Franck-Boston

Every generation laughs at the old fashions, but follows religiously the new. ― Henry David Thoreau

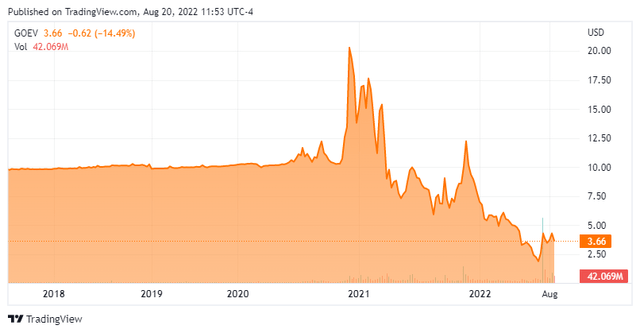

Today, we put Canoo Inc. (NASDAQ:GOEV) in the spotlight for the first time. This EV related concern came public in December of 2020 as the result of it business combination between Canoo (CNOO) and Hennessy Capital Acquisition Corp. IV (HCAC). Like so many others that took a similar path to being a public company in 2020 and 2021, the result has been an absolute debacle for shareholders to this point. Recently the company’s CEO purchased nearly $800,000 worth of shares. A sign of confidence in Canoo’s long-term future? An analysis follows below.

Company Overview

Canoo Inc. is based just outside of Los Angeles. The company designs and manufactures electric vehicles for the commercial and consumer markets in the United States. It has a variety of offerings it is working to deliver including lifestyle delivery vehicles, lifestyle vehicles, multi-purpose delivery vehicles, and pickups. The stock currently trades just above $3.50 a share and sports an approximate market capitalization of $1 billion.

August Company Presentation

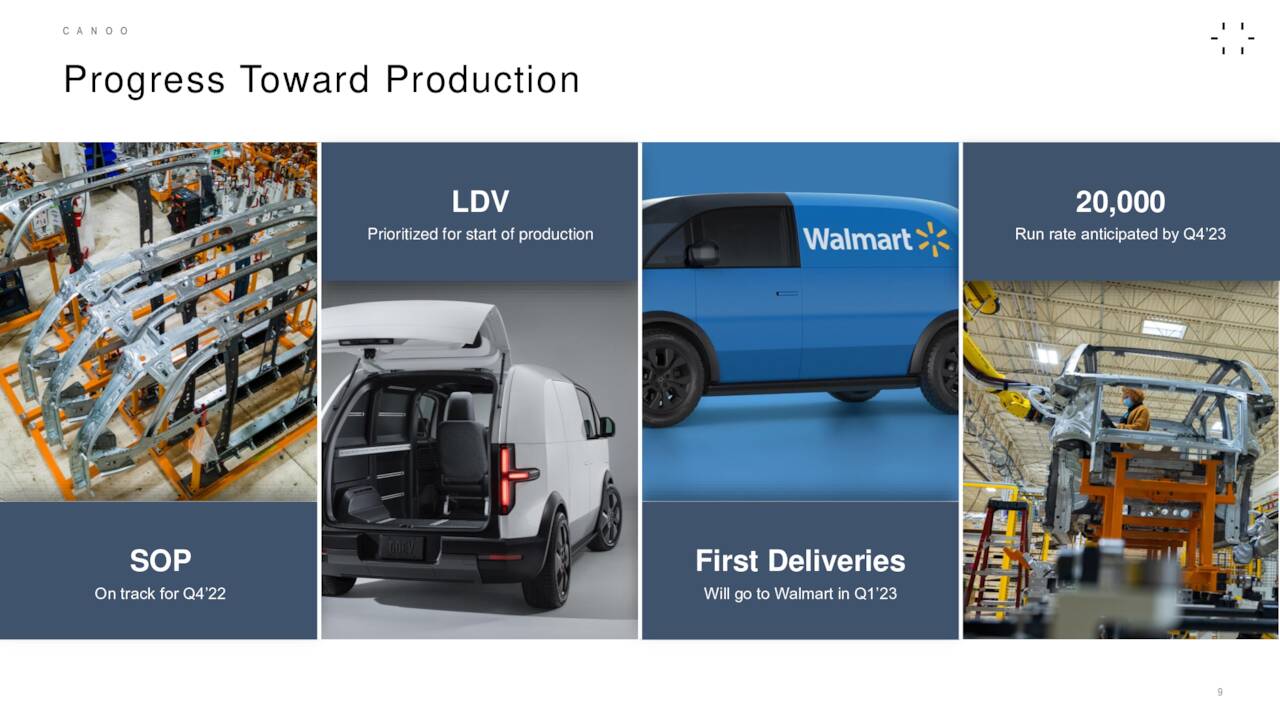

The company has spent the past few years ramping up (vehicle design, testing, certification, building manufacturing capability, etc…) to the production stage of Canoo’s journey. The company has purposely built flexibility into its manufacturing processes to be able to build a variety of different types of electric vehicles, both now and in the future.

August Company Presentation

Concurrently, the company has been booking pre-orders and believes it has an approximate $1 billion sales pipeline at this point. The start of production should commence sometime in the fourth quarter of this year. Leadership projects it will be producing at a 20,000 annual vehicle rate by the end of 2023.

