Paul Morigi

Thesis Summary

While Warren Buffett has openly criticized Bitcoin (BTC-USD), he has actually built significant exposure in the asset through his stake in a Brazilian “crypto bank”. This has become increasingly relevant now that Brazil has actually legalized cryptocurrency as a payment method.

Banking on Crypto

As of February of this year, it is known that Warren Buffett invested $1 billion in Nubank (NU), which was labelled as a crypto-friendly bank. After recent events, calling Nubank crypto-friendly might be an understatement.

First off, in May, Nubank announced that it would be offering Bitcoin to its customers and that it would also be committing 1% of its portfolio to Bitcoin. That means Warren Buffett is exposed to Bitcoin, even if it is indirectly. Interestingly, Buffett initiated a position in Nubank just as he exited from positions in traditional financial stocks like Visa, Inc. (V) and Mastercard Corporation (MA)

But there is more. At the beginning of November, NU introduced Nucoin, its own digital currency. For now, Nucoin is being developed with the help of 2000 customers, with the intention of launching officially by 2023. Initially, Nucoin will be a way for customers to receive rewards, but it will also trade as any other cryptocurrency does.

Nubank is clearly committed to the idea of crypto, and this is something an investor like Buffett must have been aware of at the time of investing. But is that all he knew?

Yesterday, Brazil, the country where Nubank is based, passed a law making cryptocurrencies a legal payment method. This was approved by the Chamber of Deputies of Brazil but still requires the signature of the president. It’s important to understand that this doesn’t mean that crypto is legal tender, like in El Salvador, but it is a step in that direction.

Whether by luck or, more likely, foresight, Buffett has a significant interest in an up-and-coming fintech with crypto exposure which is located in a country of 214 million people that just legalized crypto.

Do as I say, not as I do

Warren Buffett and Charlie Munger have made themselves a name as value investors guided by fundamentals and cash flow. This is the foundation of their publicly traded company Berkshire Hathaway (BRK.A) (BRK.B).

It’s hard to justify Bitcoin as a value investment, and this is something that Buffett himself has talked about:

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything,” Buffett said. “It’s got a magic to it and people have attached magic to lots of things.”

Source: Warren Buffett

However, Buffett must see some potential in at least some new financial technologies since he sold “traditional” financial companies in favour of Nubank.

This is also not the first time Buffett has invested in Brazilian fintech. In 2018 he bought 14 million shares, 8% of StoneCo Ltd.’s (STNE) IPO. This is a company that offers similar services to Square (SQ).

Also, while Munger has also positioned himself as a cryptocurrency detractor, he did not speak fondly of fiat currencies in this interview with Yahoo Finance.

“The safe assumption for an investor is that over the next hundred years the (fiat) currency is going to zero.”

If fiat can’t be trusted either, then what is the solution?

Buy When there is Blood on The Streets

There is definitely wisdom in Buffett’s words, and I am particularly fond of this quote.

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

Source: Warren Buffett

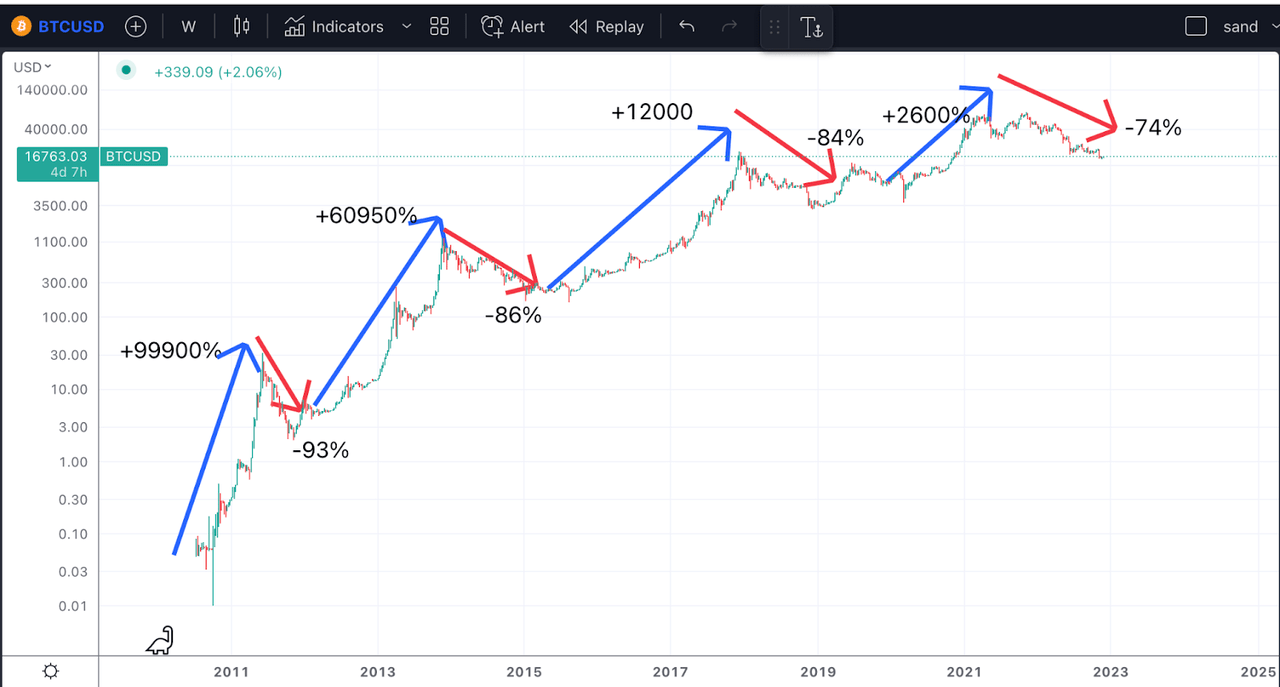

The best time to buy stocks is when everyone is too afraid to. Big panics lead to generational buying opportunities and this can be applied to Bitcoin too. In the 13 years since its inception, Bitcoin has given investors a lot of reasons to panic but has so far never failed to recover.

BTC chart (Author’s work)

Bitcoin has suffered three episodes of +80% drawdowns, which is where we sit now, roughly 74% below the recent peak. The next rally could be very close, and if history is any indication, we should easily be looking at triple-digit returns.

Final Thoughts

Bitcoin has been dead many times before, and this time is no different in my opinion. In the grand scheme of things, today’s prices offer a great opportunity to buy. Of course, there are always other things to consider, which is why I provide regular analysis on Bitcoin and the crypto markets for my subscribers. With the right approach, you can enjoy the massive gains of Bitcoin while also limiting your risk exposure.

Be the first to comment