Userba011d64_201/iStock via Getty Images

Affirm Holdings, Inc. (NASDAQ:AFRM) has dropped 87% in 2022, and what began as a promising year for the buy now, pay later fintech has turned into a heartbreaking example of value destruction.

Due to a general slowdown in the BNPL industry, the fintech was forced to reduce its sales forecast for the current fiscal year. With delinquencies also posing a direct and credible threat to Affirm, $13 is unlikely to be the company’s lowest point.

Flatlining Sales Growth

Affirm is a leading buy now, pay later startup that made a name for itself during the Covid-19 pandemic due to its rapid expansion of customer and merchant accounts.

Affirm provides merchants and customers with simple buy now, pay later services and earns a commission on each successful transaction. In addition, the company earns revenue from interest-bearing transactions on the Affirm platform, as well as fees from the use of its virtual cards, which customers can use for in-store or online purchases.

While the startup grew rapidly during the pandemic, growth in the BNPL industry has begun to slow as a result of rising inflation and slowing economic growth.

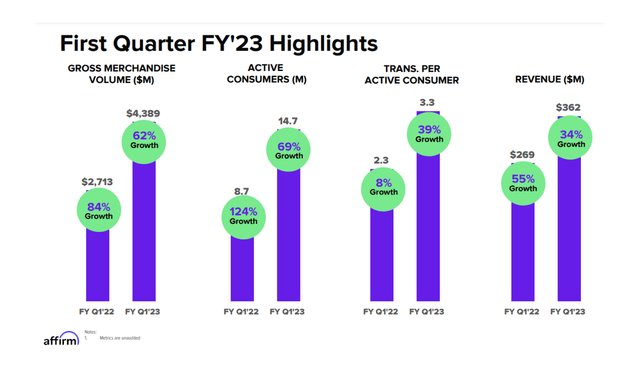

Affirm’s quarterly sales were $362 million in the first fiscal quarter of 2023, representing a 34% YoY increase. Active consumers and active merchant accounts grew at rates of 69% and 140%, respectively, YoY.

Adopting BNPL products and services is obviously a no-brainer for merchants because those products create win-win situations: the availability of BNPL products at checkout increases the merchant’s conversion ratios and represents zero-risk.

First Quarter FY’23 Highlights (Affirm Holdings, Inc.)

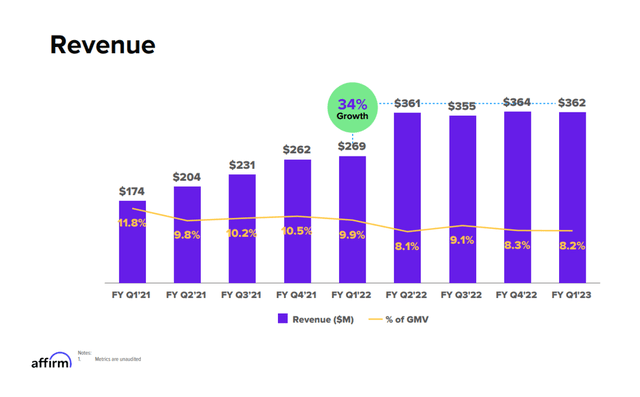

The chart above, however, does not show that Affirm’s sales growth has essentially flatlined in recent quarters. The $362 million in sales in the first fiscal quarter represented a 1% QoQ decline, and sales have not increased in the previous four quarters either.

The chart below demonstrates the growing headwinds in the BNPL industry as well as the sales challenges that Affirm is facing.

Revenue (Affirm Holdings, Inc.)

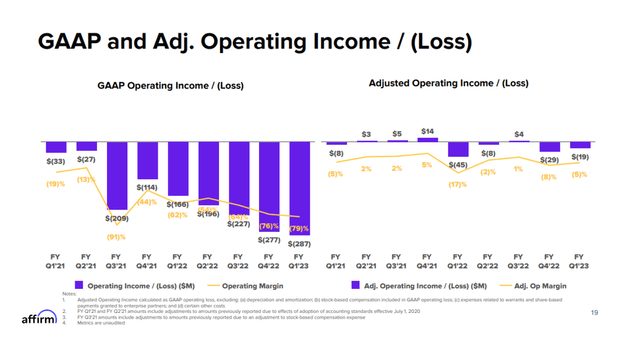

Widening Losses

While sales fell QoQ, the fintech’s losses widened significantly. The operating loss for the fiscal quarter ending September 30, 2022 was $287 million, up from $277 million in the previous quarter. With losses reaching nearly $1.0 billion in the last year, Affirm’s business may be as large as the massive 87% valuation cut in 2022 suggests.

