Reptile8488/E+ via Getty Images

ADMA Biologics (NASDAQ:ADMA) recently report their Q2 earnings that revealed strong growth in a few key metrics including total revenues, which was up roughly 90% year-over-year. This growth was fueled by positive trends in the company’s product portfolio and the expansion of ADMA BioCenters. These developments have improved gross margins and reduced net loss. Most importantly, this level of revenue growth paired with prudent financial execution is clearing a path towards profitability for ADMA.

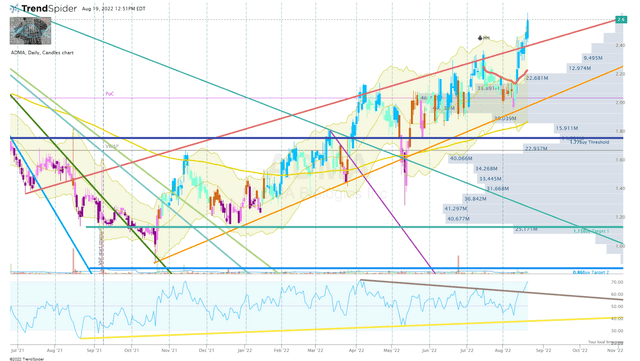

The market appears to have recognized the opportunity that ADMA presents and has supported the share after hitting its low in October of last year. As a result, I believe it is a matter of time before ADMA grinds its way up to its 52-week high and through my sell targets. Now, I must determine my course of action to ensure that I have amassed my goal position size before ADMA starts reporting a positive EPS and the share price leaves this trading range.

I intend to review the company’s Q2 earnings and will highlight some positive notes for the bulls. In addition, I will take a look at the Street’s estimates to project a path to profitability and where the company could be valued at that point. In addition, I point out some downside scenarios that could have a negative impact on the share price. Finally, I present my plan for managing my ADMA position and how I intend to ensure I have my fill before it’s too late.

Q2 Earnings

ADMA’s Q2 earnings ended up being a slight beat on EPS and revenue. Total revenues came in at $33.9M, up from $17.8M in Q2 of last year. Furthermore, ADMA’s realized a gross profit was $7.8M vs. $1M for Q2 of last year. The revenue growth and improved margins were generated by ADMA’s IVIG products including BIVIGAM and ASCENIV. ADMA’s net loss also improved from $18.9M for Q2 of 2021 to a net loss of $13.8M for Q2 of this year.

In terms of cash, the company ended Q2 with $52M with an additional $25M in non-dilutive funds from Hayfin. Furthermore, the company has $19M in accounts receivable and $146M in total inventory. Altogether, ADMA’s total liquidity is in excess of $96M, and their total asset value was ~$297M.

Q2 Highlights

The company announced that they now have eight ADMA BioCenters in operation, which is up from four centers at this time last year. Moreover, the company is working to get all of these FDA approved/licensed. What is more, ADMA has two more centers under construction. Accordingly, ADMA believes they are “well-positioned to achieve ADMA stated goal of having all 10 centers collecting and FDA licensed by year-end 2023.” Once the company has all 10 centers up and running, ADMA projects these will be able to provide an adequate amount of plasma supply to be self-sufficient.

ADMA also reported that ASCENIV’s adoption continues to expand and BIVIGAM continues to gain market share. Furthermore, the company reported that BIVIGAM is seeing “very consistent utilization amongst existing prescribers and existing patients” as well as seeing growth from current customers and adding new institutions.

My Thoughts On The Quarter

I believe the key takeaway from this earnings report was the company made progress across the board. In nearly every aspect of the company not only did we see revenue growth, but we also saw margins improve as well as a net loss. Moreover, the company was able to make progress with their plasma centers, which will be critical in achieving their goal of fully supplying their own raw material and getting their entire process in-house. If the company reported that they made a step towards profitability, but in this case, it looks like the company made a solid leap towards profitability.

Overall, I would say Q2 was another quarter of progress and ought to be celebrated by shareholders.

The Path Ahead

Obviously, the ultimate goal for small-cap biotech companies is to get a product on the market and quickly move the company to profitability. Most small-cap firms fail to get over the hump and shareholders end up paying the price through endless dilution or even bankruptcy. ADMA Biologics appears to be approaching profitability at a good clip and is expecting to cross that coveted threshold in Q1 of 2024. Not only is this a transformational event for the company, but also for shareholders and Street analysts.

Arriving at this milestone requires a company to amplify their revenue grow and narrow their net losses. Starting this year, ADMA projects they will pull in “at a minimum $130M” for their full-year revenues. It looks as if ADMA expects this number to nearly double over the next two years and hit $250M or more in revenue for 2024. Furthermore, ADMA projects their corporate gross margins to be between 40-50% and net income margins to be between 20-30%. ADMA believes this level of revenue and margins could yield annual gross profit to be roughly $100M-150M, and net income of around $50M-100M in as early as 2024. So, ADMA is not expecting to arrive at profitability at a rickshaw speed, but more like a bullet train.

