Instrument

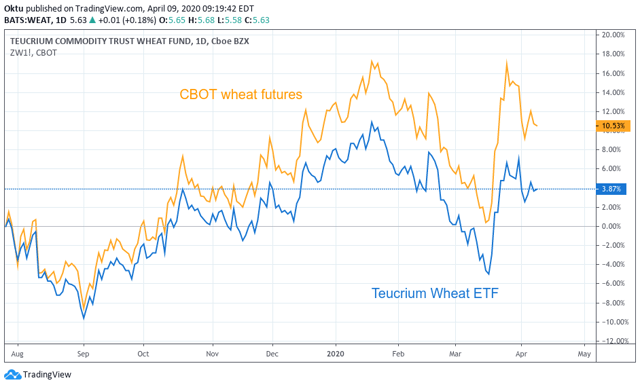

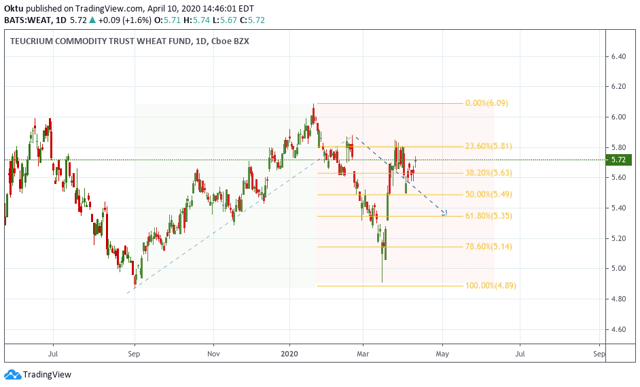

The Teucrium Wheat Fund (WEAT) provides investors unleveraged direct exposure to wheat without the need for a futures account. Therefore, the decision to invest in this fund should be made after analyzing the wheat market.

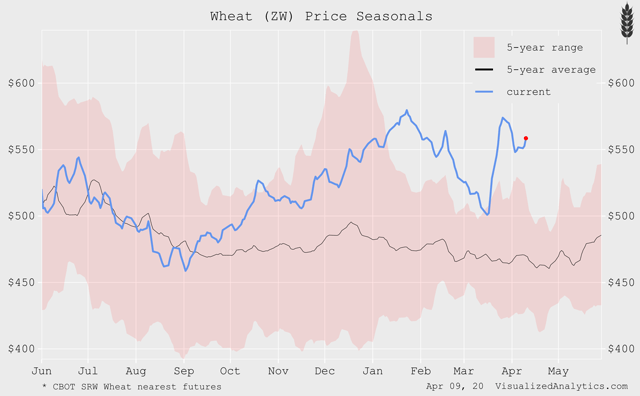

Seasonality

The current wheat futures price is well above its five-year range. This means that either wheat is overvalued or has fundamental reasons to be so expensive. Let’s look for these reasons.

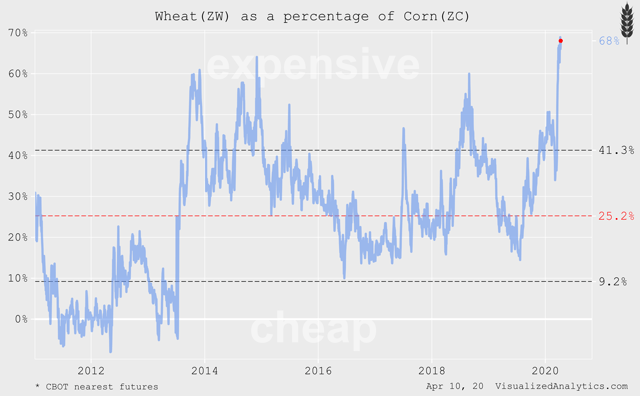

Wheat-Corn Spread

Wheat-Corn Spread

Wheat price is closely correlated with corn price, and the analysis of this relationship may tell a lot about the current state of the market. The following graph shows the history of the spread between wheat futures prices and corn futures prices (ZW as a percent of ZC) from 2011 onwards:

As you can see, now wheat is 68% more expensive than corn – the maximum value for the last nine years. This is a positive sign for corn and a negative sign for wheat.

As you can see, now wheat is 68% more expensive than corn – the maximum value for the last nine years. This is a positive sign for corn and a negative sign for wheat.

