Justin Sullivan/Getty Images News

Thesis

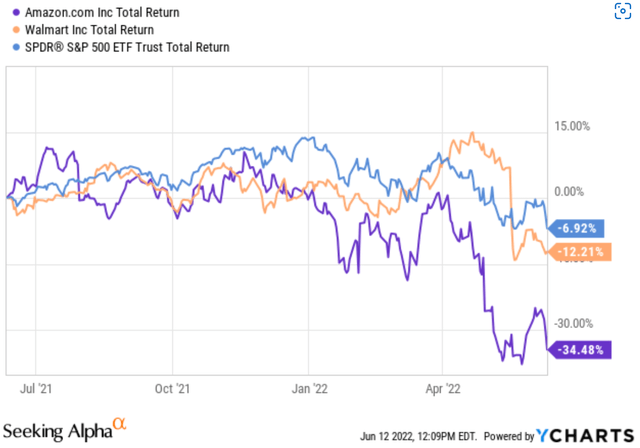

The thesis of this pair trade is quite simple. Both Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT) will be hurt by the ongoing inflation and especially record fuel costs. However, the damage will be uneven and WMT will fare better as a result. You can see the damage so far from the following chart. Both AMZN and WMT stock prices have suffered substantial declines. WMT lost more than 12% over the past 1-year period, and AMZN lost more than 34%. Both underperformed the S&P 500 by a good margin. Looking ahead, I see the negatives have already been fully priced in for WMT, but not for AMZN, for the following reasons.

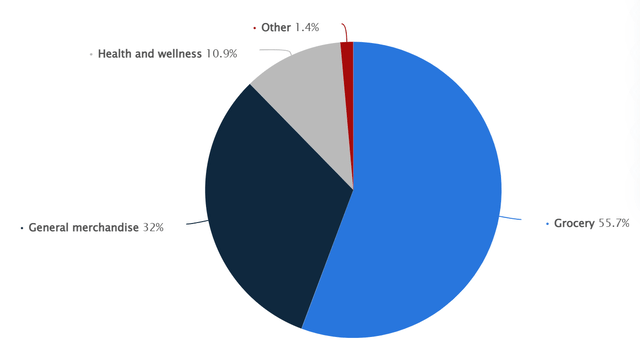

- WMT’s sales composition makes it more inflation resistant than AMZN. WMT grocery sales accounted for 55.7% of its 2022 net sales while AMZN’s Whole Food stores account for less than 1% of its annual sales. As consumers have less to spend on discretionary items, AMZN will bear a larger share of the belt-tightening.

- WMT’s transport cost is less sensitive to high fuel prices due to the geographical locations of its stores, and also its role as a leading gasoline distributor.

- WMT’s extensive gasoline distribution network also creates a hidden edge over AMZN. I actually foresee this edge to be more potent if/when gas prices further climb as higher gas prices work hard to funnel consumers to WMT stores.

- Finally, AMZN already has a negative free cash flow problem with the inflation and fuel cost problems, while WMT does not. I see AMZN’s cash problem to be exacerbated and can lead to unattractive capital allocation choices (such cut back on AWS infrastructure, issuing more equity amid price declines, et al). Such choices can trigger another large valuation contraction.

$5 gas and inflation will hurt both

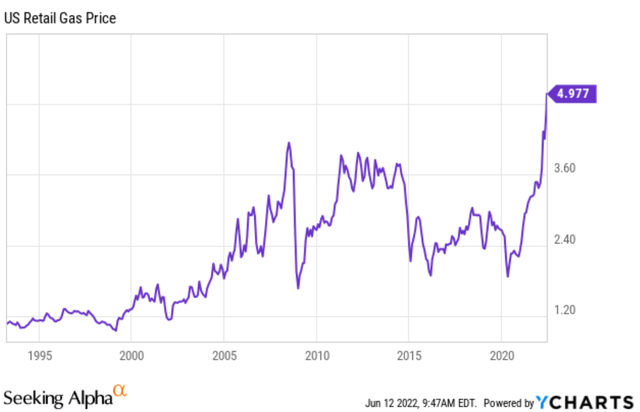

The Bureau of Labor Statistics released the inflation data last week. CPI rose 8.6% year-on-year, setting a new record since December 1981. More importantly, the prices of food and fuel increased the most. These two items are indispensable necessities of life and impact the majority of people the most. Energy prices in May rose by 34.6%. If only fuel is considered, the price has more than doubled (an increase of 106.7%). According to Ycharts data shown below, the national average price per gallon of unleaded gasoline is $4.977, the highest level ever.

