FatCamera/E+ via Getty Images

Thesis highlight

I believe Xponential Fitness, Inc. (NYSE:XPOF) is currently undervalued. Demand for personal fitness has risen rapidly in recent years, as evidenced by our friends and families nearby. XPOF gives us the opportunity to ride this wave. Its market-leading position, diverse portfolio of brands, and track record of execution provide confidence that it will continue to gain market share in the industry.

Company overview

XPOF, as a curator of renowned fitness brands across diverse verticals, with ten distinct brands under its aegis, offers specialized workouts in an environment that motivates the client to reach for his fitness goals. It is hard enough to get and stay fit. However, in a community-based environment, the client is encouraged to keep going. Considering the vast benefits embedded in being physically fit, XPOF aims to make their services available to as many as possible.

Investments merits

XPOF has a market leading position

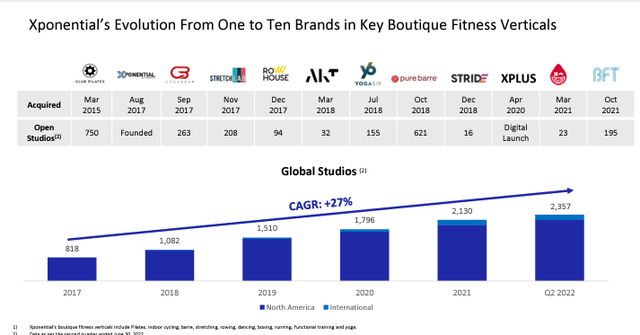

With more than 2,000 studios operating across 10 large brands like Club Pirates, Pure Barre, Cycle Bar, etc., XPOF is the big kid on the block when it comes to the US fitness industry. The three most well-known brands sold by XPOF are all market leaders. According to management estimates, Club Pilates, Pure Barre, and CycleBar were at least twice as large as their nearest competitors as of March 31, 2021. Hungry for more expansion, XPOF has been able to ride the waves of its present reputation to pull off more studio sales to their franchises and attract more customers. Management believes that a continuous, aggressive expansion reinforces the company’s competitive position in the market. This makes the brand attractive to potential franchises and studios to come under its wings.

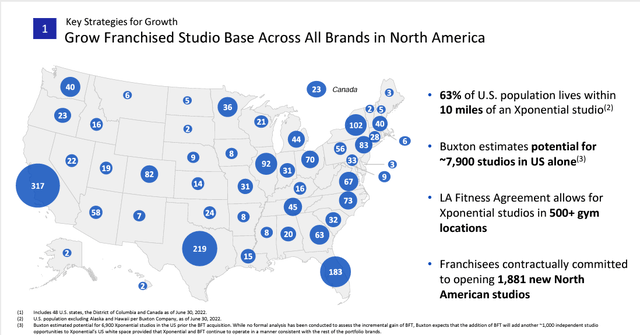

XPOF has been able to stretch its tentacles across 48 states and the District of Columbia. The Buxton Company says that over 60% of the US population, aside from Alaska and Hawaii, lives within 10 miles of an Xponential Studio (data from XPOF S-1). Any competitor will have to work out his lungs to catch up to this feat.

Portfolio of leading brands to capture multiple fitness verticals

XPOF has a portfolio of diversified brands that span varying verticals like Pilates, Barre, cycling, stretching, rowing, yoga, boxing, dance, and running. This is another advantage it holds over the rest of the pack. Where a brand uses a yoga vertical only, it gets to offer yoga services to those who come by. Because of its convenient variety, XPOF is able to serve customers with multiple needs. The franchised studios are positioned close to each other for easier access.

Another perk of its diversification is that XPOF is able to cater to all customers across parameters like age, fitness levels, allergies, preferences, and demographics. Xponential Fitness studios are able to keep their customers because of this, enhancing their CLV (Customer Lifetime Value). They have been able to cultivate a relationship with the customers that makes sure they will keep patronizing the brand.

The reputation of the brands working with XPOF is seen in the fact that three of the ten brands (Club Pilates, Pure Barre and Cycle Bar) got a spot in the 2021 Entrepreneurs Franchise 500 rankings (quoted from XPOF S-1).

30 Jun 22 investor presentation

Plenty of spaces available in U.S. for XPOF to grow

XPOF is not resting on its laurels anytime soon. Its management includes visionaries who believe that to stop improving is to stop being relevant. Businesses that last are businesses that adapt and expand. XPOF is here to last.

It has managed to expand its reach by leveraging brands and verticals. Another factor is the ability to move across regions, taking the service to the customers’ doors. If there is anything this tells us, it is that the value offered by the brand was able to connect with the customers at any age, demographic, market, and income level.

XPOF has been able to scale rapidly, yet it recognizes that there is much more to achieve. According to Buxton Company, franchises could have as many as 7,900 studios in the United States alone (data from XPOF S-1). This means 7,900 potential locations and markets in the United States, based on customer profiles and brand performance.

30 Jun 22 investor presentation

Attractive industry with attractive and loyal consumer group

In my opinion, members of boutique fitness studios are a very desirable and devoted demographic. While the fitness industry as a whole is popular with people of all ages, Millennials are disproportionately represented among boutique fitness customers (60% of whom are between the ages of 25 and 44, per XPOF S-1 filings). A member of a boutique fitness studio spends more money than the typical customer of a health and fitness club. Boutique fitness studio customers are not only the most financially committed fitness demographic, but also among the most physically active. Statistics from XPOF S-1 show that 65% of people who use boutique fitness have been to more than one boutique fitness facility before their clinical validity data collection period began.

