peshkov

Elevator Pitch

I downgrade my investment rating for Devon Energy Corporation’s (NYSE:DVN) shares from a Buy to a Hold. In my earlier April 19, 2022 update for DVN, I determined that Devon Energy is a good dividend stock. In the current article, I touch on DVN’s recent share price weakness and discuss where the company’s shares will head going forward.

Devon Energy’s stock started dropping since June because of oil price weakness, and the outlook is that a swift rebound in DVN’s share price isn’t on the cards. As such, I have a Neutral view of Devon Energy, which translates into a Hold rating.

Why Did DVN Stock Drop?

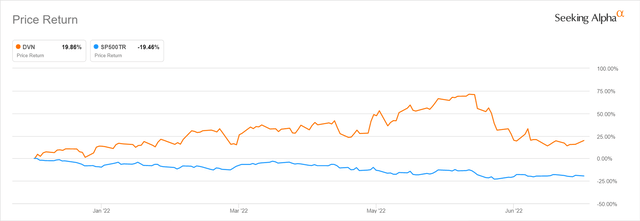

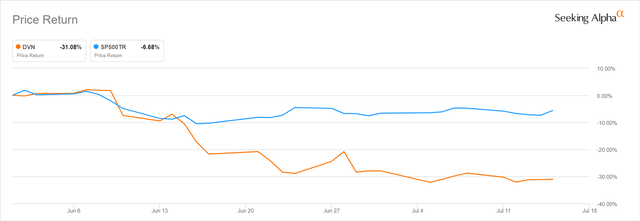

DVN’s stock has performed well this year, with its shares up by +19.9% year-to-date as compared to a -19.5% decline for the S&P 500 during the same period. However, Devon Energy’s shares began to give back some of its earlier gains since the start of June 2022. Between June 1, 2022 and July 18, 2022, the S&P 500 pulled back by -5.6%, but DVN’s stock price dropped by -31.1% in this period. In June alone, Devon Energy’s share price fell by -27.9%.

Devon Energy’s 2022 Year-to-date Stock Price Chart

DVN’s Share Price Performance Since June 2022

To understand why DVN’s shares have dropped since the beginning of June 2022, it is worth referring to Bank of America (BAC) analyst Doug Leggate’s comments at Devon Energy’s Q1 2022 results briefing on May 3, 2022. Doug Leggate noted at DVN’s first-quarter call that “your share price is pretty much flat since the oil price stopped going up at the beginning of March.” The analyst basically hit the nail on the head, as energy stocks’ short-term price movements are largely correlated with oil prices.

A July 6, 2022 Seeking Alpha News article highlighted that “Brent, U.S. crude both slump below $100/bbl” in the early part of this month. A combination of factors such as interest rate hikes, the strengthening US dollar, and recession fears have caused oil prices to trend downwards in the past one month or so. As such, it is unsurprising that DVN’s shares have dropped in tandem with the correction in oil prices.

Is Devon Energy Stock Expected To Rise Again?

The share price outlook for Devon Energy is dependent on two key factors: valuations and oil prices.

DVN currently trades at a forward free cash flow yield of 12.2% based on a free cash flow of $4,241 million (the average of the Wall Street’s consensus FY 2023-2026 free cash flow projections as per S&P Capital IQ) and its market capitalization of $34.8 billion.

As a cyclical energy stock, I will deem Devon Energy’s shares to be attractive at a free cash flow yield in the mid-teens percentage range. In that respect, DVN’s current valuations aren’t sufficiently appealing to support a substantial rebound in its stock price.

Separately, the U.S. Energy Information Administration or EIA reduced its 2H 2022 Brent crude oil price forecast from $108/bbl as per its prior June 2022 report to $101/bbl in its latest July 2022 update, which it attributed to the “expected increases in global oil inventories in late 2022.”

Furthermore, EIA expects the Brent crude oil price to decline further to $97/bbl and $94/bbl for the fourth quarter of 2022 and 2023, respectively. Taking into account the expectations of a further pullback in oil prices, it is unlikely that Devon Energy’s shares will rebound strongly anytime soon.