High inflation and fuel cost have been impacting and will continue to impact both AMZN and WMT negatively. They will be hurt twice, not once, actually.

First, people simply have less money to spend on anything else (such as shopping at WMT or AMZN) when they have to spend more money on life necessities such as fuel and food. Moody’s senior economist Ryan Sweet estimated that, based on the inflation data released by the Bureau of Labor Statistics last week, the average US household spending in May to what would have been spent in 2018 and 2019, the inflation has caused about $460 of extra living expenses per month for an average household. Assuming 1 billion households in the U.S. for the sake of simpler math, this translates to $460 BILLION less spending on everything else PER MONTH. Or $5.5 TRILLION per year if such a level of inflation persists, which is very likely. As the largest retailers, WMT and AMZN will suffer a large share such belt-tightening.

Second, both of them are facing higher costs themselves. For example, both rely on extensive distribution and delivery systems to run their businesses, and they will face much higher transportation costs and see margins pressured as a result. Walmart CEO Doug McMillon commented at multiple places during the earnings call on inflation’s toll on both its top and bottom line, citing surges in fuel, container, storage, and other costs. These comments apply to AMZN equally well.

But unequally

The key thesis here is that WMT and AMZN will be hurt unequally. And WMT will be hurt less than AMZN.

Firstly, WMT’s sales composition makes it more inflation resistant than AMZN. In 2022, WMT is still largely a grocery store (and by far the largest one). Its grocery sales accounted for 55.7 percent of its net sales in the U.S. In contrast, AMZN’s mostly carried discretionary items. AMZN does not disclose its sales composition by category. However, based on its Whole Foods grocery stores, we can gather a reasonably accurate picture. Its Whole Food grocery comprised mainly about 500 physical stores (compared to WMT’s 3,570 supercenters). In recent years, these stores rake in about $4 billion in sales per quarter or about $50B per year. it is a tiny fraction compared to WMT’s grocery sales, and even tinier compared to AMZN’s ~$600B annual sales (less than 1%).

Statista, Walmart U.S. sales share by product category 2022

Second, WMT’s transport cost is less sensitive to high fuel prices due to the geographical groupings of its stores. The following Reuters report analyzed these advantages by comparison against Target but these arguments are valid when compared to Amazon also. The following quotes are taken from the report (abridged and emphases added by me):

High oil prices … impose extra costs everywhere, but the impact varies wildly by state. Walmart stores are concentrated in states where gas and diesel prices are below the national average, like Texas and Florida, while Target stores skew toward high-cost states like California and New York. The geographical groupings of Walmart and Target stores reflect the distinct strategy of each company for going after a certain type of customer. Walmart has found its success with lower-income customers and those that can drive to its stores, versus Target who wants the affluent customer.

Third, WMT itself is one of the largest gasoline distributors in the country and can benefit from rising gasoline prices. It is hard to estimate the benefits as WMT does not release its gasoline sales. But we can again form a reasonable estimate by looking at two other top gasoline distributors, Kroger (KR) and Costco (COST). About ~20% of Kroger’s operation income is from gasoline retail. And gasoline sales make up around 10%, or $20 billion annually, of Costco’s overall sales. So I estimate gasoline sales to account for a similar fraction for WMT, between 10% to 20% both in terms of topline and bottom line. Of course, selling gas is well-known for the low margin. But given the volume, the top distributors like WMT and KR carry, it is a lucrative business that AMZN does not.

And finally, gasoline distribution also creates a higher-order benefit that AMZN dost not have. Higher gas prices better funnel consumers to WMT than AMZN. Higher gas prices lure more people to WMT chains to fill up their tanks, given the lower prices thanks to their humongous scale. After filling up thank, naturally, these people are more likely to shop in the stores or even become members of the stores.

All told, WMT equity prices have been observed to be strongly correlated in the same direction as gasoline prices in the past. Kind of counter-intuitive when at first glance. But it actually makes good sense based on the above analyses.

AMZN has a cash problem already

Another reason that WMT and AMZN will be hurt unequally is that AMZN already has a cash flow problem at hand without the high inflation and extra fuel cost. I see its cash problem to be further exacerbated by inflation and fuel cost.

