Sundry Photography

Investment Thesis

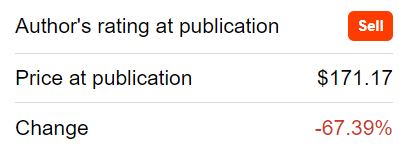

Coupa (NASDAQ:COUP) delighted investors with its Q2 2023 results, as investors welcomed anything that wasn’t bad news. After all, the stock was already down more than 65% since I had made my about turn back in December 2021 and went from bullish to bearish.

Author’s work

Indeed, my subsequent post at $64.xx per share back in March was also bearish and saw the stock slide 14% was it went into the print yesterday.

Incidentally, Coupa today is priced for less than it was for a large part of 2018.

It’s as if the past 3 years didn’t make any difference for Coupa’s shareholders. It’s nearly as if from an investors’ perspective, it would have been better if the digital transformation wasn’t underway because shareholders today have nothing to show for it.

Accordingly, with nothing but bad news now factored into its share price, I see no value in keeping my sell rating on this stock.

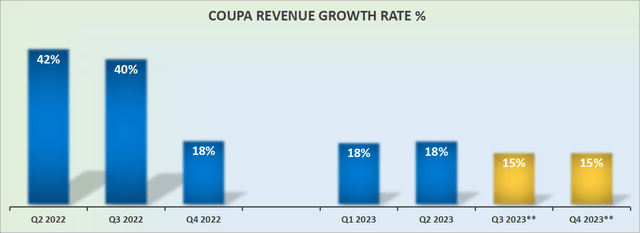

Coupa’s Revenue Growth Rates Dip Below Premium-Growth

Investors welcomed the fact that Coupa marginally increased its fiscal 2023 guidance by a few million implying that Coupa can assuredly deliver mid-10s% CAGR.

The problem for investors here is of course that the following. Coupa’s exit rate from Q4 2023 (ending January 2023) will be decidedly poor, particularly when we consider the two following dynamics.

In the first instance, this was a company that not long ago was printing, approximately 40% CAGR on a somewhat consistent basis. Or perhaps, better put, this was a company that investors could be assured was going to print north of 30% CAGR.

Today, I believe that most rational investors will no longer believe that’s the case. On the other hand, lest we forget, the stock is obviously already down a lot and factoring in a large proportion of this insight.

The second noteworthy aspect to know is that when Coupa exits its Q4 2023, its comparisons with Q1 2023 will be challenging.

It could be the case that Coupa’s revenue growth rates for Q1 2024 could dip below 15% y/y. That’s a significant gap between the Street’s expectations of 20% and a more realistic outcome for Coupa.

Consequently, I believe that in the coming weeks, investors will see Q1 2024 expectations being downgraded.

One way or another, I believe you’ll side with me in agreeing that this is no longer a growth company. Could we also agree that Coupa is approaching maturity?

And if we generally agree on that, can we also agree that mature companies don’t get a growth multiple on their stock?

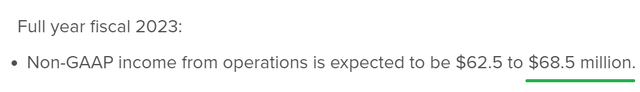

Profitability Profile in Focus

Moving on, Coupa’s profitability profile isn’t inspiring so much confidence.

Even if we both pretend that SBC is a non-GAAP, ”non-important cost”, the guidance for Q3 2023 non-GAAP operating margins leaves a lot to be desired.

- Q2 2022: 15%

- Q3 2022: 15%

- Q4 2022: 14%

- Q1 2023: 7%

- Q2 2023: 15%

- Q3 2023: *6%

That being said, if we consider the following perspective the investment setup clearly improves.

Below was Coupa’s non-GAAP income from operations outlook for fiscal 2023 at the end of Q1 2023.

You can see that Coupa was guided that at the high-end of its non-GAAP income could reach $41 million.

However, it now upwards revised its outlook for fiscal 2023 so that it now expects to reach $69 million.

Coupa is showing investors that even though its growth rates are slowing down, the business’ focus on profitability is paying fruit. At least if we pretend that SBC isn’t a real cost.

Now recall that when Coupa ended Q4 2022 its total number of shares outstanding stood at 75 million.

However, as we look out to fiscal Q4 2023, I believe that its exit rate from the quarter, including potential share repurchases will see Coupa with 88 million shares outstanding.

In other words, shareholders will have been diluted by 17% while its revenues are guided to grow by approximately 17% y/y.

So are shareholders better off?

COUP Stock Valuation – 4x Next Year’s Revenues, Really?

The biggest challenge for investors right now is coming to terms with an appropriate growth rate for Coupa.

Sell-side analysts continue to steadfastly expect that Coupa will grow by 20% in fiscal 2024. However, I categorically fail to see that as a realistic outcome.

Not only is the early part of fiscal 2024 going to comp against tougher hurdles in the same period this year, but there’s really not enough in the company’s value proposition where I can see its revenue growth rate reigniting somehow and reaching the 20% CAGR levels that the sell side is expecting.

Nevertheless, if we grudgingly agree that somehow Coupa was to grow its revenues by 20% in fiscal 2024, that would put its revenues at $1 billion.

Hence Coupa is priced at 4x next year’s revenues.

As I look around at my available opportunities list, there are simply too many more compelling stocks priced at very similar multiples or slightly higher multiples but assuredly growing at a much faster CAGR.

The one saving grace to the multiple here is that the business makes a significant amount of free cash flow. And that will go a long way to support its valuation.

The Bottom Line

Looking objectively, I believe that after reading my insights you’ll generally agree with my perspective, even if you have the odd disagreement with my point of view.

Yet as alluded to above, I believe that it no longer compensates me to be bearish on this name.

After all, I’m a value investor. And I recognize that the stock is already down 60% since I first issued my sell rating just 10 months ago.

Hence, rather than overstay my welcome, I’m going to take my “book my hypothetical” return and call it a day.

Be the first to comment