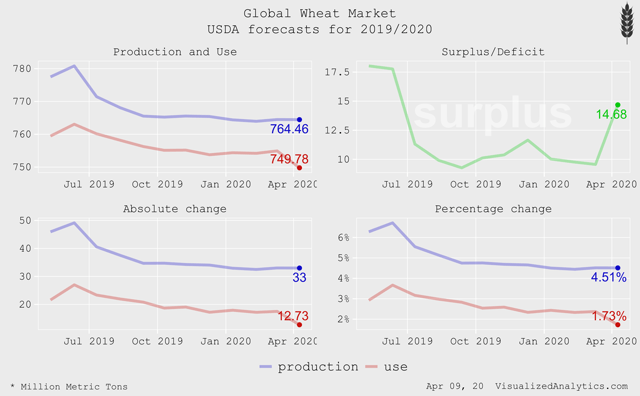

Supply and Demand

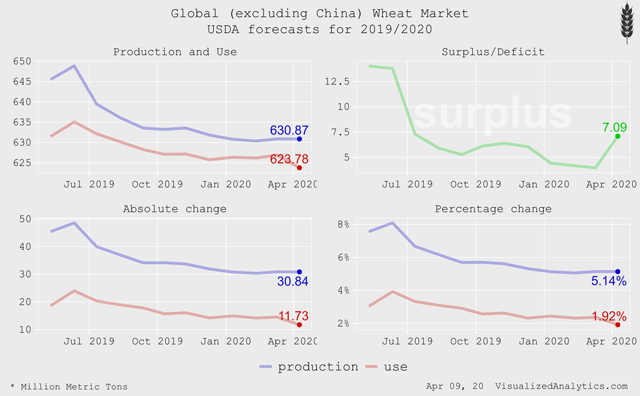

The April USDA forecast has proved to be negative for wheat. The USDA has lowered its 19/20 global domestic consumption forecast by 5.15 million tons in comparison with last month’s forecast. At the same time, world wheat production has not changed much. As a result, the expected surplus for this market has jumped from 10 to 14.68 million tons. This is a significant change.

The situation does not change much, even if we exclude China from the calculations:

The situation does not change much, even if we exclude China from the calculations:

Fundamental price

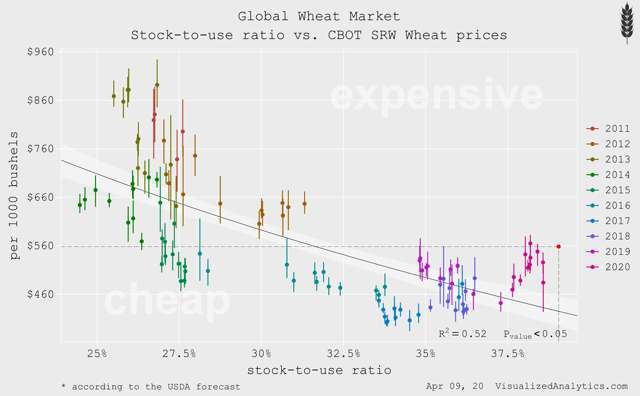

In the wheat market, as a commodity market, the price is formed on the basis of the balance between supply and demand. One of the key markers of this balance is the stock-to-use ratio. It is worth adding that there is a long-term relationship between the price of wheat and its stock-to-use ratio. Therefore, using this ratio, one can judge the fundamental state of the market.

The estimated stock-to-use ratio of the global wheat market in 19/20 is 39.04% – the highest in 10 years. According to my model, this means that the price of CBOT wheat futures is now about $450 per 1,000 bushels, or 20% below the current level:

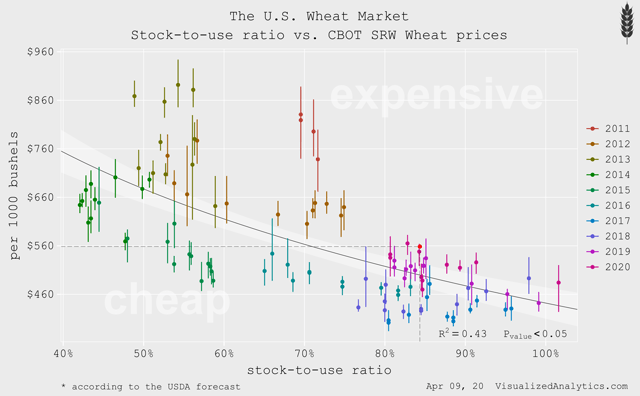

Considering the stock-to-use ratio solely for the U.S. market, one can say that the price of CBOT wheat futures is also above the balanced level:

Bottom line

So, in my opinion, the price of wheat has very few reasons to stay at the current level. One such reason is the fear that exporting countries will begin to ban wheat exports to protect their domestic stockpiles in the face of the COVID-19 epidemic. On the other hand, this same epidemic causes a decrease in business activity around the world. And this entails a decrease in wheat consumption.

Bringing it all together, I believe that the WEAT ETF will decrease to $5.4 per share in the coming month.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment