Darryl Fonseka/iStock via Getty Images

Investment Thesis

Planet Labs (NYSE:PL) has tanked since the completion of its business combination with dMY Technology Group, Inc. IV on December 7, 2021. In two and a half months of trading, its share price has nearly halved.

My question: why? My answer: no good reason.

With the SPAC combination complete, Planet now has the necessary capital to expand its sales force and invest in enhanced software capabilities (move “up the stack”) to accelerate growth. The Company appears to be in pole position to capture the “winner-take-most” opportunity for consistent daily earth observation data.

I own Planet – and consider it to be an excellent long-term investment – for reasons including:

- Expanding Moat: Planet holds an irreplicable data set comprised of ~1,700 images of each spot on Earth’s landmass. Competitors cannot go back in time to recreate this data; they are fighting an uphill battle.

- Highly Scalable Data Subscription Business: Over 90% of Planet’s revenue is recurring. With minimal incremental costs for new customers, the Company maintains 94-96% direct margins on each marginal dollar of sales.

- Customer Base and Wallet Share Expansion: Planet has exhibited eleven consecutive quarters of customer growth with a net dollar retention rate generally in excess of 100%.

- Large Market Opportunity with a Variety of Use Cases: Management has identified at least seven vertical markets that will meaningfully benefit from the incorporation of Planet data into workflows. The estimated market opportunity is over $120 billion by 2027.

- Aligned and Experienced Leadership / Shareholders: William Marshall (Co-founder & Chief Executive Officer) and Robbie Schingler (Co-founder & Chief Strategy Officer) have retained meaningful equity stakes and have been with Planet since founding.

Company & Business Overview

Before we dive in, I will provide an overview of Planet and its satellites, then shift to look at the Company through a more analytical investor’s lens.

It is important to note that Planet’s fiscal year runs through January 31 and is labeled as the year it ends in. For example, the Company’s FY 2022 just ended on January 31, 2022. Due to the recency of Planet’s listing and lack of ample data, I use both calendar year (“CY”) and fiscal year (“FY”) to provide the most complete financial picture.

History

Planet was founded in 2010 by three former NASA scientists: William Marshall, Robbie Schingler and Chris Boshuizen (exited in 2015 to join a venture capital firm). The Company’s mission is to “make global change visible, accessible and actionable” via daily images of Earth’s surface.

The initial impetus for the creation of Planet was simple: the founders believed there to be a business opportunity to image the Earth every day and sell the associated data. Having worked on small spacecraft at NASA, the trio set out to leverage the greatly enhanced computing power of consumer electronics to create a low-cost, easy-to-launch satellite capable of powerful imagery. By using inexpensive consumer electronics, Planet hoped to lower the costs of failed satellites / missions and enable frequent iteration.

Eighteen iterations and over a decade later, Planet reached its current state. The Company has now successfully launched over 500 satellites (10x that of the closest competitor) and maintains an operational fleet of over 200 Doves and 21 SkySats.

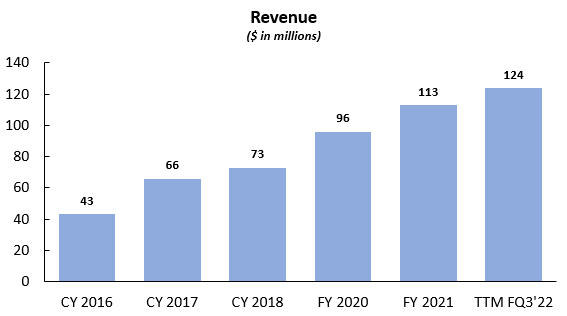

Planet Revenue (CY 2016 – TTM FQ3 2021) (Data from Planet Analyst Day Presentation)

Satellite Breakdown

All Planet satellites are manufactured in-house and designed with the principles of agile aerospace in mind. To integrate the latest technology in each iteration, Planet uses just-in-time manufacturing at a facility in California where production can easily be adjusted based on launch timeline and costs.

The satellites work in tandem to create a unique data set that no competitor can currently replicate. Doves scan Earth constantly, imaging at a three-meter resolution and looking for change. Once a notable change is detected, a SkySat can be tasked to zoom in and image the area with a greater level of detail (50-centimeter resolution). This approach ensures the uniformity of the data (each spot is imaged by Doves at exactly the same angle and time of day each day) and allows customers the flexibility to view a more granular image if needed.

Over the last 10+ years, Planet has improved the cost / benefit profile of its satellites by 1,000-fold while maintaining a very low satellite loss rate. Furthermore, Planet’s satellites have increased their total area imaged per day by 10,000x over the same period. Now, the Company’s daily area coverage is 2x the Earth’s landmass and many multiples that of the closest competitor.

Doves are highly cost-effective with a payback period of generally three to six months. At a $300k all-in cost (about half materials, half labor / launch) with a three-year useful life, it marks a drastic departure from legacy space satellites that cost hundreds of times that.

With the introduction of the Pelican in October 2021, the Company does not plan to launch any more SkySats, so I will only detail the relevant Pelican costs and benefits.

Pelicans are produced at a cost of ~$4-4.5 million with a five-year useful life. When operational in 2023, Pelican satellites will improve the (already market-leading) revisit capabilities of SkySats by up to 10x. Essentially, this means clients will be able to task Pelicans to take higher resolution images of up to 10x more places each day compared to SkySats’ current capabilities. As a result, the latency a client experiences between tasking a satellite and receiving the image will be drastically reduced.

Revenue Breakdown

Planet generates revenue by selling licenses to the Earth data and analytics produced from its satellite constellations via a cloud-based platform (similar to how a Bloomberg Terminal provides financial data).

The Company’s “one-to-many” subscription model differs sharply from legacy Earth observation providers in that each satellite image is uploaded to the Planet Platform and sold to an unlimited number of customers. This enables substantially higher margins than legacy providers who would build expensive satellites and sell individual images requested by customers (typically governments and intelligence services).

With respect to pricing, Planet sells imagery on a per unit of area basis (per kilometer, hectare, etc.) with generally discounted pricing as the volume increases. As the Company “moves up the stack” (read: turns raw imagery into data points understandable by you or me), it anticipates being able to charge higher prices because of the additional value-add and uniqueness of the data.

Expanding Economic Moat

Planet has developed a significant economic moat that steadily expands with each day that competitors lack the Company’s capabilities. With an archive of nearly 1,700 images of each place on Earth (growing each day), Planet’s data is highly differentiated from competitors who can never go back in time to gather the same images. Furthermore, customers often want to back-test their models with historical data, and as every competitor lacks Planet’s volume and consistency of data, the Company becomes the obvious go-to choice.

Planet has also benefitted tremendously from being able to iterate and refine its satellite hardware to produce the highest frequency, most uniform data available. As mentioned earlier, the Company’s satellites have gone through eighteen iterations over the last decade, yielding a 10,000x increase in imaging area per day as well as a 1,000x increase in cost / benefit profile.

This advantage is evident by comparing Planet’s capabilities to several competitors.

Currently, Planet has over 200 commercial satellites in orbit, imaging every spot on Earth’s landmass daily, with the ability to revisit certain sites for higher resolution photos up to 12x per day (remember, Pelican will expand this drastically to ~120x per day once operational in 2023).

Maxar Technologies (NYSE:MAXR) derives ~87% of revenue from the U.S. government and international defense allies, so it is generally not competing in the exact same sphere as Planet. It only has a four-satellite constellation and operates similar to a legacy provider, with customers typically paying for access to each image. Additionally, Maxar holds an imaging capacity of only ~5 million square km per day, with up to 15 site revisits per day. For reference, the Earth’s landmass is ~148.4 million square km, indicating Planet’s capacity is ~300 million square km, significantly larger than Maxar.

Satellogic (NASDAQ:SATL), another competitor, currently has 17 commercial satellites in orbit with a daily capture capacity of 300k square kilometers. As further evidence of the lead time Planet holds, the Satellogic CEO, Emiliano Kargieman, told CNBC in July 2021, “We’re going to grow the full [satellite] constellation by 2025 to 300 satellites, to get daily remaps of the entire planet.”

Planet is already generating daily remaps of the Earth, and I can’t imagine they will sit on their hands and watch as Satellogic attempts to catch up.

BlackSky (NYSE:BKSY) has only six commercial satellites in orbit, and while the exact coverage area is not available, its latest investor presentation claims it makes one million observations per day. For its most recent quarter, BlackSky reported $7.9 million in revenue; Planet reported $31.7 million in its most recent quarter.

Whichever way you look at it, it appears that Planet has established a sizable advantage over its competitors. With a strong, founder-led leadership team and a clear vision for growth, I can’t imagine the Company concedes its leadership position in the Earth observation market.

Also worth noting is the Company’s competitive advantage with respect to talent acquisition. In order to maintain its leadership position, Planet must consistently recruit the best talent available. As the scaled, proven innovator, I imagine recent engineering graduates and passionate space technologists will want to work for Planet over less proven, more bootstrapped firms. The Company also has the highest Glassdoor rating of any firm mentioned here. This advantage should prove to strengthen Planet’s moat as time passes.

