CatLane/E+ via Getty Images

Express, Inc. (NYSE:EXPR) has been a meme stock a few times over the last eighteen months and could become a casualty of the developing recession. This leveraged apparel retailer sells fashion mostly to thin and “woke” women and men with significant disposable incomes in the 18-30 age group, who could become much more practicable in their purchases during a much weaker economic period. I think it is much less likely that some guy will buy a slim apricot colored or a slime green striped suit when he is worried about keeping his job. Since they are highly leveraged, Express can’t afford to be wrong on their merchandise and with their vendors becoming much more restrictive in financing, they could be in serious financial trouble in 2023, especially if they do not receive the $52 million cash under the CARES Act.

Saved By Sycamore Partners and CARES Act

Many retailers, including Express, were struggling even before the pandemic, but at least Express was able to stay out of bankruptcy court. They received $140 million life-line financing in early 2021 from Sycamore Partners, who tried to buy JC Penney in 2020 and currently owns a long list of retailers such as The Limited and Stables. This hedge fund often “loans to own”. Without funding from the federal CARES Act (See below), it is unlikely that Sycamore would have provided the much-needed cash and Express would have been in bankruptcy court in late 2020 or early 2021.

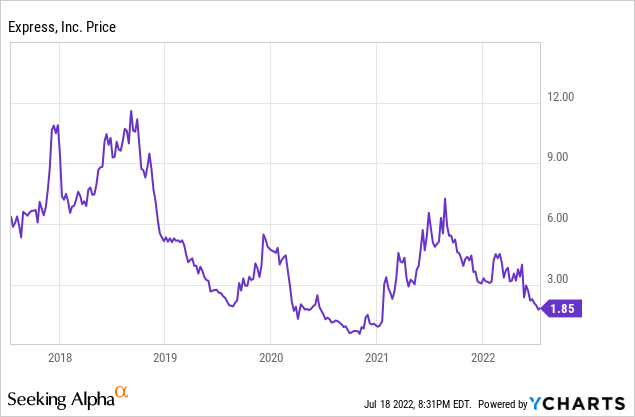

Five-Year Stock Price

Burning Cash

Express has been burning cash this year, and it could become a very serious problem if the economy stays in a prolonged and deep recession. They used $75.879 million cash for operations in 1Q 2022, which was financed by a net $80 million increase borrowing under the revolving credit facility.

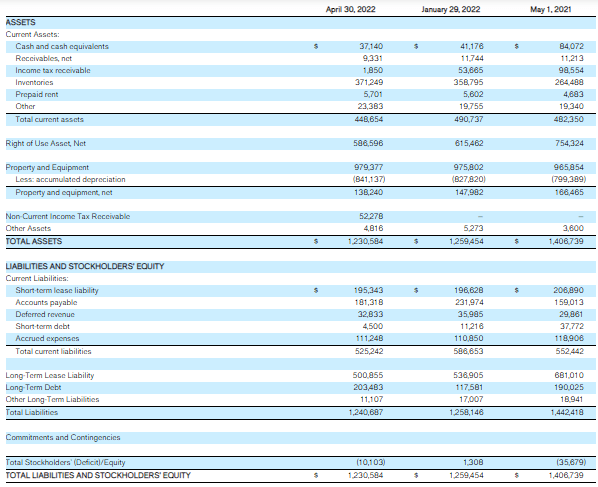

A key metric I look at in retail is the percent of inventories financed by accounts payables. A decrease in this percent figure often indicates that vendors are becoming stricter in their financing terms because they view that customer as being at higher risk for non-payment. Using their April 30, 2022 balance sheet, 48.8% of their inventories were financed by accounts payables, which is down from 66.0% on January 29, 2022 and down from 60.0% on May 1, 2021. This, in my opinion, is a yellow flag that some of their 70 primary vendors are being stricter in their financing terms. I would expect that since the economic outlook has worsened over the last few months that there could be even more inventory financing problems going forward. If vendors do not finance, then Express may have to borrow additional cash to pay for inventories, which will have a negative impact on earnings and cash flow because of increased interest expenses. Or they could just have less merchandise to sell.

Their much higher level of inventories compared to the same period last year might be great for Express or they could become a serious negative. Their inventories were up 40% in dollars and up 25% in the number of units at the end of their latest quarter. The positive is that you need more merchandise to sell to generate higher revenue. The downside is that if the economy drops sharply, they may get stuck with a huge amount of unsold inventory that would have to be deeply discounted to liquidate.

I am not sure why they did not sell additional shares to raise needed cash when the stock price was bid up by meme traders. They had April 6, 2021 and June 3, 2021 filings with the SEC for an ATM selling of 15 million shares. Express needs additional cash to survive the recession, in my opinion.

