Teka77/iStock Editorial via Getty Images

Vonovia (OTCPK:VONOY) (OTCPK:VNNVF) is Germany’s leading residential real estate company. Vonovia currently owns and manages ~550k of residential units mostly in Germany but with some apartments also in Austria and Sweden.

Whilst rental income from holding residential apartments is its main business, it also has additional segments that include:

1) Property development segment

2) Recurring sales (disposal of non-core apartments)

3) Value-add services (e.g., craftsmen, media, etc.).

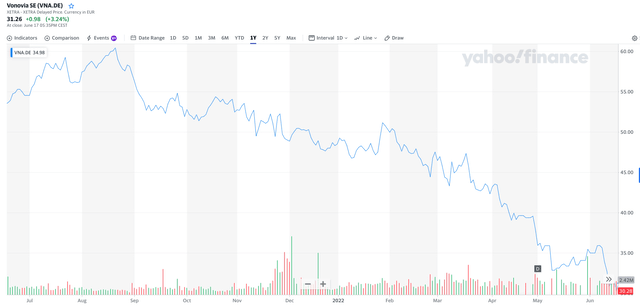

Vonovia is currently trading at less than ~0.5x of net asset value whereas historically it traded around its book value. Also, note the forward dividend yield is expected at ~6%.

Vonovia’s primary listing is on the German XETRA. I recommend buying in the German market as opposed to the much less liquid ADRs.

The share price in the last year has declined precipitously, as can be seen from the below:

Even though the underlying business momentum is strong and FCF and dividends per share are expected to grow at a strong double-digit in 2022, the share price gapped down.

(All charts in this article are from Vonovia Investor Relations Website)

What is driving the decline in the share price?

In short, it is interest rates and inflation, and market perception that its business model is broken beyond repair (more on this later).

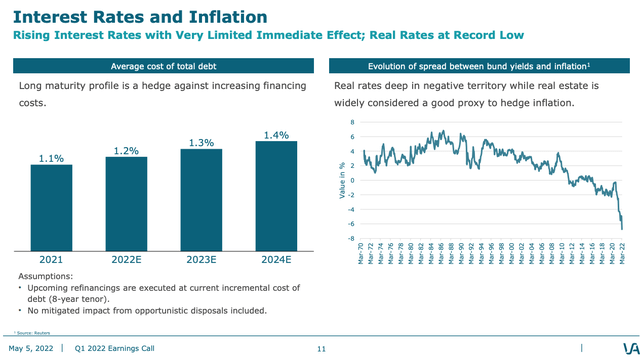

As can be seen below, the German bund has, unprecedently so, gone from negative rates to ~+1.7% in a matter of months.

And so did Vonovia’s funding cost which currently ranges anywhere between 3.5% to 4.5% compared with its current cost of debt of 1.1%.

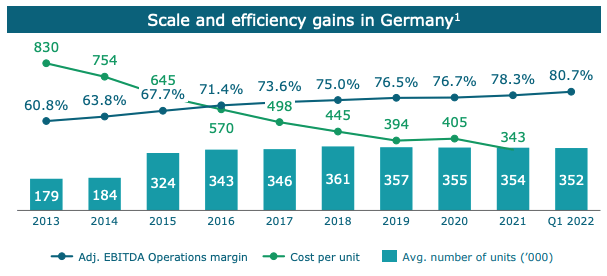

In the past Vonovia’s business model was reliant on debt-funded M&A and the acquisition of apartments (including build-to-hold apartments). It enabled scale and industry-leading cost efficiency per unit and margins as can be seen from the below chart.

Vonovia Investor Relations

Given the gross initial yield on apartments in Germany is ~3.5%-4%, this no longer makes economic sense. The old model of debt-funded acquisitions of apartments is no longer economically viable.

Additionally, Vonovia also invests in the modernization of apartments, the initial yield on these (according to Vonovia) are 5% to 8%. These are reasonable returns but still with a cost of debt of ~4%, are not that accretive if debt-funded (therefore, going forward Vonovia intends to fund these from free cash flow).

So, in a nutshell, this is the primary issue and the culprit for the share price decline. The increased cost of debt renders its current business model simply untenable.

Management has to pivot to another business model and/or deleverage (but more on this later).

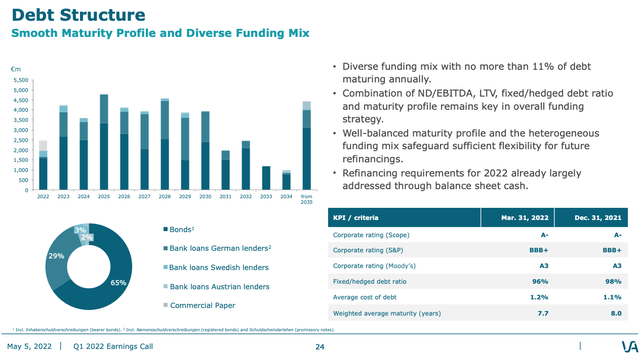

The Debt Structure

Vonovia’s debt structure is shown below:

Even though Vonovia’s cost of debt has risen significantly, the impact near term seems quite manageable.

2022 refinancing needs are financed from existing cash on the balance sheet. The 2023 refinancing events will also likely be met (at least partially) from the disposal of the non-core health care portfolio (which is not factored in the projections above).

So, the takeaway is the next few years, the impact of rising interest rates is not likely to be material.

Management also clearly indicated that it will not raise any incremental debt either. Simply put, no more organic (i.e., build to hold) or inorganic purchases (M&A) given the prohibitive cost of debt for the group.

Rental income growth and inflation

The German residential property market is a highly regulated one.

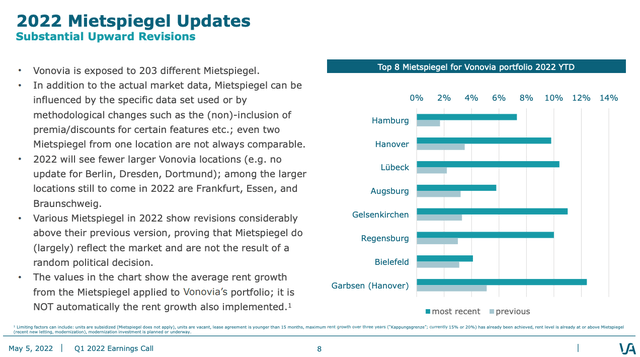

Rental agreements are evergreen and are not renewed on a periodic basis and are mostly governed by the Mietspiegel system. Mietspiegel are rent indexes that are published every two years and are calculated on the basis of rent levels agreed for comparable apartments over the last six years.

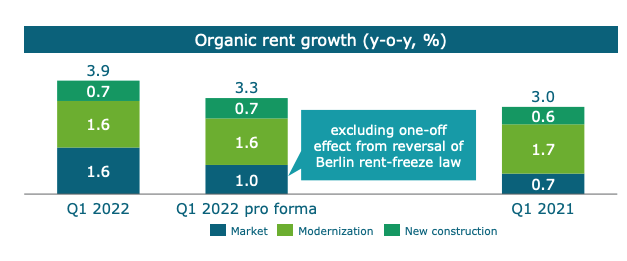

The key takeaway is that inflation gets factored in the rent but with a lag. In the past, the Mietspiegel typically resulted in ~1%-1.5% rental growth per annum given very low inflation in the Eurozone. However, the recently published Mietspiegels indicate a much more significant upward revision in the rental market (as can be seen below).

Vonovia can also accelerate the recognition of inflation of rental income by applying the Index rents method (which is also applicable in Germany alongside the Mietspiegels). Under this method, rents are adjusted annually in line with the Consumer Price Index (“CPI”). In the past, this was not advantageous to landlords given the low inflationary environment, but this has obviously changed now. Vonovia estimates that ~140k of its German apartments would benefit from being on Index rates and thus will, over time, look to transition to this methodology opportunistically.

So, the key takeaway is that Vonovia is likely to experience significantly higher growth in rental income than previously, but with some lag.

The current composition of rental income growth for Vonovia is as follows:

Vonovia Investor Relations

Going forward, the contribution from new construction will likely dissipate given that newly built apartments will no longer be retained (due to the high cost of debt). However, it is expected that the Market component (i.e., organic rental growth) will accelerate and more than offset the loss in New Construction. Modernization contribution will remain but funded from free cash flow as opposed to debt.

The book value

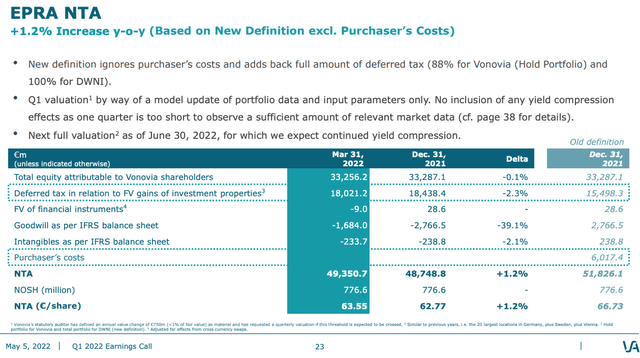

As of Q1’2022, Vonovia’s Net Tangible Assets (“NTA”) is computed as EUR63.55 per share. The current share price hovers around ~EUR31.

However, a large part of the NTA comprises the deferred tax liability on the fair value of investment properties. In other words, the tax liability if all properties were sold at book value instantaneously (will come back to that later).

The fair value of assets is understated on the balance sheet

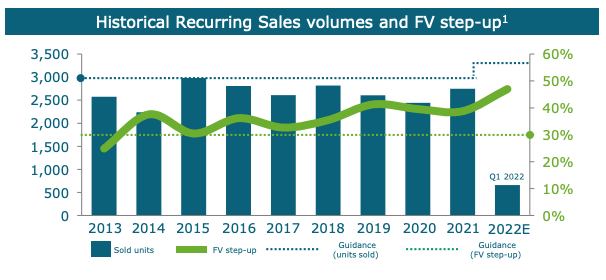

Vonovia has been routinely disposing of apartments at ~40% premium to book value. This can be seen in the below chart:

Vonovia Investor Relations

It is fairly clear that the value of the assets (apartments) is understated on the balance sheet due to its conservative valuation methodology.

So, the obvious question is why wouldn’t Vonovia sell more units at a premium to book value and then buy back shares at less than 0.5x NTA?

I think this is a possible outcome given where the share price is at the moment and may be announced in the next few months.

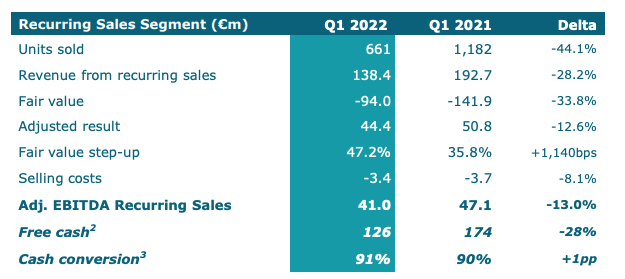

Of course, the other matter that needs to be taken into account is the tax liability and some insights can be gleaned from the recurring sales segment:

Vonovia Investor Relations

In Q1 2022, Vonovia sold 661 units with a fair value (i.e., book value) of EUR94 million and generated free cash flow (post taxes and selling costs) of EUR126 million. In other words, its cash conversion from assets disposals is well above the book value (cash generated equals 1.34x asset value).

I am not sure whether this can be extrapolated to the rest of the portfolio as the sold assets may have had specific tax attributes (e.g., high-cost base) that made them attractive for disposal. Nonetheless, it demonstrates the value that can be generated by a more aggressive recurring sales program which can be used to arbitrage the capital structure (sell assets above book value and buy back shares at a 50% discount to book).

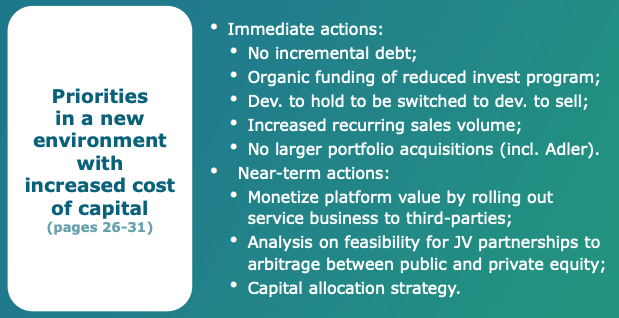

Management response

Vonovia’s management understands that it needs to reinvent the business model. The current cost of debt is prohibitive and is forcing the issue.

Vonovia Investor Relations

The immediate actions are straightforward and ensure Vonovia no longer funds in the capital markets or raise incremental debt.

The near-term actions are more profound. Vonovia is exploring a capital-light model where it manages properties on behalf of others. Vonovia has a significant cost advantage given its large scale and its AUM percentage cost is estimated at only 0.2% compared to the typical industry standard of 1% AUM.

The most interesting aspect is the JV partnership potential with insurance companies and pension funds. The key advantage is the ability to dispose of assets (or part of) in a sizeable transaction but importantly one that does not crystalize a tax liability. This should enable Vonovia to raise significant cash for both share buybacks as well as debt repayments. Importantly, Vonovia will remain the manager of the properties and generate ongoing management fees and retain its key competitive advantage of scale and efficiency.

Final thoughts

Mr. Market is frightened of the high cost of debt and concluded that Vonovia’s business model is completely and utterly broken beyond repair. This is the key reason why it trades below 0.5x its NTA.

The market is also skeptical whether organic rental growth will manifest anytime soon.

Management was caught flat-footed as well. It took them a while to understand what inflation really means to their business model and react. After all, for the last decade or so, they were so accustomed to exceptionally low inflation.

This is a brave new world for both analysts and management. The good news is that Vonovia has much flexibility and many levers to pull to manage through this.

It is clear that it needs to dispose of assets given its cost of debt, but it has time to do so optimally given limited refinancing events in the next few years.

The JV option is clearly optimal if viable. The fallback option is to sell more units selectively at a premium to book and recycle capital to higher return opportunities (modernization investments, share buybacks, and debt reduction).

It is also in a very strong position to drive a capital-light asset management/services business given its scale and efficiency.

Mr. Market is clearly over-reacting (partly urged by short selling by Bridgewater). I am very bullish and rate this as a strong buy currently.

Be the first to comment