Spencer Platt/Getty Images News

With the stock market sliding once again, some interesting names are popping up on the 52-week lows lists. One such potential bargain is V.F. Corp. (NYSE:VFC), which has dropped by half due to supply chain issues and worries around consumer spending.

People might be scared off since it is an apparel company, and clothing is known for being a cyclical industry. However, VF collects tons of brands, usually buying at low prices, and then operates them until they can sell or otherwise monetize them at more attractive valuations. This greatly reduces the boom-and-bust factor that is normally seen in the industry where companies rely on just one or two mainstay brands.

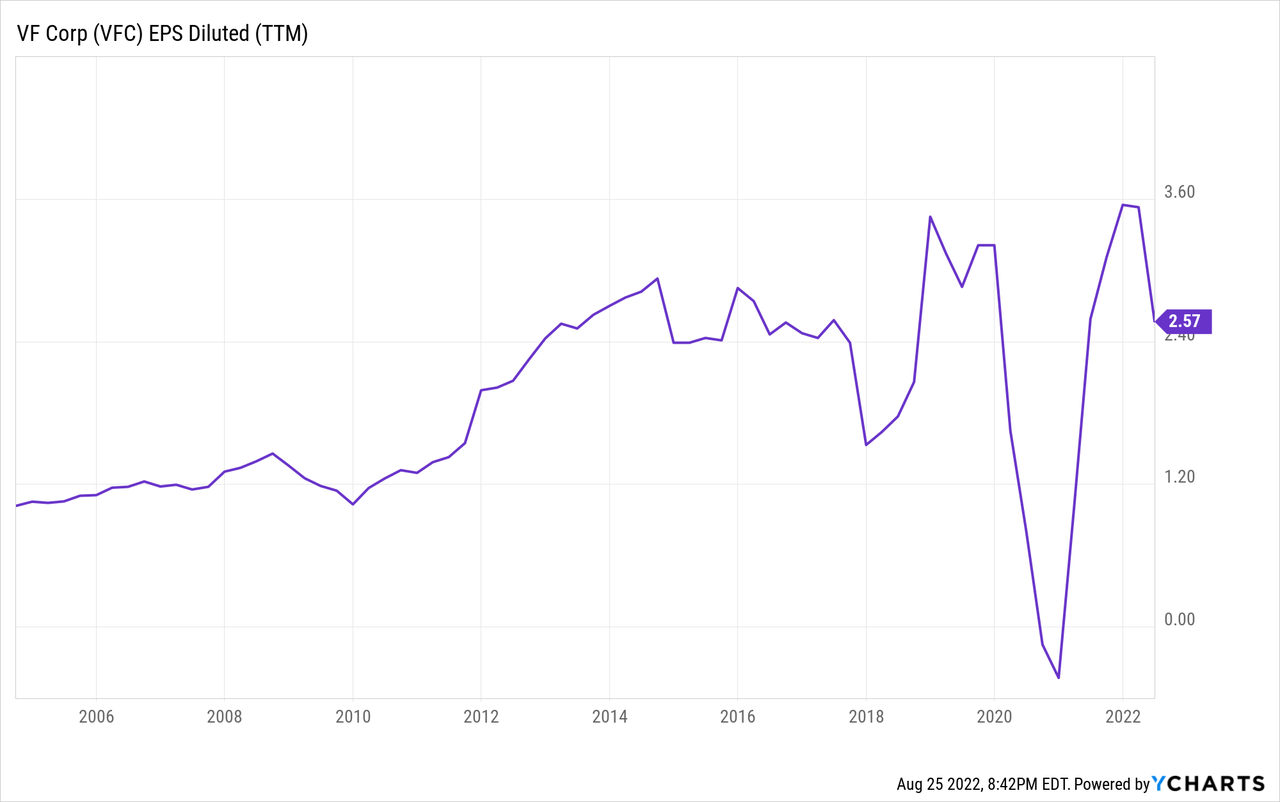

In any case, given its holdings across a ton of different apparel lines, V.F. Corp. has produced consistent earnings growth for decades and was back to record high earnings at the start of 2022:

