Mrinal Pal

Introduction

We review our Hold rating on American Express Company (NYSE:AXP) after shares have risen 11% since our last update on July 3, even with Visa (V) and Mastercard (MA) shares having been largely flat in the same period.

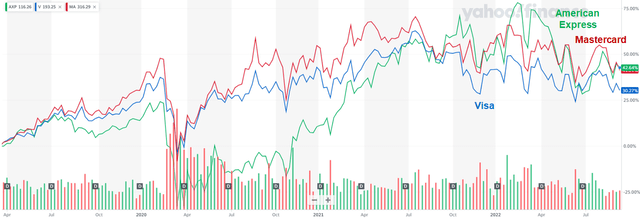

We initiated our Hold rating on AXP in March 2019, stating our view that its shares should be avoided. At present AXP stock stands at a gain of 46% (including dividends), ahead of Mastercard (which has gained 40%) and Visa (which has gained 30%), both of which have been Buy-rated in our coverage. AXP’s share price was behind for most of the period since initiation, but has caught up since last summer:

|

AXP Share Price Performance vs. Mastercard & Visa (Since March 20, 2019)  Source: Yahoo Finance (15-Sep-22). |

We remain cautious on American Express shares. U.S. consumer spending has continued to be strong. However, we are concerned about intensifying competition with bank issuers on the Mastercard and Visa networks. AXP earnings have remained smaller than before COVID-19 despite volumes having surpassed pre-pandemic levels, unlike Mastercard and Visa. AXP profit margins contracted again in Q2 2022, and expense expectations were raised. 2022 outlook imply the return of margin expansion in H2 and management targets a mid-teens+ EPS growth from 2024, but we are unconvinced. Avoid.

American Express Cautious View Recap

Our Hold rating on AXP has been based on what we see as structural weaknesses in its business model, including:

- Competition in credit cards is fierce, and AXP mainly attracts customers through rewards and co-brand partners, which competitors can match if they spend enough; this has led to escalating costs for AXP

- AXP’s closed-loop network means it bears the full costs of competing with card-issuing banks, and finds it harder to collaborate with Fintech players, including in Buy Now Pay Later (“BNPL”)

- AXP’s increasing focus on loan growth means growth is necessarily more capital-intensive, and it is likely to have to retain a sizeable portion of its earnings each year to maintain adequate capital ratios

- AXP is more exposed to a future U.S. economic downturn, since the U.S. is more than 70% of its Pre-Tax Income, and its lending activities would be vulnerable to the eventual normalization in loan losses

Most of the negatives above continue to be apparent in AXP’s recent business performance, though at present being U.S.-centric is a positive because of the much stronger performance of the U.S. economy relative to other regions.

U.S. Consumer Spending Is Strong

U.S. consumer spending is strong, as demonstrated by recent management comments and volume data.

AXP CFO Jeff Campbell, appearing at an investor conference on Monday (September 12), stated that:

The short answer is yes … The U.S. consumer continues to look very strong … you just don’t see any significant signs of weakness anywhere in the slice of the economy that we cover as we sit here today on September 12″

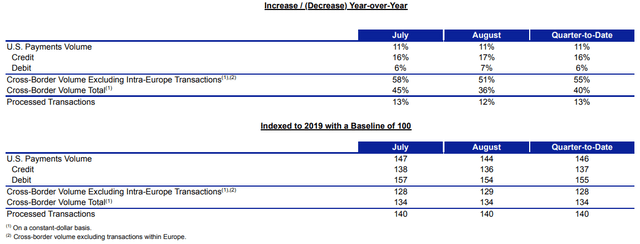

Data released by Visa for August 1-28 showed that their U.S. Payments Volume grew by 11% year-on-year in August, the same as in July; relative to 2019, Visa’s U.S. Payments Volume were at 144% in August, roughly in line with the 147% figure in July:

|

Visa U.S. Payments Volume Growth Rates (July-August 2022)  Source: Visa 8-K filing (30-Aug-22). |

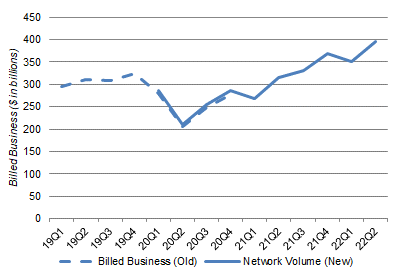

AXP’s Network Volume was well ahead of 2019 levels by late 2021, and was 27% ahead as of Q2 2022; Travel & Entertainment was at 108% of its 2019 level, largely led by strength in U.S. Consumer (at 136% of 2019 level):

|

AXP Network Volume By Quarter (Since 2019)  Source: AXP company filings. NB. AXP amended its volume nomenclature at the start of 2021. |

AXP’s U.S.-centric business has therefore turned into a positive, at least for now.

AXP Earnings Still Below Pre-COVID Levels

AXP earnings have remained smaller than before COVID-19, despite volumes having surpassed pre-pandemic levels.

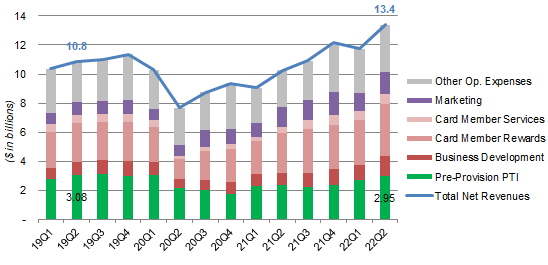

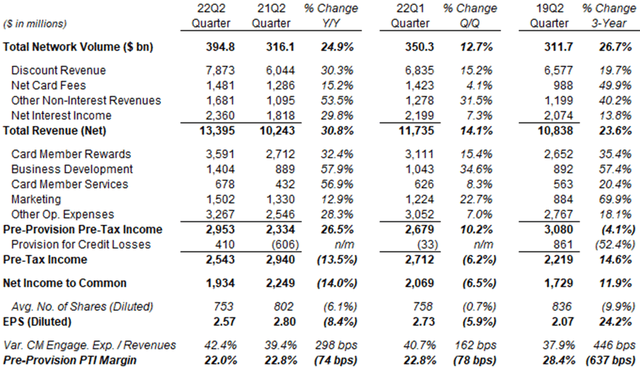

By “earnings” we mean Pre-Provision Pre-Tax Income (“PPPTI”), which excludes the impact of volatile changes in credit reserves. At $2.95bn, Q2 2022 PPPTI was 4.1% below Q2 2019, despite revenues being 23.6% larger:

|

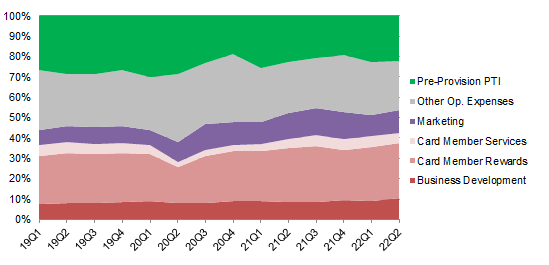

AXP Revenues, Expenses & Pre-Provision PTI (Since 2019)  Source: AXP company filings. |

This decline in profitability has been caused by the rising costs to compete, including in Card Member Services, Card Member Rewards and Business Development. Collectively referred to as “Variable Card Member Engagement Expenses”, they have risen from 37.2% of revenues in 2019 to 39.5% in 2021, and are guided to be 42% in 2022:

|

AXP Profit & Expense Margins (Since 2019)  Source: AXP company filings. |

Figures for Q2 2022 show how the rise in Variable Card Member Engagement Expenses is an ongoing trend:

|

AXP P&L (Q2 2022 vs. Prior Periods)  Source: AXP results supplements. |

On a year-on-year basis, while revenues have risen 30.8% in Q2 2022, Card Member Services, Card Member Rewards and Business Development expenses have all risen even more, and the Variable Card Member Engagement Expenses margin has risen by nearly 3 ppt from 39.4% to 42.4%. PPPTI margin was down 74 bps year-on-year.

Sequentially, while revenues have risen 14.1% from Q1 2022, both Card Member Rewards and Business Development costs have risen more, and the Variable Card Member Engagement Expenses margin was 1.6 ppt higher. PPPTI margin was down 78 bps sequentially.

Compared to 2019, Q2 2022 Variable Card Member Engagement Expense margin was nearly 4.5 ppt higher. Other expenses have also grown more than revenues, which meant PPPTI margin has fallen even more, by nearly 6.5 ppt.

AXP’s declining profitability is in sharp contrast to that at Mastercard and Visa. In Q2 CY 2022, Mastercard’s EBIT was 32.6% higher than in 2019 on revenues that were 33.5% higher, while Visa’s EBIT was 25.9% higher on revenues that were 24.6% higher.

AXP’s Latest 2022 Outlook

On releasing Q2 2022 results on July 2022, AXP raised its expense outlook, including:

- Marketing expense to be “a little over $5bn”, from “around $5bn” previously

- Other Operating Expenses to be “around $13bn”, from “a little over $12bn” previously

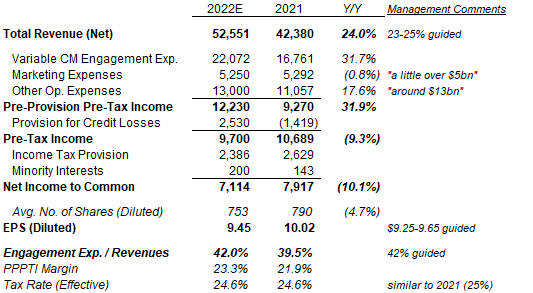

The higher expense outlook help ensure that, even as the outlook for 2022 revenue growth was raised (from 18-20% to 23-25%), the outlook for 2022 EPS remains unchanged (at $9.25-9.65). Higher expectations for credit losses are also a factor. We believe the implied 2022 P&L outlook resembles something like this:

|

AXP 2022 P&L Outlook (Estimated)  Source: AXP company filings. NB. Other Operating Expenses were net of $767m of investment gains in 2021. |

In this estimated P&L, full-year 2022 PPPTI growth of 31.9% exceeds revenue growth of 24.0%, unlike in Q1 and Q2, largely due to easier prior-year comparables in H2 where Variable Customer Engagement Expense and Marketing costs were already elevated last year.

