wdstock

Over the six years, I’ve been writing about preferred stock issues of Wells Fargo (WFC) and other major banks, I’ve had a consistent favorite.

That’s the $1,000 original issue price of Wells Fargo Convertible Preferred Series L (WFC.PL), one of my largest holdings. It has reliably yielded more than its fixed-rate counterparts with $25 bases, probably because of the higher sticker price and unusual conversion features that can be easily misunderstood.

But with interest rates rising, fixed-rate preferreds have not had a good year and the outlook is murky. It’s time to look at fixed-to-floating issues that offer shelter from a hawkish Fed.

Wells Fargo Fixed/Float Non-Cumul Perp Pfd Stock Ser R (WFC.PR) (prospectus) offers the highest yield of the Wells preferreds on my spreadsheet.

| Ticker | Original Coupon | Dividend | Price | Yield | Call date |

| WFC-R | 6.63% | $1.66 | 25.78 | 0.0644 | 3/15/2024 |

| WFC-Q | 5.85% | $1.46 | 24.5 | 0.0596 | 9/15/2023 |

| WFC-L | 7.50% | $75 | $1,265 | 0.0593 | Convertible |

| WFC-A | 4.70% | $1.18 | 20.38 | 0.0579 | 12/15/2025 |

| WFC-Y | 5.63% | $1.41 | 24.34 | 0.0579 | 9/15/2022 |

| WFC-Z | 4.75% | $1.19 | 20.58 | 0.0578 | 3/15/2025 |

| WFC-C | 4.38% | $1.09 | 19.14 | 0.0569 | 3/15/2026 |

| WFC-D | 4.25% | $1.06 | 18.9 | 0.0561 | 9/15/2026 |

Source: Author’s spreadsheet, Quantum

WFC.PR is trading above par, with a current yield of 6.44%. The earliest call date is March 15, 2024. At the recent price, yield-to-worst is 4.47%.

Issued in 2012, it pays a 6.625% fixed coupon until March 2024, when it converts to a variable rate the three-month London Inter-Bank Offered Rate (LIBOR) plus 3.69%.

LIBOR has been stuck below 1% for years, but recently perked up to 3%. That would mean the base yield of WFC.PR would rise to 6.69% if the floating rate kicked in immediately. With Fed Chairman Jerome Powell vowing to push inflation down to its 2% goal, rates are likely to continue to trend higher.

The issue qualifies for preferential income tax rates. Although Wells preferreds are rated BB+, one notch lower than Bank of America preferreds at BBB-, they generally trade in line with the BofA issues.

Existing floating-rate preferreds have been dogs since the Fed took short-term rates down near zero. For example, Bank of America Series E preferred (BAC-E), which pays the greater of 4% or the three-month LIBOR rate plus 0.35%, has been stuck well below par. WFC-R offers more generous terms.