GAAP And Adjusted Operating Income (Affirm Holdings, Inc.)

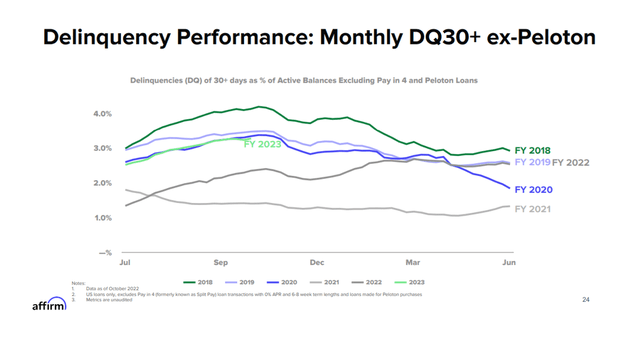

Delinquency Trends Are Negative

Delinquencies in Affirm’s business are on the rise, which is concerning for the fintech. Delinquencies typically increase when a borrower’s financial situation deteriorates.

In October, inflation moderated slightly but remained high overall at 7.7%, and consumers remain under pressure from rising consumer prices.

Furthermore, a recession is likely approaching, which strongly suggests that Affirm’s delinquency performance (shown in the chart below) will likely worsen.

Delinquency Performance (Affirm Holdings, Inc.)

Guidance For 2022

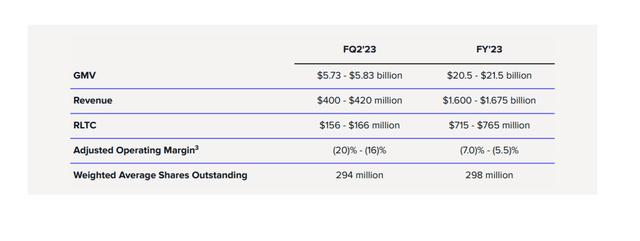

Only three months after releasing its initial guidance for fiscal 2023, the fintech lowered it. Affirm reduced its forecast from $1,625 million to $1,725 million to $1,600 million to $1,675 million, a 2% decrease at the midpoint of guidance. A 2% decrease in sales guidance is not normally a big deal, but this changes when a company is already struggling.

Affirm’s sales increased 55% YoY in the fiscal year 2022, but the outlook for the fiscal year 2023 shows only 21% growth at the midpoint of guidance.

Revenue Guidance (Affirm Holdings, Inc.)

Affirm Most Likely Overvalued

The market expects only 22% sales growth this year (in line with Affirm’s guidance) and 30% growth next year, so analysts expect only a slight improvement in growth prospects, and that’s before the U.S. economy enters a recession.

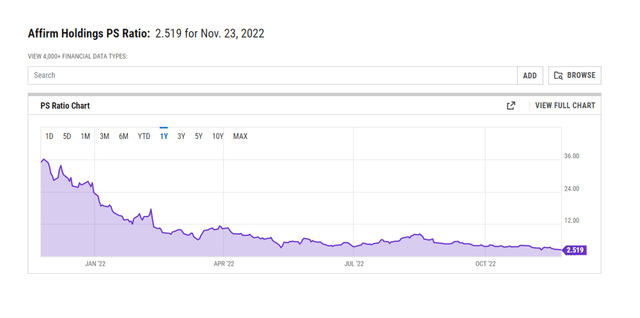

In my opinion, Affirm will never be able to return to 50% annual growth rates in the near future. AFRM’s sales multiple is currently 2.5x, making the stock overvalued given its widening losses and rising delinquencies.

Why Affirm Holdings Could See A Higher Valuation

For Affirm to be valued higher, delinquency trends must improve and consumer pressure must be at least maintained. The fintech is heavily reliant on sales growth to justify its high valuation, and the current business trajectory suggests that the fintech will struggle to persuade investors to pay a premium multiple for its growth. Delinquencies and loan defaults, in my opinion, will worsen if the U.S. economy enters a recession.

My Conclusion

This year, Affirm has lost a terrifying 87% of its valuation as the pandemic faded and investors likely realized they had overvalued high-growth fintechs with massive losses.

Affirm reduced its full-year sales forecast to $1,600 to $1,675 million. I believe that delinquency trends will worsen in the future, especially if a recession adds to consumers’ economic pressures.

With inflation also proving to be a persistent annoyance, I believe we will have to count down even further.

Affirm is currently trading at $13, and the stock could fall much lower if the U.S. economy enters a recession next year and a larger share of consumers begins to default on their BNPL obligations.

Be the first to comment