Sundry Photography/iStock Editorial via Getty Images

Investment thesis

Although initial excitement around 5G technology has likely already subsided, the communication equipment market still offers good opportunities for companies with high-quality technology portfolios. Nokia (NYSE:NOK) is a good choice for long-term investors, but we are not in a rush to buy it. We believe there will be a more attractive opportunities over the one-year horizon due to expected lower capital expenditures of communication providers.

Telecommunication equipment market

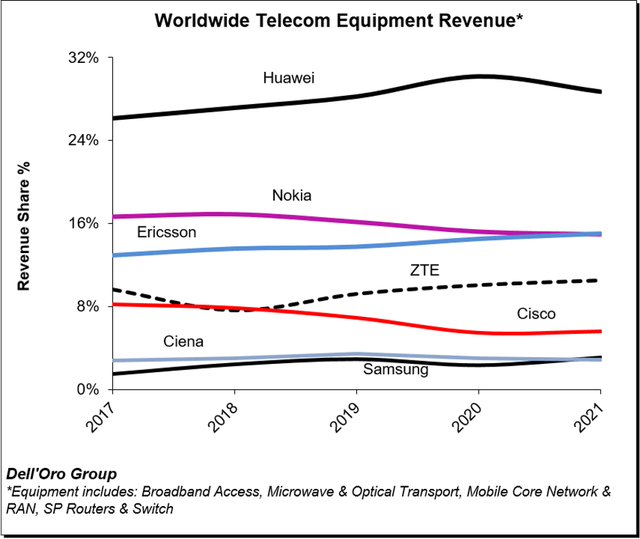

Nokia’s business has undergone significant changes over its history, the most recent of which occurred in 2013-2014. The company acknowledged failure of its activity in the cell phone industry and switched to production of networking hardware. According to the Dell’Oro Group, now Nokia holds one of the leading positions in the market.

It should be also noted that Huawei and ZTE are Chinese companies, and it is difficult to compete with them in the national market. Currently, China is the most developed market in terms of next-generation networks – according to GSMA, in 2021 about 29% of all mobile connections there were via 5G networks, while in the US – only 13%. According to Dell’Oro, the equipment sales accounted for 26% of the global volume.

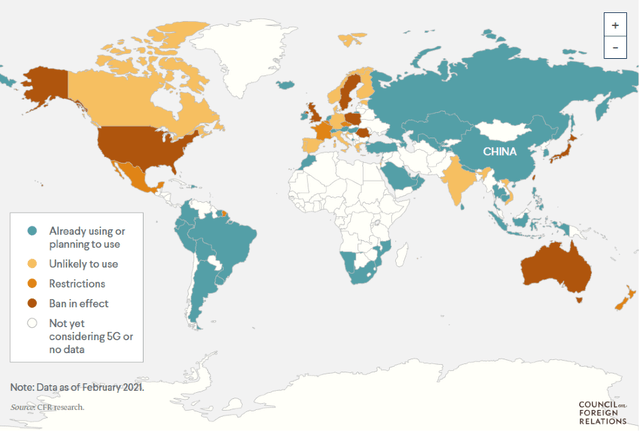

The situation in the international market is the opposite. Nokia and Ericsson are in a better position, because there are restrictions or bans on the purchase of equipment manufactured in China in several countries with developed telecom markets, according to CFR Research.