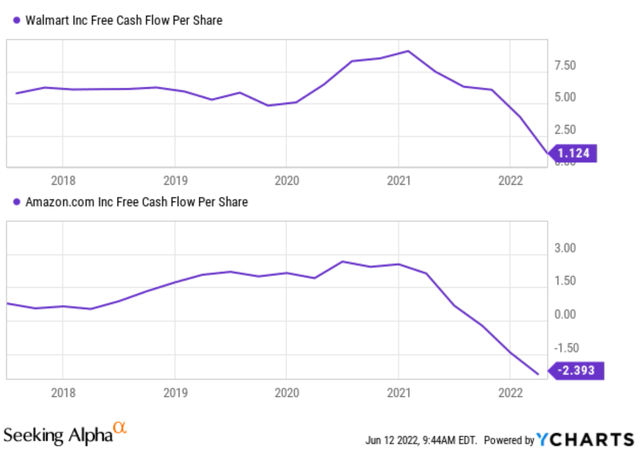

To be clear, both WMT and AMZN are having their share of difficulties with free cash flow in recent quarters given the macroeconomic headwinds. As you can see from the top panel of the following chart, WMT’s free cash flow per share peaked above $7.5 in 2021 and it declined to the current level of $1.1 per share. Amazon showed the same pattern. It’s just the deterioration is way worse. Its free cash declined from a positive level (a modest ~$3 per share) to the current NEGATIVE level of $2.4 per share.

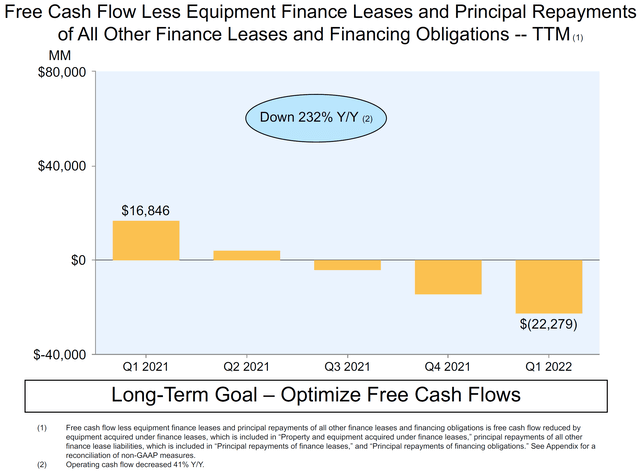

In AMZN’s case, its free cash flow problem is worse than the above picture shows because of its sizable financial lease obligations. Details are provided in my earlier analysis dedicated to its cash flow and a few key comments are quoted below:

As you can see from the following chart, after adjusting for its lease obligations, its cash flow problem is even more concerning. It has been a positive $16.8B and turned to almost zero in 2021 Q2 and Q3 (cash flow neutral). And it kept detreating from there. It was negative $20B in 2021 Q4 and reached a negative $22.3B in Q1 2022. It is debatable whether a negative FCF is absolute a bad thing or not, especially for a growth stock. For one thing, it certainly shows Amazon still finds many growth areas to invest heavily. However, a negative FCF of more than $20B is sizable even for a juggernaut like AMZN especially when its AWS growth requires continued heavy infrastructure investments.

Now, besides the heavy investment required to keep growing its AWS, the inflation and high fuel cost will create further pressure on its cash flow. The business will face some tough capital allocation choices going forward. It could scale back on its infrastructure investments, issue more equity when stock prices are low, and/or issue more debt when borrowing rates are climbing. None of these options seem attractive.

Valuation

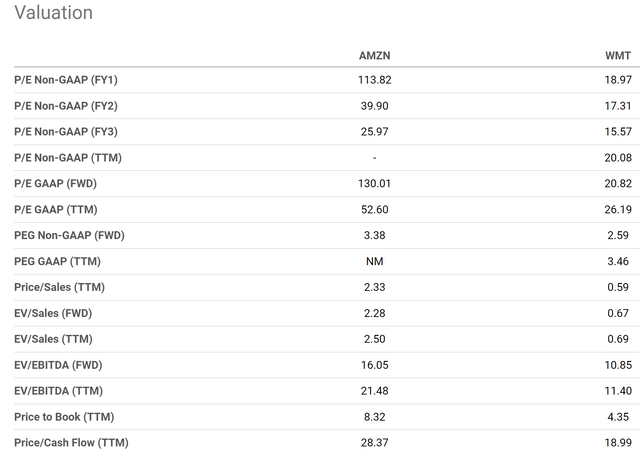

Due to the negative cash flow problem mentioned above, valuation metrics in terms of bottom lines are not really meaningful for AMZN. As you can see from the following table, its GAAP FW PE is quoted at about 114x, and its price to cash flow is quoted at about 28x. Although these metrics are perfectly meaningful for WMT, they show a very reasonable valuation at about 19x FW PE and 19x cash flow.

