Wagner Meier/Getty Images News

Investor Bias And Emerging Markets

The numbers make Petrobras (NYSE:NYSE:PBR) a glaring value, but in a modern, global market, can value hide in plain sight? We believe that investor bias, as well as the fear-greed cycle means value often does hide in plain sight. The S&P 500’s outperformance over the past 10 years has led investors to jump aboard the hype train. Meanwhile, Emerging Markets are far less expensive and offering far greater long-term returns. The recent actions of Putin’s Russia have caused investors to paint the entire asset class with the same brush. But, the world is not black and white.

Investors often allow their minds get clouded by either the risk or the reward, and forget that successful investing involves a weighing of the probabilities. In Charlie Munger’s famous speech on human misjudgment, he highlighted “the non-mathematical nature of the human brain.” If one is playing a game based on what they feel is best, rather than weighing the probabilities, they’re likely to lose in the long-run. We believe the market’s clouded its mind with risks when it comes to Petrobras.

The Hidden Catalyst

The hidden bull for Petrobras and broader Emerging Markets is reversion to the mean in global currencies. In a total fear reaction, global funds have flown into the U.S. dollar of late. While the dollar is seen as a “safe haven,” the United States has near record government debt to GDP of 122%. If this trend continues any further, the U.S. will join the likes of Japan, Venezuela, and Sudan, at the very top of this list. The “DXY U.S. Dollar Index” shows us the relative strength of the U.S. dollar in relation to global currencies. History has shown that this level of U.S. dollar strength is unsustainable:

DXY US Dollar Index (CNBC)

The Brazilian Real has fallen off a cliff compared to the U.S. dollar. In fact, today a Brazilian Real will get you just 19 cents USD, whereas, in 2011, it got you triple that amount (60 cents). If this should ever revert to the mean, the outperformance of Petrobras and Emerging Markets could be violent.

The Fundamentals Are Strong

Petrobras’ net income by segment:

| Segment | 2021 (US$) | 2020 (US$) |

| Exploration & Production | 23.35 Billion | 4.48 Billion |

| Refining, Transportation, & Marketing | 5.75 Billion | 0.11 Billion |

| Gas & Power | (0.21) Billion | 0.82 Billion |

| Corporate & Other | (7.31) Billion | (4.67) Billion |

Source: Image created by author with details from company’s annual report.

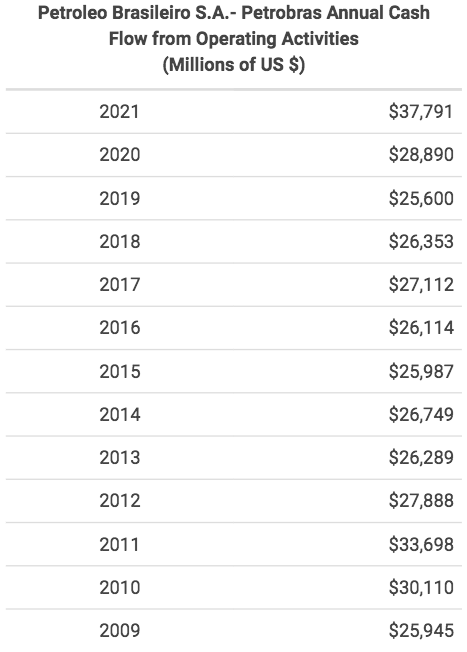

Petrobras doesn’t have an industry leading downstream business, but it does have a fairly integrated model. If the company can reduce costs in its corporate and other segment, it would boost profit even further. The company’s net income has made wild swings over the years, reporting both huge losses and huge profits. But, Petrobras’ underlying cash flow from operations has been remarkably consistent, which tells you this is a healthy business.

PBR’s Net Income (Macrotrends)

PBR’s Operating Cash Flow (Macrotrends)

The balance sheet for PBR is relatively healthy as well, with $10 billion of working capital and a manageable $44 billion of long-term debt and capital lease.

