simonkr

Sunlight Financial Holdings Inc. (NYSE:SUNL) is having a hard time cushioning the blow of economic volatility. Revenues remain stable, but expenses have skyrocketed in recent months. Although most of these are non-cash adjustments, there may be recurring expenses associated with pending inspections. Despite this, the company continues to show its resilience with adequate cash inflows and stable borrowings. Its decent growth in fund loan volume and borrowers and its re-underwriting strategy may become the foundation of its future rebound. Meanwhile, the stock price remains on the dip in line with its inability to generate income.

Company Performance

The pandemic proved a powerful growth driver for the consumer discretionary and finance industries. With more people staying home, finding ways to get busy drove many companies, including Sunlight Financial Holdings Inc. Lower interest rates and the advent of digital transformation were other catalysts. The company showed promise as it emerged and expanded in the last two years.

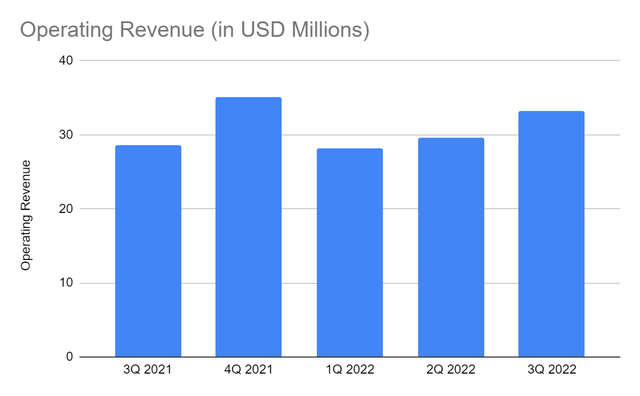

This year, things turned one hundred and eighty degrees as disruptions hammered Sunlight’s potential. Despite this, there appears to be an increased demand and production volume, showing its maintained market appeal. Sunlight continues to prove its ability to bounce back recording an operating revenue of $33 million, which translates to a 16% year-over-year growth. This is regardless of the fact that it can be deemed unnecessary as purchasing power shrinks. But I also understand its role as one of those names at the forefront of energy sustainability and financial resiliency. The company has also seen a 24% increase in the number of borrowers, reaching 22,470. With that, funded loans rose to over $800 million, a substantial comparative growth from 2021. Likewise, Sunlight’s network continues to expand as it connects to more contractors this year. These changes help the company capture more demand and cater to more customers.

Operating Revenue (MarketWartch)

Meanwhile, operating costs are stable, which appears one of Sunlight’s core strengths today. But, we can infer that it is due to the contraction, as shown by the lower PPE and intangibles. The challenge is more visible in its operating expenses. A high inflation environment continues to drive higher operating expenses. The lower labor, depreciation, and amortization expenses are also associated with its contraction.

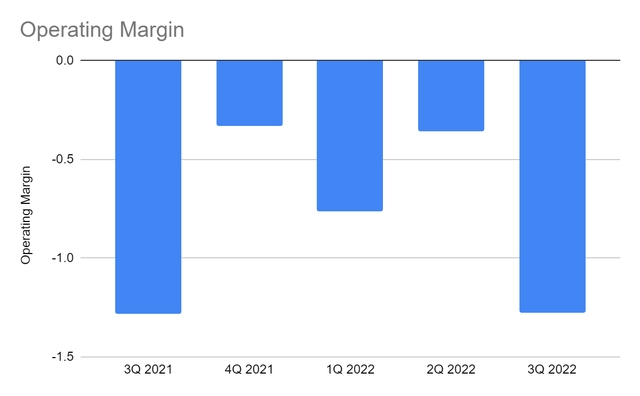

The drastic increase in expenses came from other components, particularly credit loss provisions. It amounts to over $30 million, up from only $254,000 in 3Q 2021. Even so, the company’s actions are still on the right track. Increasing provision losses is prudent after the insolvency of one of its primary contractors. Although the event is unrelated to SUNL, re-underwriting is the best option to ensure a realistic value of advances and hedge risks to its performance. Provisions are non-cash adjustments, but they directly impact Sunlight’s viability and the advances it can collect. Its operating margin dropped to -120%, slightly better than 3Q 2021 but way lower than the first two quarters.

Goodwill impairment is another indication of the hammered performance. With its contraction and the recent contractor insolvency, Sunlight’s management sees that the current figures do not reflect the actual value. It amounts to $384 million, a massive reduction in goodwill. Although it is a non-cash adjustment, it still affects the core performance. It leads to a lower valuation since the carrying value after the acquisition and disposition of assets does not match its market value. Hence, it is wise for Sunlight to retract its initial outlook to remain a realistic investment.

Operating Margin (MarketWatch)

External Challenges and How Sunlight Can Stay Afloat

It has been a challenging year for Sunlight due to the external challenges in recent months. First was the insolvency of one of its main solar contractors due to cash flow challenges. As such, the company had to raise its advances impairment reported as credit losses. In turn, it chose to re-underwrite the remaining advances to hedge risks. It is a wise and realistic response to adjust its core operations. Thankfully, revenues are still in an uptrend, although it is not enough to offset the impact.

Macroeconomic changes pose more challenges to Sunlight’s performance in the next 12 months. Inflation has cooled down in the last three months, which could have been another demand driver. Yet, interest and mortgage rates are still approaching their maximum. In the last Fed meeting, the interest rate rose by 75 bps, so it can reach 4.5-5% next year. An accelerated uptrend in interest rates continues to reduce its direct capital provider capacity. It is geared toward its indirect channel. This move affects its ability to generate returns on loans that originated at lower rates. Its persistence will increase its costs further, requiring price increases. Hence, the company must find ways to hedge its core operations from interest rate hikes. Doing so may help it maintain stable pricing and demand for its services.

