jetcityimage/iStock Editorial via Getty Images

Merger activity increased last week with four new deals announced and one deal completed. There was a significant increase in SPAC activity as well with five new SPAC business combinations announced.

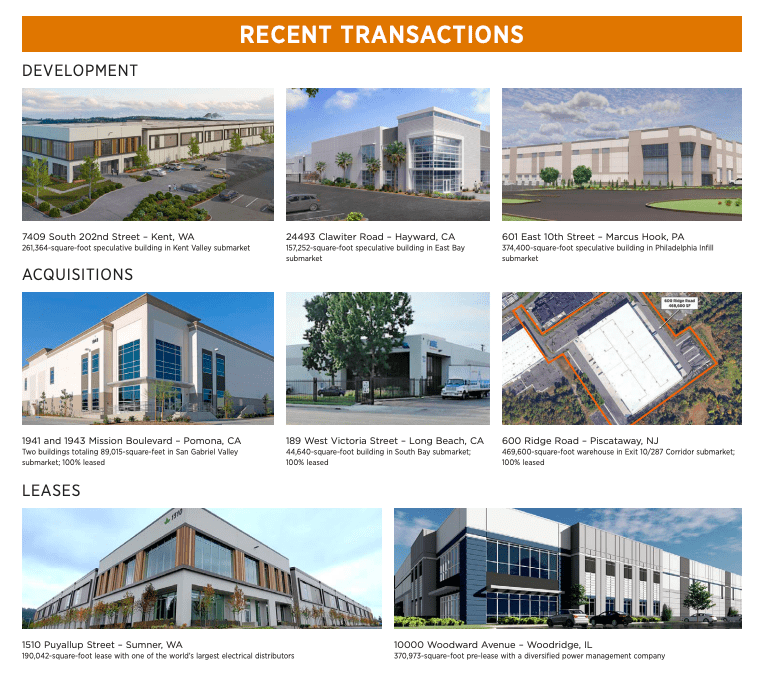

Duke Realty Corporation (NYSE:DRE)

Duke Realty is an industrial REIT, with 153 million square feet of operating properties in 19 major logistics markets across the United States. In order to focus on its industrial properties, the company sold its medical office properties to Healthcare Trust of America (HTA) for $2.8 billion in May 2017. Duke Realty has an outstanding development pipeline of 9.7 million square feet totaling $1.4 billion that is 84% pre-leased. The REIT is down about 20% year-to-date, sports a yield of 2.18% and trades at 29 times trailing twelve-month funds from operations (FFO).

Duke Realty Transactions (Duke Realty Investor Presentation)

After rejecting two prior offers from Prologis (PLD), Duke Realty entered into a definitive agreement to be acquired by Prologis in an all-stock deal valued at $26 billion. Prologis had initially offered 0.465 of its shares in exchange for one equity share of Duke Realty on November 29, 2021 and again on May 10, 2022 offering 0.466 shares of Prologis common stock for each share of Duke Realty. Duke rejected both the offers claiming they were insufficient.

On June 13, 2022, Duke accepted an enhanced offer of $26 billion from Prologis, under which Duke Realty shareholders will receive 0.475 of a Prologis share for each share held. Unfortunately for Duke shareholders, Prologis is trading well below where it was trading last November and in May. The transaction is expected to close in the fourth quarter of 2022. According to the merger agreement, the termination fee to be paid by Duke Realty in case of deal termination is $775 million and the termination fee to be paid by Prologis is $1.5 billion.

Deals In The Works

There were three new deals announced in the Deals in the Works section last week.

On June 14, 2022, oil and natural gas fracking company, Continental Resources (NYSE:CLR) received a non-binding proposal from its founder, Harold Hamm, to acquire all outstanding shares of Continental for $70 per share, representing a 9% premium over Continental’s closing price on June 13, 2022. Mr. Hamm and his family already own 83% of CLR stock.

