Johnny Greig

Investment Thesis

Martin Marietta Materials (NYSE:MLM) should continue to experience strong demand across two of its primary end markets, i.e., infrastructure and non-residential, which should be partially offset by the slowdown in the residential market. The company has a strong backlog, which should support the revenue growth in 2H FY22 along with the pricing actions taken by the company to offset the inflation. The funding from (Infrastructure Investment and Jobs Act) IIJA and the trends in the non-residential markets related to investments in data centers, cooling storage, energy, etc., should support the long-term growth of the company. The company is offsetting inflation through pricing under its value above volume commercial strategy as well as by achieving operational excellence. This should benefit the margin growth of the company in 2H FY22 and beyond.

MLM Q2 FY Earnings

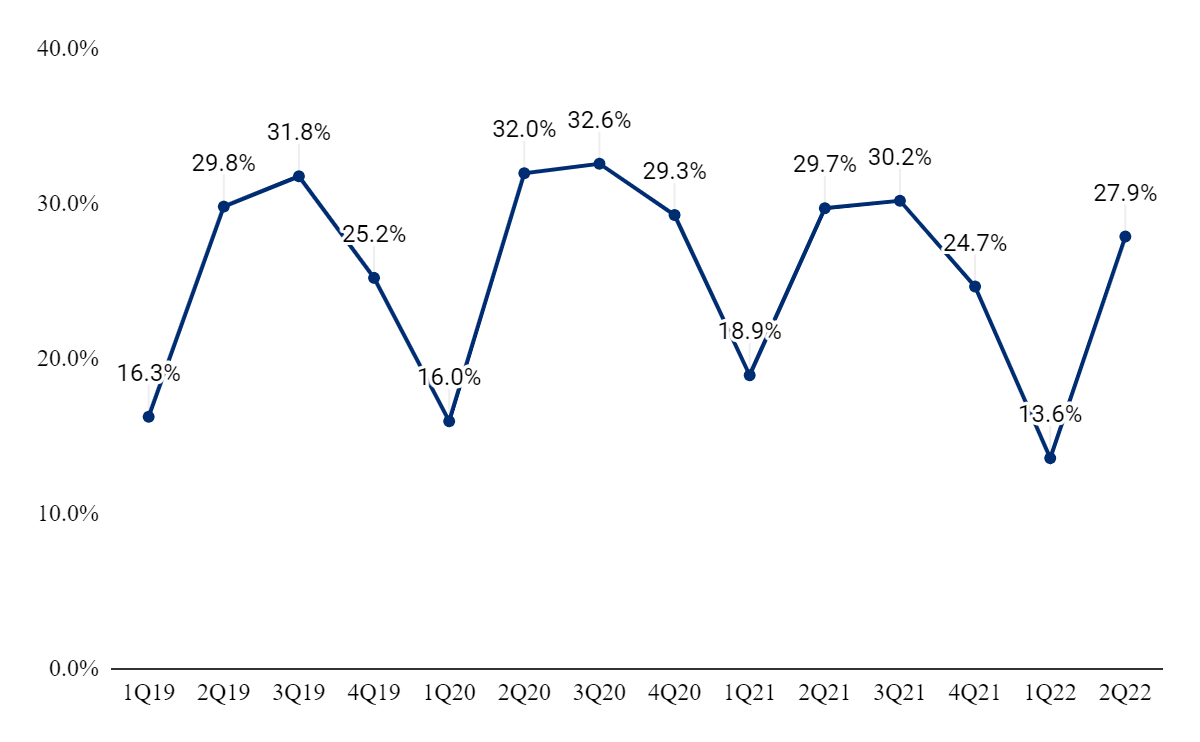

Martin Marietta Materials recently reported its second quarter of FY22 financial results that were better than expected. The revenue in the quarter grew 19% Y/Y to $1.64 bn (vs. the consensus estimate of $1.48 bn). The adjusted EPS was up 4% Y/Y to $3.96 (vs. the consensus estimate of $3.81). The strong revenue growth in the quarter was due to the implementation of price hikes, widespread product demand, and contributions from acquisitions. The gross margin in the quarter declined 180 bps Y/Y to 27.9% due to high input costs, and the adjusted EBITDA margin declined 250 bps Y/Y to 31.4%. However, adjusted EPS increased in the quarter helped by strong revenue growth.

