/iStock via Getty Images

Movado Group, Inc. (NYSE:MOV) reported flattish earnings for its fiscal 3rd quarter [ended October 31st], which in the context of global macro uncertainty is perhaps not a bad result. Consumers are under pressure due to inflation, and for a mid-point consumer goods luxury company to deliver a steady result shows resilience in the face of adversity, in our view.

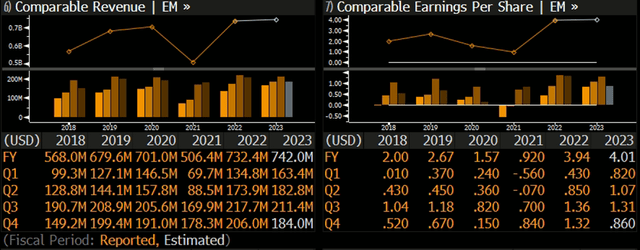

Sales decreased -2.9% but were up +3.4% in constant currency. Gross margins held up, despite inflationary cost pressure impacting raw material and production costs, and selling prices impacting final sales. Gross margins came in at 57.3%, relatively stable versus 57.7% in the year ago quarter. This resulted in bottom-line EPS at $1.31, fractionally down YoY versus $1.36. Despite a difficult environment, Movado is still on pace for record EPS for this current fiscal year, as can be seen in the following chart:

International sales were a bright spot for Movado, rising +10.2% YoY on a constant currency basis. International sales were strong in all regions. Management is particularly pleased with the strong reception to its new CK brand.

Additionally, the company believes it is well-positioned for the all-important seasonally strong Christmas and holiday season. Movado is judiciously passing on price increases, and in general high-end luxury continues to see robust demand globally, along with record-high pricing which is nonetheless resulting in more allure for high-net-worth shoppers.

The company had $187 million in net cash [zero debt] as of October-end equaling $8.30 per share, down slightly from $203 million in net cash as of July-end. This amounts to 27% of the company’s current stock market capitalization. Movado has returned $52 million to shareholders via repurchases YTD in this fiscal year.

The company has slightly reduced its full-year outlook due to the overall macro environment, and the stock reacted negatively to that, but has since rebounded somewhat. Revenues are now expected to be in the $740 to $750 million range, down from prior guidance of $780 to $790 million. Importantly, the gross profit margin remains unchanged at about 58.0% of sales. Operating profit is now expected to be $120 to 125 million, down from the prior forecast of $125 to $130 million.

We are also slightly reducing our Movado price target to $68, which is down from our prior target of $78. The earnings outlook has reduced somewhat due to ongoing economic, geopolitical and currency uncertainty. Importantly, there are genuine concerns about consumers within large markets such as China, as well as Europe due to inflation, war, and general economic uncertainty.

Movado: Global Consumer Luxury Brand

Movado Group is one of the world’s premier watchmakers in the mid-price range. They mostly produce watches tailor made for the mid-market/middle class consumer. Although headquartered in the U.S., its roots in manufacturing and design go back to Switzerland. It is best known for its Museum Watch. Movado means “always in motion.” The watches are known for their signature metallic dot at 12 o’clock and minimalist style.

The Company was incorporated in New York in 1967, and since 1993, for 28 years, it has been a public company. Since inception, the company has had a strategy of acquisitions of watch brands along with license agreements, which have played an important role in the expansion of the Company’s brand portfolio.

Robust Luxury Goods Earnings Reaffirm Secular Growth

The luxury goods industry has continued to experience robust revenue growth as rich consumers and Emerging Market rising affluent citizens keep splurging as the world recovers from COVID-19. Recently, industry leaders such as LVMH (OTCPK:LVMUY, OTCPK:LVMHF), Moncler, Hermes (OTCPK:HESAY, OTCPK:HESAF), etc. all reported strong September-quarter results that were quite resilient.

While a global recession may lead to some slowdown in demand, it is not likely to result in a major or lasting downturn for the industry. China’s property sector’s massive decline may impact the appetite for luxury goods; this is a key risk factor to keep an eye on. Movado has less exposure to China versus other premium luxury goods companies.

Strong Swiss Watch Export Data

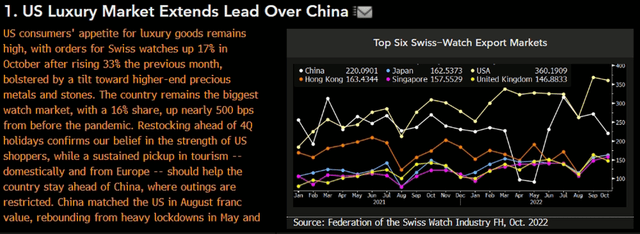

Demand for Swiss watches remained resilient in the most recent data. Exports of Swiss watches rose +17% YoY to the most important USA market during the month of October, according to the Federation of the Swiss Watch Industry. The USA remains the most important market for the industry. This newly released data is sourced from a Bloomberg Intelligence news articles written by industry analyst Deborah Aitken and based on official and publicly available Swiss Government data releases.