We wrote in detail about Continental Resources in our Special Situations Newsletter in August 2020, following a series of purchases of CLR by Harold Hamm. We also added CLR to our model portfolio and it has been one of our best performing stocks.

SPAC Arbitrage

There was one new SPAC IPO filed and five new SPAC combinations announced last week.

- On June 13, 2022, Holisto and Moringa Acquisition Corp. (MACA) entered into a business combination agreement that would result in Holisto becoming publicly listed on the Nasdaq.

- On June 14, 2022, Excelera DCE, an Accountable Care Organization and AI Platform, and Future Health ESG Corp. (FHLT) entered into a definitive business combination agreement.

- On June 15, 2022, Moolec Science, a science-based food ingredient company; and LightJump Acquisition Corp. (LJAQ) entered into a definitive agreement for a business combination.

- On June 16, 2022, Digital Health Acquisition Corporation (DHAC) announced that it has signed a definitive agreement to acquire VSee Lab, a telehealth software company.

- On June 17, 2022, Zura Bio Limited, a clinical-stage biotechnology company focused on developing novel medicines for immune disorders, and JATT Acquisition Corp. (JATT) entered into a definitive business combination agreement.

Terminated

- On June 13, 2022, Biotech Acquisition Company (BIOT) and Blade Therapeutics announced that they have mutually agreed to terminate the previously announced Agreement and Plan of Merger.

- On June 16, 2022, DNEG and Sports Ventures Acquisition (AKIC) mutually agreed to terminate their previously announced business combination agreement, effective immediately.

Weekly Spread Changes:

The table below shows weekly spread changes between June 10 and June 17, 2022.

| Symbol | Quote | Acquiring Company | Acquiring Company Quote | Current Spread | Last Week Spread | Spread Change Weekly | Deal Type |

|---|---|---|---|---|---|---|---|

| (VG) | 16.78 | Ericsson (ERIC) | 7.43 | 25.15% | 14.69% | 10.46% | All Cash |

| (NLSN) | 22.41 | Evergreen Coast Capital Corporation (N/A) | 24.94% | 14.75% | 10.19% | All Cash | |

| (MILE) | 0.7911 | Lemonade (LMND) | 17.48 | 16.22% | 7.10% | 9.12% | All Stock |

| (VMW) | 116.22 | Broadcom Inc. (AVGO) | 498.65 | 22.61% | 13.63% | 8.98% | Special Conditions |

| (TEN) | 15.51 | Apollo Global Management, Inc. (APO) | 48.25 | 28.95% | 20.48% | 8.47% | All Cash |

| (RDBX) | 12.01 | Chicken Soup for the Soul Entertainment, Inc. (CSSE) | 6.16 | -95.54% | -94.23% | -1.31% | All Stock |

| (MGI) | 9.89 | Madison Dearborn Partners, LLC (N/A) | 11.22% | 12.94% | -1.72% | All Cash | |

| (SAFM) | 208.31 | Cargill and Continental Grain Company (N/A) | -2.55% | 0.04% | -2.59% | All Cash | |

| (SUMR) | 11.98 | Kids2, Inc. (N/A) | 0.17% | 3.99% | -3.82% | All Cash | |

| (CDR) | 26.51 | Wheeler Real Estate Investment Trust, Inc. (WHLR) | 2.34 | 9.39% | 13.68% | -4.29% | All Cash |

Deal Statistics:

| Total Number of Deals Closed in 2022 | 81 |

| Total Number of Deals Not Completed in 2022 | 4 |

| Total Number of Pending Deals | |

| Cash Deals | 57 |

| Stock Deals | 17 |

| Stock & Cash Deals | 8 |

| Special Conditions | 8 |

| Total Number of Pending Deals | 90 |

| Aggregate Deal Consideration | $959.93 billion |

New Deals:

- The acquisition of Steel Connect (STCN) by Steel Partners Holdings (SPLP) for $519.36 million or $1.35 per share in cash and one contingent value right (“CVR”) to receive their pro rata share of net proceeds, to the extent such net proceeds exceed $80 million plus certain related costs and expenses, if Steel Connect’s ModusLink subsidiary is sold during the two-year period following completion of the merger.