Express, Inc.’s Balance Sheet

Express Balance Sheets (sec.gov)

CARES Act Receivable

Another problem that seems to be ignored by analysts during the quarterly conference calls is a $52 million receivable from the federal government under the CARES Act. In December 2020 management stated that they expected to receive $95 million from the CARES Act in 2Q 2021. They received about $60 million in 2021 ($43.3 million and $13.7 million related to 2020 and 2019 income tax returns, respectively, and $3.0 million related to the employee retention credit), but they have since carried $52 million as an income tax receivable. During their March 9, 2022 conference call, management stated they expected to receive the $52 million cash in 3Q 2022. The latest comment, however, from management is they now expect to receive the $52 million in 2023, and now they do not even show the receivable as a current asset on their balance sheet – it is carried under long-term assets.

I am not sure if the problem of receiving the cash is because of the complexity of the CARES Act or because the IRS is interrupting the Act differently than the way Express is figuring the amount they are owed. What is bothersome is that according to a statement in their 10-K: “The Company is currently under audit for refund claims related to the carryback of U.S. federal net operating losses as a result of CARES Act”. Express needs the $52 million cash to survive a recession, in my opinion.

Very Risky Operating Model

The problem with Express is that it is not part of some deep-pocket organization because their retail business model is very risky and it is not able to depend on being helped when their operating model is negatively impacted. Their target customers are thin, woke, middle-income 20-30 males (43% of apparel sales) and females (57% of apparel sales). (I actually think it is 18-30, but that is beyond the scope of this article.) Many of their items for males are “extra slim” or “slim” and they do also offer some “classic” fit, but nothing for those males with a few “extra” pounds. On the female side, in order to be “politically correct”, they do offer some items for women who do have some “extra” pounds, but most items are for females who are very careful with their weight.

Their pricing versus quality is about right. I think the biggest issue is that too many items are too fashion/trendy oriented and are too often not something that can be worn frequently. Just how often can a guy wear a burgundy or pink suit? (I expect some readers will think – never.) The clothes are designed by Express and made overseas. This means that they are always slightly behind any new dynamic fashion change because of the long time lag between designing and the stores actually receiving the item.

Revenue from Express was $1.339 billion in 2021, and revenue from Express Outlet was $482 million. I feel there is a real risk that consumers could at some point consider Express just some discount/outlet brand because over 35% of their stores are just outlets (342 Express and 202 Outlet stores). This would have a negative impact on their brand’s image.

Besides having a limited body type and age group target market, Express is very social media and woke-focused. They frequently mention their fashion influencers and social media discussions about Express as part of their marketing model. I consider that there is a credible risk that social media ends up effectively controlling too much of their business model and not management/board of directors making rational business decisions. Management has to be careful to continuously conform to the current “woke” social media culture or risk being “cancelled”, in my opinion, because their business model relies so heavily on fashion influencers with very large followings. Express may consider these influencers as assets, but the reality is there is a potential downside.

In addition, their current business model risks further alienating a larger number of potential customers by integrating their social/political opinions in their business model. There are many thin young potential customers who have more traditional/conservative values who can afford to buy some of their more traditional styled/colored apparel.

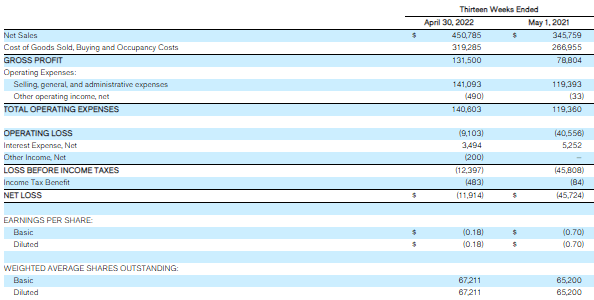

Latest Results

As can be seen from the latest income statement below, Express had a stronger 1Q, but still reported a loss of $11.9 million. I assume that this improvement was partially from customers buying some business and business casual apparel as more workers return to their offices. Some may not have bought much business apparel since before the pandemic and now realize that they need fresh new trendy clothes to wear to work. For example, men’s suit sales were up 78% for the quarter.

Quarterly Income Statements

First Quarter Income Statements (sec.gov)

While the strength might have continued into the current quarter, I worry that the recession could have a dramatic impact on buying clothes, especially if they are not really practical. Their very high inventory level could become a major liability. I saw on their website on Sunday evening that they were offering “up to 75% off clearance” and an “extra 60% off tonight only”. Often retailers have these special sales, but it could also indicate they are already having inventory worries for clearing out their remaining summer items before the start of the fall season.

Too Much Leverage

Besides the $203 million in long-term debt, they have present value future minimum lease payments of $733.5 million. In addition, they also have $181 million in accounts payable, and they only have $37 million cash. Most of their term loan and revolving credit facility mature in May 2024. Their term loan is LIBOR+7.0%-8.25%, and the revolver is LIBOR+2.0%-2.25%. As interest rates continue to increase as the Fed tightens credit, their interest expenses will increase. Because some of the latest economic figures remain fairly strong, the Fed might need to become even much more aggressive in raising rates to control inflation, which could result in a deeper recession than many are expecting.

I Consider Express Stock a Sell

1) I am expecting a recession will continue into 2023. 2) Their inventory level is too high and may need steep discounts to clear. 3) It appears that vendors are already becoming more restrictive in their financing terms. 4) Their target market is too narrow. 5) Express has too much financial and operating leverage.

Be the first to comment