Revenue Growth Prospects

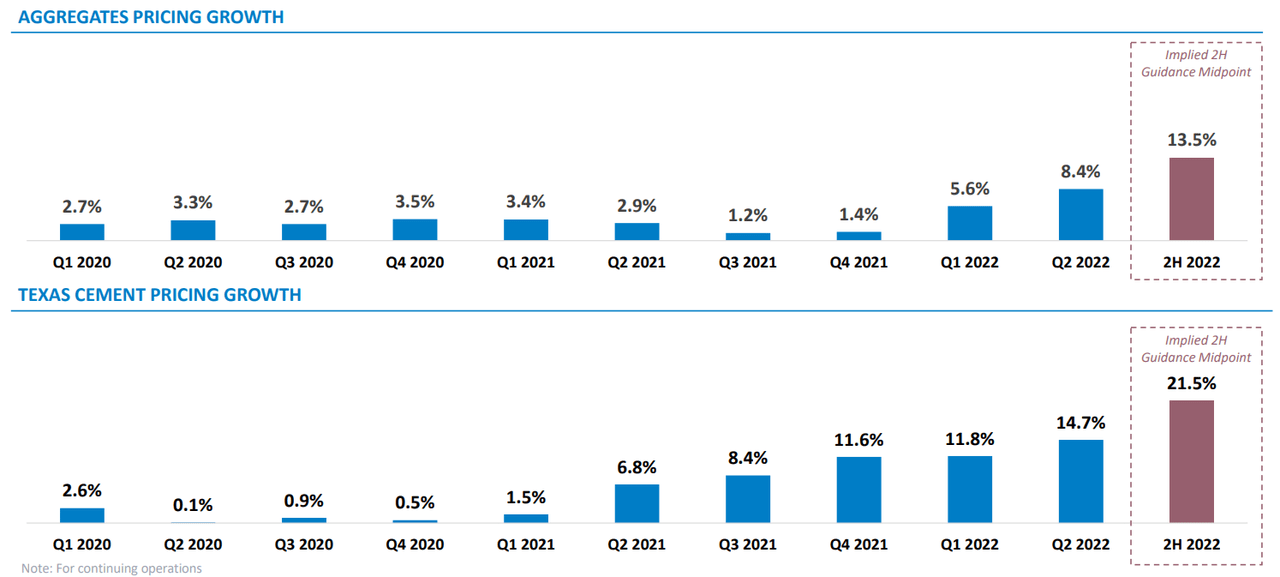

The company experienced healthy demand for aggregates in Q2 FY22 across its three primary end markets, with total aggregate shipments increasing ~9% Y/Y to 57.8 million tons. Organic shipments in the quarter increased 1.8% Y/Y despite supply chain and logistical challenges. On April 1, the company took a price hike across its products due to the increased demand and higher input costs. The organic aggregate price increased by 8.8% Y/Y to $16.40 or 7.5% year-over-year on a mix-adjusted basis to $16.20. Mix-adjusted ASP is calculated by comparing current-period shipments to like-for-like shipments in the comparable prior period. The Texas cement market is experiencing robust demand and tight supply. The shipments increased 19.8% Y/Y in the quarter to 1.1 million tons, with an increase in ASP of 14.7% to $140 or 12.5% year-over-year on a mix-adjusted basis to $137.33. The tightness in the cement market affected the ready-mix concrete business, thereby affecting the shipments of aggregates in the quarter.

In the downstream business, ready-mix concrete shipments increased 3.4% Y/Y as the demand in the Texas triangle was strong, partially offset by cement tightness in Dallas-Fort Worth, Austin, and San Antonio. The organic pricing grew 17% Y/Y, reflecting multiple pricing actions, including fuel surcharges. The organic asphalt shipments were flat Y/Y as the strong demand in Denver was offset by the late construction start in Minneapolis. The organic pricing improved 17% Y/Y, following the increase in raw material costs, primarily bitumen. Asphalt shipments increased 40%, including contributions from the acquisition of operations in California and Arizona.

MLM is experiencing strong demand despite the dynamic macroeconomic operating environment and the impact on housing starts and inflation rates. The company entered the third quarter with higher customer backlogs that were ahead of the prior year’s same period. The backlogs in the aggregates are up 9% Y/Y. In the East division, the backlog is up 13% Y/Y whereas in the Central division it is up 30% Y/Y. In the West group, the company is experiencing healthy demand and is practically sold out in the Texas cement market.

