Justin Sullivan

Many large-cap pharma stocks have seen a run-up in prices in recent months, as investors sought shelter in safety amidst economic uncertainty. However, there are some that have been left behind, offering investors value and a high dividend yield to boot.

This brings me to Gilead Sciences (NASDAQ:GILD), which remains in bargain territory with yield well above 4%. In this article, I highlight what makes GILD a solid buy at present for potentially strong long-term returns, so let’s get started.

Why GILD?

Gilead Sciences is a global biopharma company that’s been around for over 3 decades, achieving medicinal breakthroughs along the way. This includes its moat-worthy treatments for life-threatening diseases such as HIV, cancer, and viral hepatitis. Over the trailing 12 months, GILD generated $27.5 billion in total revenue.

GILD is demonstrating respectable results. While total sales grew by just 1% YoY during the second quarter, they grew by 7% YoY when Veklury is excluded. For reference, Veklury is the named drug for remdesivir, which is the COVID therapy that’s seeing a decline due partly to depleted U.S. inventories.

These strong results were driven by continued growth in GILD’s total HIV product sales grew by a respectable 7% YoY, driven by 28% growth from Bitkarvy, GILD’s once a day oral HIV drug. Also encouraging, management increased product sales guidance for the full year by $700 million, to $24.75 billion at the midpoint on the back of expected continued strong demand for HIV and oncology sales, as well as higher demand for Veklury for the remainder of the year as production ramps up.

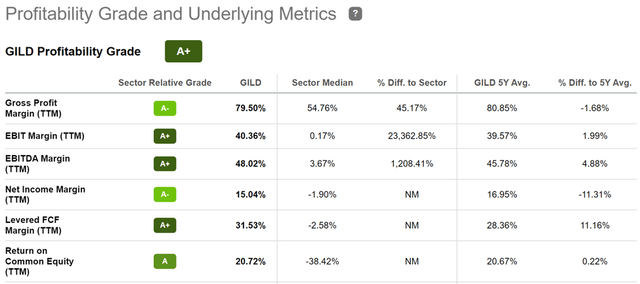

Moreover, GILD maintains strong profitability relative to the pharmaceutical sector. This is due primarily to GILD’s HIV and HCV portfolio, which are inexpensive to manufacture and requires only a small salesforce, as the drugs’ efficacy and patient need sell themselves. As shown below, it scores an A+ for profitability, with sector leading EBITDA margin and return on equity of 48% and 21%, respectively.

GILD Profitability (Seeking Alpha)

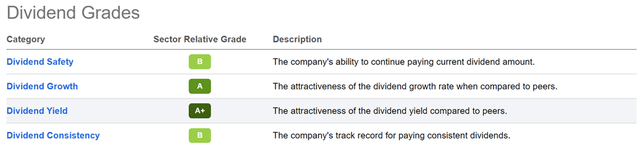

Meanwhile, GILD sports a strong BBB+ rated balance sheet and management is also focused on capital returns to shareholders. At present, GLID offers a respectable 4.5% dividend yield that’s well-covered by a 41% payout ratio, and has a 5-year 7.8% CAGR. As shown below, GILD scores A and B grades for dividend safety, growth, yield, and consistency.

GILD Dividend Grades (Seeking Alpha)

Management is also returning capital to shareholders in the form of share buybacks, including $72 million worth of share repurchases during the second quarter alone. As shown below, GILD has reduced 4.4% of its share count over the past 5 years, with the bulk of reduction being made pre-COVID, and it appears that share buybacks have started to ramp back up.

GILD Shares Outstanding (Seeking Alpha)

Risks to GILD include declining revenue from its HCV products, whose sales declined by 18% due to lower realized prices and fewer patient starts. Moreover, future drug pricing negotiations with Medicare introduces uncertainties as well. However, heavier leaning towards oncology and biologics gives it long pricing protection.

In addition, recent positive news around Trodelvy are reasons to be optimistic, as GILD recently announced that it significantly improved overall survival in certain patients with metastatic breast cancer who took part in a Phase 3 trial. Management also noted further studies underway for Trodelvy’s use in other cancer types including lung cancer in conjunction with Merck’s (MRK) blockbuster drug, Keytruda. This was noted during the recent conference call:

In our Trodelvy lung program, we initiated the Phase 2 EVOKE‐02 non‐small cell lung cancer study in the second quarter evaluating the combination of Trodelvy with Merck‘s Keytruda in patients without actionable genomic mutations.

Looking forward to the second half of this year, we expect to begin enrolling patients for the Phase 3 EVOKE‐03 or KEYNOTE‐D46 study in first‐line non‐small cell lung cancer with PD‐L1 expression level of greater than equal to 50%, in collaboration with our partners at Merck. Additionally, later this year we expect to initiate several other Trodelvy combinations, including evaluating Trodelvy in castrate‐resistant prostate cancer.

Lastly, GILD remains rather cheap at the current price of $65.34 with a forward PE of just 9.8, sitting well below that of its peers such as Merck and Amgen (AMGN), whose PE valuations range from the low to mid teens. Morningstar has an $81 fair value estimate and sell side analysts have a consensus Buy rating with an average price target of $70.57, translating to a potential one-year total return in the 13% to 29% range.

Investor Takeaway

Gilead Sciences is a strong pick for income and growth at the current price. It has leading positions in important drug categories, superior profitability, capital returns, and remains attractively valued relative to its peers. While there are some risks around potential pricing headwinds and declining HCV sales, these are more than offset by the company’s strong growth prospects in oncology. With a 4.5% dividend yield and potential for double-digit total returns, GILD is a great pick for income and growth investors at the current price.

Be the first to comment