Systematic playbook to ensure quality

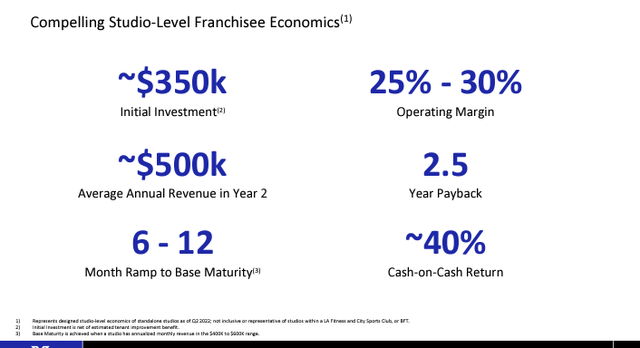

Another factor that contributed to the rise of XPOF as a powerhouse in the fitness industry is its playbook. This has helped the company to provide franchises with superior levels of experience and profitability. The process of integrating newer franchises into the system is made easy and seamless because of the investments that have been made in the franchisor. This is why studios are able to amass enviable success. The Xponential Playbook is a blueprint that contains the procedures for integrating, designing, and operating franchises. This model positions a franchise to generate at least $500,000 by the second year of operations. Only then has it reached its base maturity. However, with the Xponential Playbook at work, that could be shortened to a minimum of 6 months. Then, it grows beyond that.

30 Jun 22 investor presentation

Asset light franchise model improve profitability and provide predictable revenue

When compared to a corporate-owned model, the asset-light franchise model accelerates system-wide unit growth. As a franchise, XPOF has several predictable sources of revenue and low levels of expenditure. Upon getting an operations license in a region, XPOF received a one-time, non-refundable payment from franchises so that they could open a studio under it. This is one of the revenue streams. Other recurring sources include royalty feeds, technology feeds, merchandise sales, marketing fees, and instructor and management training revenues.

Valuation

Price target

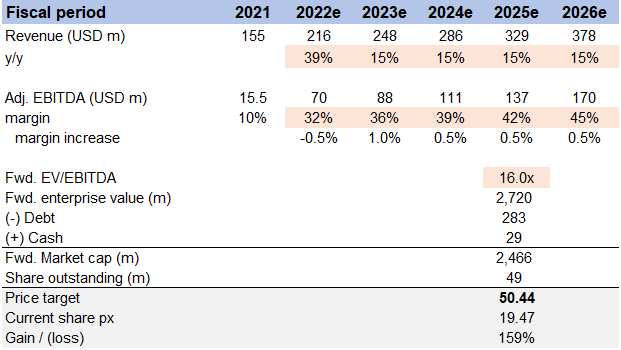

My model suggests a price target of ~$50.44 or ~160% upside in FY25 from today’s share price of $19.47. This assumes that revenue will grow in the mid-teens until 2026e, EBITDA margins will improve to 45%, and the forward EV/EBITDA multiple will be 16x in FY25e.

Image created by author using data from XPOF’s filings and own estimates

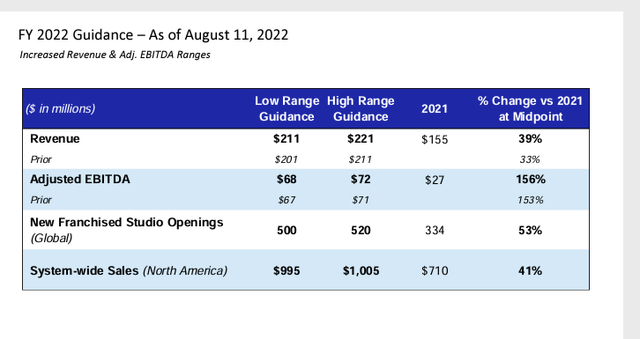

For FY22e, I used the mid-point of management guidance during 2Q22. Moving forward from FY22e to FY26e, I assumed revenue would continue to grow in the mid-teens digits and adj. EBITDA margins would increase over time due to fixed cost leverage, based on management’s long-term guidance (stated in Sep 22 investor presentation).

As for valuation, XPOF currently trades at 16x 2-year forward EBITDA. I looked at 2-year forward EBITDA as XPOF would have totally recovered from any covid impacts by then. Hence, I assumed XPOF to continue trading at the same level in FY25.

30 Jun 22 investor presentation

Risks

Shift in consumer behavior

Due to the impact of the COVID-19 pandemic, consumers still have reservations towards physical fitness classes. They fear they might make contact with a COVID patient and get infected. This fear remains even after government orders have been lifted. Consequently, it extends to the studio’s indoor activities.

This situation has pushed consumers to adopt in-home workouts. The downside of this is that it will reduce the number of times they participate in studio workout classes. Decreased patronage may affect the financial capacity of the studios. A resurgence might be around the corner, but it can’t be predicted for sure.

Growth dependent on franchisees

Another point of risk is that the growth of the business depends on the growth of the franchises. Think of franchises as the cells of a body. The body can’t exist outside cells, so can XPOF not exist outside its network of franchises? If franchises can’t find and secure sites for new studios, it will have a big effect on the rate of revenue growth.

Another way franchises could be risky is the process of opening studios in high-cost markets. This will place a strain on the finances of XPOF. The higher level of invested capital may prove detrimental in the long run.

Conclusion

I believe XPOF is undervalued as of today. XPOF is on a mission to create a healthier world in which people can live longer and better lives. Coupled with the enthusiasm of the public towards this mission, XPOF is a juicy piece of fruit that rewards the investor. The smartest investors know how to ride the waves of change. Do you?

Be the first to comment