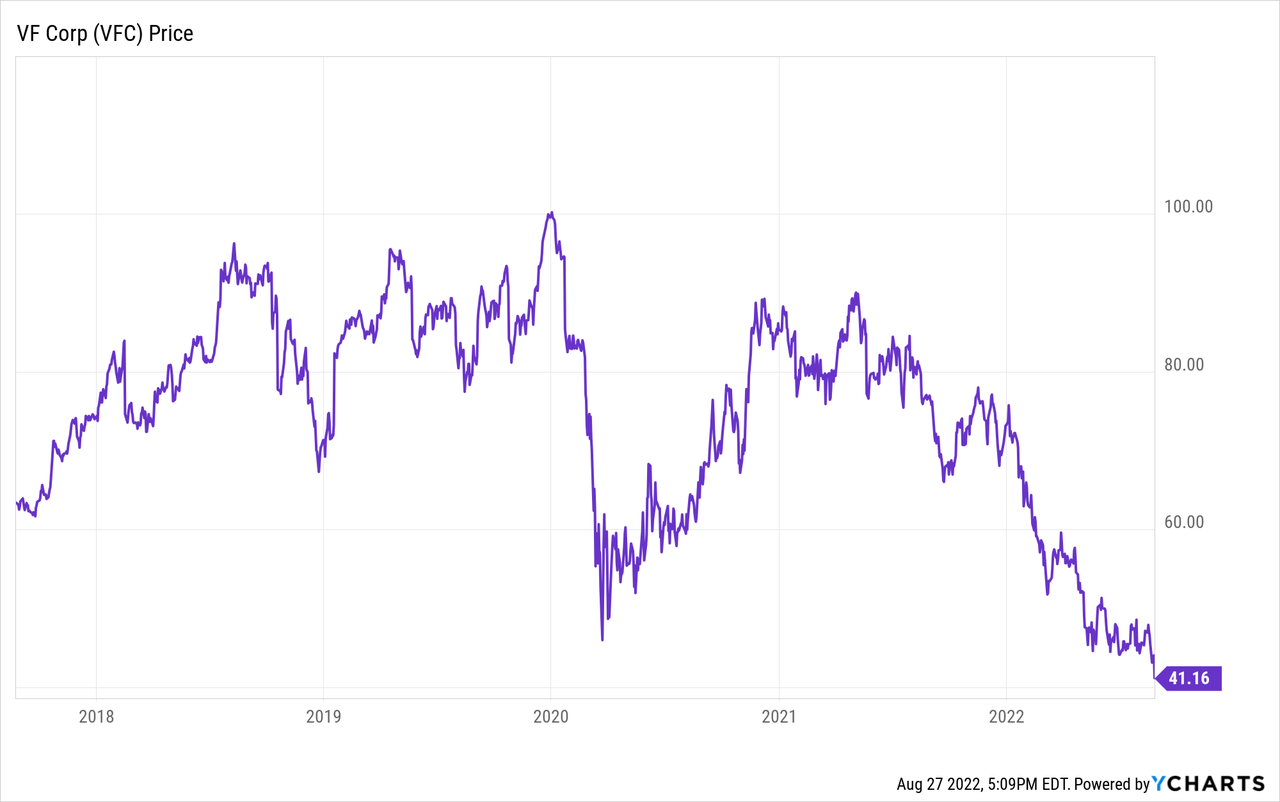

Yet, the stock price has gone off a cliff and is now selling below pandemic lows:

In the past, we had to pay at least 20x and often closer to 25x earnings for V.F. Corp. stock. Now it’s selling for 13x earnings. That’s a huge discount to normal. Could it get even cheaper? Sure, it could. If the S&P 500 drops to new lows later this year, as I think is reasonably likely, VFC stock would probably go with it.

The S&P 500 is currently around 23x earnings with V.F. Corp. at 13. In a world where the S&P pulls back to, say, 18x earnings, it’s not out of the question that VFC stock could fall to 10 or 11 times earnings. At some point, however, valuation should kick in as a solid floor.