Here, in order to gauge their relative valuation, I will use a topline-oriented metric as illustrated in the next two charts.

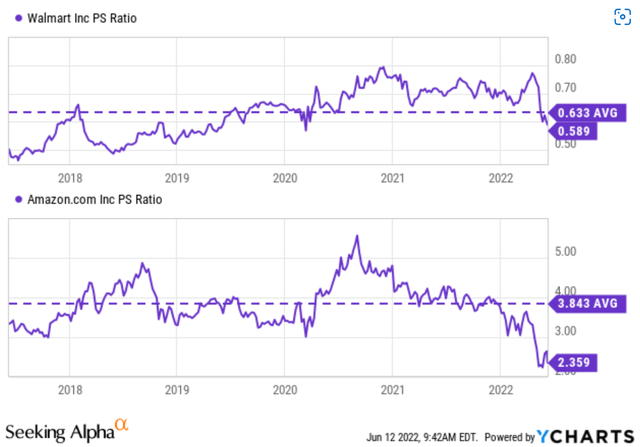

As shown in the next chart, WMT and AMZN are currently valued at a price to sales (“PS”) ratio of 0.59x and 2.36x, respectively. Firstly, as you can see, the recent corrections have brought both their valuations to be below their historical average, which is a good sign for value investors. However, AMZN’s current PS ratio is still exactly 4x higher than WMT.

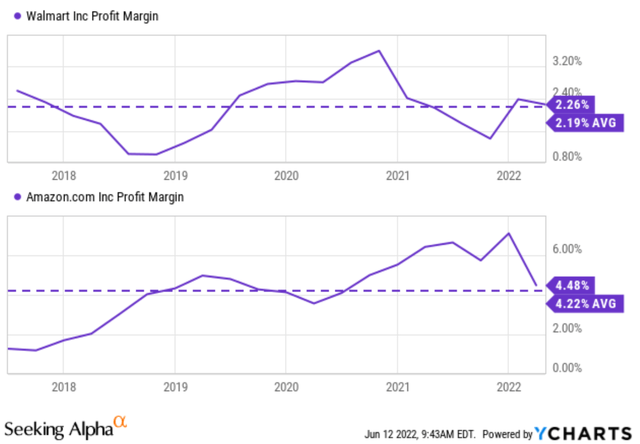

Of course, their PS ratio is exactly comparable given the margin differences. So the second chart compares their average net margins in the past five years. As can be seen, AMZN’s profit margin is indeed higher than WMT’s on average. Therefore, it is perfectly justifiable that its sales deserve a higher valuation. To wit, AMZN’s profit margin has been on average 4.48% over the past 5 years, about 2x higher than WMT’s 2.26% average.

We are still left with a 2x valuation premium for AMZN over WMT, which I find hard to justify for the risks mentioned above. Especially, given the asymmetric impact of inflation and fuel cost on these two businesses, I foresee WMT’s margin to be hovering around its historical average while AMZN profit margin be pressured more severely going forward.

Final thoughts and risks

Both AMZN and WMT are having their share of difficulties against high inflation and high fuel prices. However, I see the negatives fully priced in for WMT already and it is well-positioned to weather further inflation and fuel cost rises. In contrast, I see the troubles are only starting for AMZN. It is still valued at about 2x premium (even putting aside its negligible earnings and negative free-cash-flow problems aside). These troubles could lead to very unattractive capital allocation choices down the road and can trigger a much larger valuation contraction.

Finally, risks. The first risk is the timeframe. My above bearish thesis for AMZN is only for the near term. In the long-term, I still see AMZN as an excellent business supported by an unstoppable megatrend – our economy’s secular shift to online eCommerce. The second risks involve downside risks for WMT. Even though WMT keeps evolving and adapting, it is still largely a brick-and-mortar business and faces more competition as a result. It not only competes with AMZN (Whole Foods) but also directly against other peers both at home and abroad (such as KR, COST, and Lidl).

Be the first to comment