kosmos111/iStock via Getty Images

Aquestive Therapeutics (NASDAQ:AQST) has been making moves to maximize the value of the company’s assets in order to generate additional cash that can be used to help with the development of their epinephrine candidate, AQST-109. The company has made significant progress with AQST-109 over 2022, with positive results from both the company EPIPHAST I and EPIPHAST II studies. It is obvious that AQST-109 has become Aquestive’s lead asset and the company is pushing their chips behind its clinical and commercial success. I believe this is the right move for Aquestive and will continue to add to my AQST position.

I intend to provide a brief background on AQST-109 and will review the company’s efforts to prioritize its development. In addition, I will discuss my views on their recent efforts and the path forward. Then, I point out some leading downside risks that AQST investors should consider when managing their position. Finally, I present my plan for adding to my AQST position

Background on AQST-109

Aquestive’s AQST-109 anaphylaxis program has been the focal point of my bullish view thanks to its prospective advantages over contemporary auto-injectors. First, AQST-109 has the potential to be the first and only oral epinephrine product as a sublingual film. Not only is a sublingual formulation allow for rapid absorption, but it also alleviates some of the issues associated with injectors such as fear of needles that cause improper administration or delayed dosing. In addition, the sublingual film packaging is about the size of a postage stamp allowing for easy storage and transport to improve compliance.

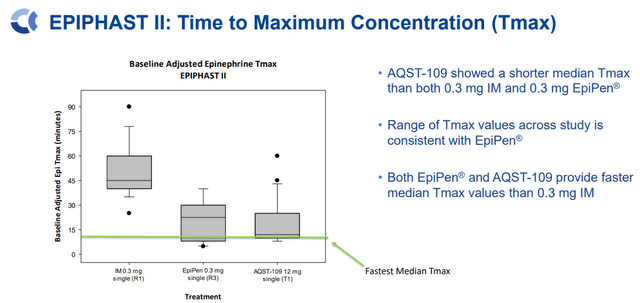

Thus far, Aquestive has reported imposing data that revealed that AQST-109 has rapid absorption and uptake with a Tmax of 12 minutes and maximum modifications to both systolic blood pressure and heart rate coming in under 10 minutes.

AQST-109 Tmax Vs. EpiPen and IM (Aquestive Therapeutics)

In situations where a second dose must be administered, AQST-109 had an even faster median Tmax for the second dose of 8 minutes.

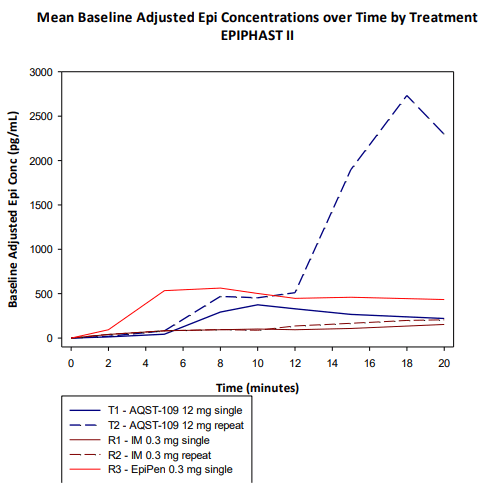

AQST-109 Cmax with Repeat vs. EpiPen (Aquestive Therapeutics)

Perhaps most importantly, AQST-109’s Tmax levels are comparable to EpiPen, and data from the EPIPHAST study displayed how AQST-109 could be a rescue medicine in an assortment of circumstances.

Aquestive has made some progress with the FDA and received an end-of-Phase II written response for CMC last month. Aquestive said they “were pleased with the FDA’s responses and believe we have a clear path forward” and “will be meeting with the FDA in an end of Phase II clinical meeting later this quarter and should be able to announce the results of this meeting prior to the end of the year.” Hopefully, the company will have some additional details on a timeline for AQST-109 beyond the goal of launch in the “U.S. as early as 2024.”

If approved, AQST-109 would be entering a sizeable market of over 40M Americans that “are at risk of experiencing a severe allergic reaction, including anaphylaxis,” which creates a $1.5B market with more than 3.5M scripts being filled for epinephrine auto-injectors last year.

Turning Their Efforts To AQST-109

In my previous AQST article, I pointed out some indications that the company was turning their focus away from neurology, and was directing our attention to AQST-109. The company appears to be fully committed to AQST-109 after out-licensing Sympazan along with other approved products and is “refocusing” the company’s “commercial leadership onto the launch of AQST-109.” In fact, Aquestive has already begun the outreach into the allergy community and established a scientific advisory board. Moreover, Aquestive has submitted abstracts to future medical meetings and intends to present three abstracts at the American College of Allergy, Asthma, and Immunology Annual Meeting. All these efforts should help Aquestive increase awareness around AQST-109 and help the company prepare for launch.

To help fund AQST-109, Aquestive has pulled in over $25M in licensing from three distinct licensing agreements. The company just signed an agreement with Haisco for Exservan for ALS treatment in China, which includes $10.5M in payments. Aquestive also secured a $3.5M upfront cash payment with Pharmanovia, for Libervant for the European Union and the United Kingdom. What is more, Aquestive has a licensing deal with Assertio for Sympazan, which entails an upfront payment of $9M and a $6M milestone payment for a long-term supply agreement for Exservan. These licensing deals will bring in near-term non-dilutive funds to support operations while eliminating the cash burn of Sympazan’s commercialization as a standalone product.