In summary, Devon Energy’s stock isn’t expected to rise in a meaningful way again in the near future, based on an analysis of the stock’s current valuations and future oil price trends.

DVN Stock Key Metrics

Looking beyond the near-term outlook for Devon Energy’s shares, it is important to review DVN’s key metrics in terms of dividends, buybacks and deleveraging disclosed as part of its most recent Q1 2022 financial results.

With respect to dividends, DVN’s quarterly dividend payout grew by +27% QoQ and +274% YoY to $1.27 per share for Q1 2022, which comprised of a variable dividend per share of $1.11 and a fixed dividend per share of $0.16.

In relation to buybacks, Devon Energy’s total shares outstanding have declined by approximately -3% between November 2021 and May 2022, after the company spent $891 million on share repurchases during this period. DVN had roughly $1.1 billion remaining from its current share repurchase authorization as of early-May 2022, which indicates that the company has the capacity to continue buying back its own shares for the rest of 2022.

With regards to deleveraging, DVN’s goal is to further reduce its financial leverage from 0.6 times net debt-to-EBITDAX as of end-Q1 2022 to 0.2 times net debt-to-EBITDAX as of end-FY 2022. The company revealed at its Q1 2022 earnings briefing that it plans to “fully retire the $390 million of 2027 notes that become callable in October” 2022, which will help it to meet its year-end financial leverage target.

In conclusion, Devon Energy continues to make good progress on its key capital allocation priorities such as returning more capital to shareholders via buybacks and dividends, and improving the financial health of the company by paying down debt.

Is DVN A Good Long-Term Investment?

DVN will become a good long-term investment, if there is greater acceptance of the company’s variable dividend policy and it becomes more aggressive in allocating capital to supporting future growth.

As indicated earlier in this article, variable dividends, pegged to 50% of excess free cash flow, accounted for 87% of Devon Energy’s Q1 2022 dividend payout. This implies that DVN’s relatively low fixed dividend payouts are not as attractive for certain income investors who prefer greater certainty in terms of future dividend expectations.

At the company’s Q1 2022 results call, Devon Energy emphasized that “what is undervalued in the (company’s) story is the repeatability (of business performance and dividends)”, in its response to a question regarding “areas where you still think that investors might not be fully appreciated or appropriately rewarding you all yet.”

In other words, it will take time for more investors to be assured that the variable dividend model works and variable dividend payouts are sustainable; and when that happens, it will be supportive of a positive re-rating of DVN’s shares.

Separately, Devon Energy disclosed last month on June 8, 2022 that it proposed a “bolt-on acquisition in the Williston Basin” with the planned purchase of “the leasehold interest and related assets of RimRock Oil and Gas, LP.”

Earlier at its first-quarter earnings briefing in May, DVN has stressed that “we’ve always had a real high bar of asset purchases” and mentioned that its “#1 priority” is “returning cash back to shareholders.” As such, it came as a positive surprise that Devon Energy announced a new deal one month later after its comments at the Q1 call.

Notably, an increase in M&A doesn’t necessarily translate into lower shareholder capital returns. DVN had guided that the proposed acquisition is expected to be accretive and will lead to a +13% growth in quarterly fixed dividends for the company assuming the deal closes successfully. Looking forward, investors will view DVN as a more attractive investment proposition, if it can strike a good balance between capital return and capital investments (such as M&A driving future growth).

In conclusion, DVN has the potential to be a good long-term investment. But Devon Energy needs to convince investors that its variable dividend policy will function well in the long run, and it is able to allocate capital in a way that supports growth without compromising on shareholder capital return.

Is DVN Stock A Buy, Sell, or Hold?

DVN stock is a Hold. Devon Energy has good long-term investment potential, but its shares are likely to be range-bound in the near future. The mixed view of Devon Energy explains my Hold investment rating for the stock.

Be the first to comment