PixelCatchers

Elevator Pitch

I retain a Buy investment rating for Choice Hotels International, Inc.’s (NYSE:CHH) stock.

In my previous June 3, 2022 update for Choice Hotels, I wrote about how CHH is growing the company’s presence in the extended-stay segment of the hospitality market and I also detailed the actions taken by Choice Hotels to optimize its hospitality property portfolio.

The market’s attention is on Choice Hotels’ recently proposed acquisition and the company’s updated guidance, which I cover in this article. In terms of organic growth outlook, CHH has recently raised its FY 2022 RevPAR guidance. With respect to inorganic growth prospects, the company is expected to complete the purchase of Radisson Hotel Group Americas in the very near term. Therefore, I have a positive opinion of CHH’s growth outlook, which provides justification for my Buy rating.

Positive On Recent M&A Deal

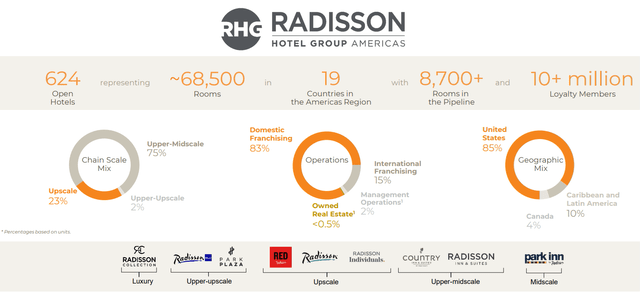

Choice Hotels announced on June 3, 2022 that it proposed “to acquire the franchise business, operations and intellectual property of Radisson Hotel Group Americas for approximately $675 million.” The acquisition target’s profile and the transaction structure are highlighted in the charts below.

An Overview Of Radisson Hotel Group Americas

CHH’s June 2022 Investor Presentation

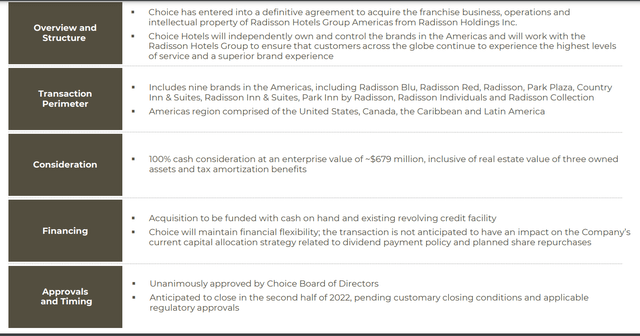

Details Of The Recently Proposed M&A Deal For Choice Hotels

CHH’s June 2022 Investor Presentation

CHH had earlier guided at the company’s Q2 2022 earnings briefing on August 6, 2022 that it is “on track to close the transaction (the planned acquisition of Radisson Hotel Group Americas) this month.” At the time of writing, Choice Hotels has yet to announce the completion of this M&A deal, but the company’s prior guidance suggests that the acquisition should be completed soon.

I have a favorable view of Choice Hotels’ proposed takeover of Radisson Hotel Group Americas for three main reasons.

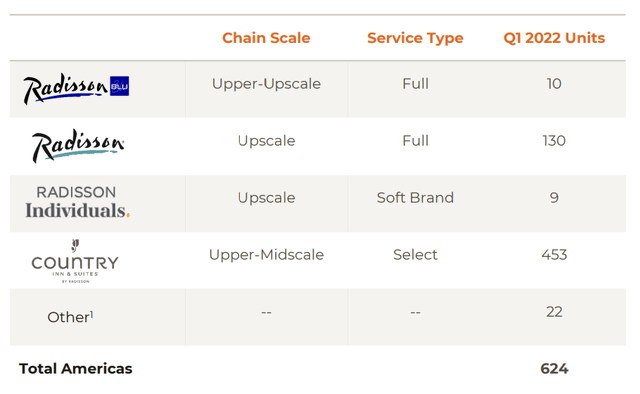

Firstly, the acquisition will allow CHH to increase its presence in the upscale and upper-midscale segments, as seen with the M&A target’s brand portfolio detailed in the chart below.

