pearleye/E+ via Getty Images

The traveler sees what he sees. The tourist sees what he has come to see.”― G.K. Chesterton

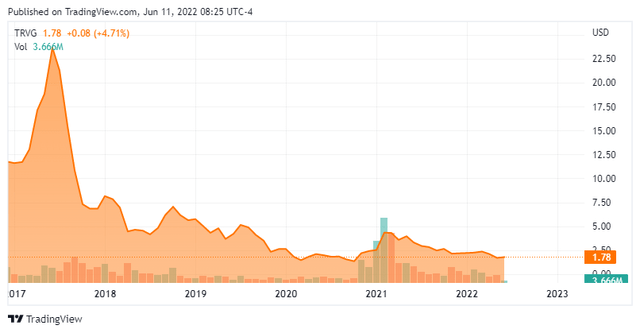

Today, we do a ‘deep dive‘ on a travel related concern whose commercials we all have seen as they inundate the airwaves. The stock has been a disaster for original shareholders as the stock is deep in ‘Busted IPO‘. With global travel starting to revive from the pandemic, can the shares rebound? We attempt to answer that question via the analysis below.

Company Overview

trivago N.V. (NASDAQ:TRVG) is based in Germany. It offers an online meta-search platform for hotels and accommodation through online travel agencies, hotel chains, and independent hotels. The company provides access to its platform through 53 localized websites and apps in 31 languages and covers approximately five million properties. Following the invasion of Ukraine, the company decided to discontinue our local Russian platform, which they expect to have an immaterial impact on its overall business. The company gets most of its revenue from advertising referral fees to the likes of Booking (BKNG) and Expedia (EXPE). Obviously the company was extremely impacted by the Covid pandemic which shut down and curtailed traffic in most of the world. The company used 2021 to further its cloud migration, roll out its CPA invoicing, and launch of their first new B2B products among other efforts to improve their business model.

May Company Presentation

The stock currently trades for just less than two bucks a share and sports an approximate market capitalization of $640 million.

First Quarter Results:

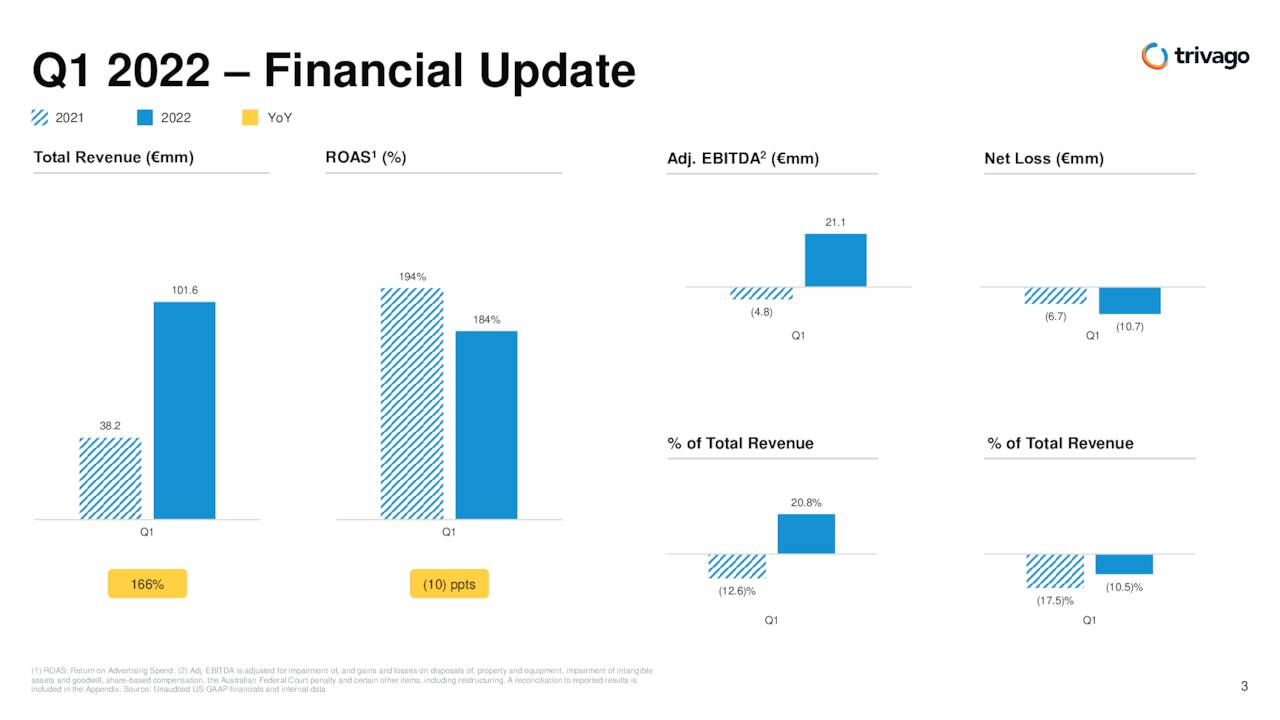

On May 5th, the company posted a net quarterly loss of -€0.03 on a GAAP basis in the first quarter. Revenues rose more than 165% on a year-over-year basis to €101.6 million as the company benefited from the lifting of travel restrictions over most of the globe.

