Justin Sullivan/Getty Images News

Rome wasn’t built in a day, and neither should an income portfolio be. The approach that some like to take is to use company-specific dividends to fund like-kind every day living expenses. For example, dividends from so-called “sin stocks” can be used as beer money, dividends from the likes of Verizon (VZ) and AT&T (T) can be used to pay off one’s monthly cell phone bill.

This brings me to J. M. Smucker (NYSE:SJM), whose familiar products are ubiquitous in most grocery stores. In this article, I highlight why SJM may be a solid choice for income investors who seek dividends from the comfort of a well-respected company, so let’s get started.

Why SJM?

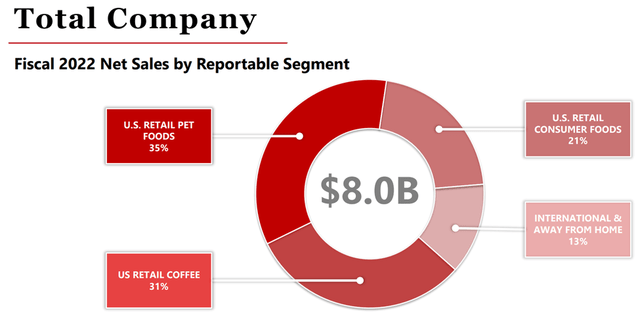

J. M. Smucker is a diversified food company with operations in the U.S., Canada, and Europe. The company’s well-known brands include its namesake Smucker’s jams, Folgers coffee, and Jif peanut butter spread. Unbeknownst to some, Smucker’s also has exposure to the growing pet foods segment, including Milk-Bone, Meow Mix, and Kibbles ‘n Bits, among others. This segment represents an impressive $2.8 billion, or 35% of Smucker’s annual sales, as shown below.

SJM Segments (Investor Presentation)

Smucker continues to fare well, with net sales growing by 9% YoY when excluding for divestitures and foreign currency effects during the fourth quarter (ended April 30, 2022). Notably, this was in spite of a 1% unfavorable impact from the recent Jif peanut butter recall. For the full fiscal year, net sales excluding divestitures and currency effects still grew by a respectable 5%.

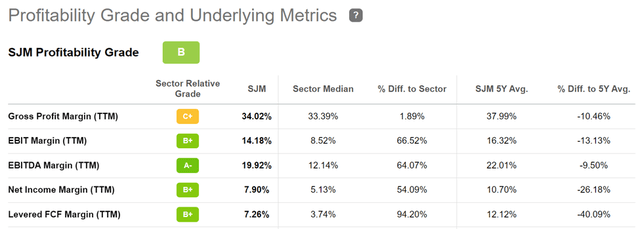

SJM also enjoys strong operating leverage due to its economy of scale. This is reflected by its B score for profitability. As shown below, SJM’s EBITDA and Net Income Margins of 20% and 8% are well in excess of the sector median in the competitive consumer staples segment.

SJM Profitability (Seeking Alpha)

Looking forward, management has provided encouraging guidance, with net sales expected to increase by 3.5% – 4.5% in the current fiscal year 2023. This could be driven in part by Smucker’s hot Uncrustables brand, which are ready to eat peanut butter and jelly sandwiches that cater to consumer preference for simplicity and convenience. This is supported by the fact that Smucker’s made 1 billion of these sandwiches in fiscal year 2022, a record for the company.

Risks to Smucker include supply chain disruptions, as management has noted that demands exceeded supply in some segments. In addition, cost inflation is a risk, as Smucker’s may need to raise prices more aggressively relative to historical standards to counter higher input costs. This may drive consumers to trade down into lower-priced private label products. Management, however, feels confident in its ability to maintain market share, as noted by the CEO, Mark Smucker, during the Q&A session of the recent conference call:

Q: So I’m just curious clearly, you’ve talked about how you’ve taken a lot of pricing, and you feel really good about that. You’ve also guided to elasticity picking up a little bit. But Mark, are there any things you can tell investors about why they should feel comfortable that elasticity won’t be much worse than what you expect? Or maybe that retailers won’t really lean in on you and your competitors maybe to start promoting more?

A: We do have a lot of confidence in our portfolio. And I think when you look at the results, particularly this quarter, 86% of our portfolio growing or maintaining share, that doesn’t just happen. It really is a combination of fantastic investment in our business, execution by our employees and the execution of our strategy by which we have refined our portfolio. And so all of those factors have contributed to those fantastic results. And so we believe that our strategy is truly working.

And then more specifically, elasticity, even in the quarter, we did see elasticity coming in better than expected. That trend has continued. As you’ve heard us talk, we are modeling, going forward, some elasticity. But at the end of the day, because we’ve been able to execute our strategy, we have and refined our portfolio. We really are in categories that are pretty resilient and our offerings about those categories are focused on a variety of value propositions and playing in multiple segments. So we just feel that we’re very well positioned in this environment and just will continue to execute our strategy.

Meanwhile, SJM sports a strong BBB rated balance sheet, and its recent share price weakness has driven the dividend yield up to 3.2%. The dividend is well protected by a 45% payout ratio, and comes with 19 years of consecutive growth, including a 5-year dividend CAGR of 6%.

As such, I see SJM as being well on its way to becoming a dividend aristocrat. As shown below, SJM scores high dividend grades, including an A+ for dividend growth relative to the consumer staples sector.

SJM Dividend Grades (Seeking Alpha)

I see value in the stock at the current price of $122, with a blended P/E of just 13.9, sitting comfortably below its normal P/E of 16.6 over the past decade. Sell side analysts have an average price target of $132 and Morningstar has a fair value estimate of $138, implying an 11-16% one-year total return including dividends.

Investor Takeaway

J. M. Smucker is a high-quality dividend growth stock that is attractively valued at the current price. The company has strong market positions in numerous categories, and its recent share price weakness has driven the dividend yield up to 3.2%. SJM may be a good investment option for those seeking a safe and growing dividend stream from a household name.

Be the first to comment