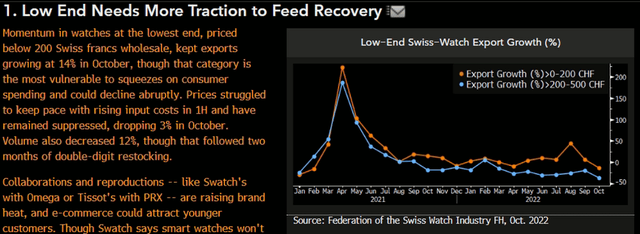

The upper-end and high luxury segment of the market is more buoyant than the mid-market. It appears high net worth consumers are not as impacted by the global recession.

5.0x P/E for Branded Luxury Goods Company

The valuations of Movado Group remain in “deep value” territory, in our view. For the current FY01/2023e, based on published Wall Street consensus estimates of $4.01, the company’s ex-cash P/E [market cap minus net cash, divided by EPS excluding interest income after-tax] is 5.8x. On forward Wall Street estimates, of $4.60 for the fiscal year ending 01/2024, the ex-cash P/E is 5.0x. The company’s net cash per share position is strong, at $8.30, accounting for 27% of the current stock price. Given the company’s solid fundamentals and favorable valuations, our revised price target now is $68, down from our prior $78 target. We arrive at our price target using a 15x P/E multiple on our conservative $4.30 forward estimate, plus adding back some of the large net cash position.

We believe our target price valuation assumptions, at a discount to the broader market, are very reasonable for a global consumer-branded stock in a secular growth industry. Other global luxury rivals, on the other hand, trade at a premium to the broader market and have had fantastic stock price performance over the last decade.

Quarterly Dividend and Share Repurchase Program

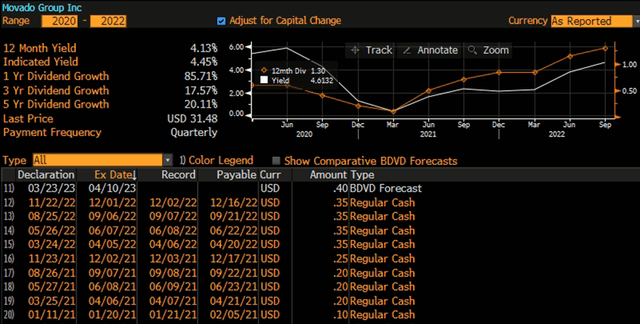

The company has paid a cash dividend of $0.35 [$1.40 annualized] for each share which gives Movado stock a yield of 4.5% and a payout of only 35% as compared to estimates for FY 01/2023. In our view, given the huge net cash position and strong FCF, MOV has much room to further increase the payout in the future.

During the 9M YTD, $52 million was spent on repurchases. The company has stepped up repurchase activity during Q3, with some $30 million completed during the quarter. The company has $24.3 million remaining available under the repurchase program as of October-end.

Recession and Inflation Risks

As we have stated previously, the purchase of luxury discretionary items such as watches is obviously cyclical, and consumers can defer and cancel such purchases. We would view Movado as a soft cyclical operating in a secular growth industry, which should mitigate recession risks. Strong demand for luxury goods globally from rising aspirational consumers in Emerging Markets should reduce economic risks and lead to growth over time.

Since Movado’s products are mid to high price points, we do not see much risk of inflation or supply chain bottlenecks. So far, they have been able to pass on price increases. Luxury goods pricing continues to rise over time.

Conclusion – Top Buy Idea, Favorable risk-reward

After several years of erratic and sluggish results going back one decade, Movado has finally found some strong sustained growth momentum. The company has strong tailwinds on a secular basis from the desire of consumers all over the world, especially in Emerging Markets, to buy branded luxury goods. The stock is simply too cheap relative to its brand franchise.

It should be pointed out that if it wasn’t for management’s super voting shares, this company would likely have been acquired in a rapidly consolidating industry a long time ago, in our opinion. With a strong balance sheet with lots of net cash, a robust dividend supplemented by buybacks, the downside risk for Movado appears to be mitigated, and the overall risk-reward is quite favorable, in our opinion. Movado remains one of our top buy-and-hold stock picks.

Be the first to comment