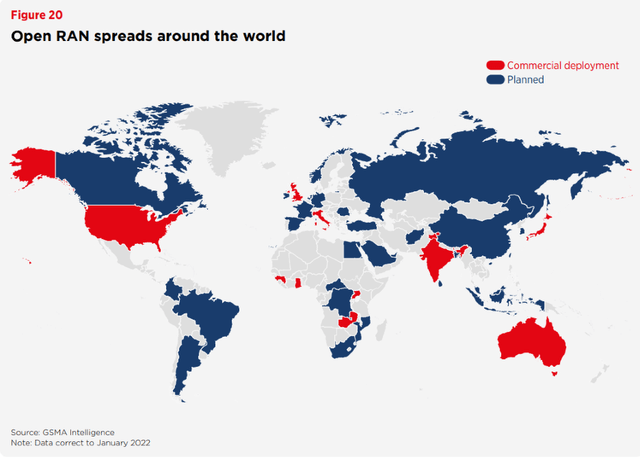

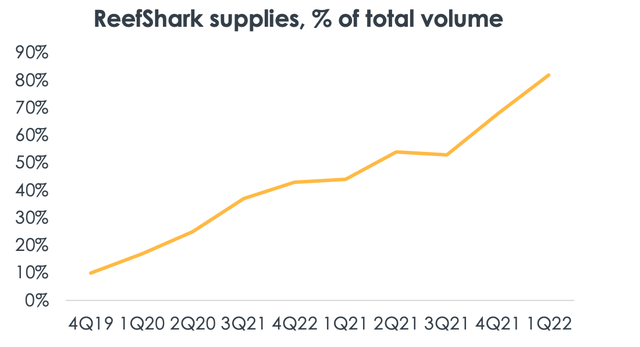

ReefShark technology is the main bet of Nokia on network infrastructure, according to company. AirScale antennas, operating as Open-RAN system, are in great demand worldwide. However, Nokia’s portfolio is not limited to antennas – the company produces submarine and fiber optic cables, cloud computing equipment and many types of other related products.

The main opportunity for business development is the transition of communication providers to the new generation networks. Nokia looks more attractive than its competitors in many respects due to the Open-RAN specification of AirScale. Since these network systems are compatible with components and software from different manufacturers, their commercial use is more competitive, according to GSMA. There are fewer restrictions, and operation of the equipment is cheaper.

What is more, the technology is still evolving and has not become widespread yet, so there are many plans to switch to open type networks. Combined with the projected increase of the 5G share in the total number of connections (from 8% in 2021to 25% in 2025), our view on Nokia’s business remains positive, as many telecom providers worldwide need to upgrade the equipment.

The supply chain crisis and inflation

Disruption of supply chains was a real challenge for Nokia last year. According to Nokia, ReefShark chip shipments almost doubled as of Q1 2021, but in Q2-Q3 shipments are likely to be at risk due to current lockdowns in China.

At previous meetings, the company’s management mentioned that logistics challenges affect not only revenue, but also the business margin. Combined with record price inflation (especially energy prices), the company is likely to experience problems with total costs in the short term. Since Nokia mainly operates under contracts, it shall be difficult to quickly pass on the increased prices to the consumer.

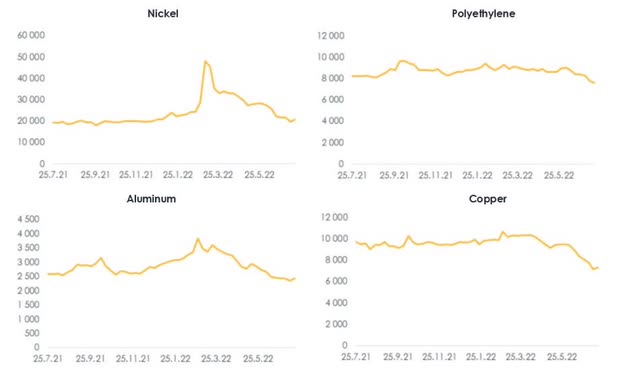

On the other hand, prices of basic materials have shown significant decline from this year’s highs (nickel, polyethylene, aluminum, copper) so the effect of inflationary pressure shall be offset by falling resource prices.

We believe that material price declines shall continue within the period of the current economic cycle and upcoming recession, as resources remain cyclical commodities. Nokia is likely to reduce product prices for future contracts not to lose competitiveness in the face of falling demand. Therefore, a drop of material prices shall have temporary effects on business margins.

