z1b/iStock via Getty Images

Energy stocks saw an unexpected downturn last week, bringing many of them back to reasonable levels. While upstream producers like Occidental Petroleum (OXY) tend to get the most attention grabbing headlines, I’m more inclined to focus on the midstream segment, which are more low-key yet come with much heftier yields. This brings me to MPLX LP (NYSE:MPLX), whose price action has brought up the yield to 10%. In this article, I highlight why MPLX is a buy on the drop, so let’s get started.

Why MPLX?

MPLX is a master limited partnership (issues K-1) that was spun off from Marathon Petroleum (MPC) 10 years ago. Its business model is rather straightforward, as it owns and operates long-lived assets, including pipelines and storage tanks, which are used to transport energy products from one point to another. MPLX also has an inland marine business, docs, and NGL processing and fractionation facilities linked to key U.S. supply basis, particularly in the Appalachia region.

What sets MPLX apart from many of its midstream peers is its assets were primarily built to serve its largest customer, Marathon Petroleum, which was its original equity sponsor. In a move seen as being unitholder friendly, Marathon Petroleum and MPLX agreed to exchange its general partner economic interests, including incentive distribution rights, for MPLX’s common equity units back in 2017.

MPLX is benefiting from increased energy demand, as total pipeline throughput increased by 4% YoY to 5.3 million barrels per day in the first quarter. Also encouraging, terminal throughput increased by 13% YoY to 2.9 million barrels per day.

Importantly, MPLX’s distribution remains very well covered, with a strong coverage ratio of 1.65x, marking an improvement from 1.56x in the prior year period. This leaves ample room for MPLX to do unit repurchases, and management followed up on this commitment with $100 million worth of unit repurchases so far this year. It also maintains a safe net debt to EBITDA ratio of 3.7x, sitting below the 4.0x that’s generally regarded as being a safe level for energy MLPs.

Looking forward, MPLX should be well-positioned to serve global energy needs, especially in Europe, considering that Russia recently announced big cuts in natural gas deliveries to the continent. It also appears that MPLX is in position to capitalize on its strong storage and export capabilities in the Northeastern U.S., as noted by Morningstar in its recent analyst report:

The end game for MPLX is building a significant asset base at the developing NGL market hub in the northeastern United States, similar to Mont Belvieu in importance, including eventual control over NGL exporting capabilities from the East Coast. MPLX has nearly all of the assets in place to do this, with the exception of direct ethane and propane (or LPG) exporting facilities. Much of the partnership’s efforts over the past few years have focused on debottlenecking NGL volumes out of the Appalachian region and providing Midwestern and western Canadian producers with access to cheaper natural gasoline and condensate.

Also encouraging, MPLX is proving its ability to adapt in an increasingly climate-conscious landscape. This is reflected by MPLX’s 45% reduction in methane emissions last year, and management recently set an aggressive target for 75% reduction in methane emissions by 2030.

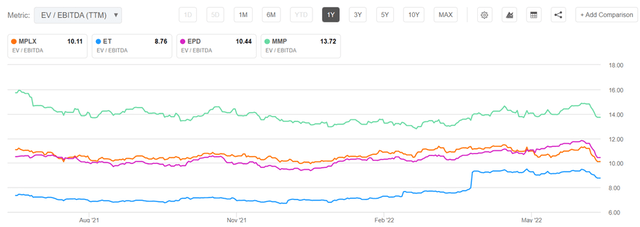

I find the recent downturn in MPLX’s share price to be a good income opportunity, considering the 10% dividend yield, safe coverage ratio, 9 years of consecutive dividend growth, and a 5-year dividend CAGR of 6%. Moreover, MPLX trades at an EV/EBITDA of 10.1x, putting it below that of midstream peers Enterprise Products Partners (EPD), Magellan Midstream Partners (MMP), and only above Energy Transfer (ET).

MPLX EV/EBITDA (Seeking Alpha)

Risks to MPLX include its 9% ownership in the troubled Dakota Access Pipeline, which has seen a series of setbacks. In addition, MPLX’s future is disproportionately tied to that of Marathon Petroleum and the capital projects that it intends to pursue in the medium to long term.

Bottom Line

MPLX is a high-quality midstream MLP that sports an attractive 10% dividend yield. It’s well-positioned to serve increased global energy demand, especially in light of recent events in Europe. MPLX also appears to be a good long-term play on the increasing importance of the Northeastern U.S. as an energy hub. As such, I believe the recent share price weakness presents a good opportunity to layer into this stock.

Be the first to comment