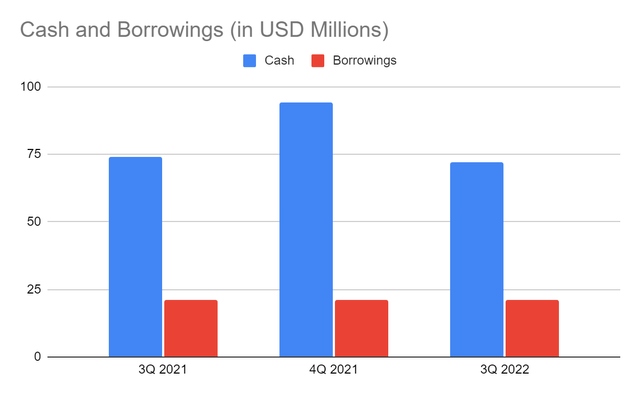

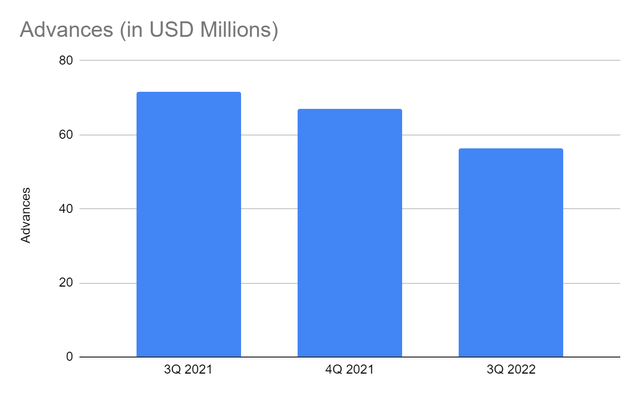

Despite being hammered by external challenges, Sunlight is an interesting company. It continues to show its potential to bounce back. With its conservative approach, it may withstand disruptions and rebound once the economy stabilizes. Its liquidity remains adequate, as shown by its stable cash levels and borrowings. Cash comprises 13% of the total assets and can cover all its borrowings in a single payment. Their difference can also cover accounts payable, funding commitments, and warrants. So the company is safe and secure from insolvency. To manage its financial leverage, Sunlight undertook a recent stock repurchase program. Advances are 16% lower than the comparative quarter due to its re-underwriting strategy to hedge risks. It still appears stable as the value remains high. Even better, cash had ample buffers to cushion the impact.

Cash And Cash Equivalents And Borrowings (MarketWatch) Advances (MarketWatch)

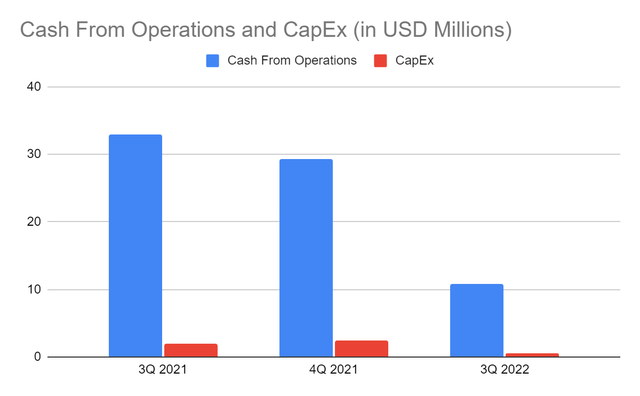

Using the changes in its cash inflows, we can verify its adequacy. Again, goodwill impairment, advance impairment, and re-underwriting of advances are non-cash adjustments. If we focus on cash transactions, cash inflows from operations will amount to $10.8 million. CapEx is low due to its contraction, so it still has an FCF of $10.2 million. Despite unforeseen challenges, Sunlight can still turn its revenues into cash. The company has adequate reserves to withstand the challenges but must not be complacent. Some tailwinds are evident, which can help regain its momentum. SUNL is at the forefront of energy sustainability and climate finance, increasing its market appeal. Demand may remain stable as inflation cools down, but the company must watch out for the impact of interest rates on its performance.

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

Since its IPO, the stock price has had a continued downtrend. Last month, it had a slight uptrend but does not show a rebound. At $1.64, it has been cut by 65% from its starting price. The trend appears logical, and even the management agrees with it. The stock price today is more reasonable, reflecting the actual value of the company. It has a BV multiple of 5.3x with a PB Ratio of 0.31, showing potential undervaluation. TBV multiple is 0.7x with a PTBV Ratio of 2.34. It is lower than the average multiples in the last two years. Indeed, the discounted book value is reasonable to reflect the value of the company.

Sunlight must endure these volatile times before growth prospects will materialize. The company must watch out for the looming recession as it contracts and increases loan provisions. Despite the still limited short-run growth prospects, a potential upside may be driven by its appealing loan characteristics. Interest rates for customers are still stable, which can entice more customers in the future. As a cheap financing company, Sunlight can also attract more solar manufacturers. Its business model in robust-growth markets can capture financial institutions with lower deposit costs. That way, it can generate more yields with manageable funding costs.

Bottom Line

Sunlight Financial Holdings Inc. still shows its potential to rebound amidst economic volatility. Steady revenues and adequate cash levels can help it rise above these challenges. Yet, it must endure more scourges to enjoy potential growth prospects once the economy stabilizes. The stock price is reasonable as it rebounds but may still be hammered. The recommendation, for now, is that Sunlight Financial Holdings Inc. is worth the risk but still a hold.

Be the first to comment