August Company Presentation

In addition, the company has an important partnership with retailing giant Walmart (WMT) with the latter committed to buy 4,500 electric vehicles with the option to purchase up to 10,000 worth within that agreement. This agreement was just signed around six weeks ago. This deal also gave Walmart a warrant to purchase up to an aggregate of 61,160,011 shares at an exercise price of $2.15 per share in GOEV and the company cannot sell vehicles to Amazon (AMZN) as well. The warrant covers over 20% of all the outstanding shares in GOEV currently. Walmart will receive the first vehicles off Canoo’s production line when it commences.

Second Quarter Results

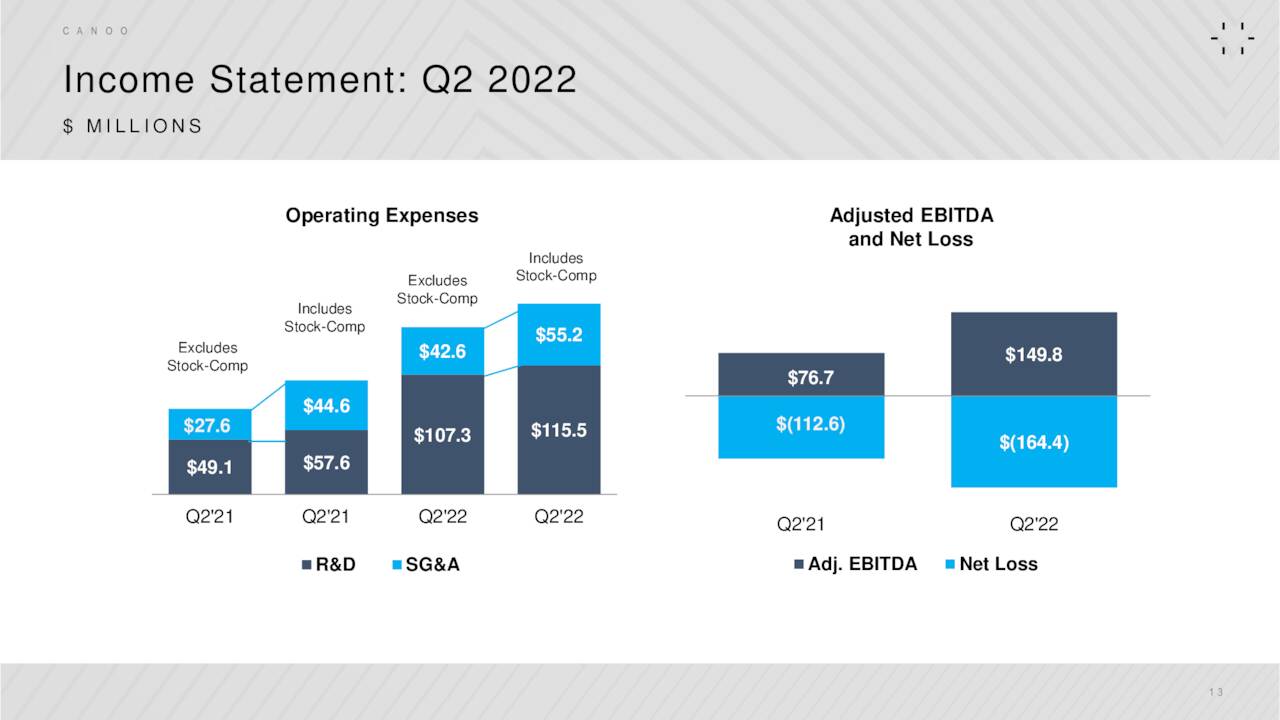

On August 8th, the company posted its second quarter earnings report. Canoo had a GAAP loss of 68 cents a share for Q2. Just after quarter ended, the company signed the contract with Walmart as described above and Canoo has also now completed 90% of their structural crash testing in the quarter and are now moving to the final phase of Federal Motor Vehicle Safety Standard certification.

August Company Presentation

Operating expenses are accelerating as the company moves towards full production mode.

Analyst Commentary & Balance Sheet

Since second quarter results hit the wires, both H.C. Wainwright ($10 price target) and RF Lafferty ($15 price target) have reissued their Buy ratings on the stock while Roth Capital downgraded its view on Canoo to a Hold.

Unfortunately the insider purchase has been swamped by sales by other insiders. A beneficial owner has sold nearly $18 million worth of shares in July and so far in August. Three other officers of the company have disposed with approximately $440,000 worth of stock in aggregate over that time as well. In addition, it appears just over a quarter of the outstanding float of the stock is currently held short.

