BlackJack3D

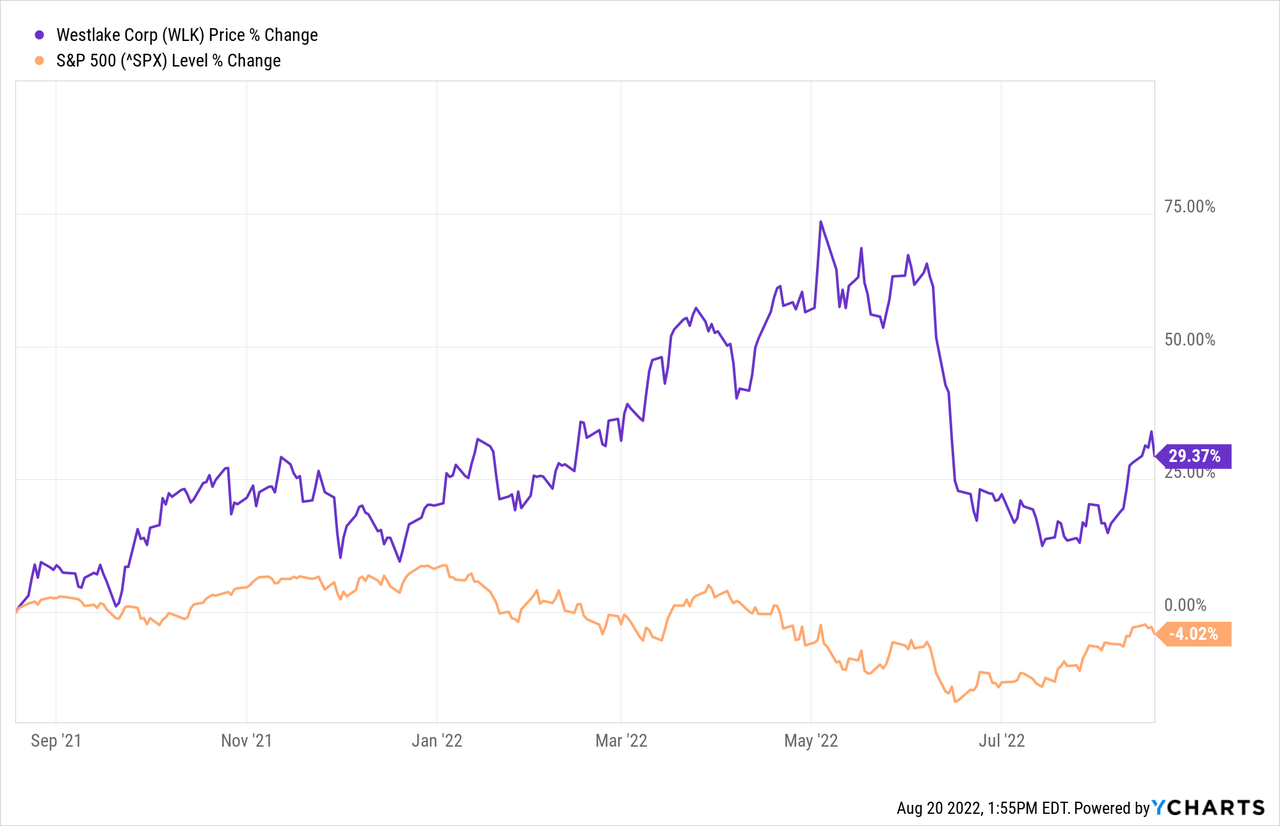

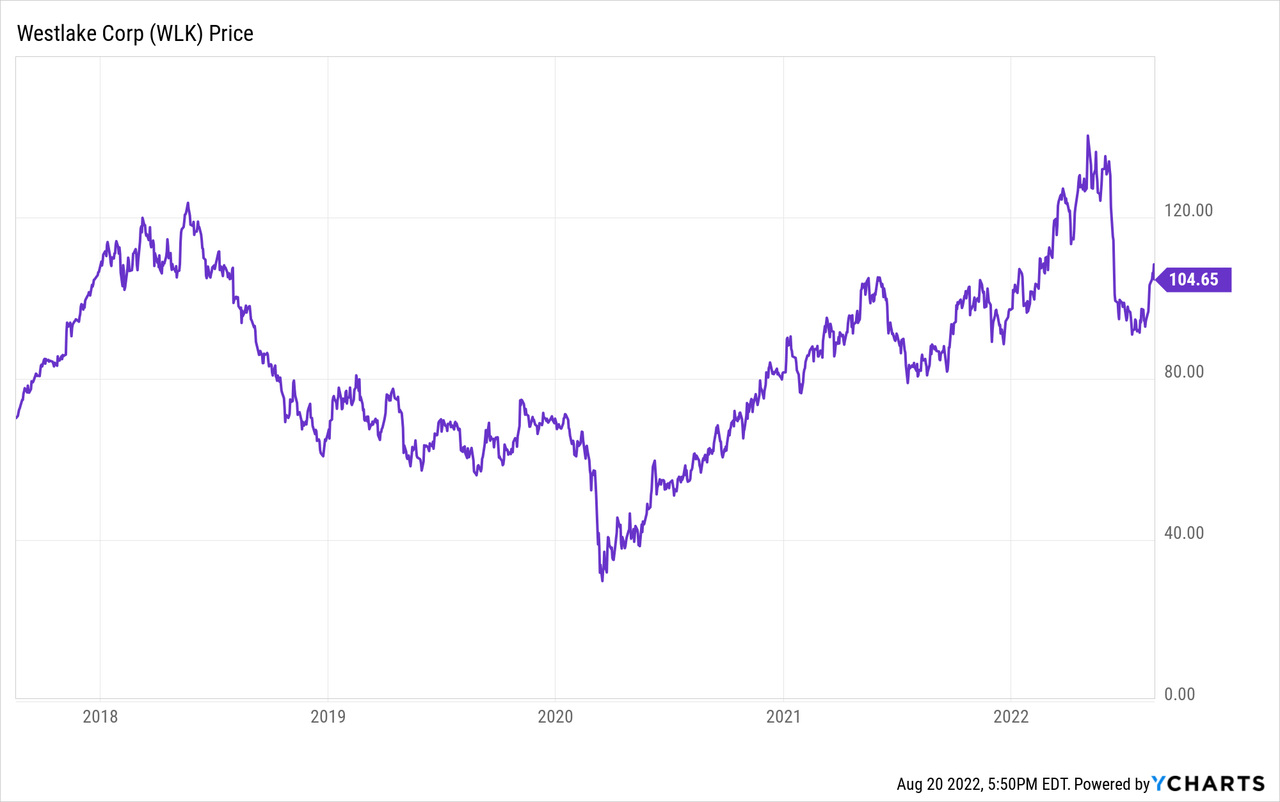

Last September, I wrote a Seeking Alpha BUY piece on Westlake (NYSE:WLK) because I thought the market’s negative reaction to the pending Boral acquisition was overdone and irrational (see Westlake Chemical Is A Screaming Value). The stock has performed very well since then (+21.3%) and has significantly trounced the S&P 500. However, at one point back in May, the stock was up nearly 50% since my BUY rating. WLK has subsequently sold-off (see graphic below) and is – once again – offering investors an excellent opportunity to pick up shares while they are on sale. That’s because, despite the stock not performing well of late, the company itself has been doing very well.

Investment Thesis

Westlake operates through two segments: Performance & Essential Materials (“PEM”) and Housing and Infrastructure Products (“HIP”). The PEM Segment is essentially a chemicals producer: polyethylene, ethylene co-products, polyvinyl chloride (“PVC”), chlorine, and caustic soda – among others. The HIP Segment manufactures products like residential siding, trim & mouldings products (through the Royal Trim & Mouldings and Kleer Lumber brands), windows, roofing, outdoor living products, stone, and all-matter of PVC related products (pipe, fittings, and compounds).

As I mentioned in my previous Seeking Alpha articles, the big catalyst last year was the announcement in June that WLK planned to buy Australia-based Boral’s North American Home Products businesses for $2.15 billion. The market’s reaction was very negative despite the fact that WLK only paid ~2x revenue and foresaw an estimated $35 million in synergies.