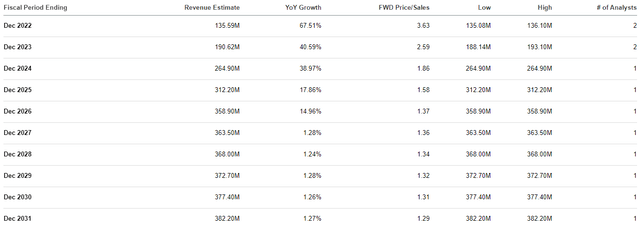

Not only does ADMA believe that they are on in the fast lane to profitability, but Wall Street analysts also have ADMA reporting significant growth over the remainder of the decade and pulling in over $250M in 2024.

ADMA Annual Revenue Estimates (Seeking Alpha)

Indeed, these are just estimates, but the fact that ADMA and the Street are in consensus on ADMA reporting over $250M in revenues in 2024 tells me that the timeline to profitability is reasonable.

Downside Risks

Indeed, ADMA has some downside risks that could weigh on the share price until they are addressed. Primarily, the company is still reporting losses and is going to chip away at that cash position for at least a year or until the company hits breakeven. Obviously, any setbacks would prolong or intensify their cash burn. Moreover, any changes in the growth trajectory could cast doubt on the company’s profitability timeline. These potential risks could weigh on the share price until the company is able to address the setback or get back on track.

Indeed, I know the company has a healthy cash position and their growth trends appear to be strong, so these risks are fairly low. However, I believe that ADMA’s share price performance over the past year has been fueled by the company’s growth trends and guidance. So, a speed bump could dent the bullish narrative and trigger some latent selling pressure to catch up with the rest of the market.

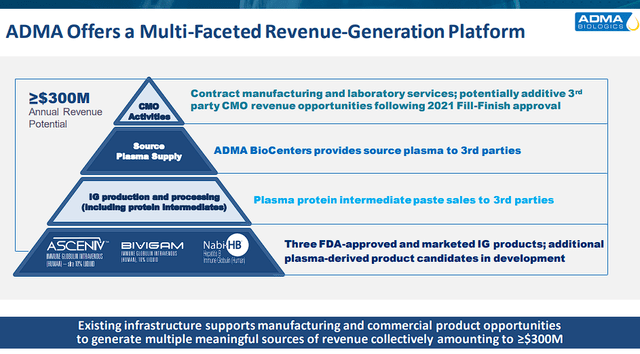

Classifying ADMA

ADMA Biologics is rapidly approaching profitability and should see an acceleration in coming quarters as the company brings more ADMA BioCenters online and the company is able to source all of their own raw materials. Once that is in place, ADMA will be able to maximize their “Multi-Faceted Revenue-Generation Platform” which is projected to be able to pull in more than $300M in annual revenue.

ADMA Biologics Overview (ADMA Biologics)

The industry’s average price-to-sales is 5x, so $300M in revenue would justify ADMA trading at ~$7.65 per share. Keep in mind, that the company had a healthy cash position at the end of Q2 with total liquidity exceeding $96M, and a total asset value of ~$297M. So, there is no imminent threat of secondary offering and there is a possibility the company could make it to profitability with the possibility of little-to-no dilutive financing. Therefore, it is possible we could see $7.65 per share if $300M in revenue is within eyesight.

At the moment, ADMA is trading around $2.50 per share, so there is plenty of profit left assuming all goes well. However, it appears to ADMA has a great technical set-up for continuation higher, so the opportunities for grabbing discounted shares might be running out.

ADMA Daily Chart (Trendspider)

ADMA Daily Chart Enhanced View (Trendspider)

Another item to consider is that ADMA is still performing their “ongoing strategic review” of “a variety of strategic alternatives” with Morgan Stanley (MS) and “remains a top corporate priority for ADMA.” Obviously, the company is looking to make a major move as an organization and is working with one of the biggest banks in the world to help determine the course of action. One must consider that a deal or decision is a matter of time, which could have a massive impact on the share price when announced.

Considering the points above, one can see why I have ADMA as a “Top Idea” in my Compounding Healthcare Seeking Alpha Marketplace Service. However, I still believe ADMA is a speculative play until they are able to report a positive EPS for the year. As result, ADMA will remain in the “Bio Boom” Portfolio and has a conviction level of 3 out of 5.

The Plan

ADMA has been trending up since October of last year and was able to rise above my Buy Targets in the Compounding Healthcare Marketplace Service. Now, we are looking ahead to the sell targets at $3.23, $3.92, and $7.94 per share. Typically, the strategy for speculative tickers in the “Bio Boom” portfolio is to book profits at Sell Target 1 and Sell Target 2 in order to get the position to “house money”. This way, the position will be de-risked and will allow the investor to re-apply those profits if the ticker decides to return to the Buy Targets. For ADMA, the strong trend towards profitability might necessitate a different approach in order to maximize profits. Personally, I am still looking to get ADMA to a “house money” state by removing my original investment, however, I am planning on selling a small lot at Sell 1 and a larger lot at Sell 2. This way, I will be able to get to “house money” by selling a smaller number of shares to allow me to have a larger position for a long-term investment.

What is more, I am still looking to accumulate ADMA ahead of breakeven if the share price returns below the Buy Threshold of $1.76 per share. If the share price does drop below my Buy Threshold, I will begin adding on reversal set-ups and will continue to add to the position until I have doubled my current position size.

Long term, I plan on maintaining a position in ADMA for at least five more years in anticipation that the company will eventually move to profitability and will graduate to my “Bioreactor” growth portfolio.

Be the first to comment