Joe Raedle

Introduction

Carvana (NYSE:CVNA) a pandemic-time stock market darling, is currently a sinking ship. The company is facing multiple impending storms at once. Demand destruction comes from low consumer sentiment due to inflation and high-interest rates, financial disaster coming from staggering losses, debt, and shareholder dilution, and finally, the prospect of macroeconomics further worsening from today’s levels may sink Carvana into bankruptcy. The company’s stock already fell 96% from its peak, but I strongly believe that Carvana has not hit the bottom yet. In fact, bankruptcy risk is on the table for discussion. Therefore, Carvana is a strong sell.

Financial Disaster

Carvana’s balance sheet is in serious condition. The company has about $1 billion in cash, which is an increase from about $247 million in the prior quarter. However, in 2022Q2, the company used about $487 million in its operations. Then, how did the company’s cash pile increase by about 300%?

Carvana took on additional debt. By the end of 2022Q1, the company’s long-term debt was about $3.28 billion, but by the end of 2022Q2, the company’s long-term debt pile doubled to $6.6 billion.

On top of about $3.3 billion in additional debt, the company diluted shareholders by about 12% in a single quarter. By the end of 2022Q1, the company had about 90 million shares outstanding which have grown to 101 million shared outstanding by the end of 2022Q2.

These data points tell a story. The company doubled its long-term debt position and diluted its shareholder value by increasing outstanding shares by 12% in a single quarter. Carvana’s financial health is disastrous today, especially because the macroeconomic conditions are expected to worsen in the coming months negatively impacting Carvana’s operation. This is not sustainable.

Used Car Demand Problem

To create matters worse for Carvana, I believe used car demand will deteriorate even further over the next few months.

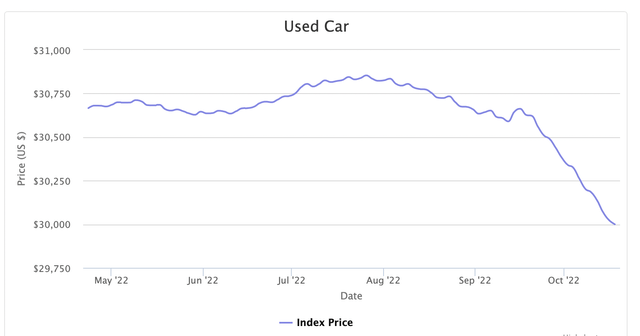

The price often reflects demand. When the demand is exceptionally high, the price of the good increases while the price falls if the demand for the product cools. The picture below shows the average price of all used cars on the CarGurus platform. Used car prices fell about 2.16 percent over the last 30 days. To further support this data, according to the Bureau of Labor Statistics, the monthly change in used car prices in July, August, and September is -0.4%, -0.1%, and -1.1%. Both private and public data show that the price of a used car is decelerating faster over time. Therefore, I believe it is logical to argue that the demand for a used car, Carvana’s core product, will deteriorate further.

Car Gurus

[Source]

Underlying Macroeconomic Trend

Past trends do not always define a future trajectory. However, considering the macroeconomic conditions today, I strongly believe that used car demand will not bounce back due to weakening consumer confidence and financial strength as a result of high inflation, rising interest rates, and negative future economic outlooks.

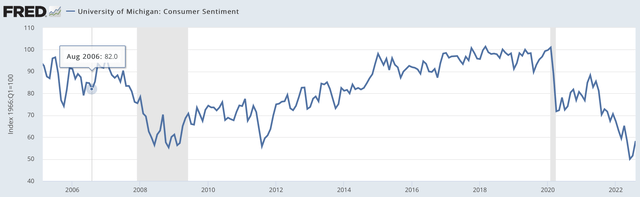

Consumer inflation in the past three months has been 8.5%, 8.3%, and 8.2%. This pressure on consumers has significantly weakened the consumers’ confidence. As the picture below shows, consumer confidence is near its all-time lows around the levels seen during the subprime mortgage crisis. Because consumer confidence indicates the consumer’s willingness or desire to buy a used vehicle, the coming few months will likely continue to see decelerating demand.

St. Louis FED

[Source]

Since 2022, the Federal Reserve has been aggressively raising interest rates to keep inflation under control. As a result, today, the Federal Reserve interest rate is between 3% to 3.25%. However, because inflation continues to be high, the Federal Reserve is expected to continue its rates of aggressive interest rate hikes. Thus, as the picture below shows, the average interest rate for financing a used car has sharply increased to above 9% for consumers with excellent credit scores. The high interest rate environment is expected to strongly deter new demand. For example, given a 4-year loan with a 10% interest rate on a $40,000 car, a consumer will pay $8700 in interest, or about 21.75% extra. Therefore, considering this environment, I believe used car demand will only weaken in the coming months.

Inventory

Finally, on top of the poor financial and macroeconomic conditions, Carvana faces one more risk. The company’s inventory is in trouble. 2020 and 2021 have been favorable market conditions for Carvana where the company was able to grow its revenue by 41.8% and 130% in 2021 and 2022, respectively. To address these market conditions and to pursue more growth, the company increased its inventory levels drastically from about $1 billion by the end of 2020 to about $3.2 billion by the end of 2021. I see this as one of the biggest risks for the company’s balance sheet. Used car prices peaked in 2020 and 2021, and the company acquired about $2 billion of used cars. However, today, used car prices falling as dramatically, and the price deceleration is only expected to increase. Therefore, it is likely for the company to re-evaluate its inventory asset, which may mean that the company is selling cars for less than its acquired price.

Risks To Thesis

If the macroeconomic conditions do not worsen in the coming months, the risks that I have pointed out about Carvana may be manageable. Carvana has aggressively built out its inventory, infrastructure, and network preparing the company for future growth in the past few years. As such, if the recession is not as bad as many economists predict it to be, Carvana may be able to wait out the storm before reaping the rewards of its investments. This may be a possibility as former Federal Reserve Vice Chairman Alan Blinder said that he thinks that an impending economic slowdown will not result in a brutal recession. Instead, it is his view that the current slowdown is part of the normal economic cycle. Therefore, investors should weigh the unpredictable nature of the macroeconomic prediction in my bearish thesis.

Summary

Carvana is no doubt an innovator with its own respective advantages, however, in the short term, the company is facing major hurdles that may push it to bankruptcy. A continual and potentially increasing loss of over $400 million per quarter with massive debt and shareholder dilution is not sustainable, especially in the current market conditions. Persistently high inflation is degrading consumer confidence and the FED’s response to the high integration rate is making used car purchases increasingly more expensive. Therefore, I strongly believe that there is a chance for bankruptcy prompting my strong sell rating.

Be the first to comment