The Valuation

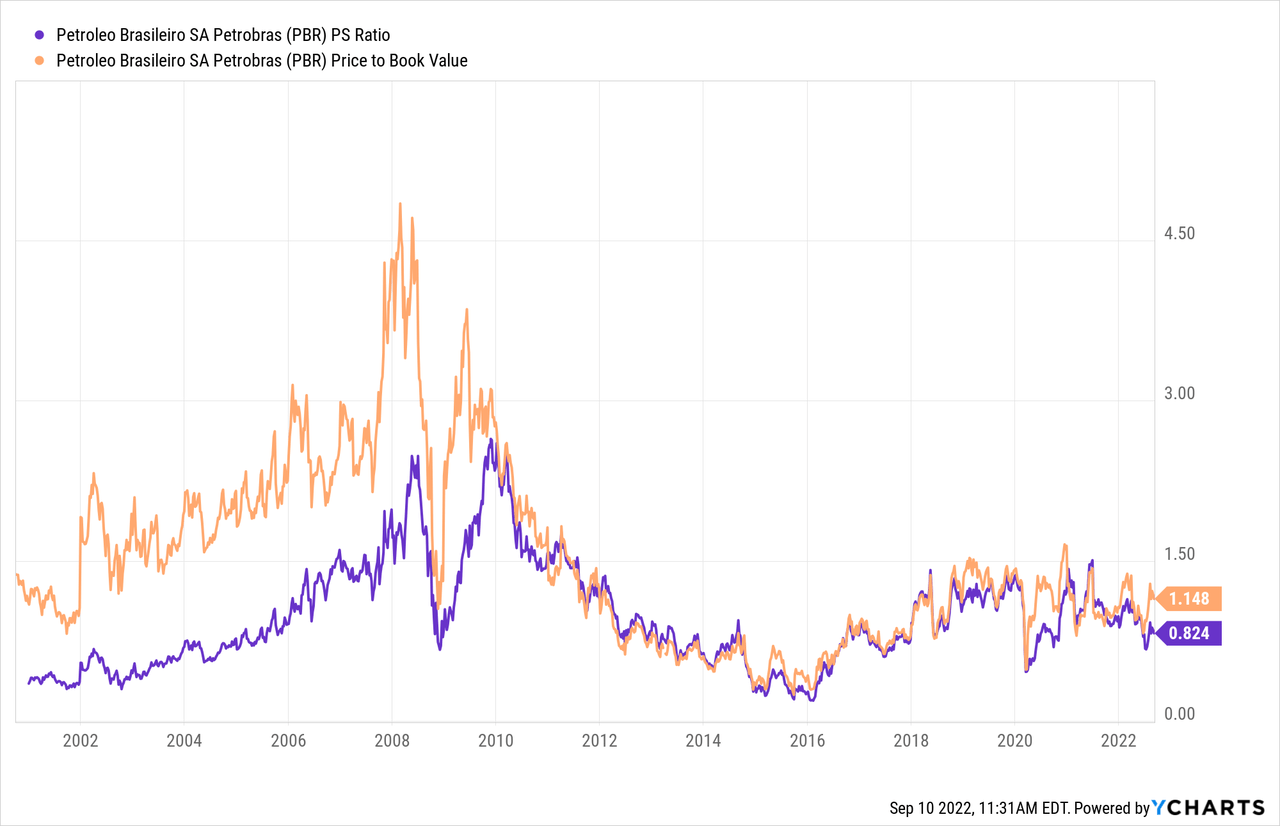

From a valuation standpoint, PBR is more expensive than it was in the depths of the 2016 commodity bear market, but less expensive than it was during the commodity bull market of the late 2000s, early 2010s:

We know that Petrobras is far less expensive than its American counterparts, so, let’s compare it to our favorite global oil play, TotalEnergies (TTE), out of France:

| As of Sept 10, 2022 | Petrobras (PBR) | TotalEnergies (TTE) |

| Forward P/E | 3.1 | 4.4 |

| Price to Book | 1.1 | 1.1 |

| Free Cash Flow Yield | 43 % | 19 % |

| Dividend Yield (Forward Estimate) | 8.1 % (Plus Special) | 5.5 % |

| Working Capital | $10 Billion | $27 Billion |

The takeaway here is that PBR is even cheaper than our favorite equity in the global oil sector. It’s very difficult to lose money on an investment with a 43% free cash flow yield.