LIBOR Going Away

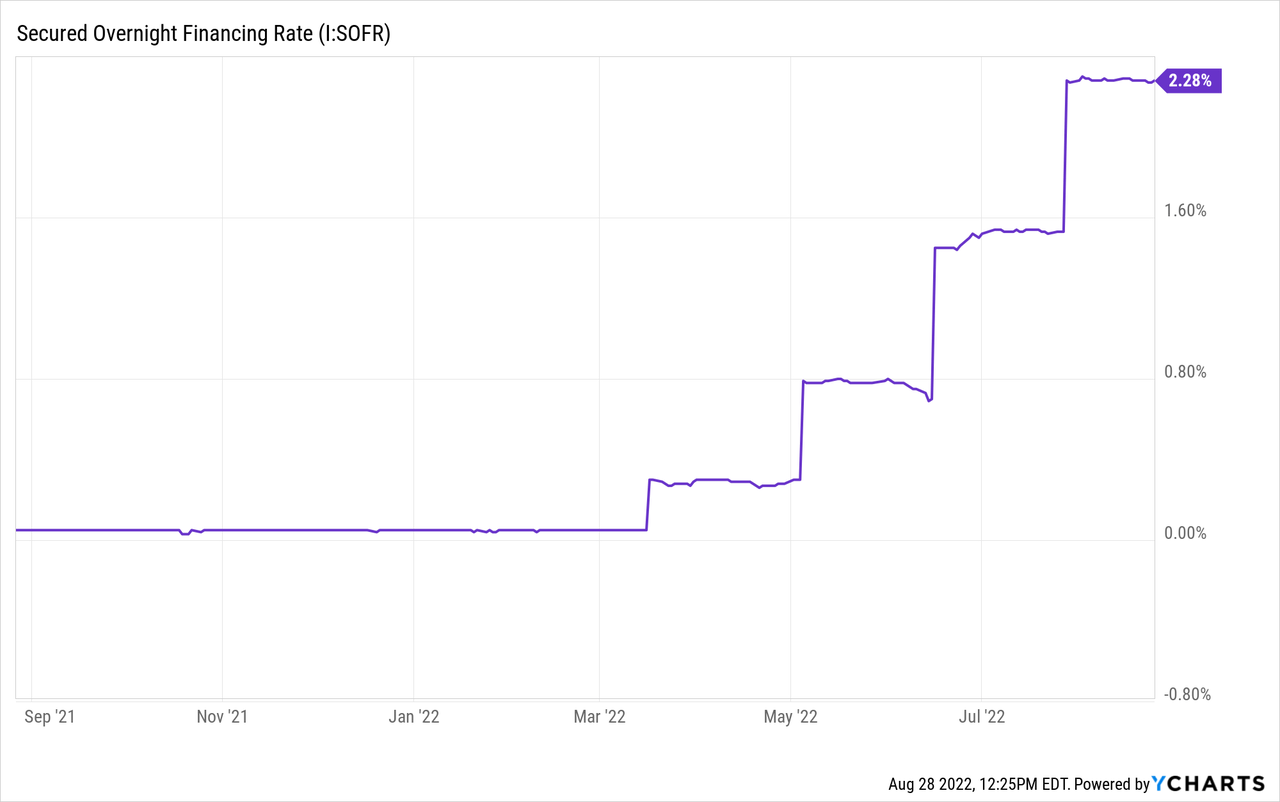

A complicating factor is that LIBOR is being phased out by banking regulators in the United Kingdom. The rate is largely determined by a survey of bankers rather than the market, and has been subject to manipulation. The Federal Reserve is in the process of rulemaking that would move the reference rate for LIBOR-linked contracts to the market-based Secured Overnight Financing Rate on June 30, 2023. SOFR is a broad measure of the cost of borrowing cash overnight, collateralized by Treasury securities.

The two rates differ in several respects. SOFR’s recent price was 2.28% and three-month LIBOR was 3%, a wider gap than usual, likely because of the positively sloped short-term yield curve. Unlike LIBOR, SOFR only looks backwards, tracking the Fed funds rate, which is expected to peak around 3.8%.

The index transition is still unknown territory. Many dividend investors will not want to sacrifice the safety of a fixed yield.

Alternative Choice

Investors who dislike call risk could consider WFC.PQ, which is selling slightly below the call price of $25. It has a lower coupon, 5.85%, for a current yield of 5.89%. It is not quite as generous, changing to a floating rate of LIBOR plus 3.09% in September 2023.

For those willing to benefit from higher short-term rates, WFC.PR looks more tempting. The stock has been trending down slowly alongside most fixed-rate preferreds (chart).

I’m considering a buy, but would prefer to get it closer to $25 to eliminate the possibility of losing principal on a call. In any case, call risk should be manageable. A tip-off will be how WFC.PQ trades in the six-month gap between its earliest call date and its sister’s.

Who says you can’t make money sitting on the SOFR?

Be the first to comment