What the market missed, and what it is still missing in my opinion, is that WLK appears to be doing a great job of vertically integrating Boral’s product line because its chemicals business provides the building blocks for its residential and infrastructure products.

So let’s take a look at WLK’s most recent earnings report and see what we can learn.

Q2 Earnings

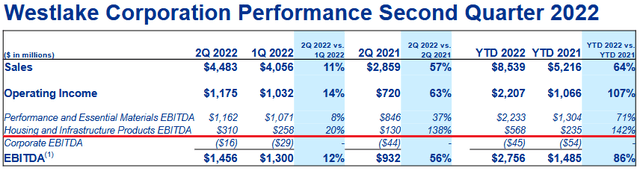

Westlake announced its Q2 EPS report on August 1 and it was a big-beat on both the top- (by $0.061/share) and bottom-lines (by $230 million). Highlights of the report included:

- Record quarterly net sales of $4.5 billion, +57% yoy.

- Record quarterly net income of $858 million, +64% yoy.

- Record quarterly EBITDA of $1.5 billion, +56% yoy.

- Q2 Net income per share was a whopping $6.60.

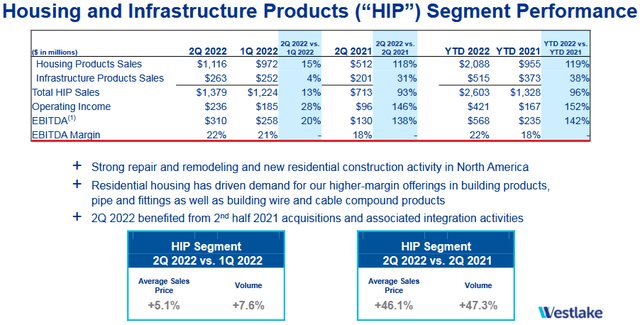

Not surprisingly, the record results were driven by the HIP segment, which grew EBITDA by 20% on a sequential basis and by 138% yoy:

Source: Westlake Chemical Q2 Presentation

Westlake’s ability to raise prices offset inflationary cost pressure while its low-cost raw materials is an advantage in comparison to its global competitors. Meantime, WLK’s vertical integration enabled it to capture margin across operations.

EBITDA margin for the PEM Segment grew on both a sequential (8%) and year-over-year basis (37%). However, EBITDA margin dropped 2 percentage points yoy. On a year-over-year basis, pricing improved 27.1% while volume expanded 17.5%. WLK experienced attractive pricing and margin conditions for chlorovinyls and continued strong demand for polyethylene from the industrial and consumer packaging markets. Meantime, Q2 was the first full-quarter of its recent Epoxy acquisition’s contributions to earnings with “solid sales prices and volumes”.

Results of the HIP Segment were more interesting to me, because it was more directly impacted by the Boral acquisition:

As can be seen in the graphic above, not only did the HIP segment grow EBITDA nicely on a sequential (20%) and yoy basis (138%), but note that WLK was able to grow margin in the HIP segment by a full four percentage points yoy despite the challenging operating environment. This to me is “proof-positive” that WLK has been successful in vertically integrating the Boral acquisition.

On the Q2 conference call, CFO Steve Bender reported:

Net cash provided by operating activities for the quarter was a record $913 million in capital expenditures for the second quarter were $230 million.

That implies free-cash-flow of $683 million – or an estimated $5.28/share based on the 129.34 million fully diluted average shares outstanding during the quarter. That’s correct: those numbers are for the quarter, not for the year. That obviously bodes well for shareholders considering WLK’s current annual dividend is only $1.43/share (1.35%).

Also on the call, CEO Albert Chao said:

During the quarter, we continue to see the benefits of our expanded portfolio driven by the acquisitions that occurred over the past year. Over year-over-year sales for the second quarter in our PEM segment grew 45% while achieving strong margins by leveraging our vertically integrated North American operations with our globally advantaged feedstock energy costs.

and

Elevated infrastructure spending, which are now beginning to see associated with the recently passed infrastructure bill will continue to support demand for our products. The spending will also pull PVC resin across our segments, enabling us to drive additional value from our recently acquired business.