August Company Presentation

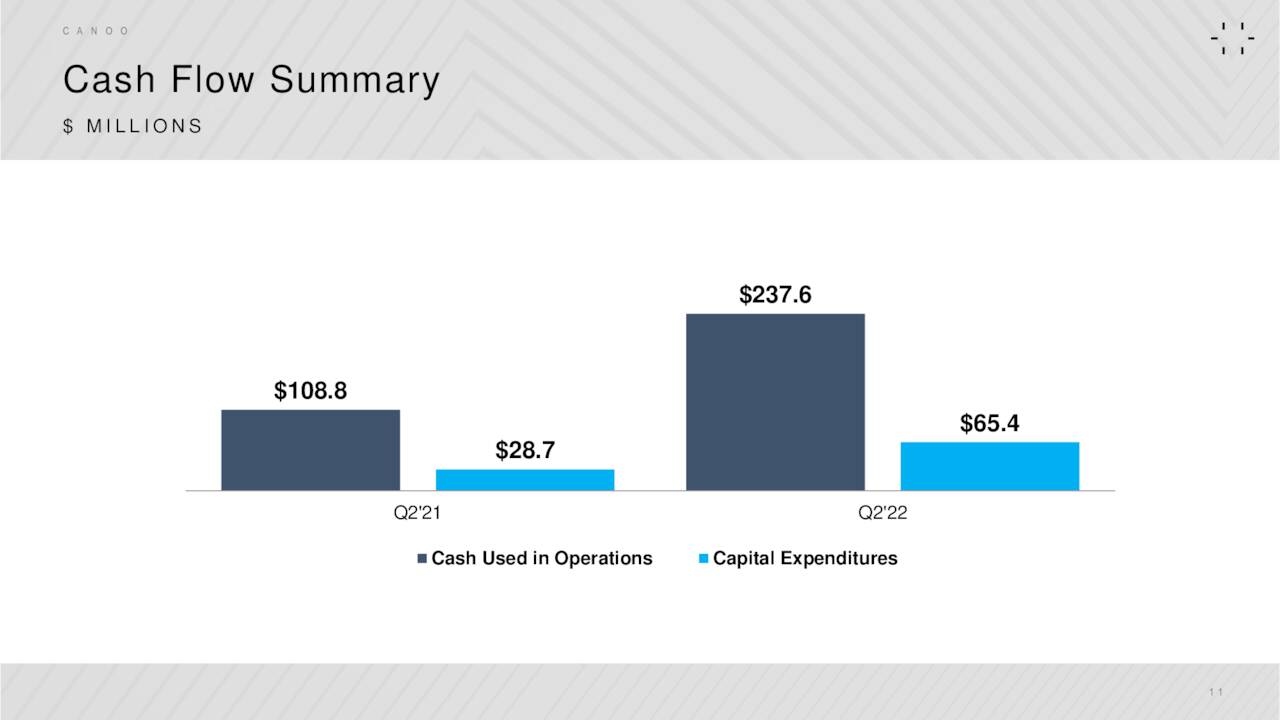

The company ended the second quarter of this year with just under $35 million of cash and marketable securities after burning through nearly $240 million worth of cash during the first half of 2022. The company also had access of up to $250 million, including approximately $220 million of unused capacity on its SEPA facility at that time. Canoo recently announced that it had signed a direct stock purchase deal to raise up to $200 million with Evercore Group L.L.C. and H.C. Wainwright & Co., LLC. The company access to funding to start up production is outlined below.

August Company Presentation

Verdict

The three analysts that cover this stock and have projections have wide ranges to their revenue and earnings expectations for the company in FY2022 and FY2023. This fiscal year, they have the company losing $1.40 to $2.42 a share on sales of anywhere between $1 million and $180 million. Next year they see continued losses in the $1.48 to $1.87 a share range as revenues soar to between $342 million to $605 million.

The start up EV space has been a black hole for shareholders to this point. One reason is the amount of competitors. Electric vehicle subscription startup Autonomy placed a $1.2 billion order for 23K electric vehicles in August of which Canoo got part of the allocation but so did BMW (OTCPK:BMWYY), Fisker (FSR), Ford (F), General Motors (GM), Hyundai (OTCPK:HYMTF), Lucid Group (LCID), Mercedes-Benz (OTCPK:DDAIF), Polestar (PSNY), Rivian (RIVN), Stellantis (STLA), Subaru (OTCPK:FUJHY), Tesla (TSLA), Toyota Motor (TM), VinFast, Volvo Car (OTCPK:VLVOF) and Volkswagen (OTCPK:VLKAF) as but one example on how crowded the EV manufacturing space is right now.

The sort of a large amount of entrants is typical at the start of any sort of paradigm shift in this country historically. There were once over hundred American manufacturers of gas powered cars in the United States at the dawn of the automobile age. Eventually only a few survived. The same can be said about the births of the radio and then the television industries.

The $7,500 electric vehicle tax credit was recently renewed in January of 2023 and last until the end of 2032 as part of the comically misnamed Inflation Reduction Act, which was a boost to the industry. The question for investors is whether Canoo will be one of the few survivors and thrive, or will the company go bankrupt or be bought out by a larger competitor after substantially more shareholder dilution? There was some M&A chatter around the company earlier this month.

At this point in Canoo’s journey, there isn’t enough evidence it will be the former. Therefore, we have no investment opinion on this name at the moment but will probably circle back in a year or two to see how the company is executing in its commercialization stage.

Conformity is the jailer of freedom and the enemy of growth. ― John F. Kennedy

Be the first to comment