The company is taking steps to increase cement production capacity in Texas due to domestic production capacity limitations and an already sold-out Texas cement market. In the short run, the continued conversion of Portland-Limestone Cement (PLC) is creating an incremental capacity for the company. In 2H FY22, approximately 25% to 30% of historical Type 1 and Type 2 cement shop volumes should be converted to PLC. PLC is an innovative product that contains 5% to 15% limestone and performs like a standard cement. The company is also expecting its new Midlothian finish mill to be completed by late 2023 or early 2024, providing 450,000 tons of net incremental capacity to the Texas marketplace.

The combined outlook for the company’s three primary end markets, i.e., infrastructure, residential, and non-residential, looks robust as the infrastructure funding and secular non-residential demand trends are expected to more than offset the potential slowdown in the housing industry. The Infrastructure Investment and Jobs Act (IIJA), which was signed into law in November 2021, has already started allocating funds for FY23 to the Department of Transportation (DoT) from July 1. This should benefit the demand for aggregated starting in the back of FY22 and expand further into FY23. The increased investment in public works provides a base level of stable demand for the company’s products in the long term.

Just like the infrastructure end market, the non-residential construction market of Martin Marietta should continue to support the company’s revenue growth as the pandemic-impacted sectors such as commercial, retail, hospitality, and energy are recovering from pandemic troughs and the supply chain disruptions have led businesses to establish manufacturing facilities closer to demand. The announcements of projects such as the Samsung semiconductor facility in Austin, the Stellantis Samsung JV for a lithium-ion battery plant near Indianapolis, the Taiwan semiconductor campus near Phoenix, and the VinFast electric vehicle site near Raleigh-Durham should help demand as they are some of the aggregate intensive projects.

The company is also experiencing an uptick in the warehouse and cold storage construction other than Amazon (AMZN), as the traditional brick-and-mortar retailers and groceries are adapting to the secular shift in consumer trends. Additionally, the data center demands remain robust, including the Meta data center projects in Kansas City and Atlanta. The strong demand across these end markets should more than offset the slowdown in residential construction due to higher prices and rising mortgage rates. I believe MLM’s revenue should benefit from the higher backlog, strong demand across two of its end markets, and price hikes, partially offset by slow volume growth in 2H FY22 due to supply chain constraints and logistics challenges.

Margins

The company is executing its value over volume commercial strategy and implementing price increases. The Value over volume strategy involves taking price hikes based on the value of the reserves and geographic positioning.

MLM’s gross margin (Company data, GS Analytics Research)

The company implemented a price hike on April 1 to offset the high input costs and plans to implement another price hike in the third quarter across its products and geographies, primarily taking effect between July 1 and September 1. Furthermore, the company is advising its customers of a fourth-quarter price increase in several markets. These commercial initiatives together with other operational inflation management actions position MLM to benefit in the near term from anticipated record second-half pricing growth. The company is anticipating 13.5% Y/Y price growth in aggregates and a 21.5% Y/Y growth in the Texas cement group in 2H FY22.

Pricing growth (MLM’s earnings presentation)

Other than managing inflation through pricing actions, the company is striving for operational excellence to lower costs per ton. The combination of pricing and operational excellence should drive the margin expansion in Q4 FY22 and beyond.

Apart from this, the company is also taking steps to improve its portfolio and maximize value through either monetizing or exchanging select assets where it may not be the best owner. In Q2 FY22, the company closed the sale of Colorado and Central Texas ready-mixed concrete operations. This transaction should enhance the margin profile of the company in the near and long term and strengthen the balance sheet for future acquisitions. On August 9, the company announced the sale of its California cement plant and related distribution terminals to the CalPortland company for $350 million. These transactions should not only help margins but also provide the company cash to reinvest in the business or create shareholder value through buybacks.

Valuation & Conclusion

Martin Marietta Materials has good revenue and earnings growth prospects. Revenue growth should benefit from strong backlog levels, healthy demand in infrastructure and non-residential markets, and pricing actions, partially offset by weakness in the residential market. The company’s margins should start improving from the back half of FY22 as the increased pricing and operational efficiency outpace the higher input costs. The stock is currently trading at 21.55x the FY23 consensus EPS estimate of $16.42, which is a slight discount to its five-year average forward P/E of 25.79x. I believe the stock is a good buy at the current levels.

Be the first to comment