May Company Presentation

As can be seen above, metrics improved across the board from 1Q2021 except for Revenue on Advertising Spend or ROAS.

Analyst Commentary & Balance Sheet

Current analyst sentiment has been abysmal on the stock since the first quarter’s earnings release. Six analyst firms including Wells Fargo and Citigroup reissued Hold ratings after quarterly numbers came out. Price targets proffered were between $2 to $3 a share. Only Mizuho Securities maintained its Buy rating on the shares, and it lowered its price target from $3.60 to $3.00 a share.

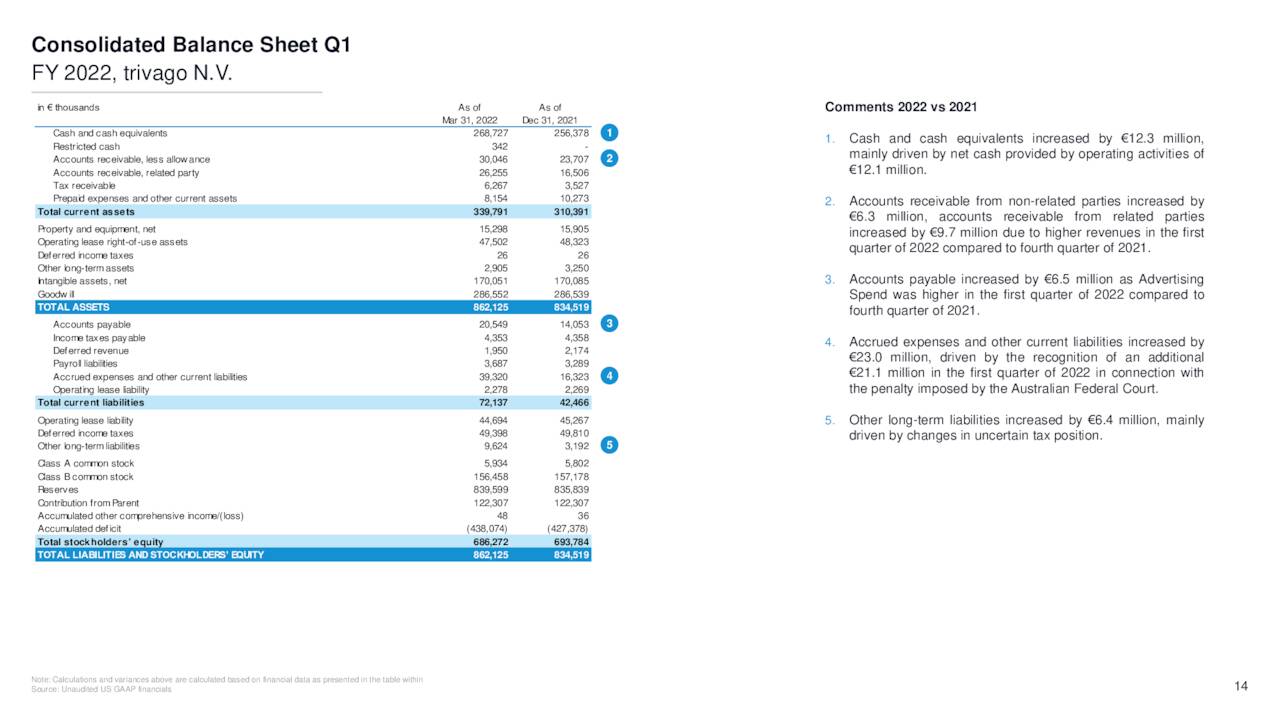

May Company Presentation

Less than two percent of the shares are currently held short. Total cash, cash equivalents and restricted cash on trivago’s balance sheet were €269.0 million as of March 31, 2022. The company has no long-term debt listed.

Verdict

The current analyst consensus has the company posting the slightest of profits in FY2022 as revenues rise nearly 60% to approximately $620 million. Revenue growth is projected to fall to some 25% in FY2023 with expectations of around a dime a share in profits.

