StockPlanets/E+ via Getty Images

Introduction

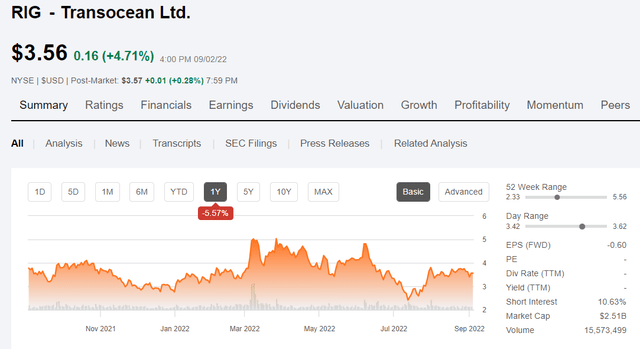

A review of the recent analyst call for Transocean (NYSE:RIG) contains some favorable signs that should boost shares of the stock as we close out the year. RIG’s stock has fallen 40% from the recent $5.00 high, and I opened a position in the low $3s. Last week I added at $3.51, doubling my stake.

RIG price chart (Seeking Alpha)

RIG grew revenues 16%, increased fleet utilization to 58.2%, and beat analyst estimates for EBITDA in Q-2, 2022. Additionally they added a critical $1.2 bn to their contract backlog, pushing it back above $7 bn. For the full year in 2022, RIG projects contract revenue of $2.6 bn, a decline YoY of ~$100 mm due to idle time on the Deepwater Asgard. Idle time usually occurs when the rig breaks down and day rate charges are suspended.

Increased activity, length of new contracts, and substantially increased day rates bode well for RIG. Rescheduling the maturity of the Revolving Credit Facility-RCF to 2025, keeps liquidity at ~$2.5 bn through a critical period. The Deepwater Atlas will arrive in the GoM-Q-4, and begin its contract with Beacon Offshore in late 2022. The Deepwater Titan will begin its Anchor contract in 2023 and continue until mid-2028.

Analysts are mildly bullish on RIG, with a Hold rating, and price targets up to $7.00. The median is $4.20. We think the company is attractive to investors willing to accept the substantial, but significantly lessened risks that remain for RIG. We will discuss these as we go along.

The macro thesis for offshore drilling: The Iron Law of Electricity

The soundness and pace of implementation of the “Energy Transition” are being re-thought. Across the continent, people are upset at the prices they are being charged for energy – very upset as it turns out – and are turning out in public spaces shaking their fists, carrying placards, and exhorting their politicians to lower energy costs.

Citizen behavior like this tends to make heads of state nervous. Historically, in times of extreme social unrest, “the heads” of the heads of state, occasionally became detached and rolled down the steps of capitol buildings. The old expression, “Heads will roll,” was likely coined at just such a pre-protest meeting of an irate body politic. In recent times, perhaps fearing just such an outcome, the former head of state of Sri Lanka sought friendlier climes in Singapore.

Green energy was supposed to be cheap and limitless, it was after all... renewable. This notion has come into conflict with the Iron Law of Electricity, which as codified by Robert Bryce in a Forbes article, states simply-

People, businesses, and countries will do whatever they have to do to get the electricity they need,” I’ve also stated it as “when forced to choose between dirty electricity and no electricity, people will choose dirty electricity every time.”

Politicians would do well to take heed. And some are. In the UK a new Prime Minister, Liz Truss, has just been elected who plans to push for new rounds of petroleum development in the British sector of the North Sea. Across the Channel in Norway, an ambitious development plan is being rolled out to increase oil and gas production.

All of this is supportive for the OSD industry. People want their electricity, and they want it… now!

The thesis for RIG

I won’t wax on terribly long here as most of you are familiar with the general backdrop. Capex for upstream, long cycle petroleum development has been constrained since the oil price crash of 2014. Some estimates run to $700 bn in needed investment to replace aging reservoirs, has been deferred in favor of shale and green energy development. Consulting firm Rystad notes–

The most impressive growth will occur in deepwater commitments (125-1,500 meters). “Deepwater commitments will see the most growth as their cost has now become much more competitive against greenfield continental shelf reserves,” the report states, noting that the number of projects is expected to rise to 181–a significant jump from 115 in 2011-15 and 106 in 2016-20. In terms of greenfield expenditures, we expect offshore project commitments in 2021-25 to be worth more than $480 billion, eclipsing by 50% the 2016-20 tally of around $320 billion,” the report states.