- The acquisition of Gold Standard Ventures (GSV) by Orla Mining (ORLA) for $138.14 million in an all stock deal. Under the terms of the agreement, Gold Standard shareholders will receive, in exchange for each Gold Standard common share held, 0.1193 of a common share of Orla.

- The merger of Electro-Sensors (ELSE) and Mobile X Global. Under the terms of the agreement, shareholders of Electro-Sensors will receive cash dividends of $4.83 per fully diluted share of Electro-Sensors.

- The acquisition of Duke Realty Corporation (DRE) by Prologis (PLD) for $26 billion in an all stock deal. Under the terms of the agreement, Duke Realty shareholders will receive 0.475 of a Prologis share for each Duke Realty share they own. We added DRE as a potential deal to the Deals in the Works section on May 10, 2022, and the price after the news of the potential deal came out was $54.77.

Deal Updates:

- On June 9, 2022, Ericsson (ERIC) announced that it has been engaged with authorities regarding the review and investigation of the company’s conduct in Iraq. The SEC has notified the company that it has opened an investigation concerning the matters described in the company’s 2019 Iraq investigation report. It is too early to determine or predict the outcome of the investigation, but Ericsson is fully cooperating with the SEC.

- On June 14, 2022, Spirit Airlines (SAVE) issued an update regarding its ongoing discussions with Frontier Group Holdings (ULCC) and JetBlue Airways (JBLU), stating that it is bound by the terms of its merger agreement with Frontier, under which a “Superior Proposal” is defined as being both reasonably capable of being consummated and more favorable to Spirit’s stockholders from a financial point of view.

- On June 14, 2022, Metromile (MILE) and Lemonade (LMND) received approval from the Department of Justice under the Hart-Scott-Rodino Act and are awaiting other required regulatory approvals. The transaction is now expected to close early in the third quarter of 2022.

- On June 15, 2022, Fulton Financial Corporation (FULT) and Prudential Bancorp (PBIP) announced that Prudential Bancorp shareholders have voted to approve Fulton’s acquisition of Prudential Bancorp.

- On June 16, 2022, Summer Infant (SUMR) announced that its stockholders have voted to adopt the previously announced definitive merger agreement pursuant to which the company will be acquired by Kids2. The closing of the transaction is expected to occur on or about June 22, 2022.

- On June 16, 2022, Oasis Petroleum (OAS) announced that its Board of Directors has declared a special dividend of $15.00 per share of Oasis common stock. The special dividend payment is subject to, the closing of Oasis’ previously announced merger with Whiting Petroleum Corporation (WLL). The special meetings of shareholders to consider and vote upon the merger are each scheduled for June 28, 2022. If requisite shareholder approvals are obtained on June 28, 2022 and all other closing conditions are timely satisfied, the merger is expected to close on July 1, 2022 and the special dividend would be payable on July 8, 2022.

- On June 16, 2022, American Campus Communities (ACC) announced that the special meeting of stockholders will be on August 4, 2022.

- On June 16, 2022, Allegiance Bancshares (ABTX) and CBTX (CBTX) jointly announced receipt of regulatory approval from the Federal Deposit Insurance Corporation.

- On June 16, 2022, Land & Buildings Investment Management, a significant shareholder of Healthcare Realty Trust (HR) issued an investor presentation outlining its opposition to the company’s proposed merger with Healthcare Trust of America (HTA) and its intention to vote against the deal at the July 15 Special Meeting.

- On June 17, 2022, the European Commission conditionally approved Welbilt’s (WBT) sale to Ali Group.

- On June 17, 2022, Preferred Apartment Communities (APTS) announced that, at the reconvened special meeting of stockholders, its stockholders approved the acquisition of PAC by Blackstone Real Estate Income Trust.