While this would represent a return to margin expansion, it is less meaningful because it is on the back of an exceptional post-COVID rebound in revenues (management only targets 10%+ revenue growth from 2024); and also because expense growth has been uneven and concentrated in the prior year.

Whether AXP will have operational leverage in a normal environment is a key question for investors, for the reasons explained below.

Return of Operational Leverage?

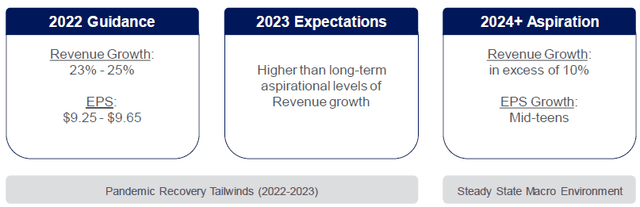

AXP’s medium-term targets include revenue growth of 10%+ and EPS growth in the mid-teens from 2024:

|

AXP Mid-Term Targets  Source: AXP results presentation (Q2 2022). |

To achieve the implied margin expansion, AXP needs operational leverage, which management expects to come from marketing and infrastructure expenses rising slower than revenues, even as Variable Card Member Engagement Expenses continue to rise faster than revenues. CFO Jeff Campbell reiterated this in his comments on September 12:

There is margin pressure on that Variable Customer Engagement line relative to revenues … we have a focus on offsetting by the fact that our marketing costs have historically grown more slowly than our revenues … [and] we have a very long track record of needing to grow the infrastructure costs … at a much slower pace than you have revenue growth.”

We are unconvinced. AXP has gone through a period of clear margin decline in 2018-21, and the likely small improvement in 2022 is partly due to an easy prior-year comparable. How much AXP will have to spend on cardmember engagement and marketing in the future will also depend on its competitors, many of them large banks like JPMorgan (JPM) and Bank of America (BAC) who have much deeper pockets and can accept much lower Return on Equity than AXP (which had a Return on Equity of 34.4% in Q2 2022).

More Earnings Needs To Be Retained

As we expected, AXP now has to retain more of its earnings as its lending volume is growing again.

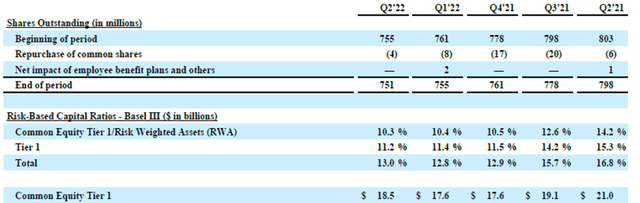

Since Q4 2021, AXP’s Common Equity Tier 1 (“CET1”) Ratio has fallen from 10.5% to 10.3% (though still within the 10-11% target) even though it has retained enough earnings to grow its CET1 Capital from $17.6bn to $18.5bn:

|

AXP Capital Ratios & Share Buybacks (Last 5 Quarters)  Source: AXP results supplement (Q2 2022). |

The $0.9bn of earnings implied to have been retained during H1 represents 22% of AXP’s Net Income in this period. With its surplus capital spent and more of its earnings needing to be retained, the number of shares AXP repurchased each quarter has fallen from 20m in Q3 2021 to 4m by Q2 2022.

American Express Valuation

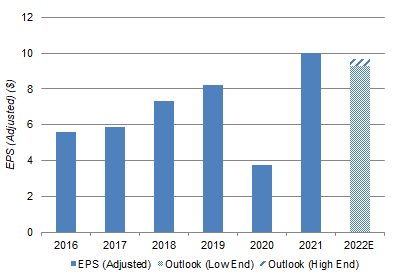

AXP’s EPS has been volatile due to one-off credit reserve changes, with earnings having been reduced by $4.73bn in Provision for Credit Losses in 2020 but being increased by a $1.42bn benefit in 2021:

|

AXP Adjusted EPS (2016-22E)  Source: AXP company filings. |

At $156.13, relative to pre-COVID 2019 earnings, AXP stock is trading at 19.1x P/E. The stock is also trading at 5.4x Price/Book (with a book value of $28.82 at Q2 2022), which on a targeted Return on Equity of 30% also implies a P/E of approx. 18x. (The P/E multiple is 14.8x on 2021 EPS and 16.5x on the mid-point of 2022 guided EPS.)

Prior to COVID-19, AXP share price peaked at approx. $135 in February 2020, which also represented a Price/Book of 5.1x (relative to a book value of $26.51 at Q4 2019).

AXP stock pays a dividend of $0.52 per quarter ($2.08 annualized), implying a Dividend Yield of 1.3%. AXP continues to target a 20-25% Payout Ratio.

We do not believe AXP shares are particularly cheap at present, unless it can achieve the low-teens EPS growth targeted by management.

Is AXP A Buy? Conclusion

We reiterate our Holding rating on American Express stock.

Be the first to comment