Darren415/iStock via Getty Images

The daily action of the S&P 500 (Index: SPX) nearly crossed the threshold of becoming very interesting last week. For us, we define “very interesting” as being a three percent change from its previous day’s closing value. But ultimately, the index came up short, ending the trading week at 3,900.86 after dropping 2.91% on Friday, 10 June 2022.

That nearly very interesting decline happened because the Consumer Price Inflation report came in much hotter than expected, confirming President Biden’s inflation still hasn’t been slowed. Because that’s the case, the report shifted a portion of the forward-looking attention of investors back toward the current quarter of 2022-Q2. The new information about U.S. inflation puts more attention on what the Federal Reserve may do about it when they meet next week, accounting for the partial shift.

But not a full shift, for the practical reason of the coming expiration of dividend futures contracts for 2022-Q2. With those contracts expiring on Friday, 17 June 2022, investors kept a majority of their focus on 2022-Q3 as their primary time horizon.

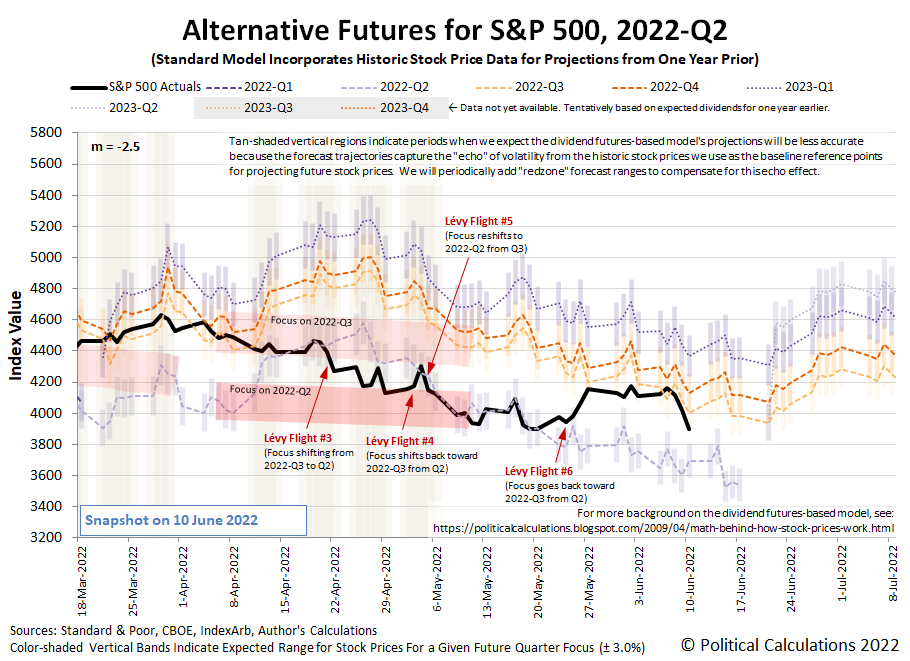

At least, that’s what we can divine from the latest update to the dividend futures-based model alternative futures chart.

It’s possible this change will become large enough to fully qualify as a new Lévy flight event. On that count, we’ll find out for sure soon enough, and no later than at the end of the Fed’s two-day meeting on Wednesday, 15 June 2022.

Until then, here’s our recap of the market-moving headlines of the trading week ending 10 June 2022, where you can see investors began absorbing the news U.S. inflation would come in higher than previously anticipated on Thursday, 9 June 2022. Before that point in time, we would describe the day-to-day volatility of the index as being consistent with garden-variety noise.

Monday, 6 June 2022

- Signs and portents for the U.S. economy:

- Former top Fed minion to face music for wrong inflation call:

- Bigger trouble developing in China:

- BOJ minions determined to keep never-ending stimulus plan going:

- ECB minions expected to do something about Eurozone inflation:

- Wall Street ends up with growth stocks, but inflation fears linger

Tuesday, 7 June 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan, Eurozone, World:

- Mixed economic signs in China:

- Central bank minions outside Japan take combatting inflation seriously:

- Wall Street jumps with tech, energy; Target news weighs on retailers

Wednesday, 8 June 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan, China:

- Better than expected signs in the Eurozone:

- Central bank minions dealing with inflation, ECB minions to be late to rate hiking party:

- Wall Street falls as Amazon, chipmakers weigh

Thursday, 9 June 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Mexico:

- Bigger stimulus developing in China:

- ECB minions signal they’re done thinking and will wait until July to start rate hikes:

- Wall St drops as investor jitters climb before CPI data Friday

Friday, 10 June 2022

- Signs and portents for the U.S. economy:

- Expectations grow of more, bigger rate hikes by Fed minions:

- Bigger trouble developing in China, Japan:

- Bigger stimulus developing in China:

- Bigger central bank rate hikes getting on the table to combat inflation:

- Wall Street ends down sharply as hot inflation data intensifies investor fears

Combining Thursday and Friday’s investor reactions to news of higher-than-expected inflation in the U.S., the S&P 500 lost 5.3% of its value in response. The index was down 5.1% for the week, where that smaller change indicates the index was rising before the higher inflation news arrived.

A lot changed for expectations of the Federal Reserve’s plan to hike rates in the latter part of the trading week ending on 10 June 2022. The CME Group’s FedWatch Tool is projecting a half-point rate hike to be announced after the Fed meets next week (2022-Q2), with a greater than 20% probability they’ll boost it to a three-quarter point hike. Beyond that, the FedWatch tool now also expects a three-quarter point rate hike just six weeks later (2022-Q3), followed by another half-point rate hike in September 2022 (also 2022-Q3), which has become the future quarter of interest for investors to focus their forward-looking attention.

The Atlanta Fed’s GDPNow tool turned even more pessimistic in the past week. Its forecast of real GDP growth of 0.9% for the U.S. in 2022-Q2 is down from last week’s projection of 1.3% annualized growth. If that downward trend continues, it suggests the U.S. economy is potentially in the midst of experiencing two consecutive quarters of real GDP shrinkage, which many associate with the economy being in recession.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment