Douglas Rissing

The iShares Exponential Technologies ETF (NASDAQ:XT) is an ETF that purportedly invests in major, disruptive trends that are likely to displace lots of current industry and be major sources of economic and social value. The ETF is very dispersed in terms of specific securities, and while the diversification makes it difficult to concretely analyse, the broad buckets in which the stocks fall are going to be levered substantially to general market forces. This ETF will respond substantially to whatever happens on Wednesday when the Fed will speak on the tenor of rate hikes to be pursued now that inflation might be able to peak. We think markets are not going to like what the Fed has to say, but you never know how far the market is going to look, and the situation with the yield curve leaves room for a positive reaction too.

XT Breakdown

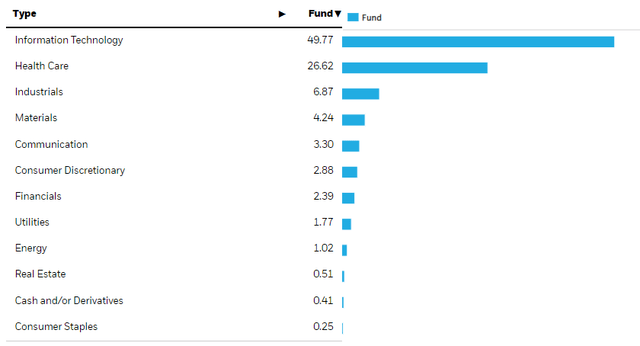

We have discussed the XT ETF in the past, and beyond the fact that it addresses some very sexy market themes, we note that the profile of many of its stocks, especially those in the healthcare allocation (26% of the portfolio), are going to be reflexively exposed to the fortunes in the equity markets. In other words, many of these healthcare stocks are not large biopharma companies, but smaller pharma companies that really only have or two patents, or are still in the process of getting approval.

Sector Allocations (iShares.com)

The other major exposure is the IT exposure. Here we have a lot of stocks that would be more akin to industrial but are supported by both EV trends and direct EV subsidies, or the general electrification and renewable energy trend like US solar companies. But there are other more typical tech exposures too like a host of cloud stocks, like Arista Networks (ANET) and VMware (VMW). While the cloud companies tend to be very profitable, some of the smaller tech and renewable energy exposures are more sensitive to capital markets due to either their earlier stage profile or capital intensity. While reflexivity is less of an issue for these stocks, they’ll generally have a higher Beta, and that is well demonstrated by the portfolio’s overall 25% YTD decline.

Bottom Line

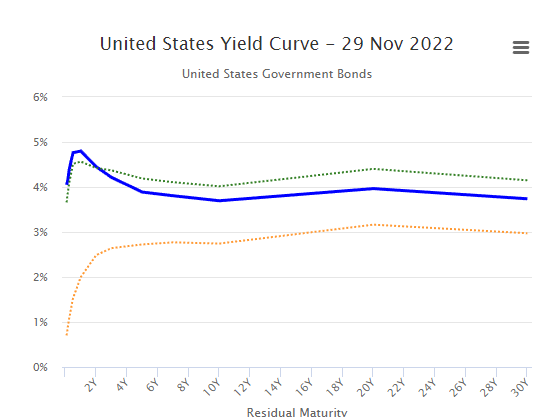

On Wednesday we are going to hear from the Fed regarding plans for monetary policy. The market rallied when CPI growth paused as markets hope that Powell is going to announce space for slowed rate hikes, or hopefully smaller rate hikes already. The issue is that inflation expectations need to be nonexistent for the Fed to be satisfied, that is what indeed the Fed has said itself in previous meetings. In other words, there is no guarantee yet that inflation rates couldn’t still propagate by the wage-price spiral. Therefore, rates are going to rise, likely 75 bps in our view, another couple of times until rates exceed 6% in the yield curve for the next couple of years.

However, the yield curve has an extreme shape; high rates are expected for many years out. With many cost push factors easing, we have seen CPI peaking, and if the Fed indicates that it will take care of the economy once the back of inflation is broken, these longer-term expectations may ease, and this may be the basis for the market to revalue meaningfully on Wednesday. Since discounts are to a higher power in later years, longer-term rate expectations are much more important than the shorter term expectations. There is room for a market bounce on Wednesday if the Fed moderates its language regarding coming years, and seems more willing to respond to the state of markets. We don’t think that will happen, but if it were to happen, XT would be a good way to speculate on the market bounce while also being able to hold longer-term if necessary a higher growth portfolio, which has gotten a major discount now.

Yield Curve US (wordlgovernmentbonds.com)

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment