Enes Evren/E+ via Getty Images

The selloff in just about everything this year has created some truly extraordinary buying chances across the board. While the buy-everything-with-a-ticker rally from 2021 is dead and gone, if you can spot companies with sustainable advantages today, the upside potential is enormous.

One company that I believe fits that description is small-cap medical device maker InMode (NASDAQ:INMD), which has seen its stock fall from $99 to just $24 in the past eight months. That alone does not make it a buy, but I believe a variety of other factors, in conjunction with this price decline, do indeed make it a buy.

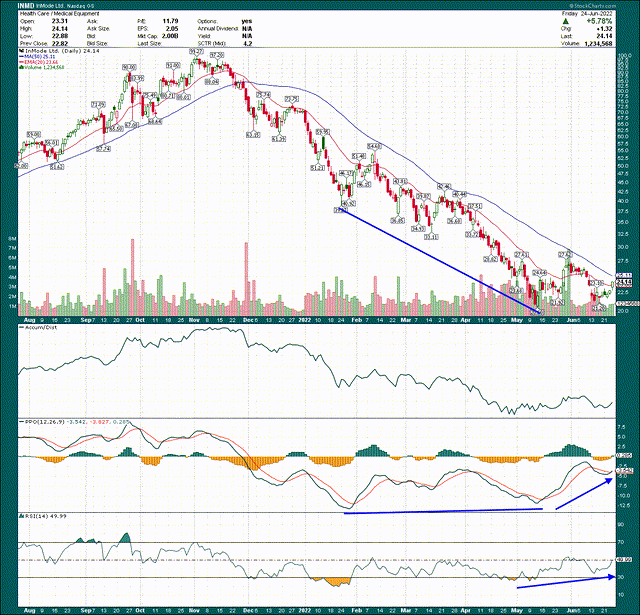

The daily chart shows exactly what you want to see for a stock to be making a sustainable bottom. There was a massive positive divergence put into place from January to May of this year, as price declined by about half, but the PPO made a higher low. Then, if we turn our attention from May to June, price is making a double bottom while the PPO moves significantly higher. This action is extremely bullish and makes it much more likely the low is in for the stock.

There is still work to do for the bulls, including sustaining a move over the 20-day exponential moving average, and then eventually, the 50-day simple moving average. The latter of the two hasn’t been touched since 2021, so that will be a sizable test. However, the daily chart shows that we have significant evidence to suggest there are no more lower lows coming.

Unfortunately, one thing InMode doesn’t have is relative strength.

As we can see in the top panel, its relative strength against its peer group has been poor, and the peer group has been poor against the S&P 500. That’s not supportive of the bullish argument, but relative strength comes second to price action and momentum, so in this case, it isn’t a big enough detractor to pull me off the bullish stance.

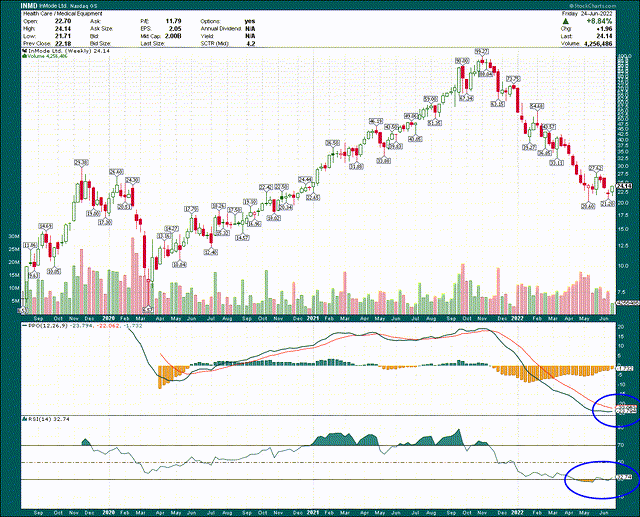

Finally, here’s a simple view of the weekly chart, and I want to highlight the PPO.

The weekly PPO made its top at 20 late last year and has fallen all the way to -24. That’s an extraordinary move, and the stock is extremely oversold on this measure. In addition, as the price is bottoming, the weekly PPO is about to print a bullish crossover, as seen in the rapidly shrinking histogram. In other words, I think we’re about to get a very bullish indicator on the weekly chart, which adds credence to the idea that the daily chart is showing a sustainable bottom.

I see a lot to be bullish about from a technical perspective, but now let’s take a look at the fundamentals to see if there’s support there as well.

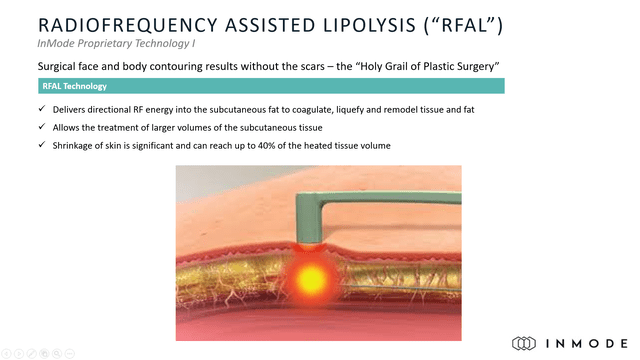

An attractive portfolio and world-class profitability

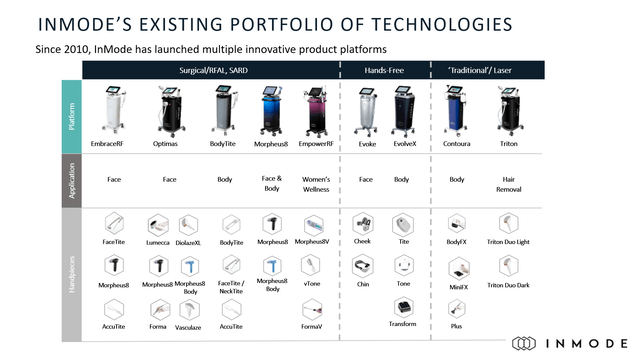

InMode is a medical device maker that focuses on non-invasive body contouring products using proprietary technology. The company is fully integrated in that it designs, manufactures, and markets its wares globally. The technology utilized is radiofrequency assisted lipolysis, or RFAL. It uses RFAL to perform outpatient procedures such as liposuction, skin tightening, body and face contouring, skin rejuvenation, and more. The company’s products can be used as an alternative to plastic surgery, offering sizable benefits such as no scars, no hospital stay, and no general anesthesia. InMode has built a deep portfolio of products and treatment options for a variety of applications and has grown at very rapid rates in recent years.

Above we can see just how many different applications the company’s products have, meaning its potential customer base is wide and deep. InMode reckons there are more than 200,000 surgically trained physicians globally, and its products allow these physicians to ad incremental services to their offerings by using InMode’s products.

The RFAL technology is the core of the investment case, so let’s briefly look at what makes it attractive.

As mentioned, RFAL allows for body contouring without actual surgery. While this isn’t applicable in some cases where there’s a sizable amount of body changes being done, for many minor changes, RFAL is ideal. Applications such as the waist, neck, cheeks, arms, legs, and more can be fulfilled with RFAL rather than going into surgery, which requires anesthesia, and is likely to leave scars, as well as a big bill for the patient. InMode is not going to replace plastic surgery, but it is likely to replace some plastic surgery, and in fact, already is doing so.

InMode has grown by leaps and bounds in recent years. That’s great, but what’s extremely impressive is the company’s profitability, particularly for one without a long operating history.

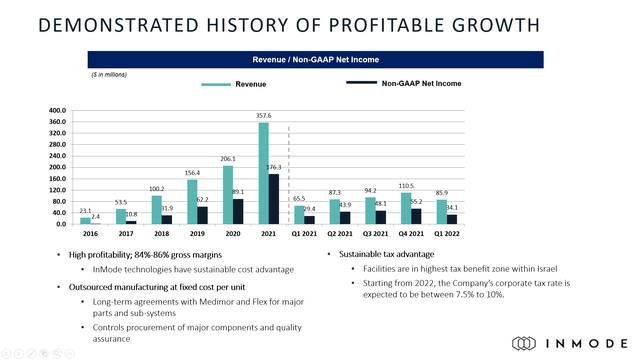

Investor presentation

From 2016 to 2021, revenue grew from $23 million to $358 million, staggering growth by any measure. Early-stage medical device companies often grow quickly but at great cost from R&D and selling costs. However, InMode is producing net income margin of about 50%, which is absolutely extraordinary. There aren’t that many companies in the world with that kind of profitability, and it’s a huge reason why I think InMode will move a lot higher in the months to come.

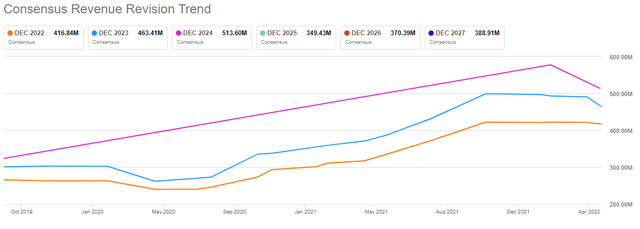

Revenue revisions have moved slightly lower over the past few months, but look at how they’ve improved over time. It’s understandable revenue estimates would have moved lower in the face of recession and high levels of inflation, but this is hardly cause for concern. Guidance and first half results for this year were both strong, so again, I don’t see any long-term concern for the health of the business. We’ll get another read on the company’s outlook in late July with the earnings report.

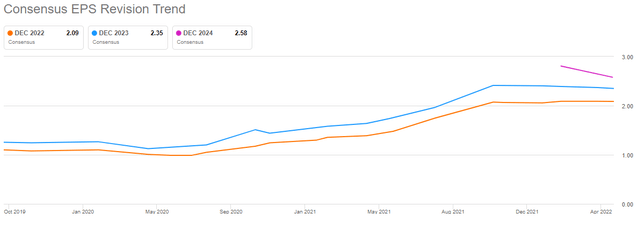

We see a similar pattern with EPS, which has come down slightly in recent months but looks bullish to me.

What we want to see is movement up and to the right, and that’s what we have. The one thing that isn’t quite as bullish is that there isn’t a huge amount of space between the lines, indicating relatively modest year-over-year growth. InMode at the moment isn’t an outright growth stock, so if that’s what you’re after, perhaps it isn’t for you. However, if you like value, a bullish chart, and strong financials, perhaps it is.

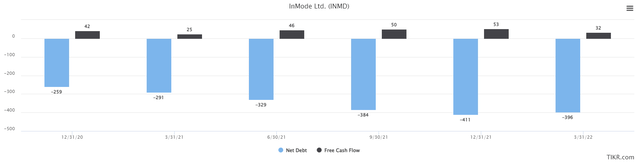

This is a look at quarterly net debt and free cash flow, both in millions of dollars. What it shows us is that InMode has ~$400 million in unencumbered cash on its balance sheet and that it produces between $30 million and $50 million of incremental cash each quarter. For a company with a $2 billion market cap, $400 million in free cash and another ~$150 million each year is tremendously attractive. The company recently announced it would buy back up to a million of its own shares to use some of this cash. Now, one million shares aren’t going to move the needle given that’s just over 1% of the total outstanding. But what it does is signal to the market that the company sees value in the stock.

COVID crash valuation as the company thrives

InMode’s valuation, in light of what we saw above, is really inexplicable. The company’s revenue hasn’t cratered, its profitability hasn’t wavered, and guidance was quite good for this year in the most recent earnings report. In other words, there’s been nothing that I’ve seen that should suggest we get a trough multiple, other than fear of a recession causing lower spending on its procedures. Could that happen? Sure. Is there evidence of it up to this point? I’d say there isn’t based on the above.

But that’s exactly what we have, as we can see above with the price to forward PE ratio. InMode peaked at 54X forward earnings last fall, and I’m not suggesting we’ll see that again. However, 11X forward earnings is what InMode was valued at during the worst of the COVID panic selling in early 2020. Does that sound reasonable to you? I sure don’t think it does.

I’m not suggesting 54X earnings is coming, but 25X is certainly a possibility. That would put InMode in the middle of its historical range, so it’s not like I’m out on a limb here. That would put the stock at ~$59 by the end of this year if it were to achieve that valuation on $2.35 in 2023 EPS. Even if I’m wrong, and we don’t see 25X earnings, 18X would still be $42, or nearly double from here.

That’s the opportunity with InMode as it has ~$400 million in free cash, produces more every quarter, has proprietary technology, and unbelievable margins. The stock is trading like we’re already in a recession, so I see the risk as firmly skewed towards the bulls here.

Be the first to comment