In addition to these licensing deals, Aquestive still has Libervant in play as the company continues to work with the FDA to confirm that they have a well-defined threshold for the orphan drug block. Aquestive mentioned they have delivered a planned protocol for a head-to-head study with Valtoco and are anticipating a response from the FDA. Aquestive could explore out-licensing opportunities for Libervant, which could provide a substantial upfront payment, as well as milestones and royalties.

The company’s recent licensing deals along with their cost savings initiatives is a sign they are driving their energy into AQST-109. What is more, the company still has their remaining ATM along with other non-dilutive funding to push AQST-109 through the FDA and onto the market.

My Thoughts On The AQST-109 Storyline

It appears as if Aquestive is attempting to maximize their opportunities to generate non-dilutive cash with the company’s remaining levers to help fund the advancement of AQST-109. The company’s partnership or licensing deals has bolstered their cash position and the company had more cash at the end of Q3 than at the end of Q2. This should encourage investors to look forward to the upcoming FDA end-of-Phase II meeting, and subsequent pivotal trial for AQST-109. Eventually, a streamlined Aquestive will be moving down a defined path to a potential approval in a strong $1B market that is comprised of antiquated products. Aquestive has the chance to disrupt an entrenched market that is in dire need of some progress, and AQST-109 might be the product that changes how we treat severe allergic reactions. Clearly, we don’t know if AQST-109 will be a success, but the prospects of disrupting this market could make Aquestive an attractive investment or acquisition target. At the minimum, the ticker should be “in play” as we move closer to a potential approval date, thus, allowing investors to manage their positions.

Downside Risks

The company’s efforts to generate cash and reduce expenses might have a positive impact in the future, however, the company’s recent quarterly performance indicates that AQST investors need to be prepared for a potentially rough ride in the near term. The company’s total revenues were $37M thus far in 2022, which is down from $39.8M for the same period in 2021. The company might have a great plan and could be on the way to a transformative event, but the fact remains that their earnings are not a highlight as they are still reporting net losses. Moreover, Aquestive finished Q3 with only $18.6M in cash and cash equivalents, so investors need to accept there is a possibility the company will have to rely on some form of dilutive funding to get AQST-109 across the finish line despite their best efforts to avoid dilution.

The AQST-109 storyline does have some other risks to consider, including regulatory failure, payer support, and competition. Although AQST-109 has performed well in the clinic thus far, it is possible the FDA will not give the candidate the green light the first time around.

Considering these downside risks, I have assigned AQST a conviction level of 3 out of 5, and the ticker will stay in the Compounding Healthcare “Bio Boom” Portfolio.

Still a Top Idea

AQST has been one of my “Top Ideas” in my Compounding Healthcare Seeking Alpha Marketplace Service since Day 1 for a number of reasons. First, the company’s PharmFilm technology has distinct advantages over other routes of administration and has produced multiple FDA-approved products. Second, the company has multiple revenue streams and a history of making deals. However, my bullish conviction on the AQST thesis has been fixated on the company’s discounted valuation, which is still trading at a considerable markdown for its estimated sales.

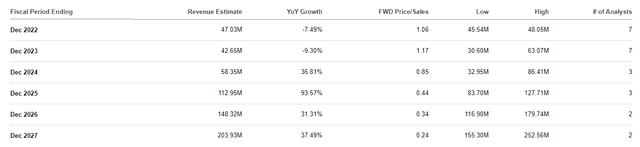

Aquestive Therapeutics Revenue Estimates (Aquestive Therapeutics)

For 2022, the Street is projecting Aquestive will record ~$47M this year, which is approximately 1x price-to-sales and 1.83x EV-to-sales. The industry’s average price-to-sales is 5x and EV-to-sales is 4x, so, we can say AQST is undervalued for its expected 2022 numbers.

If AQST was trading at the industry’s average, it would be around $4.30 per share for this year’s revenue estimates. If Libervant and AQST-109 are approved, we should expect the company to experience a sharp increase in their revenue. Looking at the Street’s estimates, we can see analysts are forecasting strong double-digit growth starting in 2024 and will continue to report growth through 2027 where they expect the company to report over $200M in revenue. Obviously, this level of revenue growth would amplify AQST’s discounted label at this time.

My Plan

In my previous AQST article, I deliberated on how I was going to “remain aggressive with my cost-average strategy despite the uncertainties. I will continue to accumulate under the buy threshold of $2 per share and will increase my share sizing if the share price returns to under $1.05 per share.” Furthermore, I was also going to “increase my sizing if the results from the EPIPHAST II study show AQST-109 has at least equal to EpiPen, or the company reports that the FDA is in support of their comparative study for Libervant.” Well, I haven’t really touched my AQST since my previous article due to the overall market providing numerous other trading and investment opportunities that are hard to pass by. However, I am still keeping a close eye on AQST as we approach the end of the year, which is when we could hear an update on AQST-109 and Libervant. Once we get an update, I will wait for the volatility to subside and will recommence my accumulation process.

Long term, I am still devoted to maintaining an AQST position for at least five more years in anticipation that the company will get AQST-109 through the FDA and quickly move to profitability.

Be the first to comment