Indeed, WLK appears to be hitting on all cylinders … except for the stock price.

Shareholder Returns

A week or two after the stellar Q2 report, Westlake announced a 20% increase in the quarterly dividend (to $0.3570/share) and a $500 million expansion of the existing share buyback plan (which had only $50 million remaining). In the announcement, WLK reported that – since the inception of the initial share repurchase plan in 2011 – the company has bought back ~9.8 million shares at an aggregate purchase price of ~$600 million. That equates to an average of an estimated $61.22/share (the stock closed Friday at $104.65). That is an example of a share buyback program that has actually delivered value for the ordinary shareholder.

Valuation

As mentioned in the bullets, WLK’s TTM P/E ratio is only 4.8x, a ridiculously cheap valuation level that appears to be pricing in an extreme recession scenario and a much deeper plunge in the domestic housing market. The market also seems to be valuing some financial stress.

Yet WLK’s balance sheet is strong. After retiring $250 million of debt during Q2 (thereby lowering the annual interest expense run-rate by about $9 million), the company ended Q2 with cash & cash equivalents of $1.3 billion and total debt of $4.9 billion. That puts WLK’s net-debt to EBITDA ratio well below 1 at 0.74x. That being the case, it would appear WLK’s balance sheet is well prepared for almost any economic scenario it could be facing going forward (with the possible exception of a very deep and prolonged recession).

JPM has an overweight rating on WLK and says the stock is undervalued compared to peer DOW (DOW). J.P. Morgan analyst Jeffrey Zekauskas pointed out that peers Dow and Olin (OLN) currently trade at a ~5.3x multiple of estimated 2023 EBITDA, while Westlake is slumming at ~3.6x. Zekauskas said he sees no reason for the gap and has a $135 target for WLK, which he says is a ~4.6x multiple of estimated 2023 EBITDA.

Risks

Westlake is not immune to the macro-environment risks with respect to inflation, the potential for higher interest rates, covid-19 related shutdowns and supply chain disruptions, and the impact of Putin’s horrific war-of-choice on Ukraine that has effectively broken the global energy & food supply chains. Any of all of these factors could cause a domestic or global economic slowdown and/or a recession that would put downward pressure on WLK’s stock price.

Certainly WLK is quite exposed to a slowdown in the domestic housing sector. Indeed, U.S. home sales fell 6% in July (the sixth monthly drop in a row) while Forbes reported the housing market “collapse has deepens.” That said, I think the market has overreacted in taking WLK’s stock down to such a low valuation level. I could understand the stock drop if WLK was highly levered going into a housing slowdown, but as I mentioned earlier – that simply is not the case. Meantime, as the CEO mentioned on the conference call, the Biden administration’s infrastructure plan is supporting demand.

While WLK saw higher ethane, natural gas, and other raw material costs during Q2, note that domestic pricing for ethane and natural gas are well below that of most other countries due to the US’s strong domestic shale production. That remains a competitive advantage for WLK versus its overseas competition. That said, margins could fall in the 2H of this year and in 2023 if overall market demand slides.

Income oriented investors should consider that the Chao family holds ~70% of Westlake stock. That being the case, the family may tend to over-emphasize share buybacks over dividends in order to reap generational wealth by capital appreciation as opposed to taxable dividends.

Summary & Conclusion

WLK could easily earn $20/share this year (consensus estimates are for $20.95/share but are typically slow to react to softening demand). At Friday’s closing price of $104.65, that gives WLK a forward P/E of only ~5x. That is an extremely attractive valuation and a great entry point for investors. As a result, I upgrade my rating on WLK from HOLD to BUY with an end of year price target of $120, or ~7x next year’s earnings estimate of $16.91/share. The bigger reward for shareholders will be in the next up-cycle, in years past 2023. My advice is to BUY, hold, and be patient.

I’ll end with a 5-year price chart of WLK stock and note that despite the record quarterly results, despite the recent Boral and Epoxy acquisitions, and despite its strong balance sheet, WLK is currently trading below where it was back in 2018. That is, the recent selloff on the right-hand side of this chart is totally irrational in my opinion, and I expect the stock to regain the $120 level by year-end:

Be the first to comment