- On June 17, 2022, Citrix Systems (CTXS) filed with the European Commission for its proposed sale to Elliott Management and Vista Equity. The provisional Phase 1 deadline has been set for July 22.

- On June 17, 2022, Rogers Communications (RCI), Shaw Communications (SJR) and Quebecor announced an agreement for the sale of Freedom Mobile to Quebecor, a critical step towards completing the merger between Rogers and Shaw.

- On June 17, 2022, Black Knight (BKI) and Intercontinental Exchange (ICE), each received a Request for Additional Information and Documentary Material, referred to as a “Second Request,” from the FTC with respect to the merger. Accordingly, the HSR waiting period will expire 30 days after ICE and Black Knight each certify their substantial compliance with the Second Request, unless earlier terminated by the FTC or extended by agreement of the parties or court order.

Closed Deals:

- The acquisition of Renewable Energy Group (REGI) by Chevron Corporation (CVX) on June 13, 2022. It took 105 days for this deal to be completed.

Top 10 deals with largest spreads:

Please do your own due diligence on deals with large spreads. Some of these large spreads might be related to regulatory issues or because of the way the deal is structured. We classify some of these deals as “special situation” deals in our merger arbitrage tool and provide additional details to help with the analysis. There may be unique situations related to special dividends, spinoffs, proration, etc. that need to be accounted for when looking at these spreads.

| Symbol | Announced Date | Acquiring Company | Closing Price | Last Price | Closing Date | Profit | Annualized Profit |

|---|---|---|---|---|---|---|---|

| (TWTR) | 04/25/2022 | Elon Musk (N/A) | $54.20 | $37.78 | 12/31/2022 | 43.46% | 81.35% |

| (BKI) | 05/04/2022 | Intercontinental Exchange, Inc. (ICE) | $85.00 | $64.69 | 06/30/2023 | 31.40% | 30.48% |

| (TEN) | 02/23/2022 | Apollo Global Management, Inc. (APO) | $20.00 | $15.51 | 12/31/2022 | 28.95% | 54.19% |

| (ATVI) | 01/18/2022 | Microsoft Corporation (MSFT) | $95.00 | $74.71 | 06/30/2023 | 27.16% | 26.36% |

| (SIMO) | 05/05/2022 | MaxLinear, Inc. (MXL) | $106.95 | $84.21 | 06/30/2023 | 27.01% | 26.22% |

| (VG) | 11/22/2021 | Ericsson (ERIC) | $21.00 | $16.78 | 08/22/2022 | 25.15% | 143.43% |

| (NLSN) | 03/29/2022 | Evergreen Coast Capital Corporation (N/A) | $28.00 | $22.41 | 12/31/2022 | 24.94% | 46.69% |

| (VMW) | 05/26/2022 | Broadcom Inc. (AVGO) | $142.50 | $116.22 | 04/30/2023 | 22.61% | 26.20% |

| (SJR) | 03/15/2021 | Rogers Communications Inc. (RCI) | $32.40 | $26.63 | 06/30/2022 | 21.67% | 718.96% |

| (CHNG) | 01/06/2021 | UnitedHealth Group Incorporated (UNH) | $27.75 | $22.96 | 12/31/2022 | 20.86% | 39.05% |

Conclusion:

As we come closer to the end of the second quarter of 2022, multiple deals received required approvals last week while some continue to face hurdles. SPAC activity picked up last week with five new business combinations announced but two active business combinations were terminated.

We have been publishing our two weekly articles, Insider Weekends and Merger Arbitrage Mondays, on Inside Arbitrage for free continuously for nearly 12 years. Starting next month, we will be rolling both these articles into our paid subscription service, Inside Arbitrage Premium.

The Premium service includes a monthly special situations newsletter, a model portfolio and mid-month updates. Beyond content, it also includes a plethora of tools including our popular Merger Arbitrage Tool and various custom screeners like the Spinsider and The Double Dipper. Click here to learn more.

Be the first to comment