Now leadership believes based on comments on their last earnings call that inflation may play to its advantage as the value of price comparison that they can bring to their users in the months and potentially years to come. That might be true, but soaring jet fuel costs may cause airline ticket costs to rise further curtailing travel demand. The same could said for the increased costs the hospitality space faces.

The Digital Markets Act in the European Union is also setting new standards for states that self-preferencing of own products will be restricted, particularly for accommodation metasearches. This should make it more difficult for search engines to steer traffic into their own metasearch products, which would help trivago’s business model, especially if these same rules eventually made it to the States.

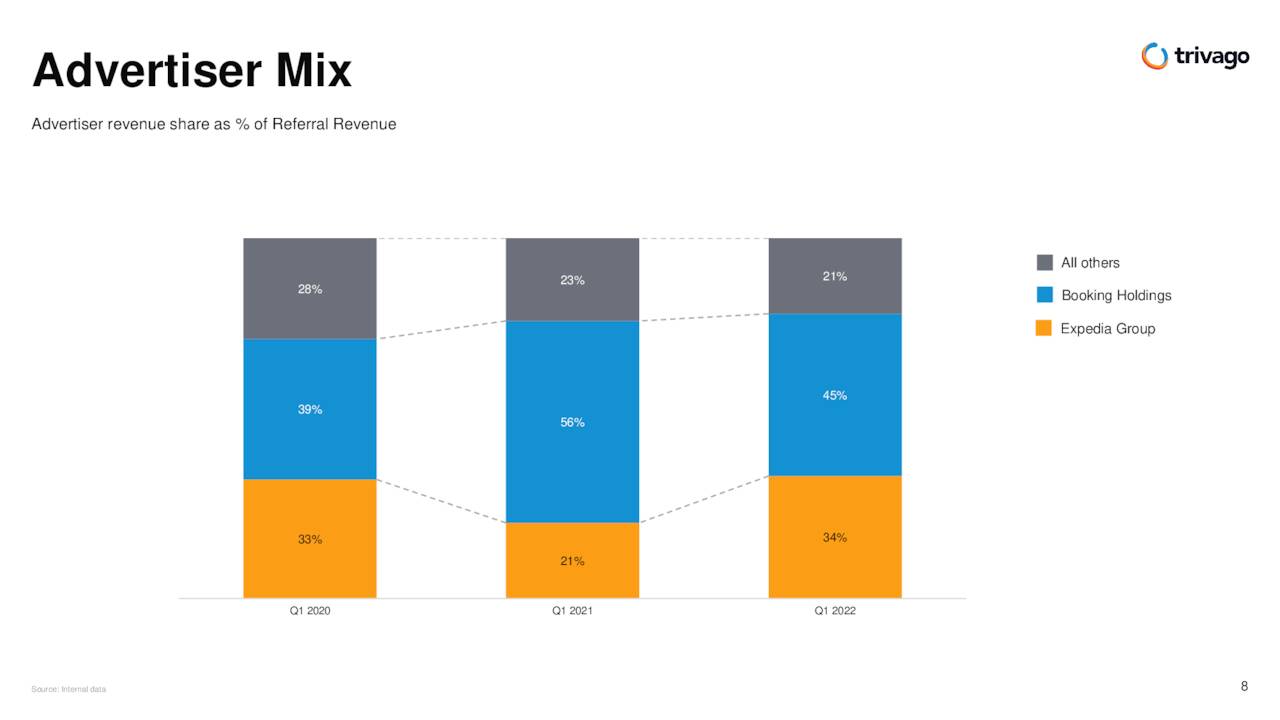

The company is very reliant on its revenues from two key customers, Expedia and Booking, which deserves some caution. In addition, while current revenue growth is impressive; it is coming off a once a lifetime pandemic. Sales growth is also not translating into profits with stock trading at 17 times FY2023’s projected earnings (which will go out the window, should a recession emerge). The company was having the same problem before the pandemic sans the sales growth as a Seeking Alpha article in 2019 went into.

The company seems to have made some nice progress over the past year, although information is somewhat harder to get than if it was a U.S. based firm. If I thought the global economy was accelerating, this is a name I would probably take a ‘watch item‘ position in. Unfortunately, my view is the country and most of the developed world has a high likelihood of entering into a recession over the next 12 months. Obviously, this will have significant impacts on travel demand. Therefore, I am going to side with the analyst firm views on this name and pass on any investment recommendation around it at this time.

Travel makes one modest. You see what a tiny place you occupy in the world.”― Gustave Flaubert

Be the first to comment