Telecoms capital expenditures are likely to decline

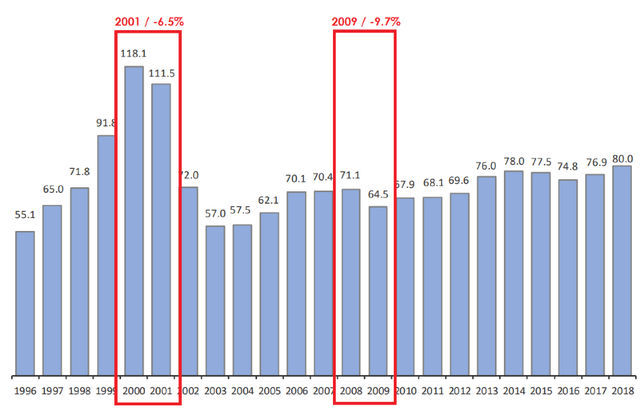

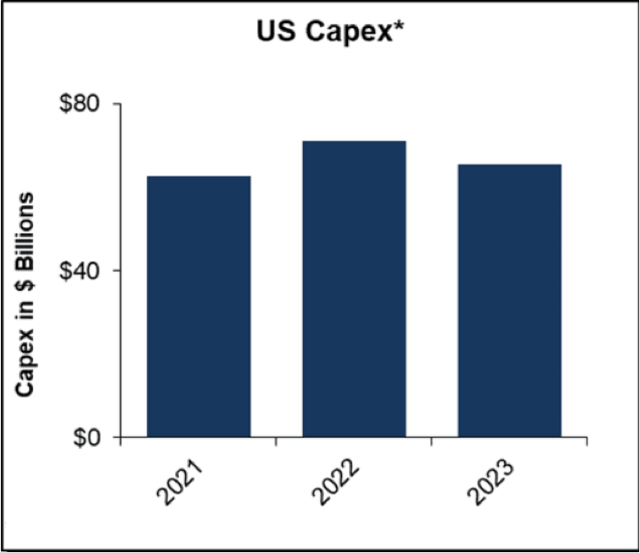

The business of telecom companies is resilient in terms of consumer demand, but the capital expenditures of communication providers also depend on general economic conditions and confidence of management in the future. Traditionally, in the years following the crisis, according to USTelecom, the amount of capital investment declined conservatively.

Dell’Oro research agency also predicts a slowdown in capital investment growth over the next 2 years.

Although the industry still requires significant equipment renewal for transition to 5G, in our opinion, given the expected recession, the dynamics of capital investments in Q3 2022 – Q2 2023 shall be significantly lower than expected.

Transition to new generation mobile networks is resource-intensive and takes a long time to recoup. Meanwhile, the highly competitive market, stable trend of ARPU decreases and still high inflationary pressure may create certain difficulties for some representatives of the telecom industry, forcing them to abandon short-term plans of equipment purchases.

In addition, this economic downturn is accompanied by interest rate increases. This makes it more expensive to finance infrastructure construction and equipment purchases, so we expect capital investment to decline in the near term more than before.

We believe that a boost for financial results of Nokia will arise in H2 2023, when the economy comes out from recession, supported by lower interest rates.

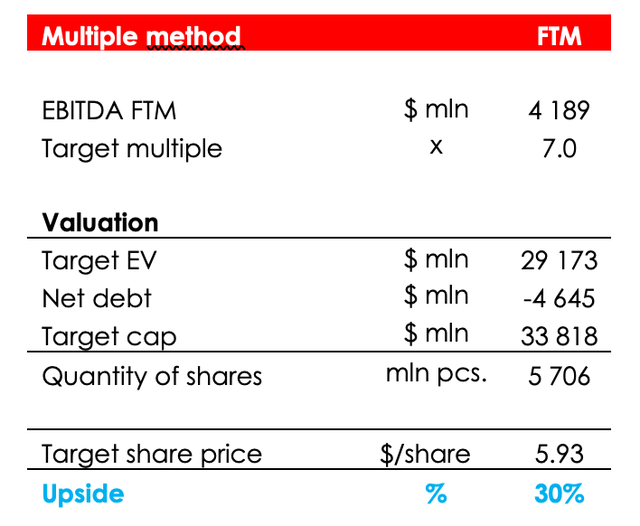

NOK Valuation

Based on our forecast, Nokia’s stock value is $5.93 per share. We maintain a HOLD rating for the company, with upside of 30%.

The conclusion

We believe that a bet on Nokia is a good choice, as part of the equipment renewal process of communications providers and the transition to 5G. We maintain a positive view on the company’s business – the communications equipment industry is still attractive, and Nokia’s technology shall allow the company to remain a key player in the market.

Nevertheless, over the one-year horizon, the company may experience problems with the number of orders due to an expected recession and lower business activity, so it is too early to buy Nokia. We recommend waiting for a more significant upside, which is likely to appear owing to the overall indices declining and poor quarterly reports in Q4 2022 – Q1 2023. To manage the position effectively, investors should check the company’s quarterly reports, recordings/scripts of calls, industry reports (e.g. GSMA, Dell’Oro, Moody’s), and follow the company’s announcements of new contracts and presentations of new technologies.

Be the first to comment