Radisson Hotel Group Americas’ Brand Portfolio

CHH’s June 2022 Investor Presentation

At the company’s most recent quarterly results call, Choice Hotels revealed that the mean domestic RevPAR (Revenue Per Available Room) for Radisson Hotel Group Americas’ hotel property portfolio was +38% higher than that for CHH prior to COVID-19. This is a clear indication that Choice Hotels will benefit from an uplift in RevPAR following the conclusion of the takeover deal, thanks to an increased proportion of higher-RevPAR hotels in the upscale and upper-midscale segments.

Secondly, Choice Hotels will increase its exposure to specific geographic markets in the US and overseas in a meaningful way.

In the US, CHH has traditionally boasted a stronger presence in the Southeast. The company acknowledged at its second-quarter investor briefing that it is “over-indexed in the Southeast and in that sort of Texas across into the Southwest as well”, and highlighted that it is “underpenetrated” in other regions in the US. In comparison, Radisson Hotel Group Americas’ domestic hotels are located in the West Coast and Midwest of the country.

In terms of international markets, Radisson Hotel Group Americas’ 64 hotels located in Latin America and the Caribbean are expected to grow the number of hotels that Choice Hotels has in this region by more than +50%, as indicated in CHH’s June 2022 investor presentation. According to geographical segment data sourced from S&P Capital IQ, Choice Hotels generated 98% of its fiscal 2021 revenue from the US. As such, the inclusion of Radisson Hotel Group Americas will be an important first step for CHH’s geographical diversification efforts.

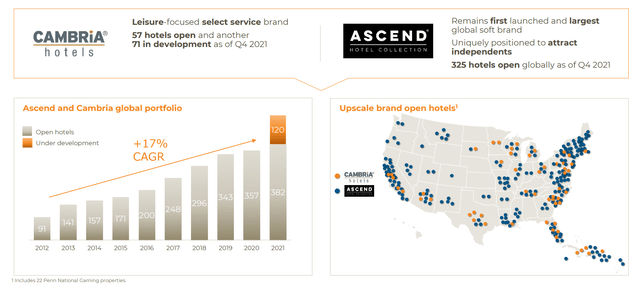

Thirdly, CHH will be in a better position to optimize its mix of business and leisure travelers.

In the past, Choice Hotels will naturally boast a large share of leisure travelers in terms of mix due to its portfolio which has relatively lower exposure to the upscale and upper-midscale hospitality segments. But the acquisition of Radisson Hotel Group Americas will increase its loyalty membership base by +19% from the current 53 million to around 63 million. A significant majority of Radisson Hotel Group Americas’ 10 million loyalty members are very likely to be business travelers with greater spending power. The increase in the mix of business travelers driven by the recent deal will have a positive effect on CHH’s existing upscale portfolio.

Choice Hotels’ Existing Upscale Hospitality Brands And Portfolio

CHH’s February 2022 Investor Presentation

More importantly, the growth outlook for Choice Hotels is excellent even if one excludes the impact of the proposed acquisition, as I will discuss in the next section.

Updated Management Guidance

CHH raised its RevPAR growth guidance for full-year FY 2022, when it reported the company’s financial results for the second quarter of this year on August 4, 2022. As per its Q2 2022 earnings presentation slides, CHH is now expecting its fiscal 2022 RevPAR to be +11%-13% higher than pre-COVID levels in 2019. Earlier, Choice Hotels was guiding for a +10%-13% growth in RevPAR for FY 2022 vis-a-vis FY 2019. In other words, the company has increased the lower-end of its full-year RevPAR guidance.

The good performance of Choice Hotels’ portfolio for Q2 2022 and July 2022 explain why the company was optimistic about its full-year growth outlook. CHH’s Q2 2022 RevPAR was +13% higher than the company’s Q2 2019 RevPAR. Similarly, the company’s July 2022 RevPAR has exceeded its July 2019 RevPAR by around +14%, as per the management’s comments at the recent quarterly earnings call.

In the very near term, tough economic conditions could turn out to be positive for Choice Hotels. As consumers tighten their purse strings, they are most probably going to opt for domestic travel plans to destinations with driving distance, and avoid longer-distance trips that come with the burden of costly air tickets. This is a key factor that supports Choice Hotels’ updated management guidance which points to the company’s RevPAR staying above pre-pandemic levels.

Closing Thoughts

Choice Hotels stays as a Buy-rated stock for me. The outlook for CHH is favorable taking into account the company’s recently disclosed acquisition and its organic growth prospects as indicated by its FY 2022 RevPAR guidance.

Be the first to comment