ArLawKa AungTun/iStock via Getty Images

Energy Transfer LP (NYSE:ET) has a very checkered past that includes delivering underwhelming total returns to unitholders for years thanks to several aggressive and ultimately ill-fated expensive acquisitions and growth investments. Most recently, investors were hit hard by a steep distribution cut in 2020 in response to ET’s balance sheet becoming overleveraged. After the partnership was put on notice by credit rating agencies that its investment grade credit rating was at risk, management made the decision to slash the distribution in order to accelerate debt reduction and save the investment grade credit rating.

As management stated at the time:

The reduction of the distribution is a proactive decision to strategically accelerate debt reduction as we continue to focus on achieving our leverage target of 4 times to 4.5 times on a rating agency basis and a solid investment grade rating.

We expect that the distribution reduction will result in approximately $1.7 billion of additional cash flow on an annualized basis that will be directly used to pay down debt balances and maturities. This is a significant step in Energy Transfer’s plan to create more financial flexibility and lessen our cost of capital. Once we reach our leverage target, we are looking at returning additional capital to unitholders.

However, this year management has begun increasing the distribution once again – with its latest hike bringing the year-over-year quarterly distribution growth to over 50% – and is now a further 33% distribution increase away from fully restoring it to its pre-cut level of $1.22 on an annualized basis. In this article, we will share two big reasons why we believe management will hike its quarterly distribution by 33% next year.

#1. Leverage Ratio Target Almost Met

As management stated following its latest distribution increase:

The distribution per unit is more than a 50 percent increase over the second quarter of 2021 and is a 15 percent increase over the first quarter of 2022. This distribution increase represents another step in Energy Transfer’s plan to return additional value to unitholders while maintaining its target leverage ratio of 4.0x-4.5x debt-to-EBITDA. Future increases to the distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per quarter, or $1.22 on an annual basis, while balancing the partnership’s leverage target, growth opportunities and unit buy-backs.

Thus far this year, ET has made great strides toward its goal of fully restoring its pre-cut distribution. For example, it has increased full year adjusted EBITDA guidance, which improves its leverage outlook given that EBITDA is the denominator in the leverage ratio equation. When combined with continued aggressive debt reduction, management was able to announce on its latest earnings call that:

We are pleased with the progress we have made toward reaching our leverage target range we remain focused on improving our financial flexibility and paying down debt in order to further strengthen our balance sheet. In addition, we will continue to evaluate returning additional capital to our equity unitholders through distribution growth on a quarterly basis.

With analysts forecasting $2.39 in distributable cash flow per unit for 2023, ET should be easily able to increase its quarterly distribution to its pre-cut level of $0.305, especially given that it will no longer be under intense pressure to pay down debt in order to reach a leverage target.

#2. Unit Buybacks Are Increasingly Unlikely

The other main reason why we believe that ET will fully restore its quarterly distribution next year is that they are increasingly unlikely to devote significant resources towards unit buybacks. The reasons for this include the Inflation Reduction Act (which taxes buybacks), the strong unit price performance in recent months which make buybacks less accretive, and the increasingly positive outlook for the industry thanks to the rapidly growing demand for energy exports from North America. With buybacks set to be taxed starting in 2023, it just makes sense for ET to return that capital to investors via tax-deferred distributions instead. On top of that, with the unit price appreciating considerably this year, buybacks do not generate as attractive of a return as they would have previously. Finally, with the mid to long term cash flow profile for the business improving, management should have more confidence in its ability to sustain a meaningfully higher quarterly distribution rather than favoring more flexible methods of returning capital such as buying back units.

Investor Takeaway

Despite the robust distribution growth year to date from ET, it still has quite a ways to go to reach its 2020 level. However, thanks to a freshly deleveraged balance sheet, a very impressive free cash flow and distributable cash flow yield, an improved mid to long-term outlook for the business, and a markedly reduced case for allocating capital to buybacks, we see no reason why ET will not be able to fully restore its quarterly distribution to its pre-cut level of $0.305.

The only factor we see potentially interfering with this is if ET decides to spend a lot of money on expensive acquisitions between now and then and feels the need to allocate capital towards it instead of taking on more debt. While this is certainly a risk with Kelcy Warren in charge, we ultimately think management will find a way to do both and expect management to stay the course towards fully restoring the distribution. We rate ET a Strong Buy and expect it to continue delivering outsized total returns to investors at current prices.

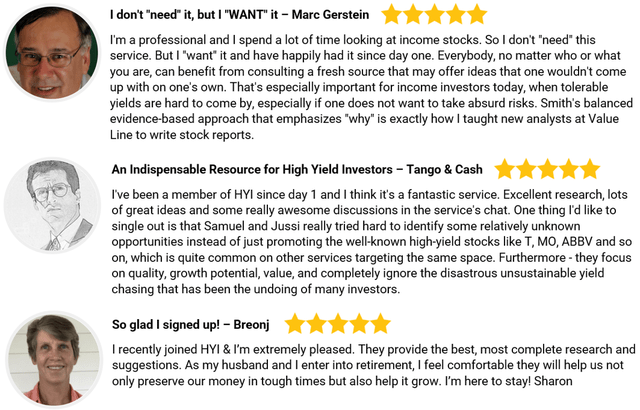

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,400 members on board and a perfect 5/5 rating from 145 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered.

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Be the first to comment