The big IOC’s are faced with declining daily production and reserves at a time when supplies are stressed globally. I discussed this thesis in an earlier article if you would a deeper look at my thinking on this topic. Energy Security is now the watchword as the EU grapples with the loss of Russian supplies, and the poor performance of Wind over the past year. All of this is bullish for RIG and its chief competitors, Valaris (VAL), Noble Corp (NE), Diamond Offshore (DO), and Seadrill (OTCPK:SEDRF).

Improved price forecasts for oil and gas, vastly lower deepwater development costs driven by modern rigs and project redesigns post 2015 that reduced costs by billions, set the stage for a robust deepwater market over the next few years.

Manpower and supply chain limitations also will prevent too many stacked 6-7th gen rigs from returning to the market suddenly and driving down prices. Keelan Adamson, COO commented in regard to an analyst question on timelines for rig reactivation–

In the positive side of all that is our customers are starting to recognize that which feeds directly and to what Roddie was saying earlier, that our customers are approaching us with urgency, and quietly actually in the direct negotiations to try to secure the assets that are going to be available. Because they know if they don’t, they’re not going to have availability at all, it’s going to take a little bit longer than they want to start their campaigns, they’re going to have to pay more for it because they’ll have to pick to the reactivation and the upgrade in the mode. So, all of that bodes well for us and continued progression day rates. – (Source: RIG Q2 2022 Earnings Call)

At the 97% capacity noted in the call, as demand increases, rig rates will surge higher.

Fernley shows active utilization for global 6 and 7 Gen fleet over 97% – (Source: RIG Q2 2022 Earnings Call)

The day rates for the 6-7 gen rigs were above $600K in early 2014. If we achieve anything close to that, a lot problems begin to go away for RIG. In my view the Rubicon has been crossed for the OSDs and better times are ahead!

The recovery has a global footprint

The Gulf of Mexico is one of the most active areas. The call noted the following conditions for rig contacting in the GoM-

There are more than 10 programs yet to be awarded that are set to commence between now in the second quarter 2023. Importantly, direct negotiations continue to dominate as a result of market tightness, and we are seeing improved contractual terms, higher day rates and longer durations.

Latin and South America, substantial contracting activity is ongoing and the region continues to drive the largest recovery and incremental deepwater rig demand. Specifically in Brazil, there are 10 opportunities comprising in excess of 21 years of demand. In addition to the Petrobras (PBR) prospects, medium to long-term opportunities with IOCs and other NOCs, including Equinor (EQNR), Shell (SHEL), Petronas (OTCPK:PNADF), and TotalEnergies (TTE) are expected to commence in 2023 and 2024. This underpinned by Brazil’s desire to double production by 2030.

West Africa and the Med, show very encouraging floater demand, and it is expected that over 20 programs will be awarded and commenced within the next 18 months.

Asia Pacific, is driven by India. ONGC has demand for more than four rig years of work in India that could absorb at least three rigs. Additional demand in India and Australia is expected to increase in mid-2023 and early 2024, which would result in a regional rig shortage at this time driving higher day rates as assets will need to be mobilized from other regions to fill this demand.

Norway is committed to new gas exploration and the market there is primed for tight supply. Transocean thinks this will ultimately lead to a sold out market in 2024, as current active utilization is already at 88%, up from 82% last quarter.

Risks

There are still too many cold-stacked 4-5th gen-rigs built before 2011, generation rigs. With 6-7th generation rigs above 97% utilized, there is a temptation to market older rigs that would not command the day rates the newer ones do.

I see this as an increasingly remote risk and expect the older rigs to be written off in the coming years. Reactivation costs vary, but often hit the $100 mm mark and no one is going to spend that kind of money to get these rust buckets back to minimum standards. But they are still out there floating in the rig boneyards of Tenerife, Singapore, and a few other places old rigs go to die. The truth is pump capacity, Managed Pressure Drilling-MPD status, hook load capacity, lack of robotics and other technological innovations, mean these older rigs just are not suitable for the UltraDeep Water-UDW, projects now on the drawing board.