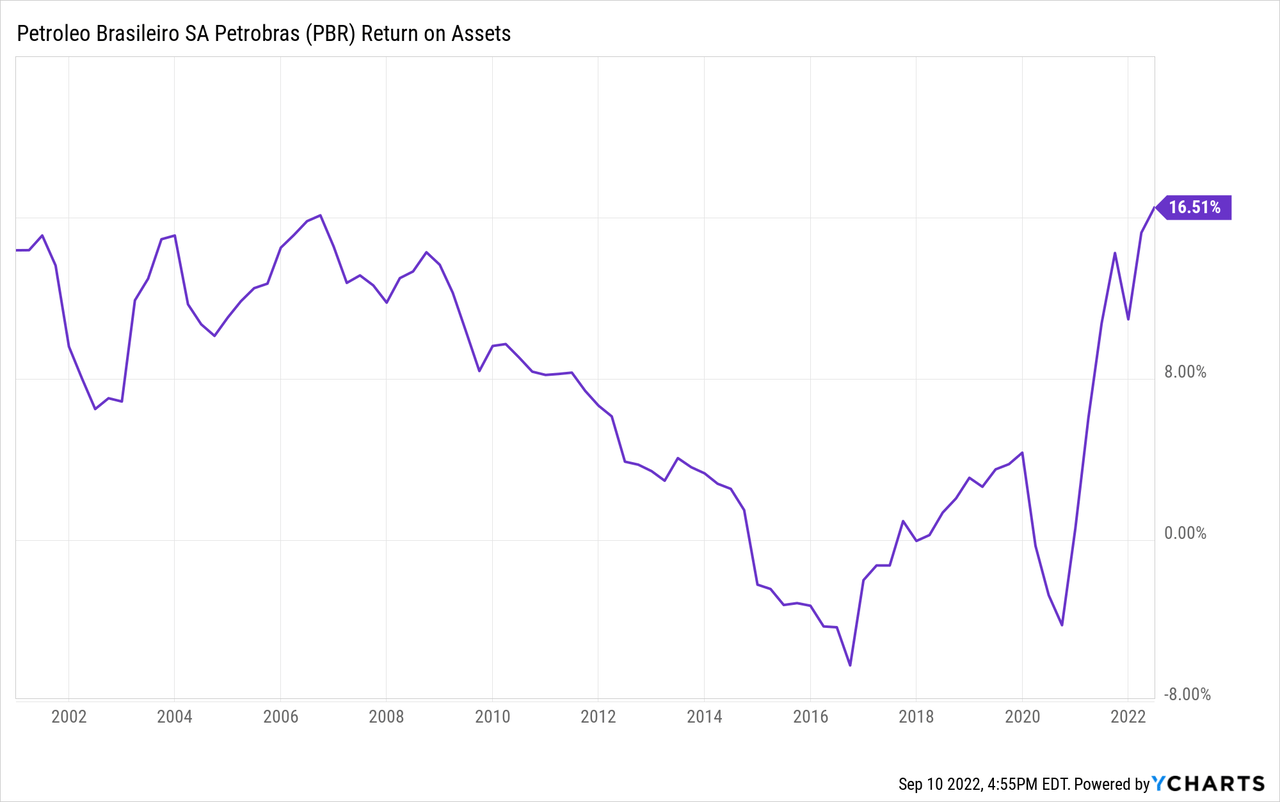

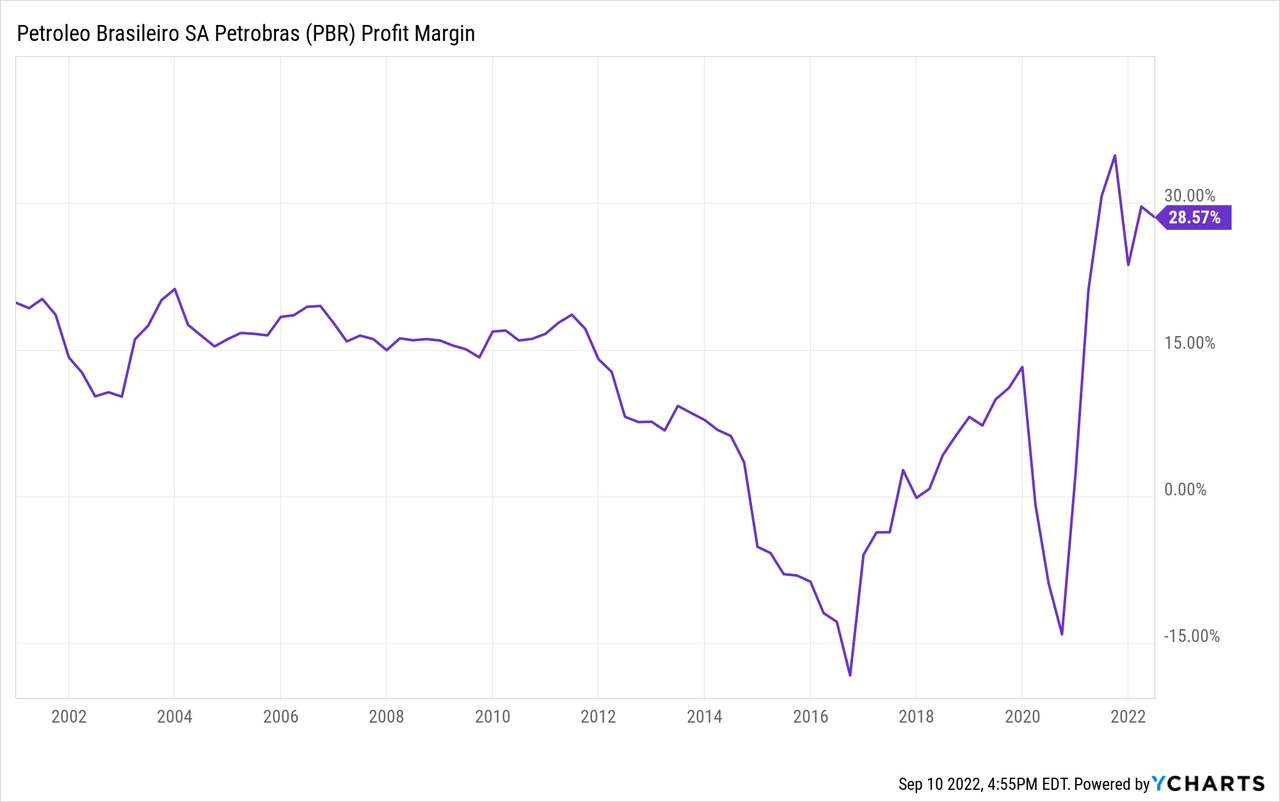

However, investors need to understand that Petrobras is currently over-earning on both a profit margin and return on assets basis. This is due to high oil prices:

We’ve smoothed out PBR’s earnings, analyzing its average ROA, profit margin, and free cash flow, as well as what the company would earn at $75 per barrel Brent Crude. Combined, this gives us normalized earnings of $17.4 billion ($2.67 per share). In other words, PBR has a normalized PE of just 5.2x.

Our 2032 price target for PBR is $35.30 per share, implying returns of 17% per annum with dividends reinvested. Keep in mind, this is a base-case scenario.

- We believe Petrobras is capable of growing its normalized EPS ($2.67 per share) at 4.5% per annum. We’ve used The Balance’s estimate of roughly $95 per barrel Brent Crude in 2032. Petrobras can grow its earnings further by improving efficiencies and acquiring assets. This gives you 2032 earnings of $4.15 per share. Petrobras has dwindling oil reserves (9.88 billion barrels of oil equivalent) and has underinvested in renewables. We worry the company will enter major decline at some point in the 2030’s as the world continues to transition to electric vehicles and the company begins to run out of oil. We’ve assigned a terminal multiple of 8.5x.

The Dividend Policy

The dividend yield for PBR is variable. The company’s committed to paying out 25% of its adjusted net income, at a minimum. Petrobras also stated it will pay special dividends, representing 60% of free cash flow, whenever their gross debt is less than $60 billion. The company’s gross debt currently sits at $53.6 billion. In other words, the special dividend will continue for the meantime, but it’s no guarantee long-term.

So, Why Is Petrobras So Cheap?

The company is audited by one of the world’s big four accounting firms and follows IFRS accounting standards. The numbers should be legit, so what’s going on here? Well, the Government of Brazil owns 29% of the company, and doesn’t have the greatest track record. In the Petrobras scandal of 2014, government officials collected billions of dollars in bribes from Petrobras. The company was buying their votes to push forward shady business operations. These shady operations cost investors another $12.5 billion of misallocated cash.

We believe investors are being fully compensated for Brazil’s political history. But, these political risks layer into the long-term risks of dwindling oil reserves and a transitioning industry. Investors should weigh a Petrobras holding accordingly.

In Conclusion

When it comes to Petrobras, the market has set its eyes squarely on the risks, but the mathematics point to huge total returns. Here’s some advice legendary investor Sir John Templeton passed on to Bill Miller:

There are only two types of investors, those who are outlook and trend investors and those who are price and value investors. 90% of people are outlook and trend investors.

When the outlook is scary, but the value is favorable, that’s the time to buy. We have a “Strong Buy” rating on Petrobras. Just don’t go all-in. With the vicissitudes of the world economy, anyone can draw the short straw.

Be the first to comment