Shares are already way down here even with little underlying reason for suffering more than the S&P 500 in particular. Despite earnings being around flat for now and set to trend back up soon, shares are off 50% from last year already.

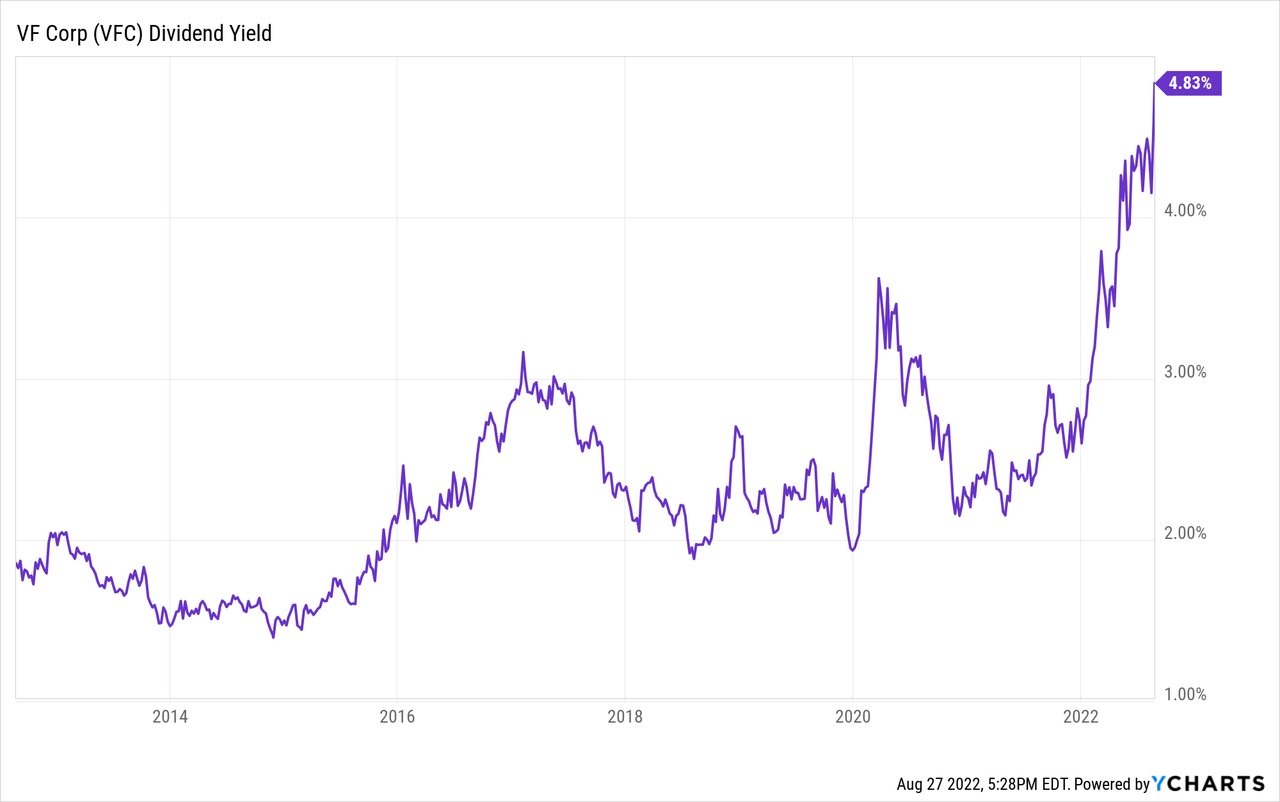

The company is also a Dividend Aristocrat with a long track record of consistent dividend hikes. Now, the yield has blown out from its usual 2-3% range up to 4.8%:

Why Is The Market So Concerned?

There is one specific negative that has hit solely V.F. Corp lately. That is that a judge found that V.F. Corp. underpaid taxes related to the acquisition of Timberland, and thus is on the hook for as much as $850 million in relation to that. This works out to less than $3/share for VFC stock which is not a huge problem in the grand scheme of things. However, it has caused debt rating downgrades and limited the firm’s ability to execute a share buyback now when prices are most advantageous.