The debt is still out there, nearly $6.4 bn of it and the interest runs $100 mm a quarter. Any change in the recovery story that will lead to positive cash flows that will come from higher day rates and longer term contracts that eliminate white space on the schedule, put RIG right back in the dumpster.

Dilution is also a risk. The company has been balancing its books with ATM-At Market Equity sales, generating $100 mm in the quarter, but increasing the float to 705 mm shares. This is likely to continue as noted in the call-

We fully anticipate with new now authorization for another $400 million. As always, you can expect us to continue to prudently make in share capital and opportunistically access capital markets as and when we believe it makes sense. (Source: RIG Q2 2022 Earnings Call)

Your takeaway

Make no mistake RIG is a challenged company, but things are getting better. Drilling contractors are the first to see a downturn and the last to show recovery. Remember many of our star E&P companies, Occidental Petroleum (OXY) and Devon Energy (DVN), were a couple of quarters away from bankruptcy a couple of years ago. Then things got better. A lot better.

Operators are now drowning in cash flow, and rig companies, thanks to rig retirements, and new, unmet needs for new supplies of oil and gas, are in the driver’s seat when it comes to pricing.

So why RIG? They are not yet cash positive as are some competitors like VAL, and NE. Primarily pricing and depth of inventory favor RIG. Valuations are above 50X EPS for both VAL and NE. That’s a bit high, and particularly for a drilling contractor. What about Diamond Offshore? They show some EBITDA, but aren’t generating positive OCF as of Q-2, 2022. There’s nothing that really says, “buy me” in any of those companies.

On the good side, all of the competitors have come through Chapter-11, and have clean balance sheets, which is why their stock prices have ramped up. So what? Do we really think investors are going to pay 60, 70X EPS for these companies? Not likely, so the growth phase is over for these guys.

RIG is the leader in the space most in demand-DW and UDW rigs, with the ability to dial up new 6-7th gen rigs to meet demand in key markets.

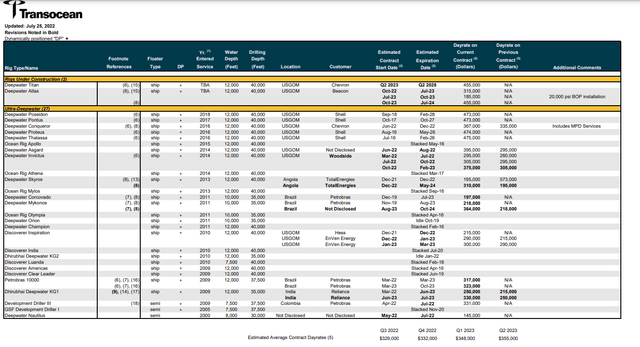

RIG Fleet Status Report (Transocean)

The company expects to add $26K per day in revenue per rig through Q-2, 2023, as per the slide above. If we assume 30 marketed rigs, that’s another $285 mm in annual revenue, pushing the total to $3.0 bn, and perhaps $1.2 in EBITDA. Now we can do some ciphering.

RIG is trading today at 9X EV/EBITDA using SA data. If we see that $1.2 bn in EBITDA become a reality in Q-2, 2023, the share price should rerate to the $5.00 level to maintain that 9X. So far so good.

Suppose rig rates begin to move toward $425K per day by YE 2023? That would push revenue toward $4.6 bn, with EBITDA nudging $2 bn. To hang on to that 9X multiple the stock would need to rerate to $15 per share. This is speculation on my part, but I think you will agree it’s not complete fantasy in the market that appears to be emerging for the OSDs.

That’s the reason I am in RIG. The possibility is pretty strong that over the next couple of years deepwater drilling could become a real business again. If that happens, today’s prices for RIG are a bargain.

Now we have to temper that optimism with the ongoing dilution as they raise capital through stock sales. I think there is a possibility we have to endure that for another few quarters before cash flow begins to cover fixed and variable expenses.

I think RIG is appropriate for investors willing to take a gamble on the market continuing to develop in the direction I have described in this article.

Be the first to comment