Highly Scalable Data Subscription Business

Planet’s “one-to-many” subscription model provides a high degree of scalability coupled with higher margins than legacy Earth observation providers who sold images to individual clients. Revenue visibility is also strong, with over 70% of contracts having multi-year durations.

The scalability of the platform is demonstrated by the consistent and substantial increase in gross margin over the last several years. From FY’20 to YTD FQ3’22, Planet’s gross margin increased from (7%) to 36%, a 43-percentage point increase. Importantly, this margin includes satellite depreciation and would be notably higher if it were broken out into operating expenses (as several other satellite companies do).

As the Company continues to scale revenue amid increased sales and marketing efforts, gross margins will, in all likelihood, steadily improve due to outstanding direct margins. New customers contribute revenue at a 94-96% direct margin, meaning ~$95 of every incremental $100 in sales immediately flows through to gross profit.

Over the long haul (5-10+ years), I expect Planet to approach 70-80%+ gross margins as its cost of goods sold remains relatively fixed, and new satellites require capital outlays of only $300k per Dove and ~$4 million per Pelican.

Customer Base and Wallet Share Expansion

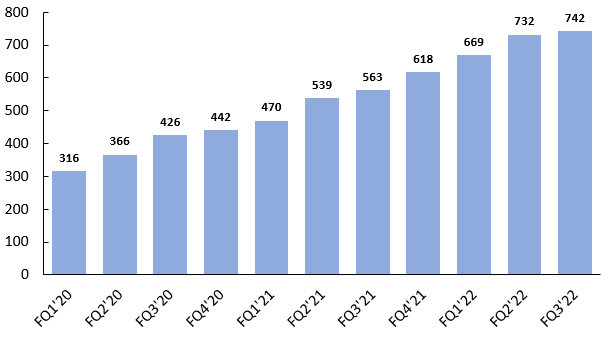

Planet has exhibited consistent growth in its customer base at a 36% (2.75 year) compound annual growth rate since FQ1’20 (as far back as data is available).

Planet Quarterly Customer Count (Data from Planet Analyst Day Presentation)

Additionally, some acceleration to growth could be possible in the near-term future as the sales pipeline grew 46% YoY in FQ3’22, and there are over 40 deals in the pipeline with over $1 million annual contract value (“ACV”). Ashley Johnson, Chief Financial Officer, pointed to another factor that could spur near-term growth on the FQ3 earnings call:

Historically, our growth rate has been limited by the amount we’ve been able to invest in growing our sales force. As such, one of the primary expected uses of the capital we raised in going public is to invest in our sales force and the supporting infrastructure that they need to meet the market potential we see for Planet’s data.

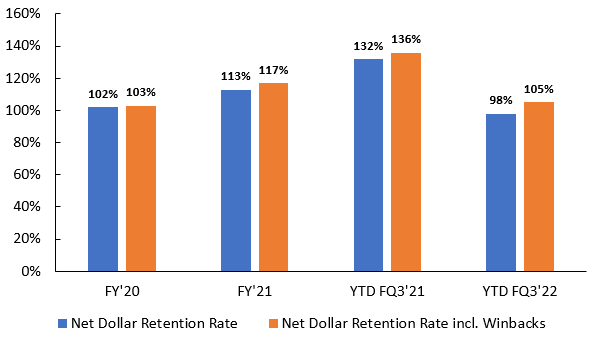

On the same call, she noted that Planet’s net promoter score has significantly improved recently as they continue to invest in customer service and enhanced data solutions. This should translate, in turn, to an increase in the Company’s net dollar retention rate (“NDRR”), which for the most part has remained above 100% historically.

Planet Net Dollar Retention Rate (Data from Planet Prospectus)

The decline in the metric for YTD FQ3’22 is primarily attributable to the loss of a large government contract after it was taken over by an unsanctioned regime in Q3 (for my money, I bet the contract was with an Afghanistan security agency as Kabul was overtaken by the Taliban in August 2021). While such political violence certainly represents a risk, it is important to note that the decline in NDRR is not due to customer dissatisfaction, but merely an unfortunate occurrence.

Importantly, the NDRR including customer winbacks has exceeded the NDRR in each period that we have data, indicating previously churned customers have recognized the value of Planet’s offering after cancelling and returned within the following two years.

Large Market Opportunity with a Variety of Use Cases

The key driver behind the historical customer growth and net dollar retention rate has been simple: customer satisfaction. Customers across a variety of industries benefit meaningfully from incorporating Planet’s data into their workflows.

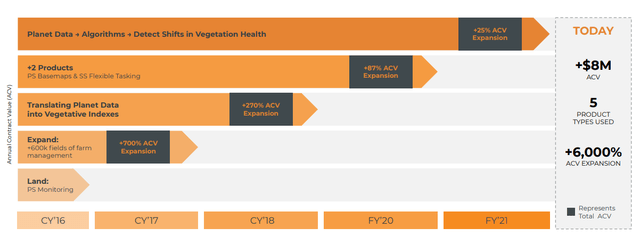

Agriculture: Approximately a quarter of the Earth’s landmass consists of agricultural land, so agriculture was an obvious use case for Planet as it built out its data platform. For FY’21, agriculture contributed ~23% of revenue.

Farmers typically want intelligence on their fields several times per week in order to effectively monitor each area and adjust methods based on performance. Previous solutions only provided such data on an annual or infrequent basis at best, limiting farmers’ ability to learn until after the crop season. However, with Planet’s solution, farmers can view the relevant data on a daily basis, driving crop yields up 20-40% and decreasing the use of fertilizer and other chemicals. Corteva, for instance, contracts Planet to image over a million farmer’s fields per day. The below image demonstrates the steady growth in spending of a large commercial agriculture customer.

Planet Agriculture Customer Spending Growth (Image from Planet Analyst Day Presentation)

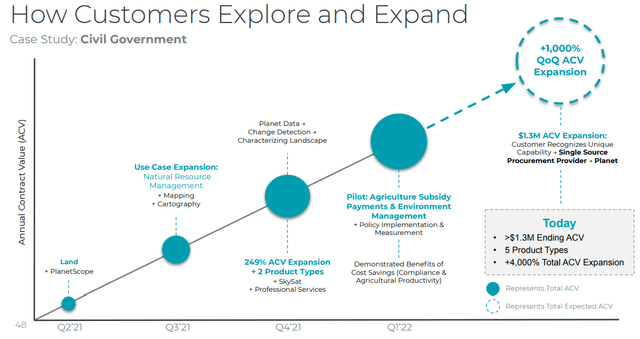

Civil Government: For FY’21, civil government contributed ~24% of revenue. Planet’s data assists civil customers plan for and mitigate damages from floods and fires as well as plan for future development, etc. As an example, Planet can map every tree in California and determine which areas are the most prone to future wildfires. Moreover, it can predict where possible floodplains will be and which buildings / future construction areas will be affected. The below image represents the ACV expansion of one civil customer.

Planet Civil Government Customer Spending Growth (Image from Planet Analyst Day Presentation)

Mapping: Mapping contributed ~17% of FY’21 revenue. Services such as Google Maps and other navigation systems are kept up to date using Planet data. Furthermore, mapping generally ignored areas of the world has resulted in valuable information to a variety of potential customers. For instance, Planet images uncovered ~200 potential Uyghur camps in Western China; Planet images have monitored the movement of Russia’s military on the border of Ukraine; and Planet images have discovered illegal gold mining activity in the heart of the Amazon rainforest.

Defense and Intelligence: Defense and intelligence customers accounted for ~22% of FY’21 revenue. The use cases for this market are well known at this point, but no platform provides the daily frequency of entire Earth data that Planet does. The Company’s data enables governments and agencies to monitor resources, track vessels and aircraft, create emergency response plans and enhance general security systems, among other things.

Additional Markets: Planet sees a substantial opportunity to further expand its offerings into additional vertical markets, particularly as the Company develops the analytical capabilities to turn its raw imagery into relevant, actionable data points that can be interpreted by non-geospatial experts.

In finance, for example, imagine the value to a hedge fund of knowing the wheat crop yield before the vast majority of market participants. In insurance, clients can use Planet’s historical data to optimize pricing models, more accurately forecast potential risk and validate claims. In forestry, the Company can map the daily effects of deforestation across the globe. For sustainability efforts, Planet has mapped all of the world’s coral reefs to monitor for further signs of depletion.

Within all of these, Planet data allows companies to monitor their sustainability footprint. Over the coming years, I expect this to be more and more valuable as requirements for precise measurements of companies’ impact may be required.

Overall, Planet’s data is not limited by use cases. As the Company works to improve automated object recognition and, in general, make its data more accessible to non-geospatial experts, I anticipate continuous growth as the data applications extend to more use cases.

Aligned and Experienced Leadership / Shareholders

Planet is currently led by two of the three co-founders, who have both retained substantial equity stakes post-SPAC combination. Prior to the potential dilution from the recently amended employee incentive plan, Will Marshall holds 9% ownership, with Robbie Schingler maintaining an 8% interest. Both have been with the Company since its inception, and prior to that, worked at NASA building small spacecraft. As an added anecdote, Will Marshall’s PhD supervisor previously won the Nobel Prize in Physics.

Planet’s leadership is highly respected at the Company, and employees generally like working there and feel passionate about their jobs. The Company maintains 4.6 stars on Glassdoor, and 92% of employees approve of the CEO. This is essential to continuing to attract top talent.

I also feel it is worth noting that after listing on December 7, 2021, Planet reported earnings and held a conference call despite the fact they had no obligation. This speaks to a shareholder-friendly management, as well as a commitment to spreading the word of the Company. With less than 20% of outstanding shares owned by institutional investors, Planet has potential to explode if it executes over the next year and institutional acceptance sets in.

Furthermore, Planet has several strategic investors that may propel the Company forward. Draper Fisher Jurvetson, for one, holds ~9% of the Company’s equity, with Steve Jurvetson sitting on the Board of Directors of SpaceX. With his experience in innovative spacecraft, Mr. Jurvetson could be a strategic resource in the future.

Lastly, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) holds ~12% ownership, indicating the strong potential the company sees in Planet. In fact, similar to Google indexing the internet, Planet’s long-term goal is to index its daily Earth data. I don’t believe it is worth going into detail on the plan yet as it is far out in the future, but the point is, eventually customers should be able to query simple things such as, “Exactly how many houses are in Orange County, CA?” or “What time of day is the peak traffic on I-95?” and Planet will retrieve the exact number as of that day. If Google sees the potential for this to occur long-term, I can sure be patient as well.

Valuation

For all of the business potential, I believe Planet trades at quite a reasonable valuation. Pro forma for the business combination, the Company has ~$600 million of cash on its books and no debt. At a market cap of ~$1.4 billion, this translates to an enterprise value / trailing twelve-month sales multiple of ~6.5x.

Relative to the Company’s long-term prospects, I consider this exceptionally reasonable, and I am confident in management’s vision and ability to execute. Furthermore, as Planet scales revenue, it should become significantly more profitable due to the limited incremental costs of its data subscription model.

Risk Analysis

Competitive Threats: Consistent with any innovative business, the Company faces the threat of new entrants. However, as detailed above, I am confident in the moat protecting Planet’s position as well as leadership’s ability to continue to innovate and improve their solutions.

Geopolitical Risk: As is apparent through Planet’s loss of a large government contract due to an unsanctioned regime takeover, the Company may be susceptible to such events occurring and immediately lose the full value of a contract. However, this seems to be a minor risk in the grand scheme of Planet’s appeal to commercial enterprises and developed governments.

- Additionally, there are risks associated with countries such as Russia, China, North Korea, Iran, etc. not allowing the Company’s satellites to image their territory. However, this is mitigated by international law that declares anything beyond 100 km in the air free space, and satellites can take pictures as long as they are above that distance (Planet’s satellites orbit at ~300 km).

Short-Term Cash Burn: As the Company ramps up investments in sales and marketing and research and development, I anticipate the Company’s profitability and cash burn to increase substantially in the near-term. However, these investments pave the way for Planet to capture the market and, in my opinion, support the long-term thesis. Also, management noted on the FQ3 earnings call that the Company is “fully capitalized” for expansion.

Talent Acquisition: A major factor in Planet protecting its market position is continuing to attract top talent. While the labor market is fiercely competitive right now, Planet has managed to keep hiring on pace with plans, which provides a degree of comfort surrounding this. Additionally, being the proven market leader and a scaled business with over $100 million in revenue helps to attract talent.

Dilution: With the recently authorized employee incentive plan, there is potential for significant dilution to existing shareholders. However, with the long-term prospects for the Company and performance-oriented thresholds, I anticipate that any dilution will be moderated by the long-term success of the Company, as well as the future cash generation that can potentially be used to repurchase shares.

Conclusion

The revolution that has occurred over the last decade in space satellite efficiency is akin to the transition from mainframe to desktop computing. Planet has established a leadership position in the large and growing market for Earth observation data, and with a strengthening moat, it should be able to drive sustained growth long into the future. As the Company moves its data up the stack and extends use cases into additional verticals, growth rates should accelerate, and more customers will recognize the value of accessible daily Earth data. I recommend investors purchase shares of Planet with a plan to monitor the Company’s performance and hold for a decade or longer.

Be the first to comment