More broadly, the negative economic and inflationary environment is having an effect on the whole apparel sector and VF in particular. The company just trimmed its FY ’23 earnings guidance from $3.35 per share to $3.10. This would still represent year-over-year growth and is hardly in line with a stock that is down by more than half. Still, VF is seeing some headwinds now and things could get worse before they get better.

Additionally, there were concerns about V.F. Corp.’s growth rate even prior to the pandemic.

The company paid out more in combined dividends and share buybacks than it generated in free cash flow over the past decade. That’s fine for a mature stable company, but it’s not something you expect to see from a firm that is growing much. And, as is, V.F. Corp.’s dividend growth rate has trailed off markedly, which isn’t too surprising given the slowdown in the momentum of its business operations.

Some of this is clouded by the spin-off of Kontoor Brands (KTB), which was the company’s jeans business. Not only was did that reduce V.F. Corp.’s overall profitability and cash flow, Kontoor was a particularly low-growth and high cash flow segment of the business. Kontoor brands initially spun off at a 7% dividend yield, highlighting just how much of a cash flow machine it was and is.

So you can give V.F. Corp. something of a pass for the specific struggle in raising the dividend at more than a nominal rate lately. Still, if management is going to return to the more robust growth days of old, it needs to make more shrewd acquisitions or otherwise unlock new upside possibilities.

I give companies with a differentiated business model and decades of proven success the benefit of the doubt during a down period. That being the case, the skeptics have a reasonable argument here. If the numbers don’t start looking better during the next economic expansion, we’ll need to revisit this point.

VF’s Earnings May Not Even Fall That Far

With VFC’s stock price down 60% from its all-time high, you’d imagine that the company was going through a major crisis. And yet, the numbers just don’t reflect that. At all.

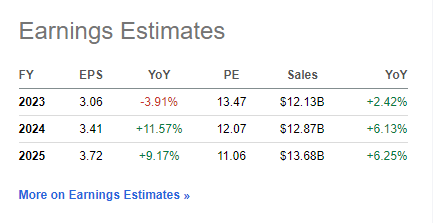

Here are earnings estimates for the company going forward:

VFC earnings estimates (Seeking Alpha)

For fiscal year 2023, analysts see revenues growing 2% while earnings dip a mere 4%. In 2024, analysts see sales growth returning to the mid-single digits while earnings growth moves back to 10% annually. This is not what you’d expect to see given the abysmal action in V.F. Corp.’s stock price.

The selling has accelerated in recent days as the market has turned downward again, along with analysts raising concerns over VF’s near-term outlook. I don’t fault the analysts for doing their job; the company faces headwinds in the short-term. There’s no denying that. But for growth and income investors that want to buy Dividend Aristocrats, much of the ability to get good prices comes from buying during times like this when short-term traders react sharply to economic swings.

V.F. Corp.’s Bottom Line

The inflation situation is causing problems for all sorts of consumer discretionary products, and apparel is no exception. In a time of penny-pinching, a firm like VF will have short-term issues in passing along the full effect of inflation to consumers.

However, as its Dividend Aristocrat status proves, V.F. Corp has shown itself to be remarkably capable of enduring economic swings without ruining its bottom line. The company’s broad stable of different brands gives it a big advantage here as it has a variety of different styles, trends, and price points with which to meet changing consumer behavior.

I’d also note that the dividend is well-supported. With the annual dividend at $2.00 per share, there is significant wiggle room between earnings and the current dividend rate as well.

V.F. Corp. shares were arguably quite overvalued when they hit $100 in January of 2020. I doubt we’ll see that price again for some time. That said, the pendulum has swung too far in the other direction. Figure an 18x multiple on fiscal year 24’s projected $3.41 of earnings, and that gets to a stock price of $61, or 50% upside from here. Throw in a 4.8% dividend yield with annual increases, and VFC stock should be a strong performer for the average growth and income portfolio.

Be the first to comment